After years of struggle Hike had shut down its Hike StickerChat, rebranded Hikeland to Vibe and introduced an online gaming platform Rush. The pivot appears to be a smart move for the company which could be evident from its scale which skyrocketed from Rs 13k in FY20 to Rs 19 Cr in FY22.

However, those numbers, when seen in the context of its outstanding losses, which continued to climb and crossed Rs 1,775 crore ($235 million) in FY22, must seem like a number from “believe it or not”.

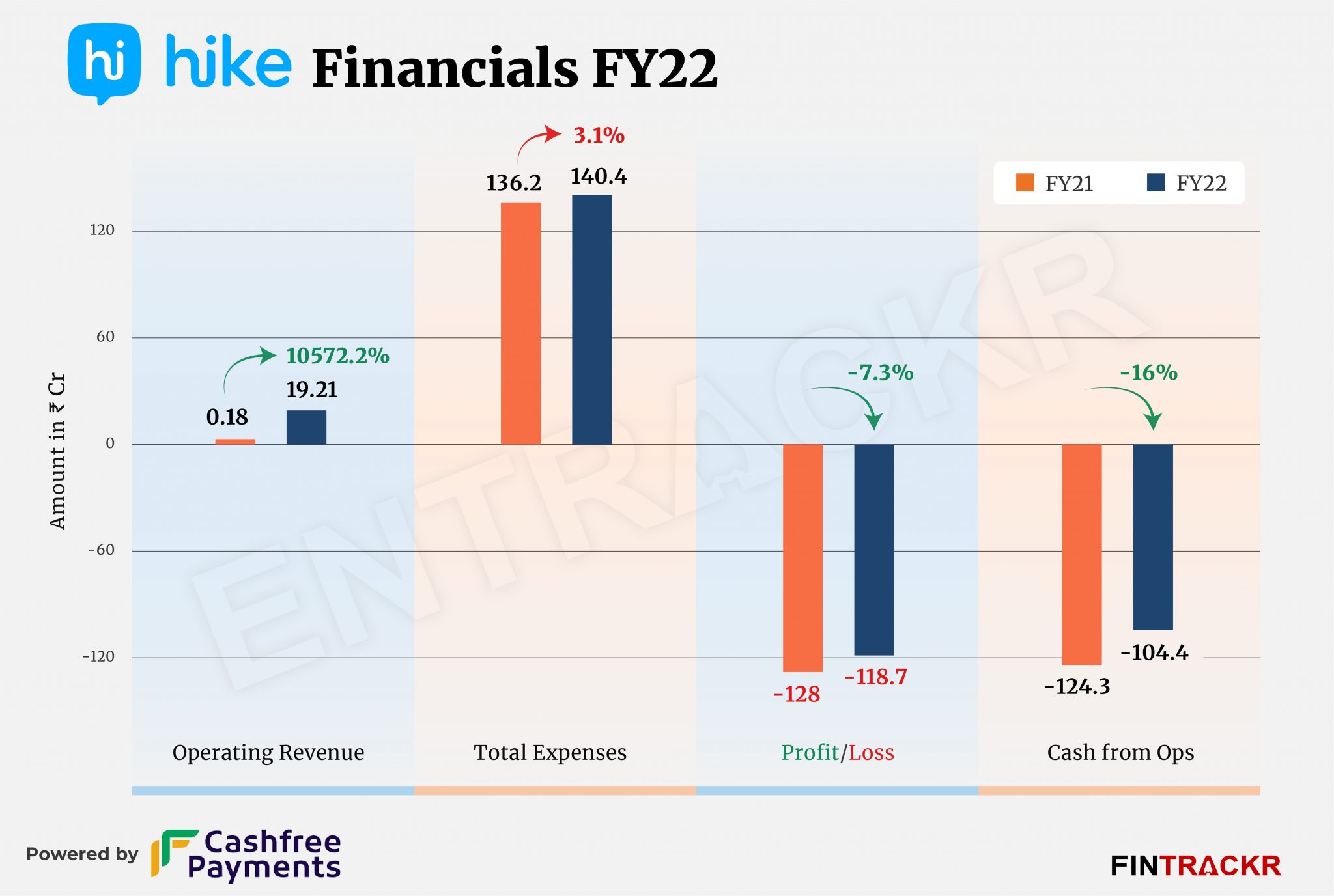

Hike’s revenue from operations ‘raced’ to Rs 19.21 crore during the fiscal year ending March 2022 as compared to Rs 18 lakh in FY21, according to the company’s standalone annual financial statement with the Registrar of Companies (RoC).

Hike has generated around Rs 21 crore from operations during its whole journey.

Hike generates revenue via its online gaming platform named Rush by Hike. It represents the difference between the number of entry fees paid by customers less amounts won and the membership fees for joining the application as a VIP member. The company also earned Rs 2.55 crore via interest and gain on investments and other non-operating income which drove its total revenue to Rs 21.76 crore in FY22.

Previously, Hike used to be a P2P messaging application but in January 2021 it switched to a different domain and introduced two new platforms Vibe and Rush. Vibe is a social media platform to watch videos together while Rush is a real money skill-based gaming platform that hosts multiple casual games and was developed in-house by the company.

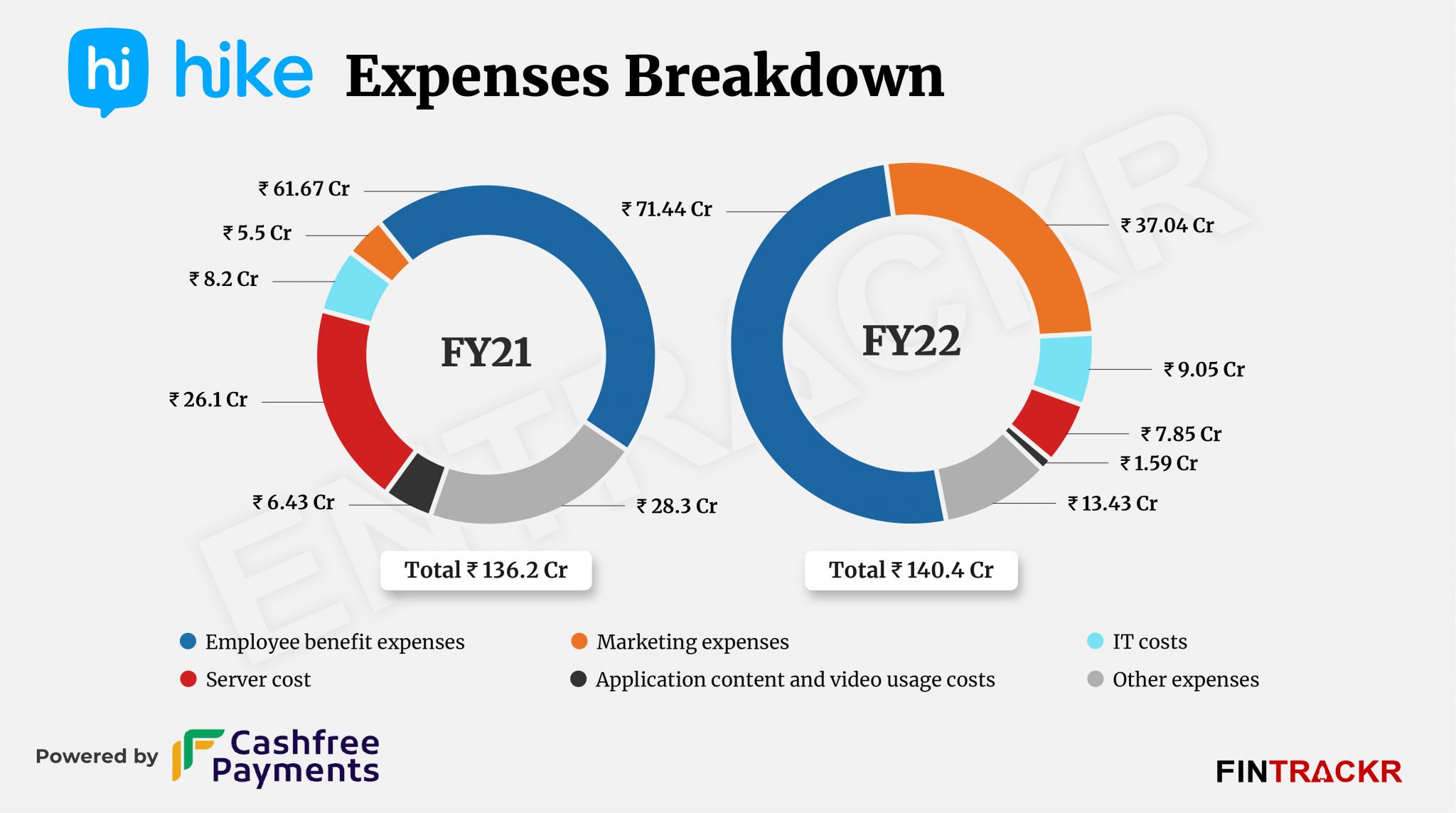

Moving towards expenses, employee benefits represented the largest cost element contributing 51% of the total expenditure. This cost surged 15.8% to Rs 71.44 crore in FY22 from Rs 61.67 crore in FY21. Importantly, this cost also includes employee share-based payment (settled in equity) of Rs 14.9 crore.

Marketing expenses turned out to be the second major cost and shot up 6.7X to Rs 37.04 crore during FY22. Information technology (consumables and consultancy) expenses went up 10.4% to Rs 9.05 crore.

Spends on server cost and application content cum video usage costs shrank around 70% and 75% respectively to Rs 7.85 crore and Rs 1.59 crore in FY22. The company also booked retainership expenses of Rs 4.51 crore during the same period.

Hike kept tight control over its spending to limit its overall expenditure increase to only 3% at Rs 140.4 crore in FY22 as compared to Rs 136.2 crore in FY21. Growth in scale and stable expenses also helped the company to improve its bottom line. Its annual losses narrowed 7.3% to Rs 118.7 crore in FY22 against Rs 128 crore in FY21.

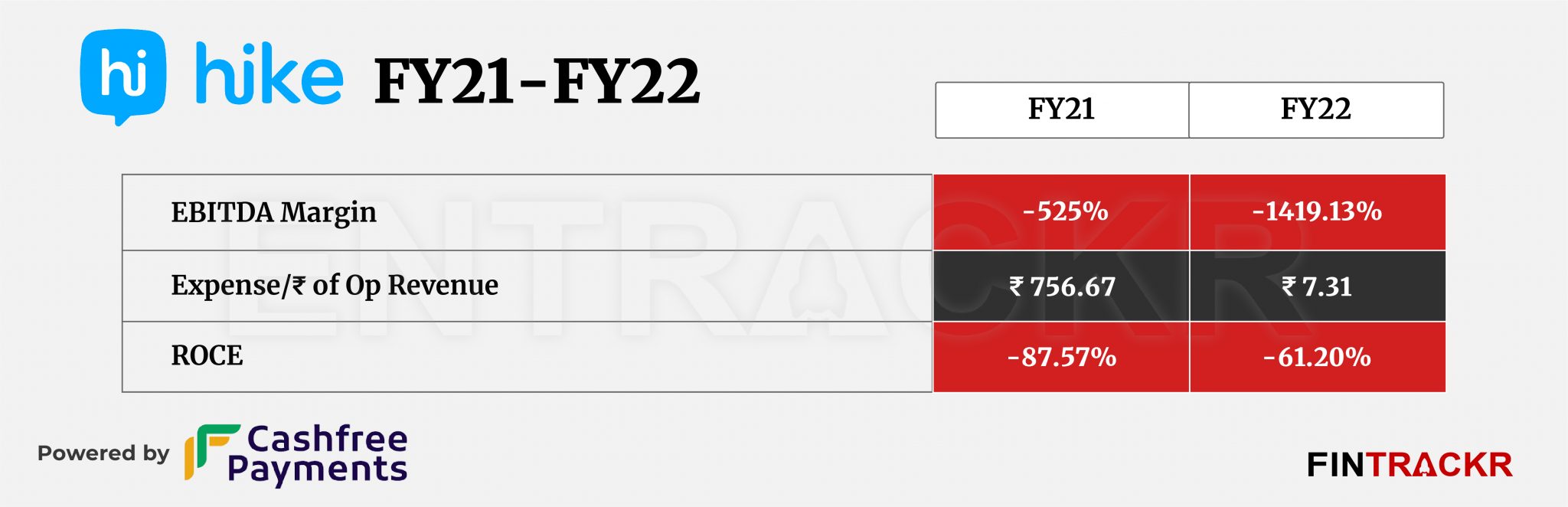

Meanwhile, the company’s cash outflows from operations bettered by 16% to Rs 104.4 crore during FY22. Its EBITDA margin and ROCE improved to -525.00% and -61.20% during the year.

On a unit level, Hike spent Rs 7.31 to earn a rupee in FY22 as compared to Rs 756.67 to earn the same during the preceding fiscal year. Moreover, the outstanding losses stood at Rs 1,775 crore during the same period.

Hike raised an undisclosed sum across two tranches since January this year for its product Rush Gaming Universe (RGU) – a web3-based virtual world where players can play, compete, and win. As of now, the NCR-based firm has raised around $261 million in total funding across eight rounds.

The firm carries the baggage of a series of disappointments that was its messenger service and the losses it piled up there. Its unicorn moment, which arrived as far back as 2016, will be just a memory to employees who have survived the intervening years. With its attempt to leverage the high interest in gaming, the firm has entered yet another area where competition is intense from global players, and user interest is fickle. It will take real chutzpah to make its past history of stumbling cool for the new generation of gamers it wants to court. Convincing investors (yet again) might have been the easy part of the job for Hike. Yet again.