There is a rising awareness about teaching financial literacy to youth at a relatively younger age. Instead of figuring it out much later in their life, parents are trying to help kids, especially teenagers, learn the best skills to manage money. This becomes pertinent as more teenagers are looking to take up small projects or tasks to make money, enhance skills, and of course, get real-world exposure.

Mumbai-based Funngro is striving to help teenagers achieve all of the above in a more efficient and structured way.

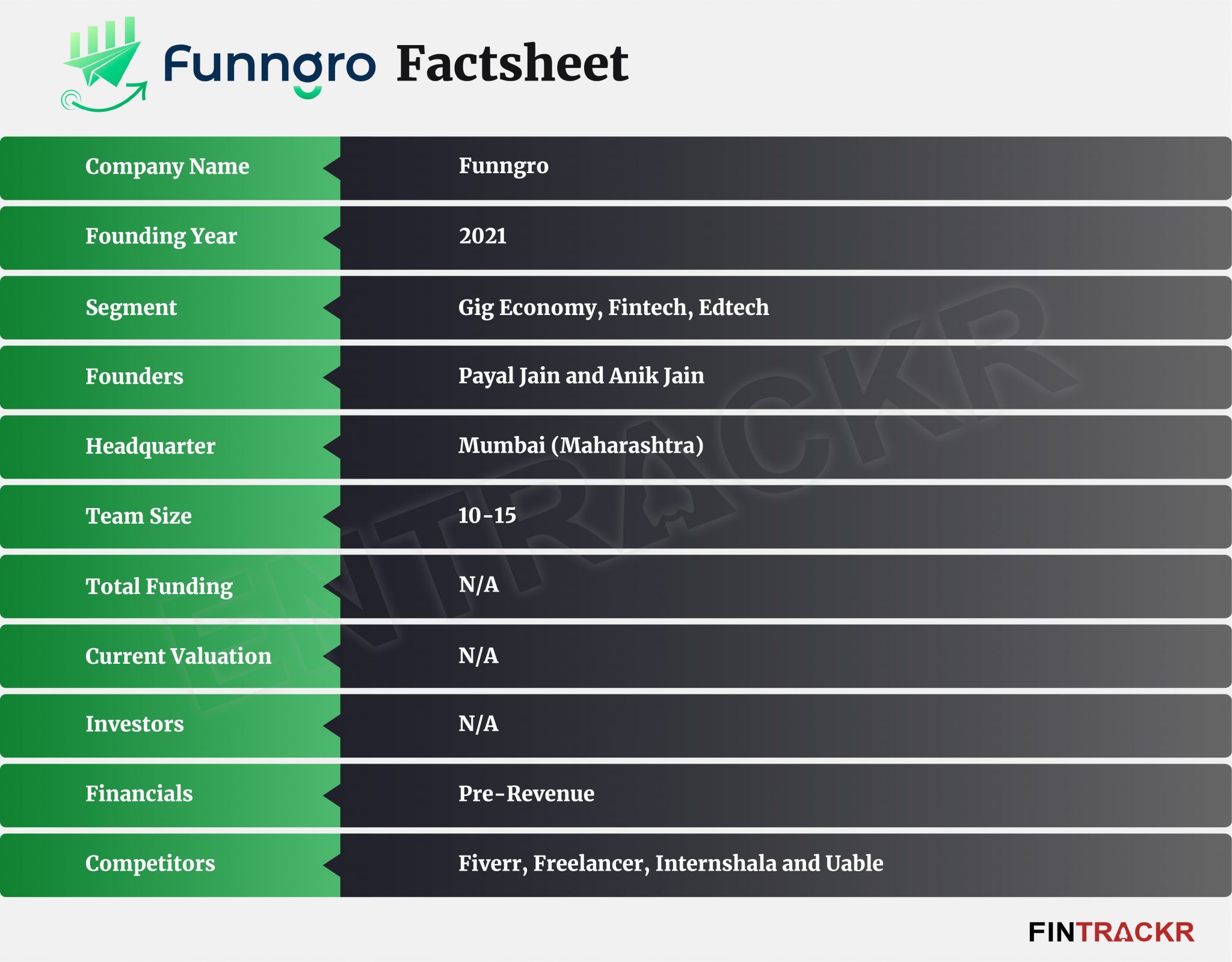

Founded in 2021 by Payal and Anik Jain, both of whom have backgrounds in finance, Funngro offers teenagers the opportunity to earn money, gain financial knowledge, and acquire real-life work experience. Anik is a second time founder with experience of taking his previous startup Symbo to scale, whereas Payal was previously Customer Success Director at Worldline Global, a digital payment firm.

“We started Funngro with the sole aim of helping teenagers understand the value of money, but not in a boring preaching manner,” CEO and co-founder Payal told Entrackr.

She added that the platform began as a financial education platform aimed at teenagers and parents. The initial version of the platform allowed teenagers to earn rewards – to be converted into real money – for doing certain tasks. Teenagers are also given a prepaid card (virtual and physical), in partnership with Fino payments bank. On customer demand, Funngro later added a real-life work project feature to help teenagers to make money through the platform by working with companies as well as gain financial knowledge.

To get started on Funngro, teenagers have to be above 14 years of age and have parental approval. Parents also have the option to bar their kids from earning. Payal said teenagers can pick up to five projects at a time to help balance their studies.

Teenagers can then register on the platform and pick areas of interest from topics like social media marketing, website design, video creation, voice-over, content writing, and more.

That said, India has a sizable population of adolescents. Funngro is trying to focus on this vast population that now has access to technology and marketing skills in tier 1 and tier 2 cities. The company aims to be the go-to platform for all things earning and finance related for teenagers in the country. It aims to acquire 5.5 million users in the next three years.

There are a bunch of fintech platforms in India that are targeting teenagers.

For instance, FamPay gained wide attention last year when it raised $38 million in a series A funding led by Elevation Capital. The round also saw participation from notable VCs like Sequoia Capital India, Venture Highway, and Y Combinator. Other well-known names in the teenagers-focused fintech platforms are Muvin and Junio.

Funngro, however, is looking to stand out from these firms by focusing on financial education and real-life work experiences.