Agritech finally attracted major investor interest in 2021 with startups in the space recording a 300% jump in funding to $636 million from $155 million in the previous year, as per Entrackr’s report. This year, we have seen a more than $550 million fund inflow and this has given a license to such startups to grow rapidly.

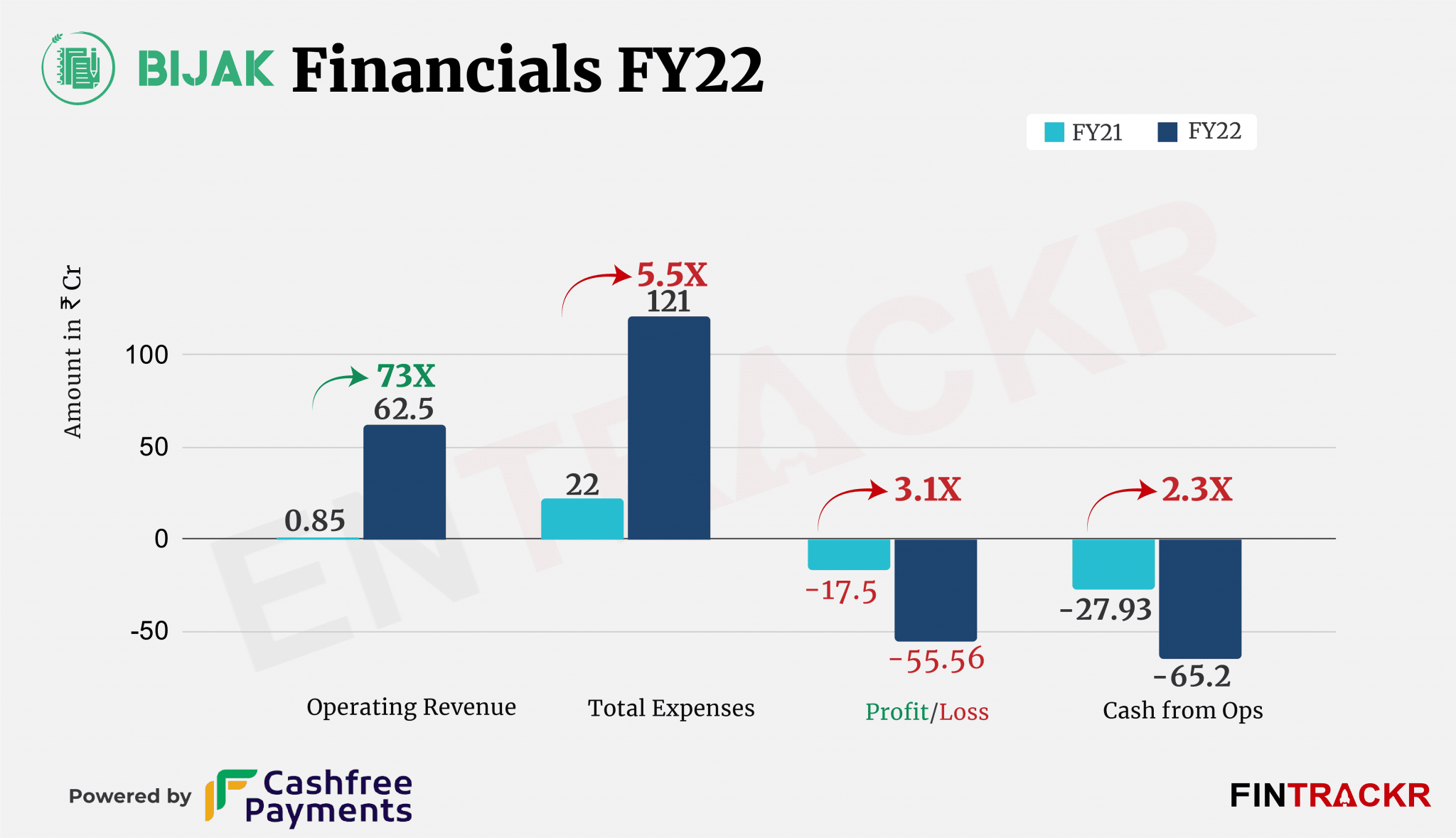

Gurugram-based Bijak, which also raised back-to-back funding during the period, witnessed a multi-fold growth in scale in FY22. The company’s revenue from operations jumped 73X to Rs 62.5 crore during the fiscal year ending March 2022 from Rs 85 lakh booked in FY21, according to its annual financial statements with the Registrar of Companies (RoC).

The company assists and aids in buying and selling agricultural commodities via its mobile based platform and remits funds on behalf of its customers (buyers and sellers). For its efforts, it earns commission income for providing platform, aggregated logistics services, loans, and working capital.

Launched by Nukul Upadhye, Mahesh Jakhotia, Jitender Bedwal, Daya Rai, and Nikhil Tripathi, Bijak is a B2B trade platform for the agricultural sector.

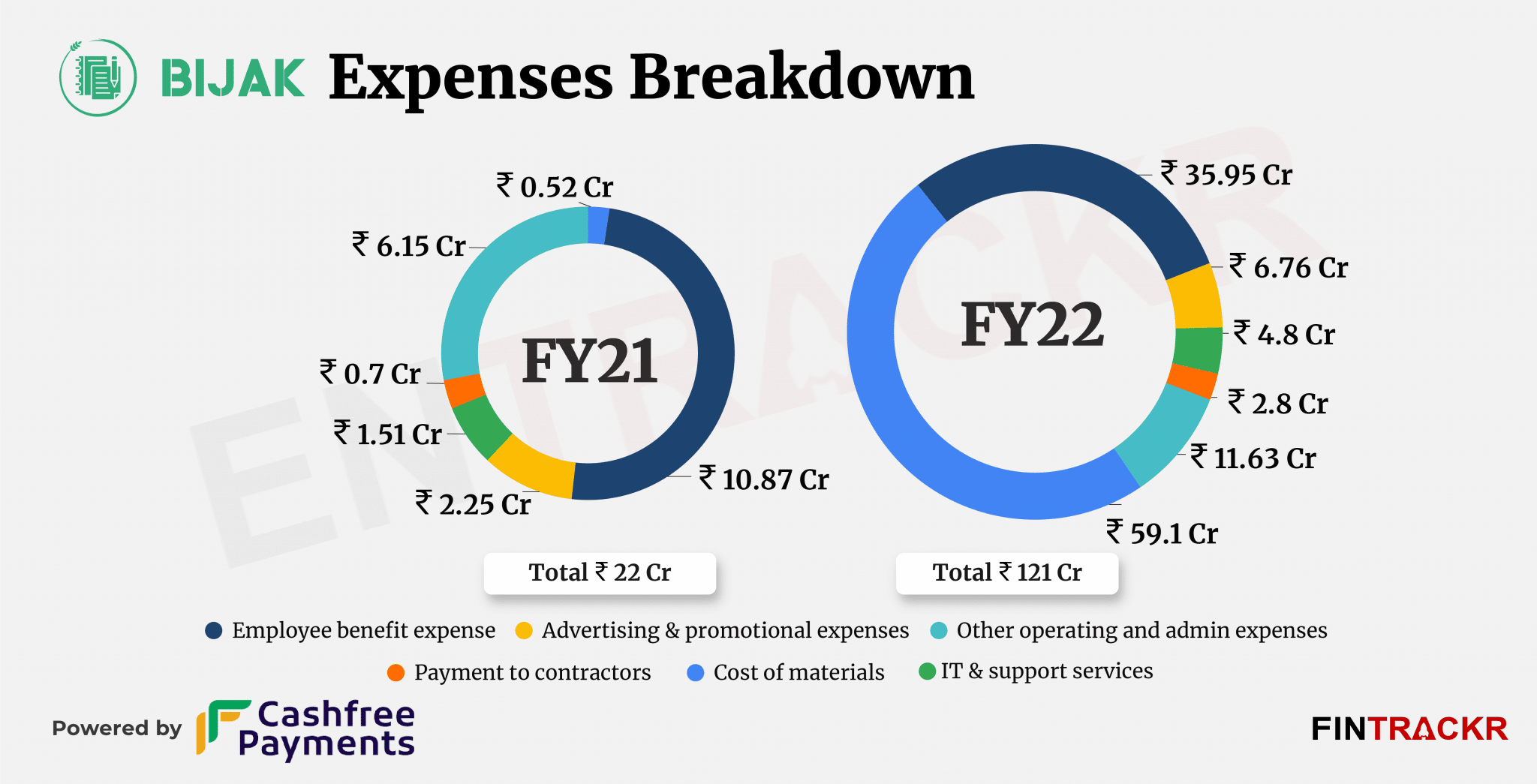

On the expense front, cost of materials accounted for nearly 49% of the overall expenses during the year. The cost registered at Rs 59 crore in FY22 as compared to Rs 52 lakh in the preceding year.

Employee benefit expense was the other major cost during the last fiscal, contributing 29.7% of the total expenditure. The cost shot up 3.3X to Rs 35.95 crore in FY22 from Rs 10.87 crore in FY21.

During FY22, advertising cum promotional expenses and payment to contractors surged 3X and 4X to Rs 6.76 crore and Rs 2.8 crore respectively. The company also incurred IT & support services costs (including payment gateway charges) of Rs 4.8 crore which grew 3.2X from Rs 1.51 crore in FY21.

In total, Bijak’s annual expenditure surged 5.5X to Rs 121 crore in FY22 from Rs 22 crore in FY21. In line with revenue and expenses, losses of the startup spiked over 3X to Rs 55.56 crore during FY22 as compared to Rs 17.5 crore recorded in FY21. Bijak’s operating cash outflows also surged 2.3X to Rs 65.2 crore during the same period.

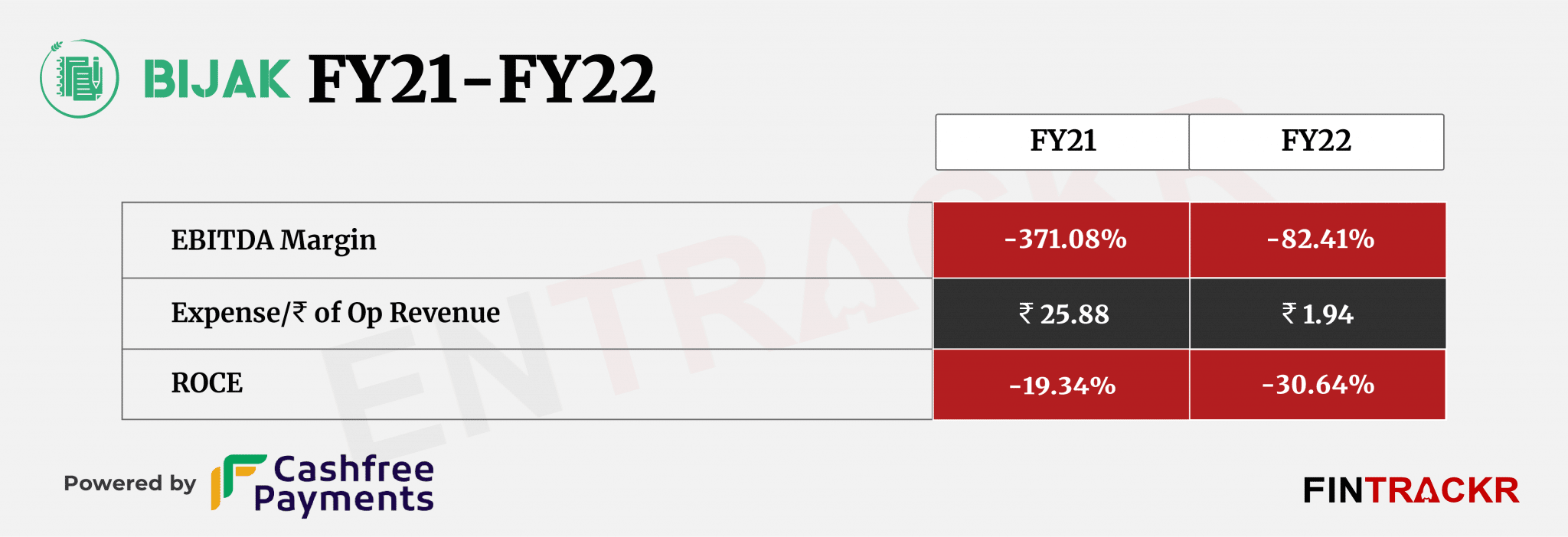

Growth in scale helped the company to improve its EBITDA margin to -82.41% during the year. On a unit level, Bijak spent Rs 1.94 to earn a rupee of operating revenue in FY22.

A part of the second cohort of Sequoia’s accelerator Surge, Bijak scooped $20 million led by Bertelsman with around a 2X surge in valuation in January 2022. The company is expected to close the round at around $35 million as per media reports. The company has a presence in more than 1,200 regions across 28 states including Maharashtra, Uttar Pradesh, Madhya Pradesh, Punjab, Bihar and it deals in more than 200 commodities.

Bijak recently claimed that it does monthly transactions worth over Rs 300 crore and 75,000 buyers and sellers trade on its platform.