Paytm Mall has been trying to find a sustainable model for the past two years. The search is nowhere close to ending as evident from its top and bottom lines for FY22.

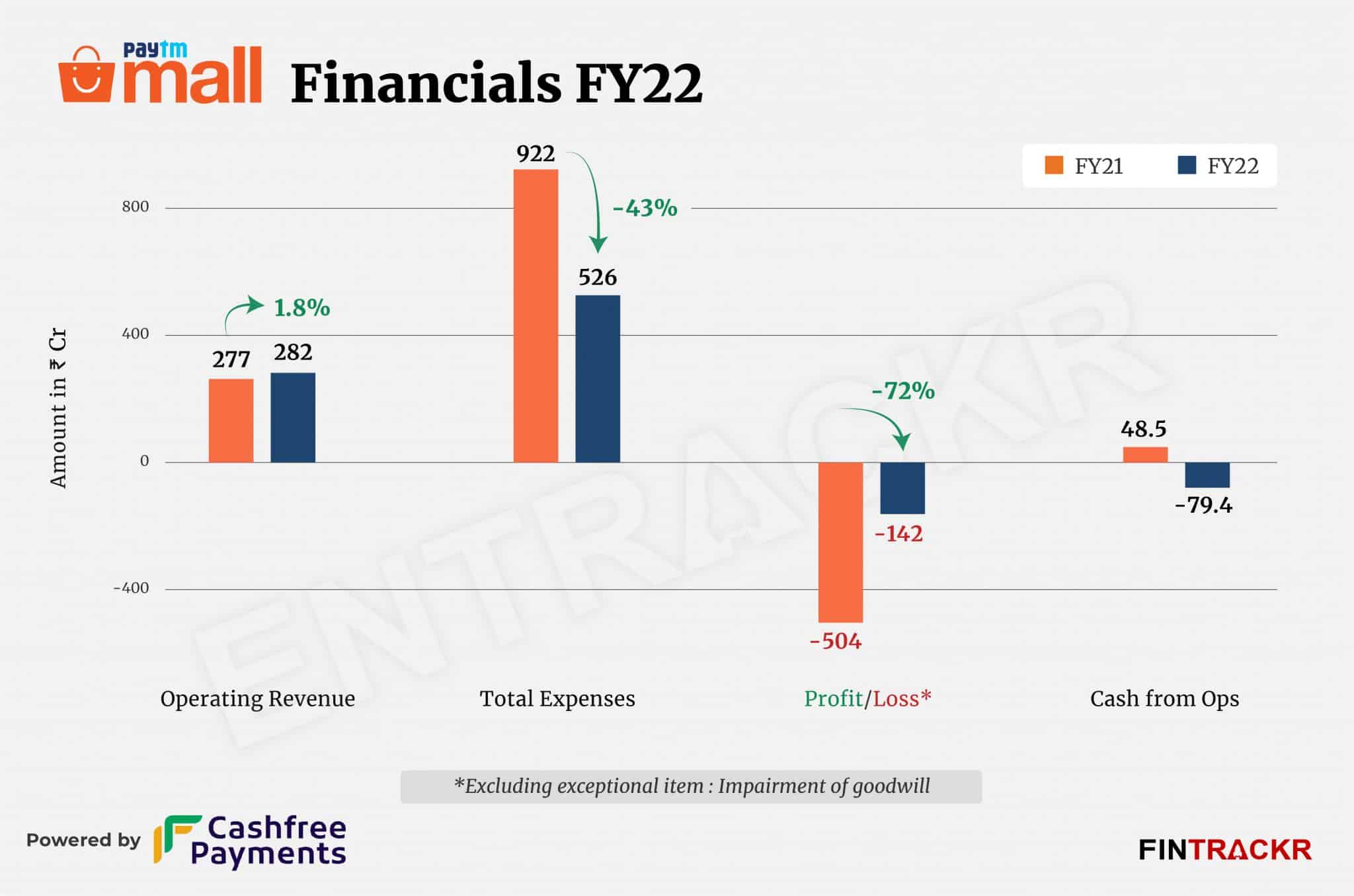

After a major dip in revenue in FY21, the company saw a nominal 1.8% growth in its scale with controlled expenses.

Paytm Mall’s revenue from operations grew to Rs 282 crore during the fiscal year ending March 2022 from Rs 277 crore in FY21, according to the company’s annual financial statement with the Registrar of Companies (RoC).

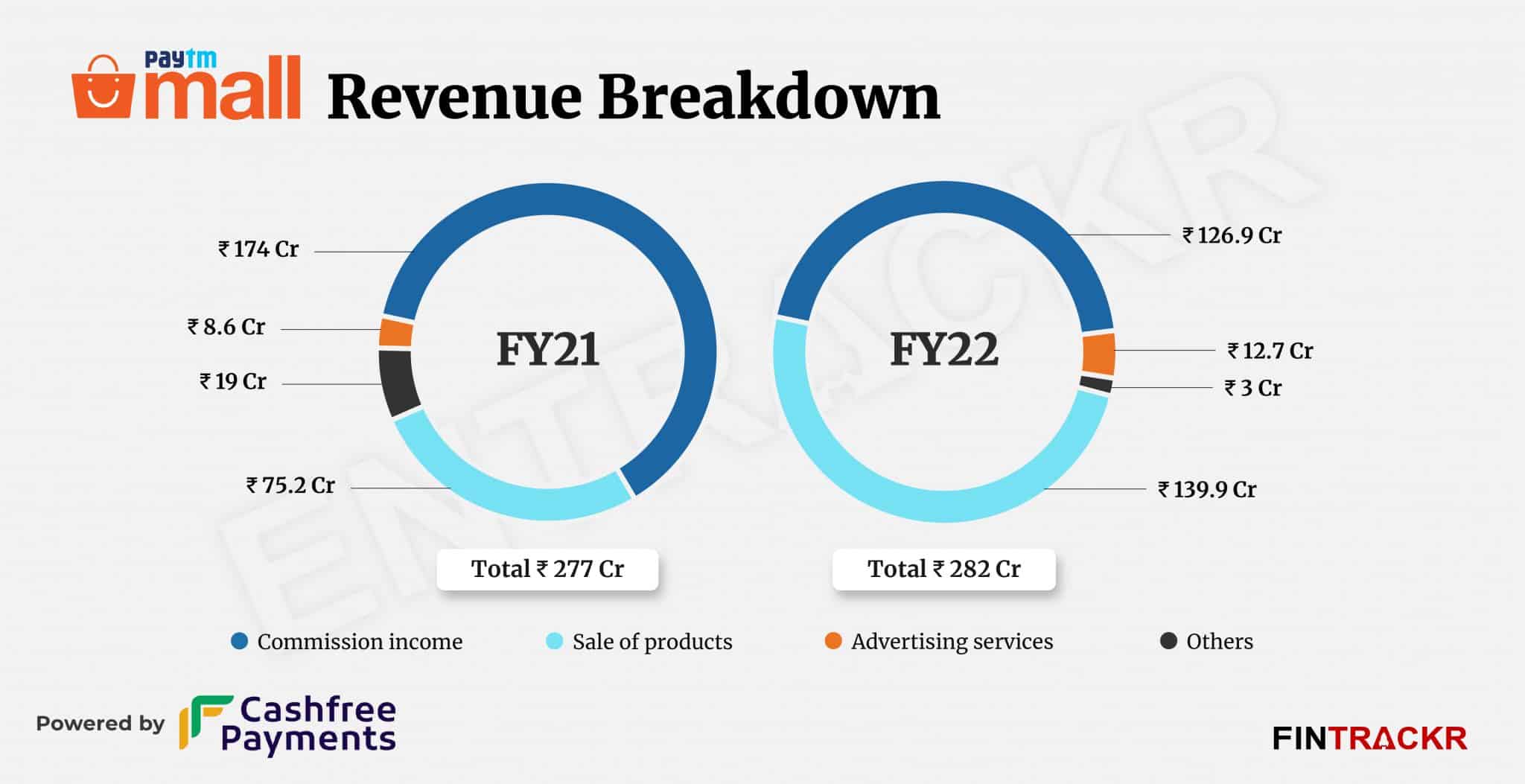

Collection from the sale of products emerged as the largest source of revenue contributing 49.6% of the total operating revenue. This income grew 85.3% to Rs 139.9 crore (including incentives of Rs 2.17 crore) in FY22 from Rs 75 crore in FY21. Commission collected from merchants and sellers for providing platform services accounted for 45% of the total collection which declined 27% to Rs 126.9 crore during FY22.

The company booked revenue of Rs 12.7 crore during FY22 as a marketing promotion fee for providing advertising services on its platform. This income surged 47.7% from Rs 8.6 crore in the preceding fiscal. It also collected other operating revenue of around Rs 3 crore including recovery of claims from courier companies.

Paytm Mall also recorded non-operating income of Rs 21.6 crore from liabilities/provisions written back and Rs 80.4 crore as interest income related to bank deposits, the fair value of royalty, and others which drove the total revenue to Rs 384 crore during FY22.

Interestingly, only about 53% of revenue in FY22 came from India with the rest from other countries. Paytm Mall’s 47% revenue came from offshore markets is even odder when one considers that the company doesn’t have a significant presence in any overseas markets.

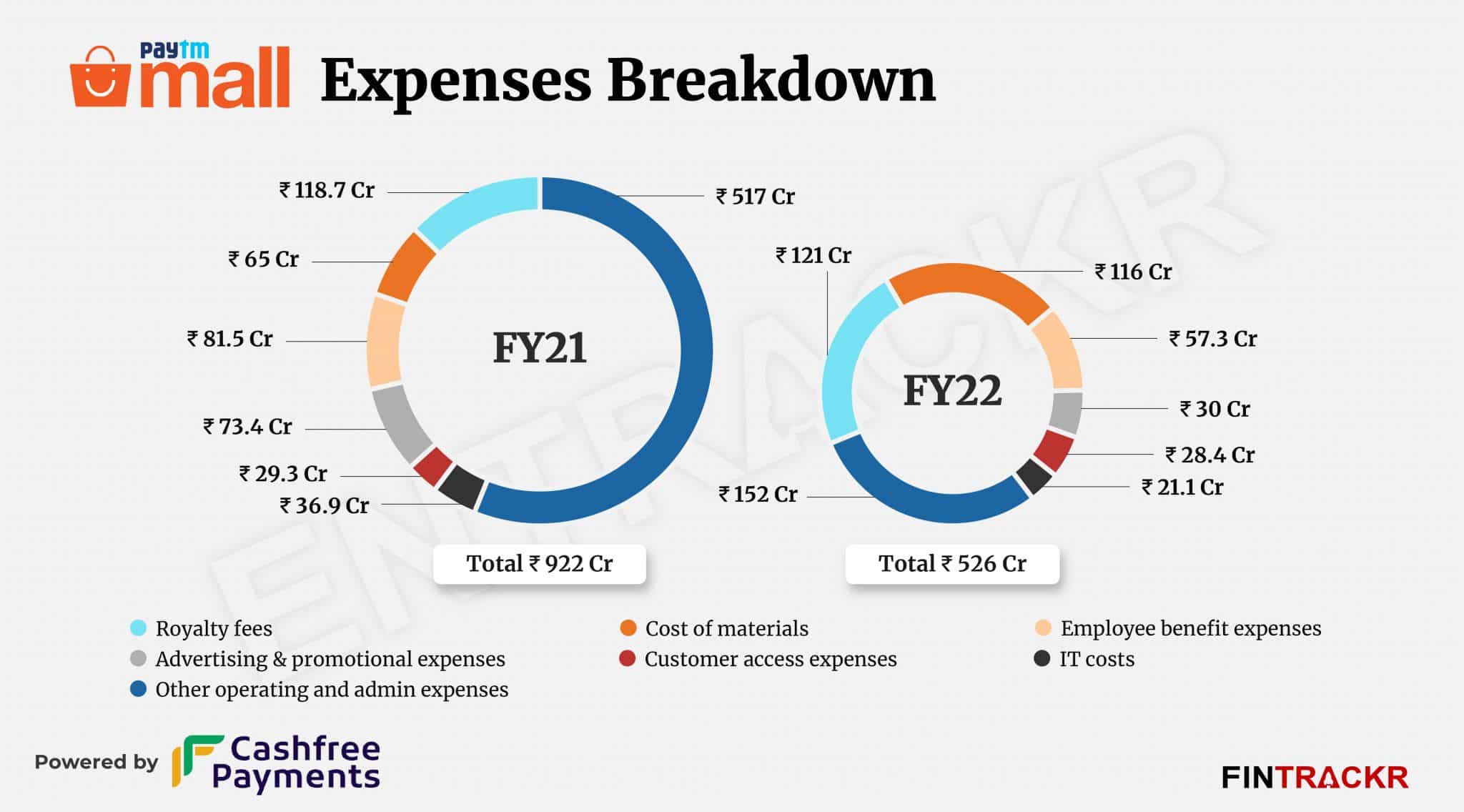

On the expense front, royalty fees paid in exchange for services received from One97 Communications Limited (Paytm) turned out to be the largest cost element, forming 23% of the total expenditure. The expense increased by around 2% to Rs 121 crore in FY22 from Rs 118.7 crore in FY21. The cost of materials formed 22% of the overall expenses and expanded 78% to Rs 116 crore during FY22 from Rs 65 crore in FY21.

For the unversed, Paytm Mall isn’t a subsidiary of One97 Communications Limited, but has been licensed to use the Paytm brand, and run on the Paytm app.

During the last fiscal year, employee benefit expenses and advertising cum promotional expenses narrowed by 29.7% and 59% to Rs 57.3 crore and Rs 30 crore. IT costs such as connectivity and payment gateway charges also shrank around 43% to Rs 21.1 crore during FY22 from Rs 36.9 crore in FY21.

Paytm Mall’s expenditure depleted 43% to Rs 526 crore in FY22. As a result, losses of the company shrank to Rs 142 crore in FY22. The company also booked an exceptional item of Rs 398 crore as impairment of goodwill taking the losses to Rs 540 crore, as per the annual statements filed to MCA portal. The surge in losses could be attributed to Rs 398 crore worth impairment of goodwill booked under non-cash adjustment. Entrackr has excluded this expense while calculating the overall losses and ratios.

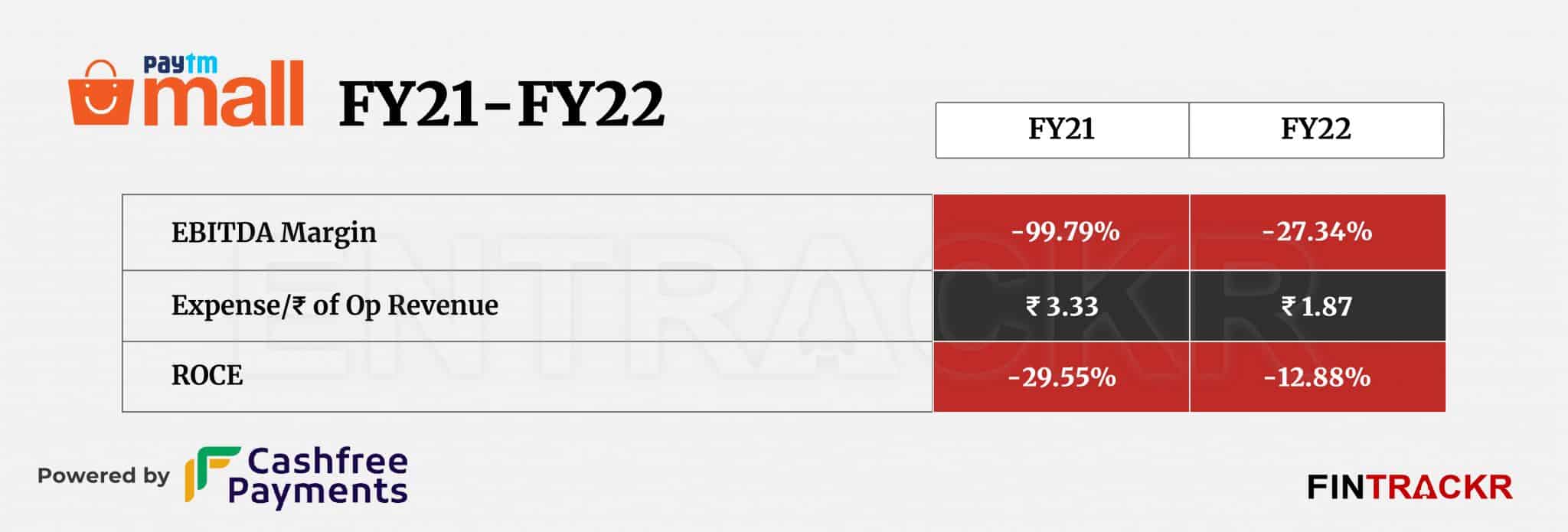

Coming to ratios, EBITDA margin and ROCE improved to -27.34% and -12.88% during the year. On a unit level, Paytm Mall spent Rs 1.87 to earn a rupee of operating revenue during FY22.

In May, Paytm Mall pivoted from the traditional physical goods e-commerce marketplace to join the government-backed e-commerce platform the Open Network for Digital Commerce (ONDC). As per the company, it will also explore opportunities in the export business. Looking at the numbers, it clearly had a plan in mind that has led to the sharp rise of revenues outside India.

Meanwhile, Paytm Mall’s early and key backers Alibaba and Ant Financial also took an exit from the Bengaluru-based company.

While no longer a subsidiary, the deep legacy relationships with former parent One97 are nowhere close to unwinding soon, as evident in the numbers. For a truly sustainable future, the firm probably needs to look at every cost harder in that respect, and build further on the new opportunities it is mining now. With a major cleanup behind it in terms of booking and writing off losses, there is a real chance for this long time ‘has been’ or ‘almost famous’ to prove detractors wrong. We might have the answers as early as next year with the FY23 numbers.

Update: The headline and story has been updated to remove the surge in losses due to impairment of goodwill booked under non-cash adjustment.