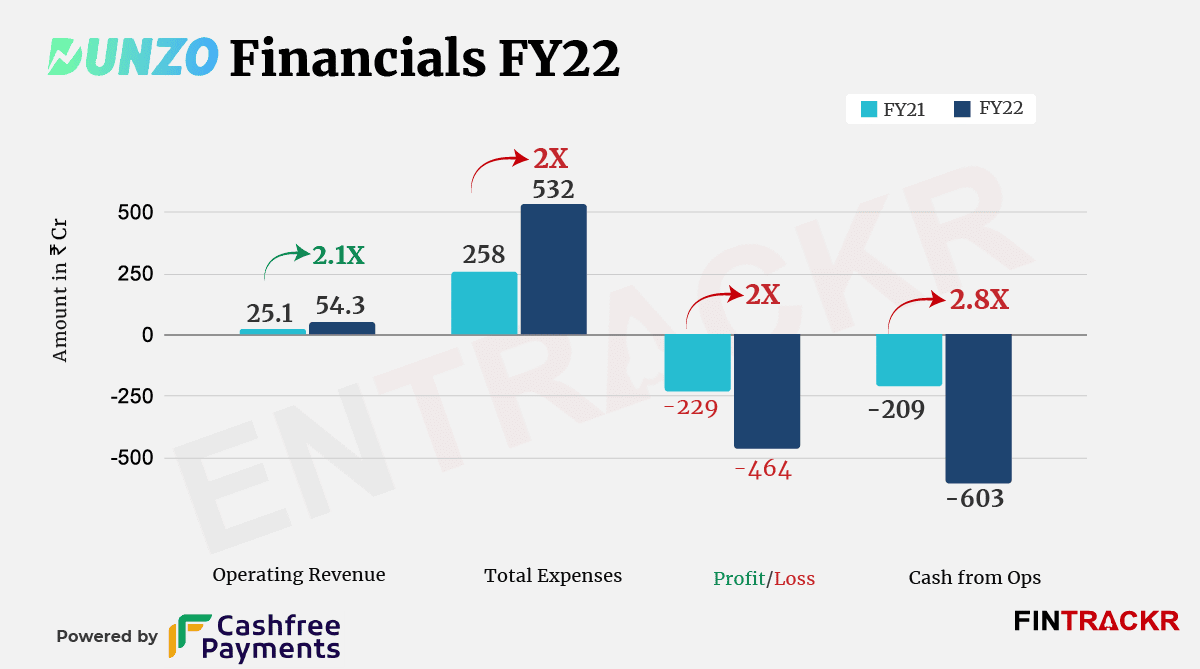

Dunzo, which counted Google among its backers until Reliance moved in last year, continued to bleed during the last fiscal year as the company’s losses spiked 2X and crossed the Rs 460 crore mark. The company’s scale also grew two-fold in FY22 on the back of its quick commerce business.

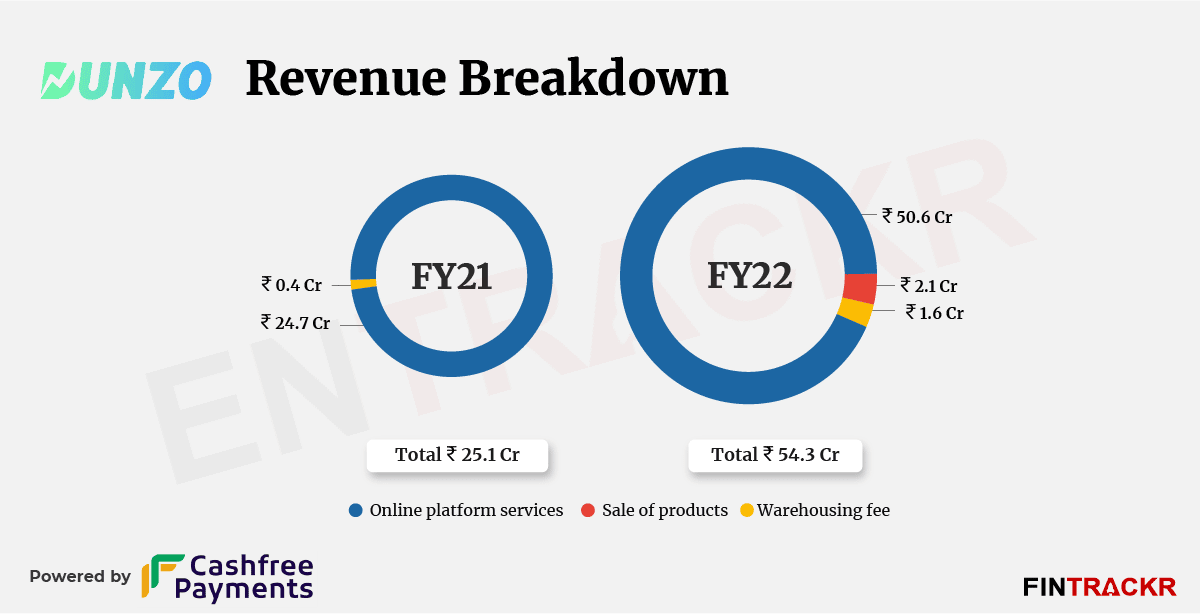

Dunzo’s revenue from operations grew over 2X to Rs 54.3 crore in FY22, according to its annual financial statements with the Registrar of Companies (RoC) show. The firm generates revenue largely from online platform services which contributed nearly 93% to the total operating income.

Collection from online platform services ballooned over 2X to Rs 50.6 crore in FY22 from Rs 24.7 crore in FY21. These services include commission collected from riders, advertisement fees, sale of traded goods, subscriptions et al. Importantly, this also includes Rs 2.3 crore collected via D4B (Dunzo for Business).

Importantly, the firm had reclassified its financial statement for the corresponding year, which impacted revenue, expenses, and loss figures for FY21.

Revenue from merchant stores for providing warehouse management jumped 4X to Rs 1.6 crore during FY22 while the sale of products brought Rs 2.1 crore to the company’s coffers. Dunzo also made Rs 13.4 crore mainly from interest on bank and security deposits which pushed its total revenue to Rs 67.7 crore.

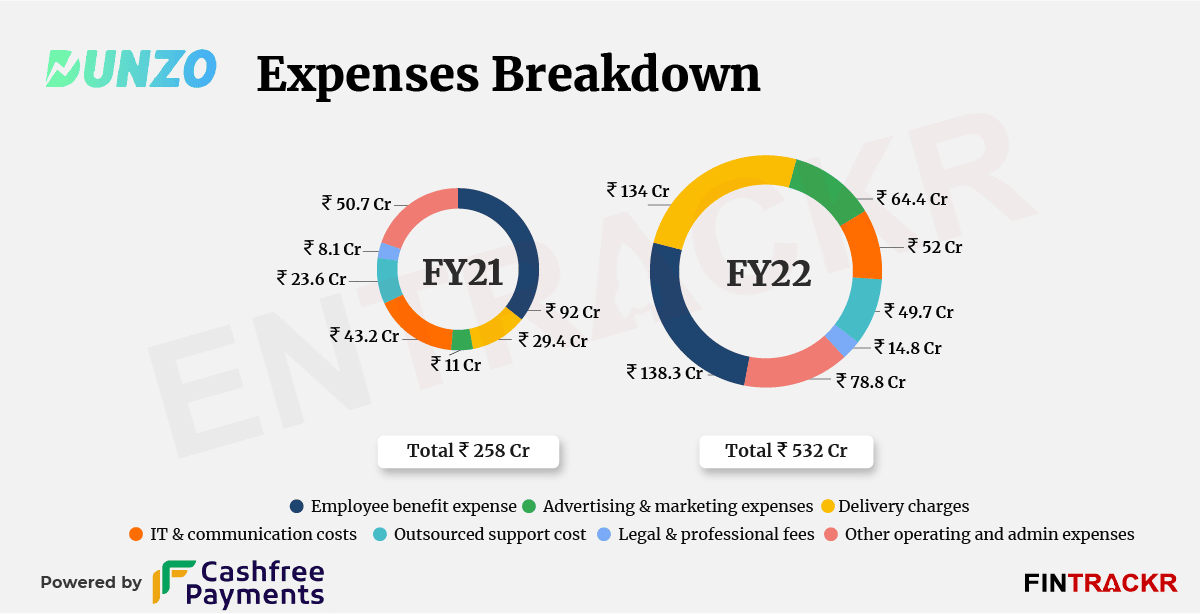

Akin to many growth stage companies, its employee benefits expense constituted the largest cost element, forming 26% of the annual expenditure. This cost surged 50.3% to Rs 138.3 crore in FY22 which includes Rs 19.4 crore of ESOPs expenses.

Delivery related expenses accounted for 25.2% of the overall spending and shot up 4.6X to Rs 134 crore in FY22 from Rs 29.4 crore in FY21. Dunzo’s marketing cost ballooned 5.9X to Rs 64.4 crore.

Dunzo’s annual expenditure and losses closely tracked revenue growth to bloat 2X to Rs 532 crore and Rs 464 crore respectively in FY22.

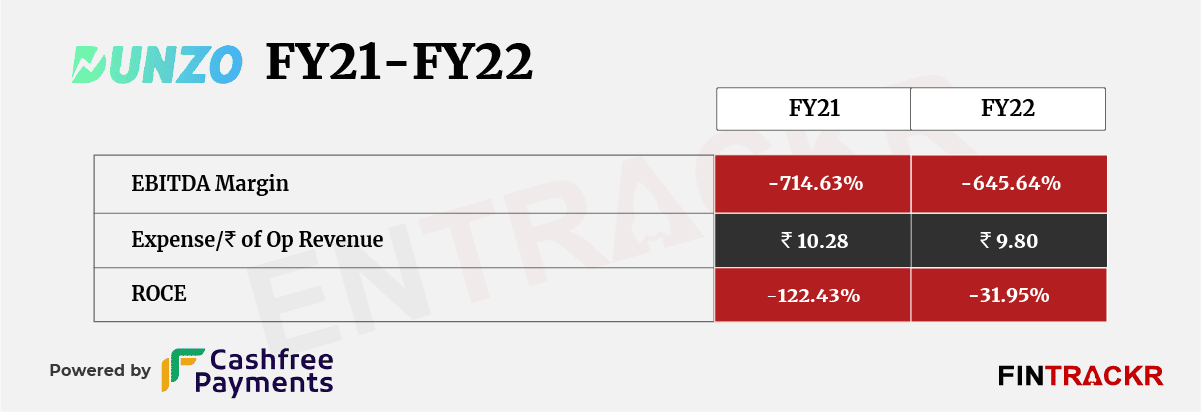

Coming to ratios, EBITDA margin and ROCE are registered at -645.64% and -31.95%. On a unit level, Dunzo spent Rs 9.8 to earn a rupee of operating revenue in the fiscal year ending March 2022.

While Dunzo has managed to grow its scale by 2X in FY22, the company is yet to reach a meaningful revenue milestone considering its age and funding. The company losses continued to be a concern which is unlikely to abate even in the ongoing fiscal year. During the first half of this year (Jan to June), Dunzo lost Rs 230 on each Dunzo Daily order. In June, the company had an EBITDA loss of Rs 176 crore which it projected to cut to Rs 100 crore by December.

Dunzo also projected an ambitious revenue goal: Rs 2500 crore in FY23 which is almost 50X of its FY22 collection. With no formal milestones in sight on the revenues front that would indicate such massive growth, the next big trigger would perhaps be a larger deal with Jiomart on deliveries.