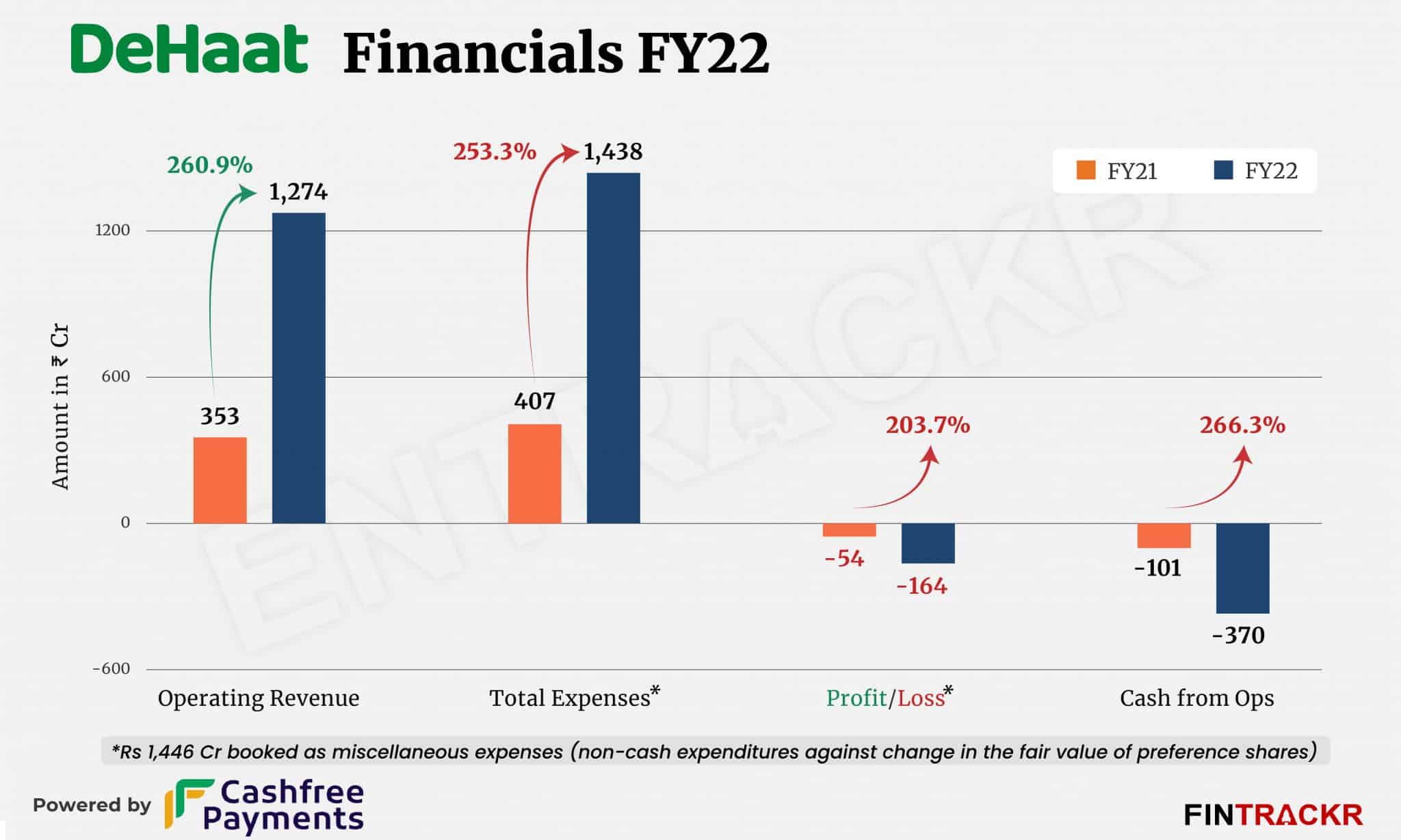

Full-stack agritech platform DeHaat has been eyeing break-even in the first half of FY24 and the company’s financial numbers in the last fiscal also give such indication. During FY22, DeHaat managed to keep its losses under control despite a 3.5X surge in expenses over FY21 numbers.

The Patna-based company’s scale also soared 3.6X to Rs 1,274 crore, as per the annual financial statement with the Registrar of Companies.

DeHaat provides agricultural inputs (seeds, pesticides, fertilizers), agricultural finance, warehousing, cold storage, and advisory services such as soil testing and yield prediction services. The company currently operates in 11 states including Bihar, UP, Odisha, Maharashtra, Gujarat, Haryana, MP, and West Bengal, and claims to serve over 1.5 million farmers in its service network.

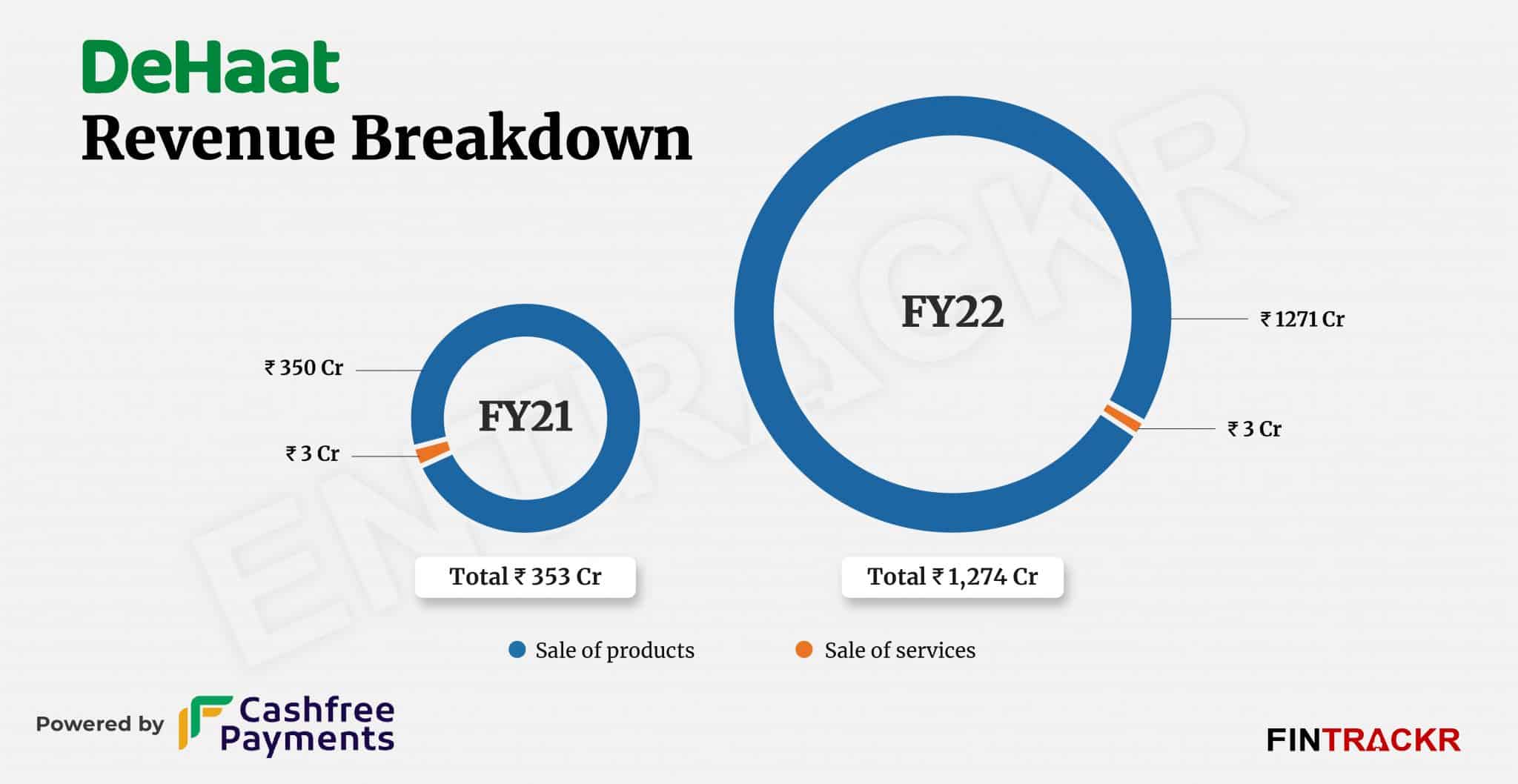

The sale of agricultural inputs accounted for 99% of its total revenue which surged 3.6X to Rs 1,271 crore in FY22 while the revenue from advisory services remained flat at Rs 3 crore during the last fiscal. The company also made Rs 13.25 crore interest from current investments which grew around 5X in FY22.

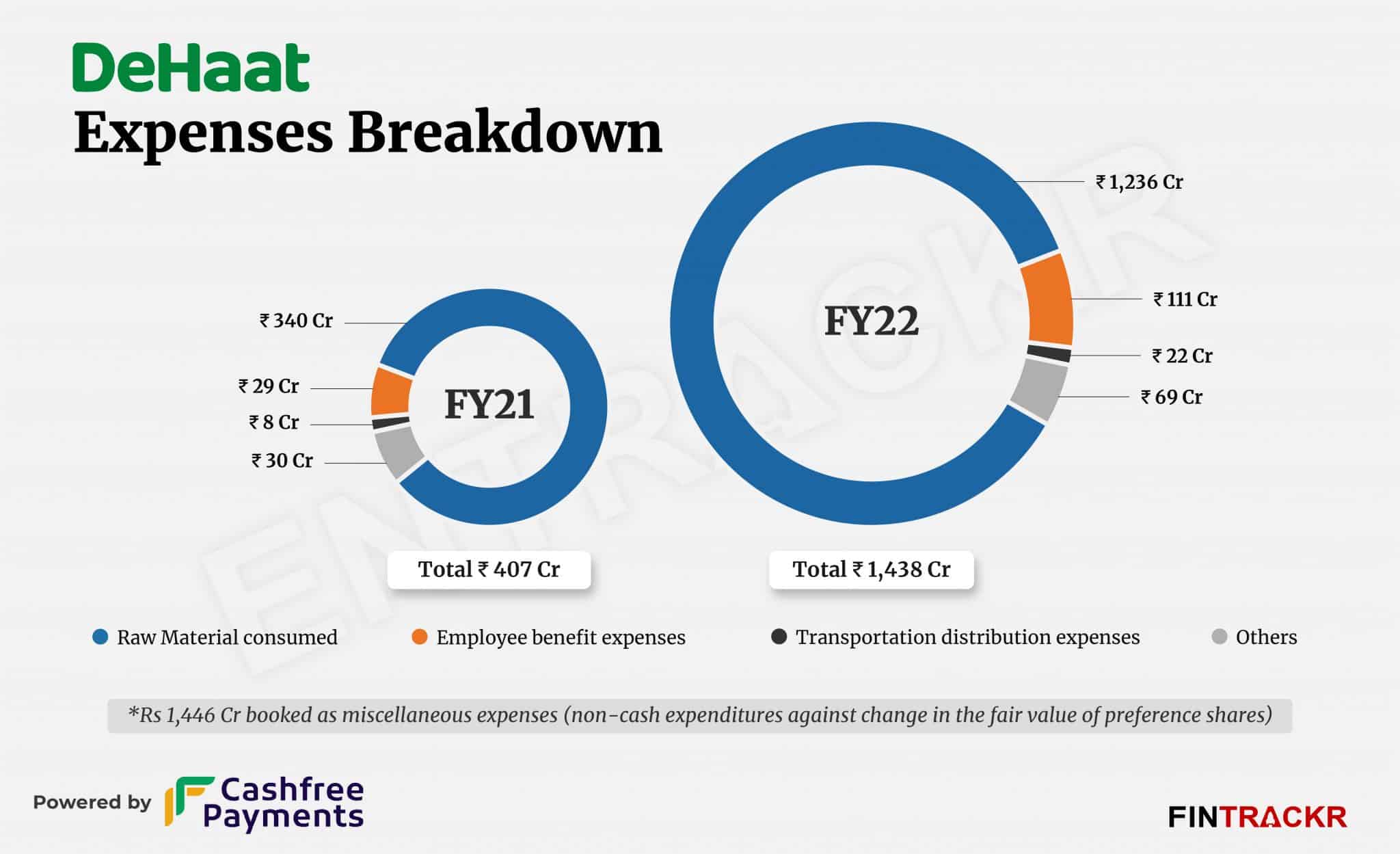

On the cost front, the procurement of agricultural inputs such as seeds, fertilizers, and pesticides turned out to be the largest cost center for the company which formed 86% of the total cost. This expense grew 3.6X to Rs 1,236 crore in the fiscal year ending March 2022.

Employee benefit expenses were the second largest cost which shot up 3.8X to Rs 111 crore in FY22 from Rs 29 crore in FY21.

The company spent Rs 22 crore on transportation and distribution which pushed its overall cost by 3.57X to Rs 2,852 crore in FY22 from Rs 798 crore in FY21. Importantly, the Gurugram-headquartered company booked Rs 1,446 crore as miscellaneous expenses, which were the non-cash expenditures against change in the fair value of preference shares.

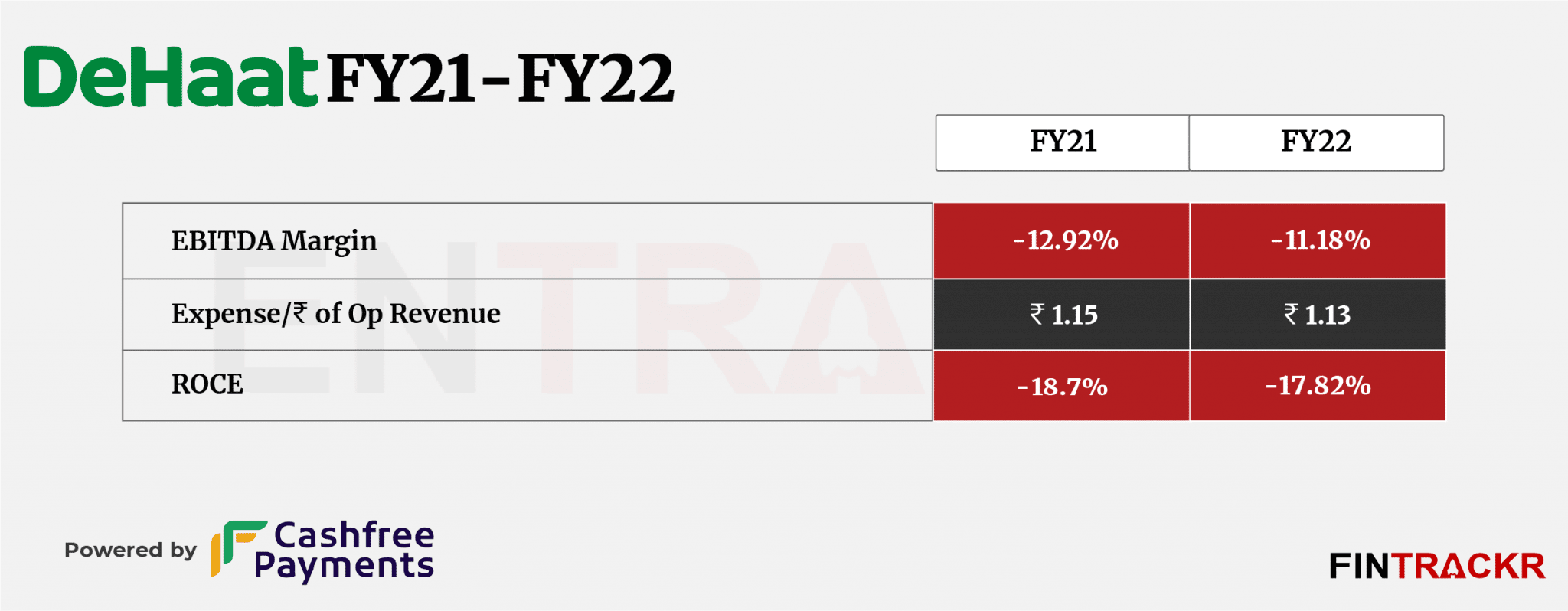

With a sharp rise in expenses, DeHaat’s losses spiked to Rs 164 crore in FY22 as compared to Rs 54 crore in FY21. Its cash outflow from operations also jumped 3.6X to Rs 370 crore in FY22. On a unit level, DeHaat spent Rs 1.13 to earn a single rupee in the last fiscal year.

With operational revenues rising, and costs that should be under control going forward, the firm seems well placed to benefit from the potential in its market. Improving rural infra and incomes means the opportunity continues to grow, and DeHaat has achieved the scale to benefit now. A breakeven show in FY23, if that happens, will be a huge milestone for the firm, especially if it comes on the back of sustained growth.

Revenue wise, DeHaat is on top among agritech startups while Tiger Global-backed Ninjacart missed the Rs 1,000 crore revenue mark by a small margin. Waycool claims to have recorded Rs 1,008 crore in revenue in FY22. The company is yet to file its audited financial statements for the last fiscal year.