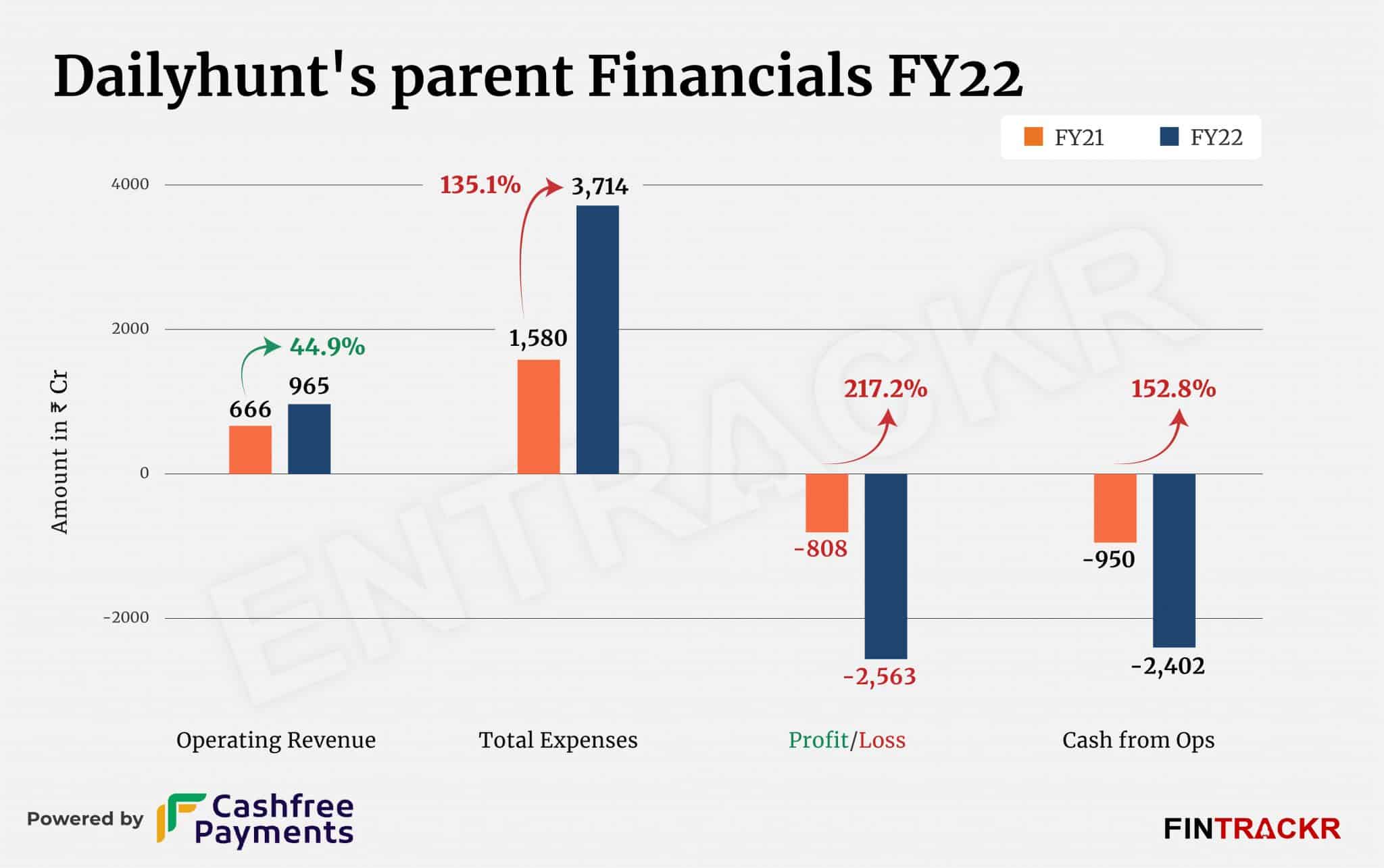

VerSe Innovation, the parent company of vernacular news aggregator Dailyhunt and short video entertainment app Josh, continues to bleed heavily as the company’s losses spiked over 3X and crossed Rs 2,500 crore in FY22.

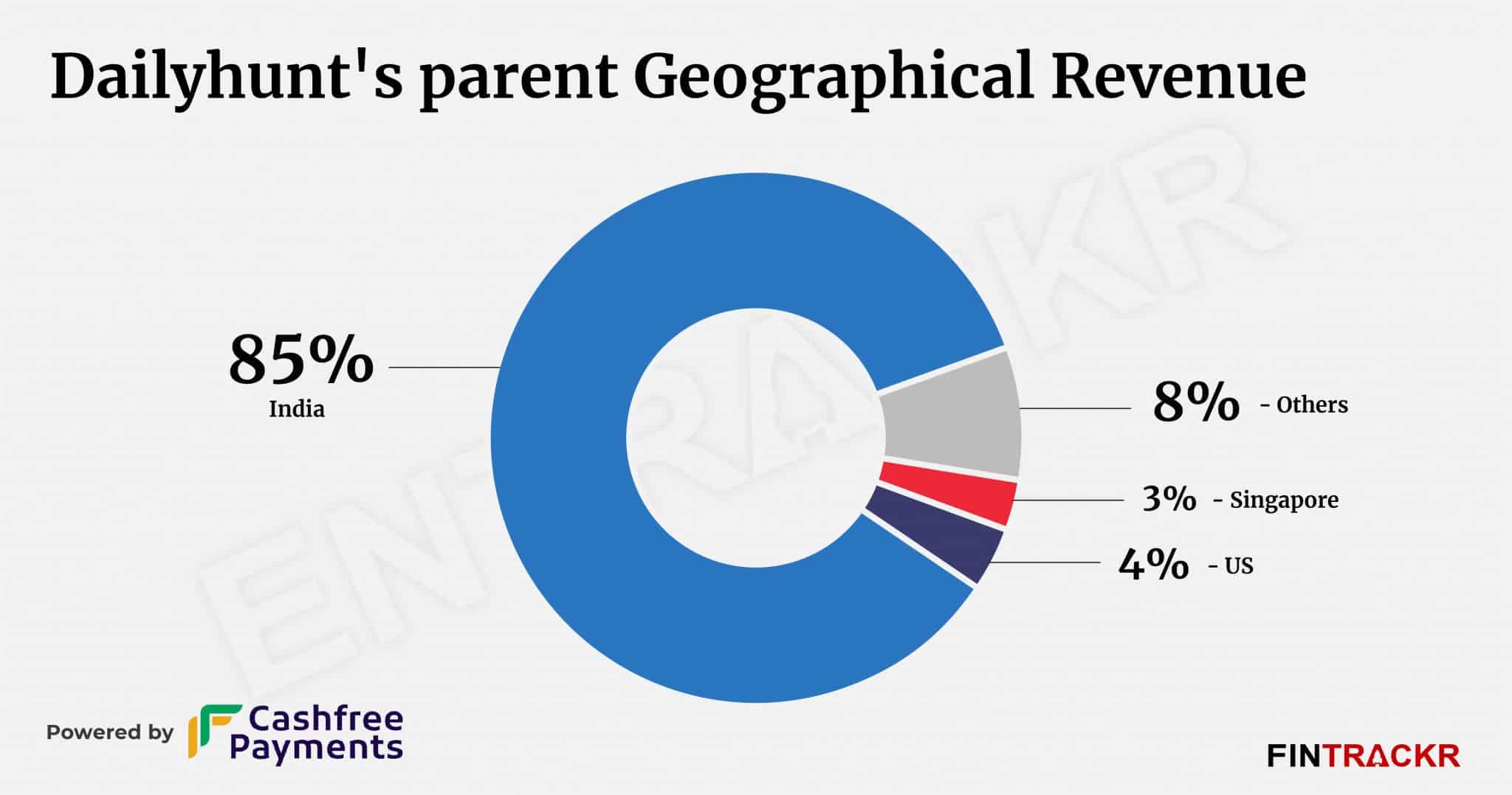

Meanwhile, its operating revenue grew 45% to Rs 965 crore during the same duration, according to its annual financial statements with the Registrar of Companies (RoC). The group derived its entire collection from online advertising and subscription services through its mobile apps and website.

The company also made Rs 19 crore from bank deposits and liabilities which it wrote off during the fiscal year.

The statements didn’t provide any revenue break-up across Josh and DailyHunt. But a Dailyhunt spokesperson told Entrackr that “100% revenue in VerSe” was from advertising on Dailyhunt and that the ad revenue grew 1.5x year-on-year.

The spokesperson added that all their investments were made to “grow Josh.” VerSe raised $450 million during FY22, at a valuation of $3 billion and splurged heavily on marketing and creating an ecosystem to enable a creator economy for its app. The company further raised $805 million at $5 billion valuation in April (FY23).

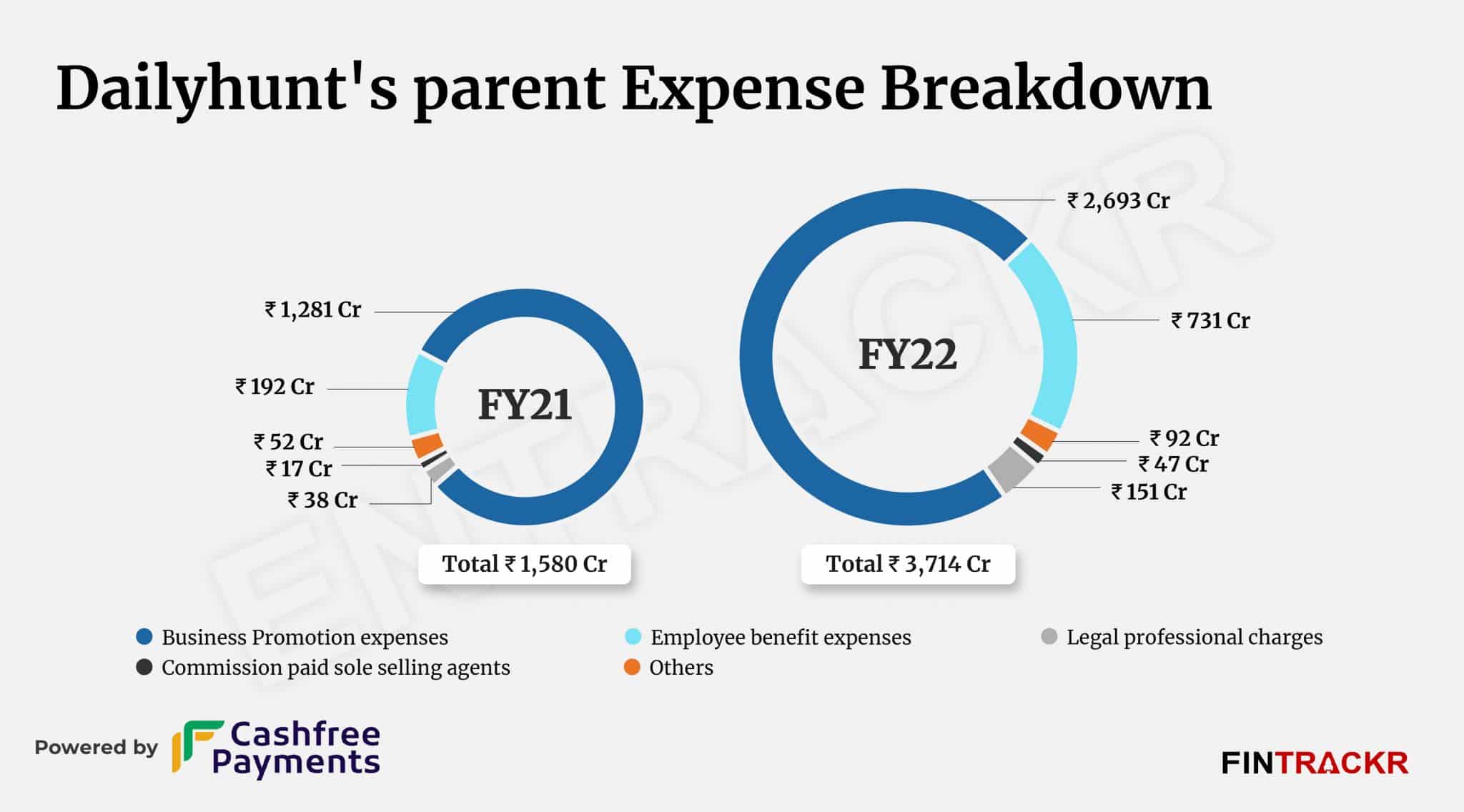

Business promotion expenses were the largest cost which spiked 2X to Rs 2,693 crore in FY22 from Rs 1,281 crore in FY21. This cost is 2.8X of the company’s operating revenues in FY22.

Employee benefits expense was the second largest cost for VerSe Innovation which surged 3.8X to Rs 731 crore in FY22. This cost included Rs 375 crore on employee stock option (ESOP) that was settled in cash.

Legal & professional expenses and commissions paid to agents blew 4X and 2.7X respectively to Rs 151 crore and Rs 47 crore in the last fiscal. In the end, its total cost ballooned 2.3X to Rs 3,714 crore in FY22 from Rs 1,580 crore in FY21.

With this spike in expenses, DailyHunt’s parent company’s losses shot up 3.17X to Rs 2,563 crore in FY22. Its cash outflows from operating activities also jumped 2.52X to Rs 2,402 crore while the firm’s unit economics also took a hit and it spent Rs 3.85 to earn a single rupee in FY22. A VerSe spokesperson told Entrackr that Dailyhunt exited March 2022 as EBITDA neutral. “In the last 7 months Dailyhunt has grown to 8% EBITDA positive,” they added.

Dailyhunt competes with Inshorts in the news aggregation and hyper-local video business, whereas its short video app Josh competes with ShareChat’s Moj, MX TakaTak, YouTube Shorts and Instagram, among others.

TikTok’s ban in 2020 gave birth to a host of short-video apps including Josh, Moj, and many others, who have been competing with each other to become the next TikTok.

Josh launched in late-2020, and since then seems to have been bleeding money in marketing the app and also attracting top creators. “All burn/losses were due to investments in Josh around tech, IT and marketing,” said the spokesperson. “This burn/loss grew 3.17x year-on-year.”

Josh is locked in a fierce battle with ShareChat’s Moj and is likely to continue to lose money. VerSe’s spokesperson, however, clarified that Josh’s monetization began in August and is expected to cross $100 million in annual recurring revenue during FY23. With Daily Hunt already within touching distance of Rs 1,000 crores, no mean achievement in the fiercely competitive advertising market, it would seem the firm is well placed to monetise inventory as and when it meets market requirements. However, the pressure from legacy media, peer group startups, and incumbent social media giants like Google and Facebook will continue to weigh on growth, which is bound to come at a high cost in the foreseeable future too.

Update: We have updated the headline to correct the revenue of the company in FY22.