Myntra is the largest fashion-focused e-commerce platform in India and its scale in the last fiscal reflects that. The Walmart-owned company has crossed the Rs 3,6o0 crore revenue mark in the fiscal year ending March 2022.

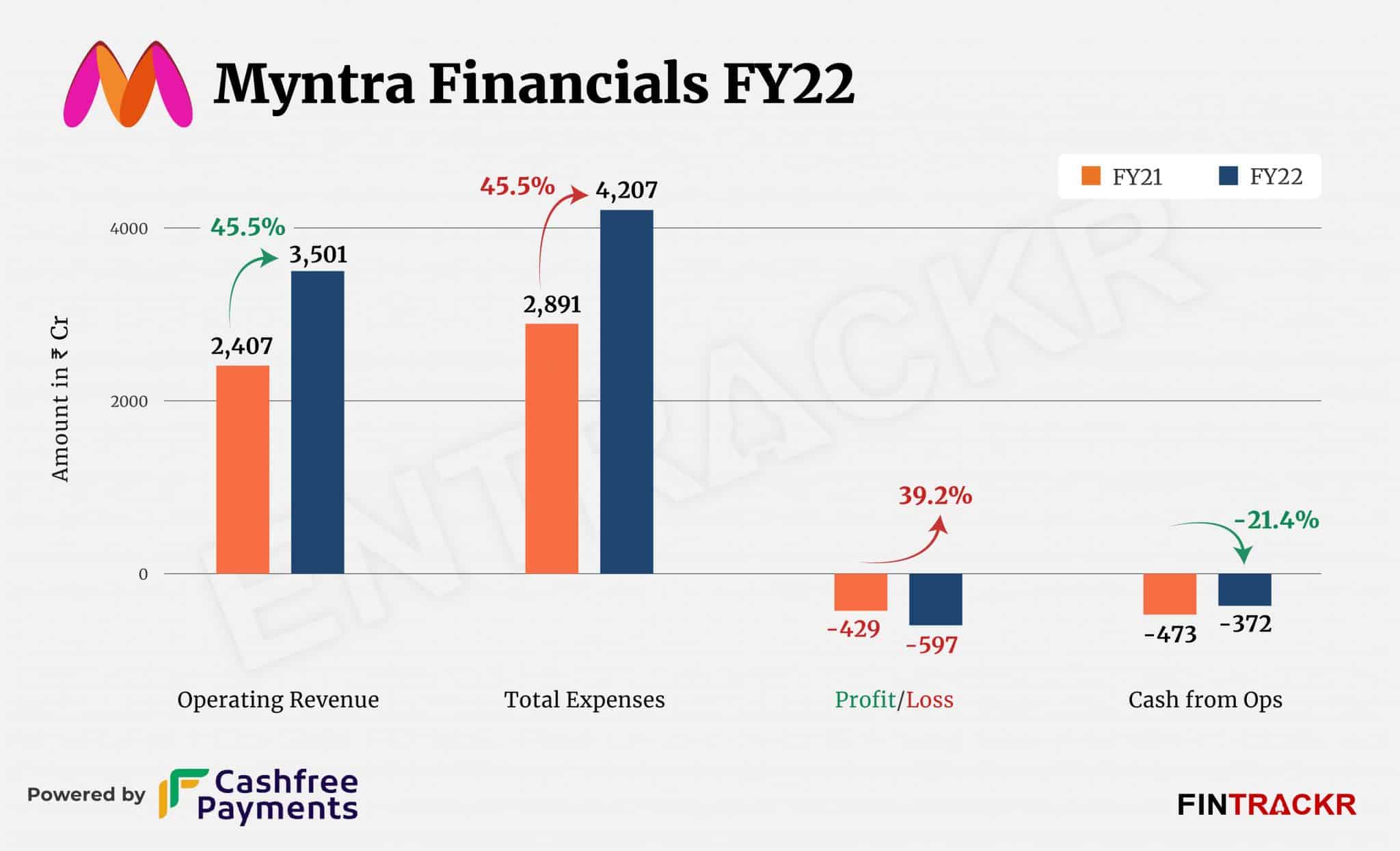

Myntra’s operating revenue surged 45.5% to Rs 3,501 crore in FY22, according to the company’s consolidated annual financial statements with the Registrar of Companies (RoC). It also made Rs 108.7 crore of non-operating income mainly from services such as electronic gift vouchers, royalty income, sublease revenue, and others which pushed its total collections up to Rs 3,610 crore.

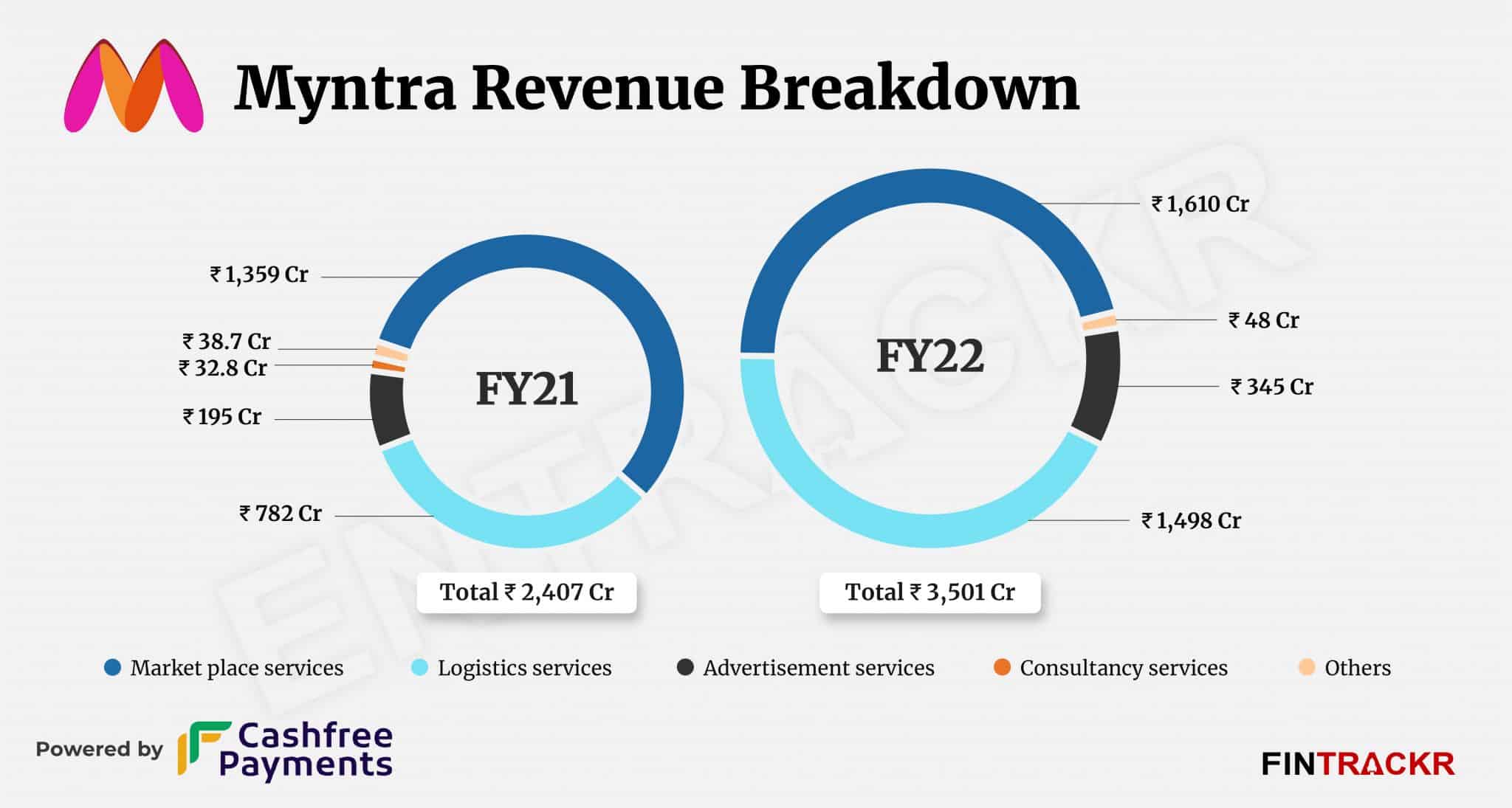

Marketplace and logistics services were the major source of revenue for Myntra, contributing around 46% and 42.8% of the operating revenue which surged 18.5% and 91.6% respectively to Rs 1,610 crore and Rs 1,498 crore in FY22. Its income from advertisement services grew 77% to Rs 345 crore in FY22 from Rs 195 crore in FY21.

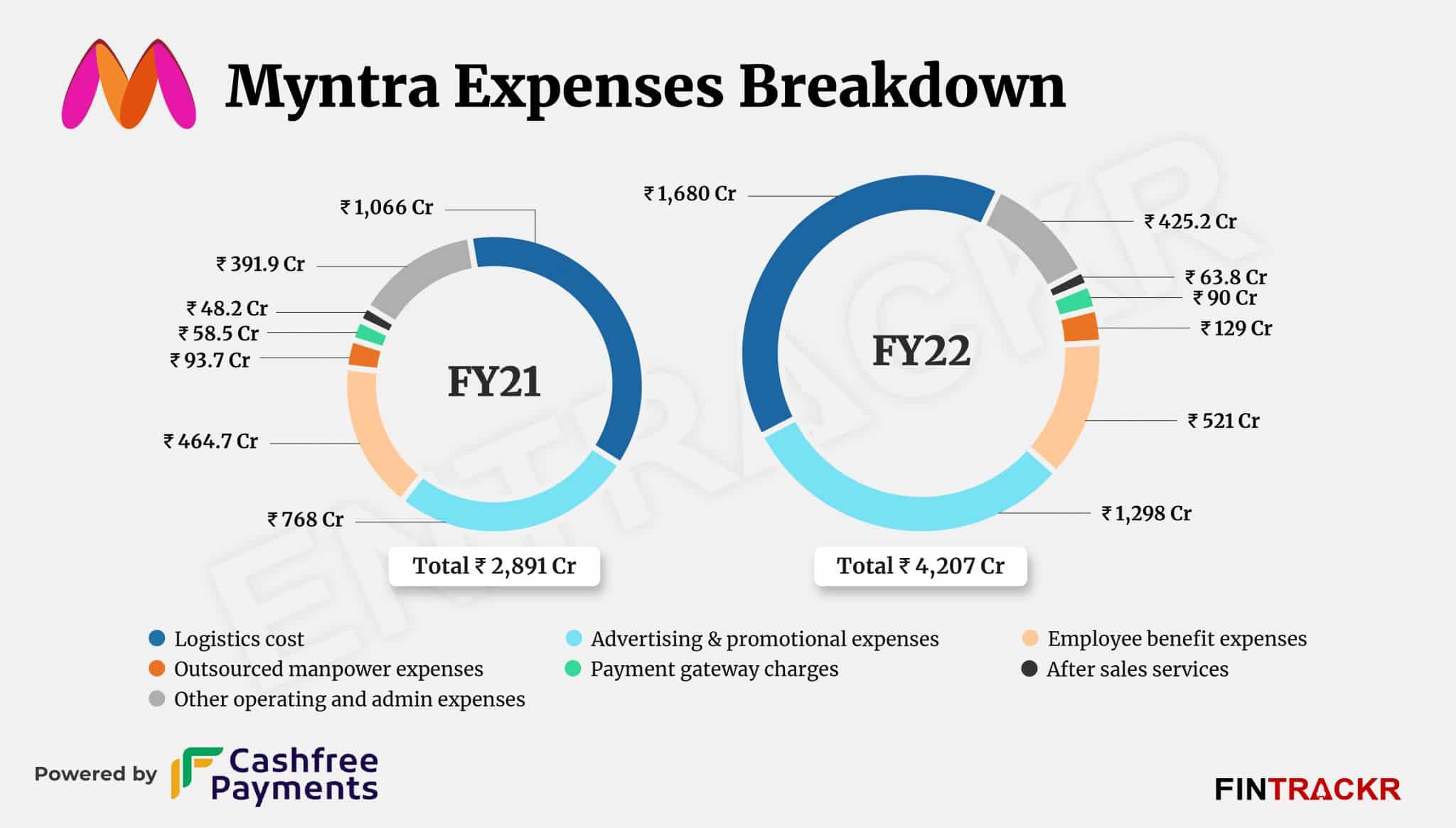

When it comes to expenditure, logistics turned out to be the biggest cost center for the company contributing nearly 40% to the annual expenditure. This cost surged 57.6% to Rs 1,680 crore during FY22 from Rs 1,066 crore in FY21.

Advertising and promotional expenses were the other major expenses during the last fiscal year which accounted for around 31% of total cost and soared 69% to Rs 1,298 crore in FY22. Employee benefit and outsourced manpower expenses increased 12% and 37.7% to Rs 521 crore and Rs 129 crore respectively in FY22. Importantly, its employee benefits cost includes ESOPs expenses of Rs 139 crore which were settled in equity.

The company also incurred payment gateway charges and after sales services (customer support services) of Rs 90 crore and Rs 63.8 crore which surged by 53.8% and 32.4% respectively during the last fiscal year.

Myntra’s total expenditure also grew 45.5% to Rs 4,207 crore in FY22 as compared to Rs 2,891 crore in FY21. While the operating revenue and total expenses surged at the same pace, an 83.6% spike in non-operating income helped the company control losses to some extent. Myntra’s losses increased 39% to Rs 597 crore in FY22 against Rs 429 crore reported in FY21.

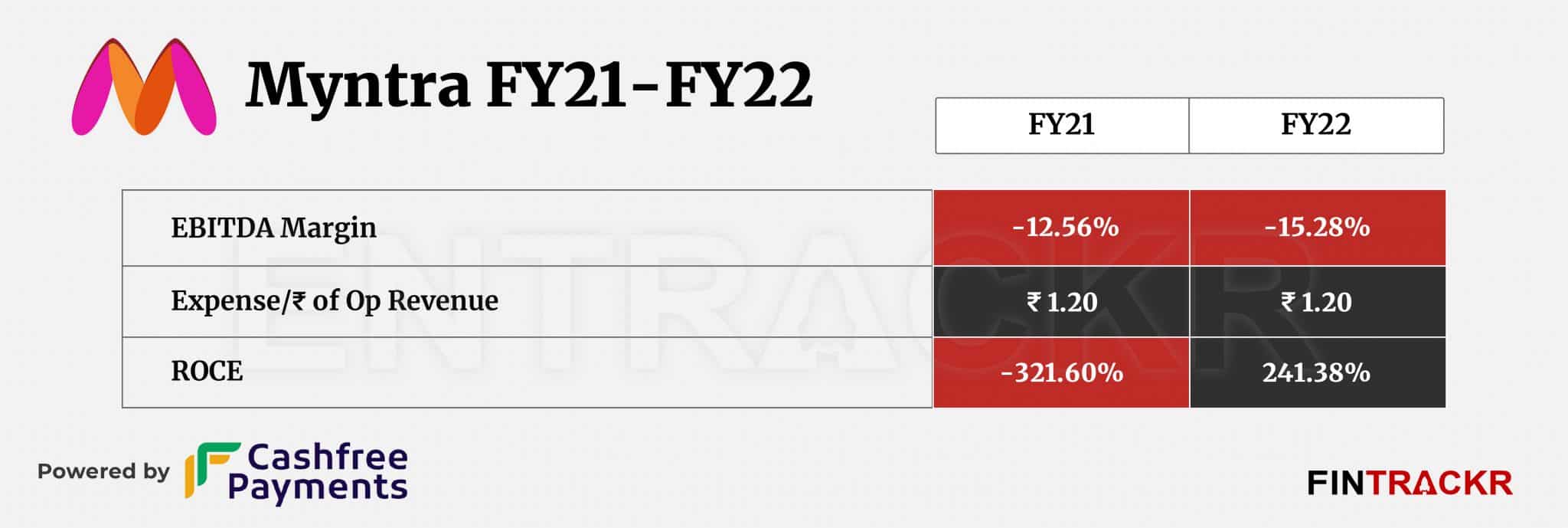

The EBITDA margin of the company worsened by 272 BPS to -15.28% in FY22. On a unit level, the Bengaluru-based company spent Rs 1.2 to earn a rupee of operating revenue during FY22.

The 45% plus growth indicates the kind of processes, brand, and execution capability the company has undoubtedly built over the years. But competition, far from reducing, remains intense, of not growing, from stand-alone as well as platform brands like Reliance’s Ajio. Indicators are also strong that new user growth is slowing down across the digital domain, making it all the more critical for Myntra to focus harder on metrics like revenue per user.