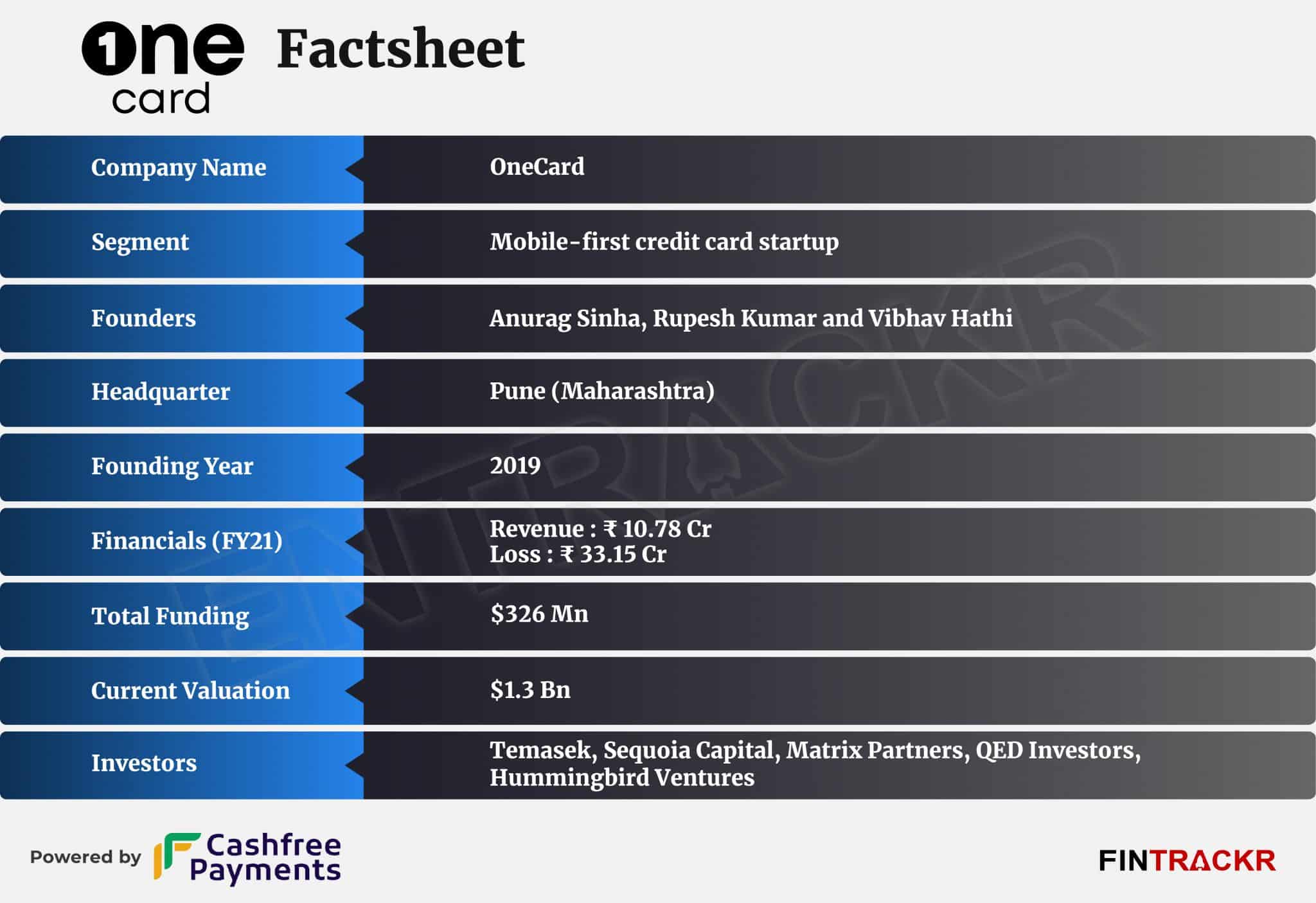

Mobile-first credit card startup OneCard turned unicorn after raising around $101 million in a Series D funding round led by Temasek in July. While details of the new investment have been unknown, Fintrackr has sifted through the company’s regulatory filings to decode round-break-up, cap table, and valuation.

The board at OneCard has passed a special resolution to allot 2,68,891 Series D compulsory convertible preference shares (CCPS) at an issue price of Rs 29,843.62 per share to raise Rs 802.5 crore or around $101 million, according to the company’s regulatory filings with the Registrar of Companies (RoC).

Entrackr had reported about this round with exact details on July 4.

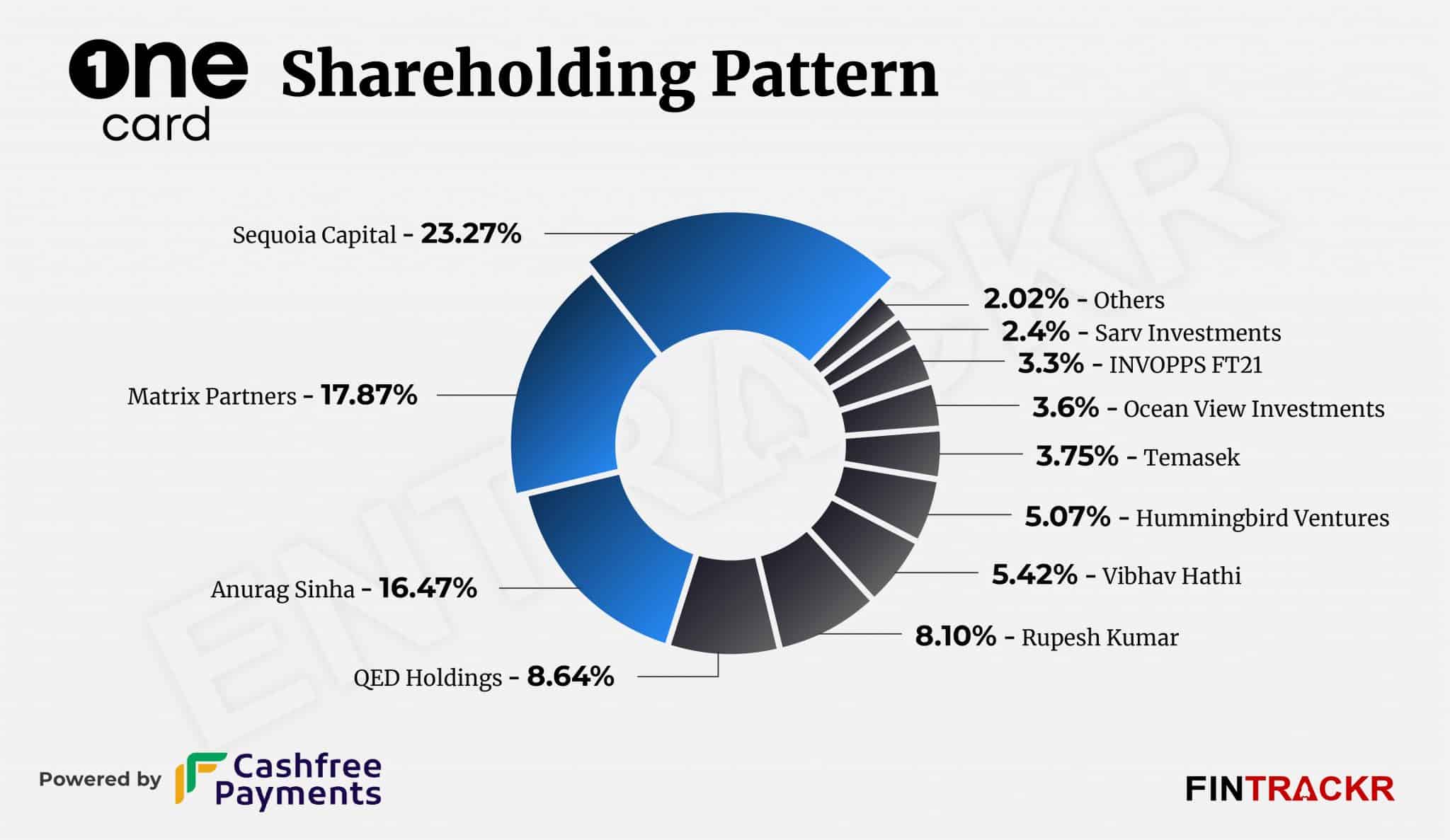

Temasek spearheaded the Series D round with Rs 375 crore ($47.3 million) followed by QED Holdings and Ocean View Investments joined the round with Rs 153.75 crore and Rs 150 crore respectively. Sarv Investments infused Rs 112.5 crore while Sequoia invested Rs 7.5 crore. Matrix and Hummingbird invested Rs 1.87 crore each.

As per Fintrackr’s estimates, the company has been valued at around Rs 10,000 crore or $1.3 billion (post-allotment). The company has raised around $326 million in funds to date including a $75 million round in December 2021.

OneCard offers first-time credit card users a virtual, cellphone-based card to build a credit score. It also enables an equated monthly installment (EMI) facility for purchases of Rs 3,000 and runs a credit score tracking cum credit management app called OneScore which claims nearly 70 million users.

Post allotment of this round, Sequoia holds 23.27% stake followed by Matrix and QED Holdings which own 17.87% and 8.64% respectively. Co-founders Anurag Sinha, Rupesh Kumar, and Vibhav Hathi collectively command nearly 30% of the cap table. The complete shareholding pattern of the company can be seen below:

While OneCard did not disclose financials for FY22 yet, it remained a pre-revenue stage company during FY19 and FY20. However, the firm managed to post Rs 10.78 crore in revenue in FY21. As per the annual financial statement filed with RoC, the company’s losses soared 4.3X to Rs 33.15 crore in the fiscal year ending March 2021.

The company competes with Tiger Global-backed Slice and Uni who have been exploring co-branded credit cards after The Reserve Bank Of India prohibited prepaid cards and wallets from lending.