Consumer lending platform EarlySalary, which is popular for providing short-term loans and salary advance loans, recently raked in its largest fundraise of around $110 million.

EarlySalary concluded this round in a mix of equity and debt at a post valuation of $300 million. While the Pune-based company did not provide further information, Fintrackr has decoded some interesting numbers and facts through the company’s regulatory filings.

The board at EarlySalary has passed a special resolution to allot 1,26,843 Series D CCPS at an issue price of Rs 60,982.84 per share to raise Rs 775.5 crore, regulatory filing with the Registrar of Companies (RoC) shows.

Singapore-based TPG Growth (through The Rise Capital) led the round with Rs 448.5 crore ($56 million) while Norwest and existing investor Piramal Capital participated with Rs 276 crore ($35 million) and Rs 50 crore ($6.2 million), respectively.

The board members at EarlySalary filed another resolution to issue Series D1 CCPS to the company’s founders Ashish Goyal and Akshay Mehrotra which is worth Rs 104.3 crore. It appears that founders have put this money in the company.

In a recent interview, Goyal disclosed that $100 million was a primary transaction while $10 million was a secondary sale.

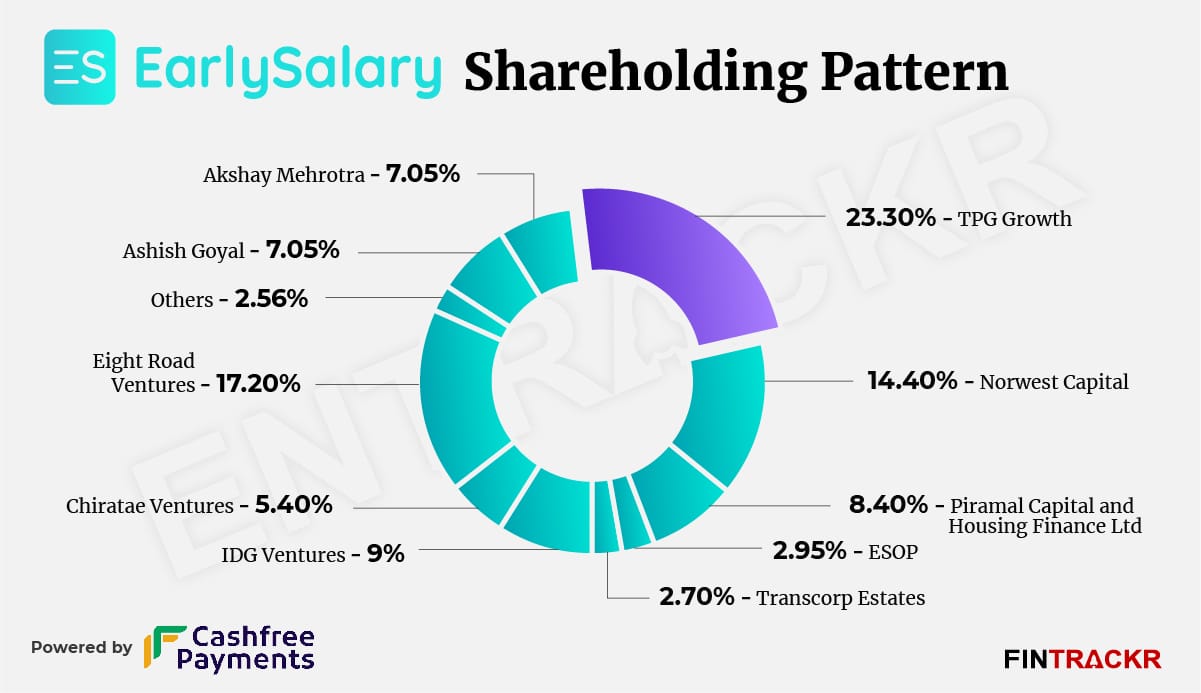

With the infusion of fresh funds, TPG growth became the largest stakeholder in the firm with 23.3% of the capital while Norwest Capital and Piramal Capital & Housing Finance command 14.4% and 8.4% respectively in the organisation. Founders collectively hold a 16% stake. The complete shareholding can be seen below:

As per Fintrackr’s estimates, the company has picked up the new round at a valuation of $290-300 million— 4X higher than what it was during its previous round in 2020.

Seven-year-old firm, EarlySalary offers short-term loans of up to Rs 5 lakh for shopping, travel, education, and medical emergencies to working professionals in small, medium and large companies. Besides instant and personal loans, it also offers BNPL and free credit score check feature.

The company claims that it has around 12 million app downloads and is present in 150 cities. The company has already disbursed nearly 2.8 million loans worth nearly $1 billion and aims to add 100,000 new users every month.

EarlySalary’s revenue from operations decreased by 17% to Rs 84.2 crore in FY21 from Rs 101.6 crore in the previous fiscal year (FY20), according to the company’s annual financial statements. It posted a loss of Rs 18.8 crore during FY21. The company is likely to have improved its unit economics in FY22 as Goyal (co-founder and CFO) claimed that it’s profitable after tax (PAT). FY22 numbers are yet to be filed.