Academic-focused fintech startup Jodo has raised $15 million in Series A financing round led by Tiger Global and participated by existing investors Elevation Capital and Matrix Partners India.

The proceeds will be deployed towards tweaking products, catalyzing sales and expanding workforce, said Jodo in a press statement.

While Jodo hasn’t disclosed details of the fresh round, Fintrackr has managed to decode the Series A round via the company’s regulatory filings. Tiger has spearheaded the round with Rs 78.5 crore while existing investors Matrix and Elevation pumped in Rs 19.6 crore each, as per filings.

As per Fintrackr’s estimates, the company has been valued at around $90 million post allotment of the new round.

Jodo helps middle-income families manage the academic expenses of their children whereas the company helps schools digitize the collection process and offers multiple payment options. It claims to power fee collection for over 700 schools and have facilitated fee payments for over one lakh students.

The Series A round for the Bengaluru-based company has come after two years. It has raised $3.8 million from Matrix, Elevation and 15 angels including Amit Rajan, Nithin Kamath (through Rainmatter Capital), Softbank’s Sarthak Misra and CRED’s Kunal Shah. Entrackr had exclusively reported Jodo’s seed round.

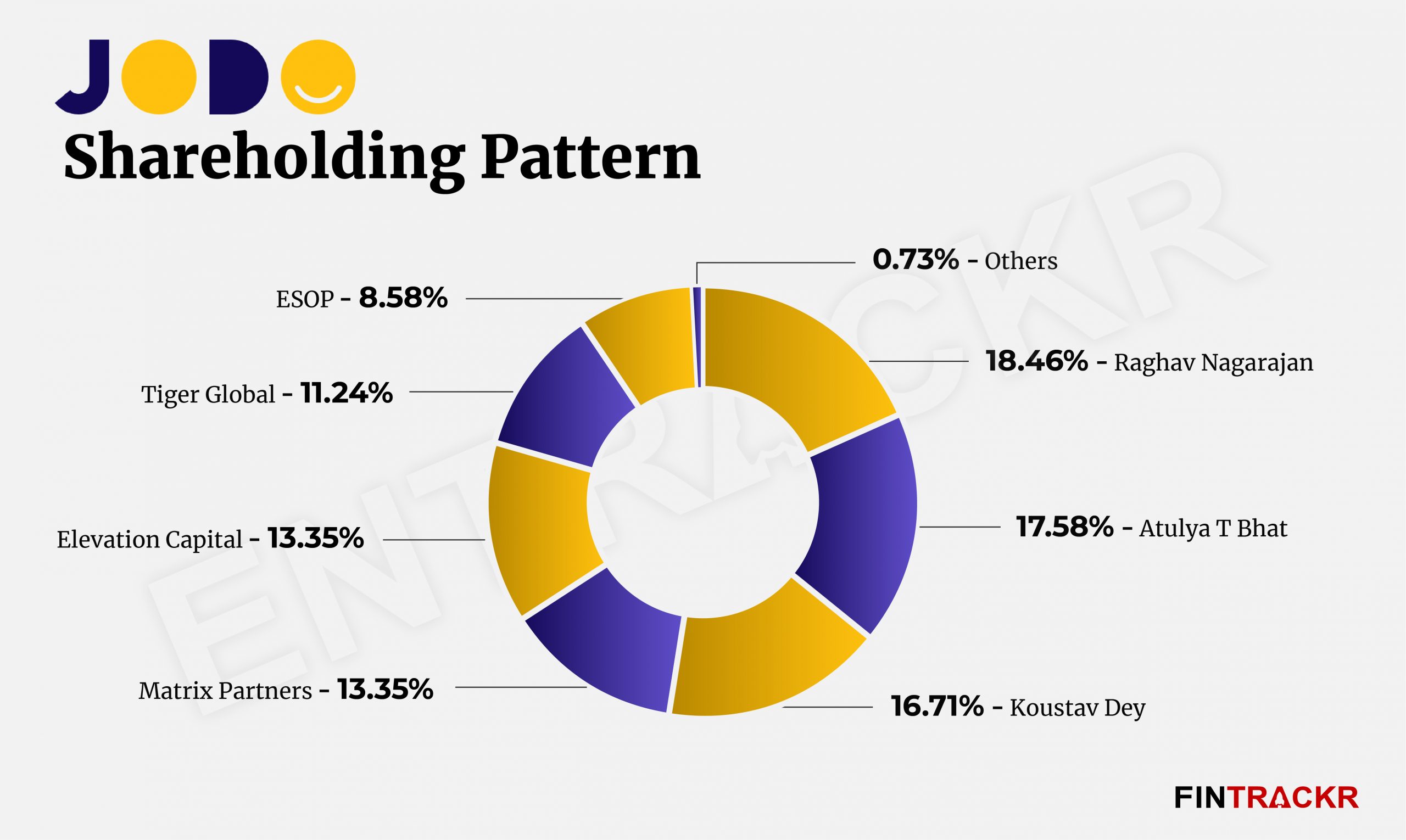

Following the Series A round, Tiger holds 11.24% stake in Jodo whereas Matrix and Elevation command 13.35% each. Co-founders Raghav Nagarajan, Atulya T Bhat and Koustav Dey collectively own 52.75% stake. It’s worth noting that the trio are former executives of Matrix Partners India.

Jodo directly competes with Mumbai-based GrayQuest which raised $1.2 million in a pre-Series A round led by Foundation Holdings in May last year and indirectly with horizontal payment companies such as Paytm.

Incorporated in 2020, Jodo was a pre-revenue stage startup during FY21 as its revenue from operations stood at Rs 8 lakhs with a loss of Rs 1.73 crore.

The shifting strategy of Tiger: From growth to early stage

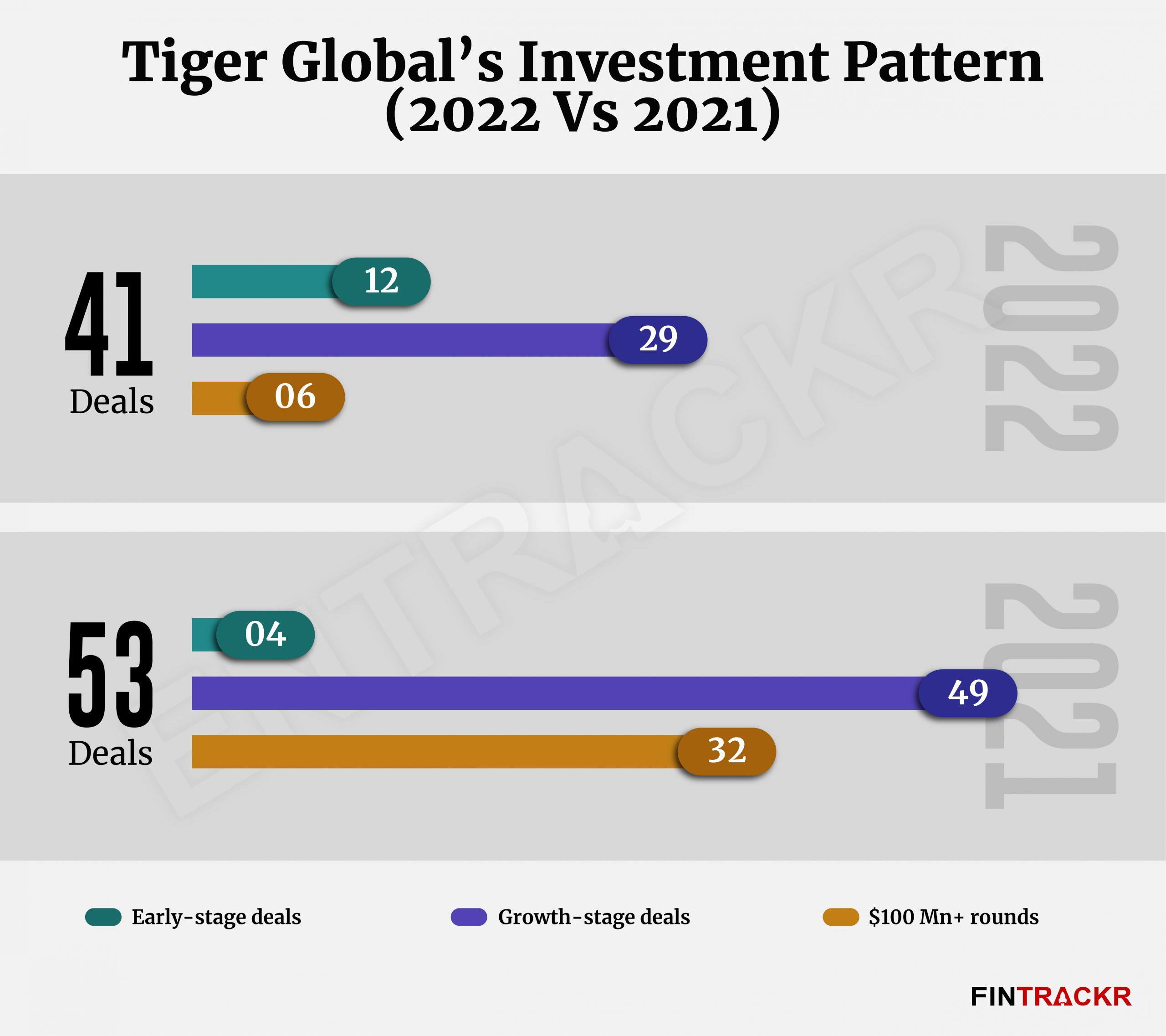

Tiger Global, which was majorly backing growth and late-stage startups in 2021, has changed its strategy and now it’s eyeing more early-stage deals. As per Fintrackr’s data, Tiger Global has made 12 early-stage bets in 2022, a jump of threefold as compared to four deals in the previous year.

The slowdown in funding can also be evident from the investment pattern of the New York-based fund which invested or was the lead investor in 32 $100 Mn+ rounds in 2021 which further reduced to only six as of August 9, 2022.