Online investment platform Upstox has received fresh funds to the tune of Rs 50 crore ($6.3 million) in a mix of debt and equity from Blacksoil Capital and Xceed Investments LLC in its ongoing Series C round.

The board at Upstox passed a special resolution to issue 1,583 Series C4 CCPS to Xceed Investments LLC at an issue price of Rs 99,831 per share and 700 debentures to Blacksoil Capital at an issue price of Rs 5,00,000 each to raise an aggregate amount of Rs 50.8 crore.

The Mumbai-based company grabbed the headlines when it turned unicorn following a $25 million round led by existing investor Tiger Global. The company’s valuation saw a jump from less than $1 billion to more than $3 billion during the unicorn round in November last year.

The valuation of the company remains unchanged.

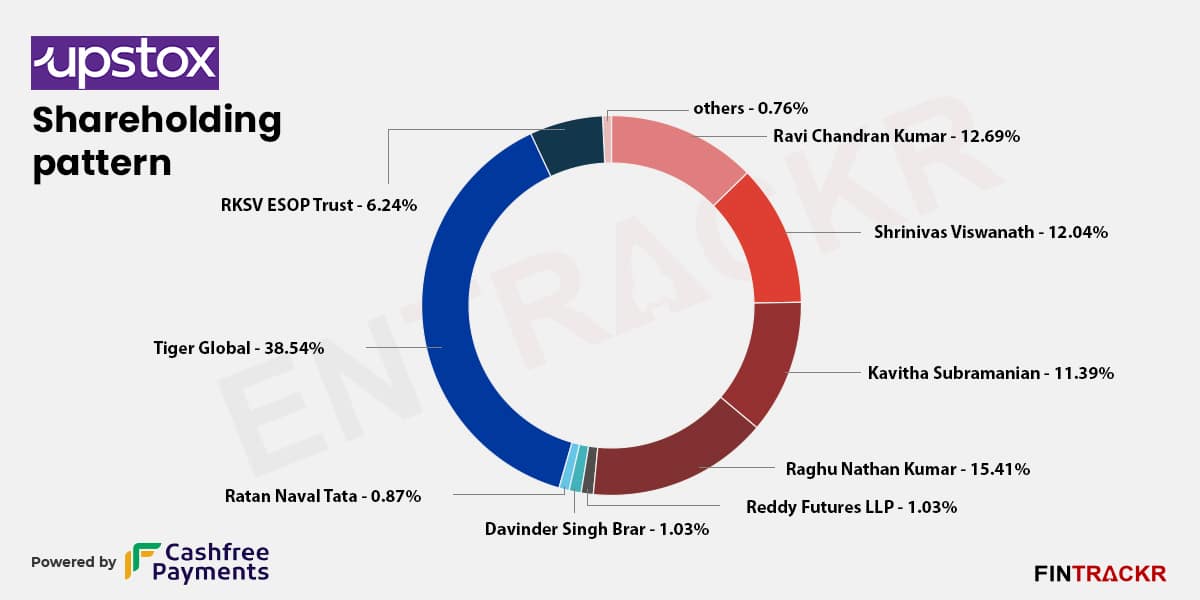

Following the multiple capital infusion in Series C round, the shareholding pattern of Upstox has also been changed. Tiger Global, which picked up 31.1% stake in Upstox in 2019, has increased its holding to 38.54%. The founding team including Ravi Kumar, Shrinivas Vishwanath, and Kavitha Subramanian have 36.12% stake. Raghu Nathan Kumar, the company’s director, has 15% stake.

Raghu Nathan Kumar along with Ravi Kumar, and Shrinivas Vishwanath, started RKSV Securities in 2009 which later changed to Upstox in 2016. The Upstox team is now being led by Ravi Kumar (CEO) while Kavitha Subramanian and Shrinivas Viswanath are its other two co-founders.

Importantly, Upstox has also provided a complete exit to its early backer Kalaari Capital. This can be seen on Kalaari’s website. In 2021, the Vani Kola-led firm had about 8-10 partial or full exits from startups such as Dream11, WazirX, Milkbasket, Simplilearn, and Shop101.

Upstox allows retail investors to trade in the equity market through the platform and mutual fund investments, futures and options trading. In May, the company claimed that it crossed 10 million user base, ahead of its competitor Zerodha which had 9 million users then.

Backed by the likes of Ratan Tata, Upstox competes with Zerodha, Groww, and INDmoney. Apart from Zerodha, Tiger is an investor in all three stockbroking companies.

It’s worth mentioning that Tata Group’s super app Tata Neu is also in the process of launching a stock broking service. Tata Fintech, which appears to be a backend entity for the stock broking service, has also sought approval from the market regulator Securities and Exchange Board of India (SEBI). Entrackr exclusively reported the development on August 25.

In April, Entrackr reported that Upstox was going to execute a share buyback plan worth around Rs 29 crore or $4 million from its founders and employees. This buyback was the first ESOP liquidity program by the company since its inception.