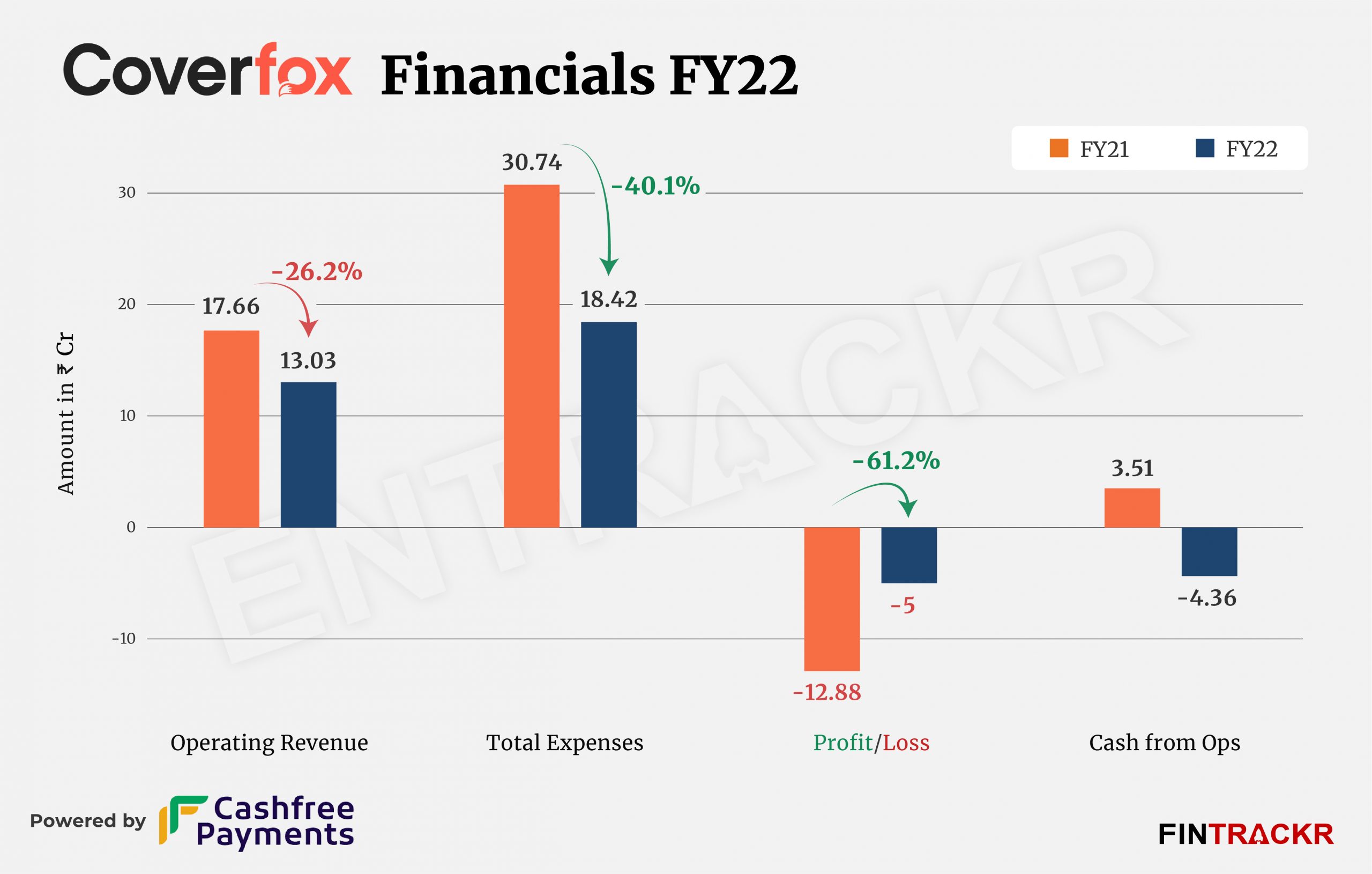

After facing an existential threat due to the movement of its co-founders, SAIF Partners (now Elevation Capital)-backed insurance selling platform Coverfox’s insurance broking arm: Coverfox Insurance Broking Pvt Ltd continues to see a fall in its scale. The company’s operating revenue shrank 26.2% to Rs 13.03 crore in FY22, as per its annual financial statement filed with the Registrar of Companies (RoC).

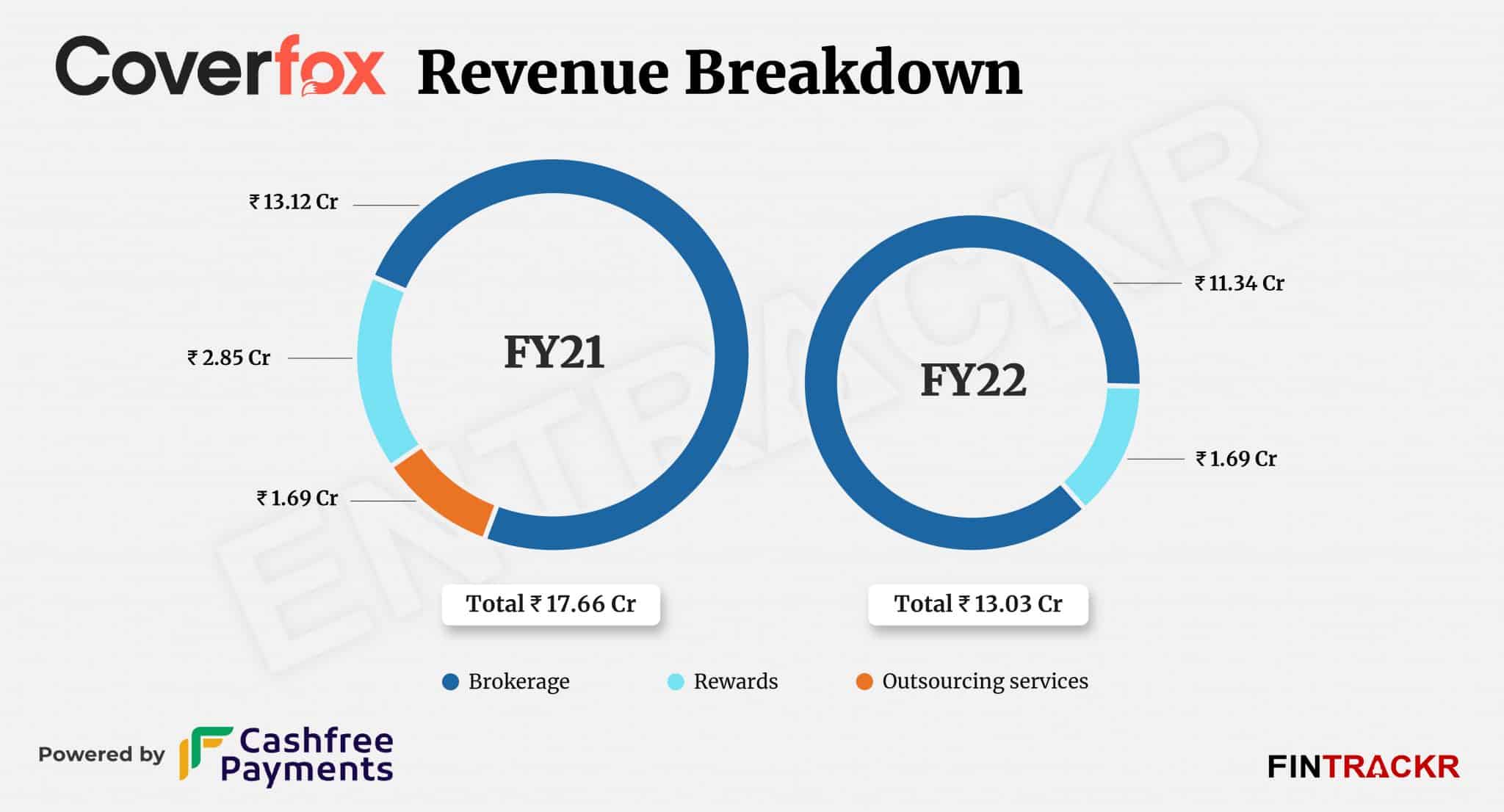

Coverfox is an insurance broking firm that deals in distribution of car, bike, health, team insurance and investment plans. Brokerage income has remained the major source of revenue for the firm which forms 87% of its operating revenue. This income decreased 13.6% to Rs 11.34 crore in FY22 from Rs 13.12 crore in FY21.

The Mumbai-based company also made some income from rewards commission which plummeted 40.7% to Rs 1.69 crore in FY22.

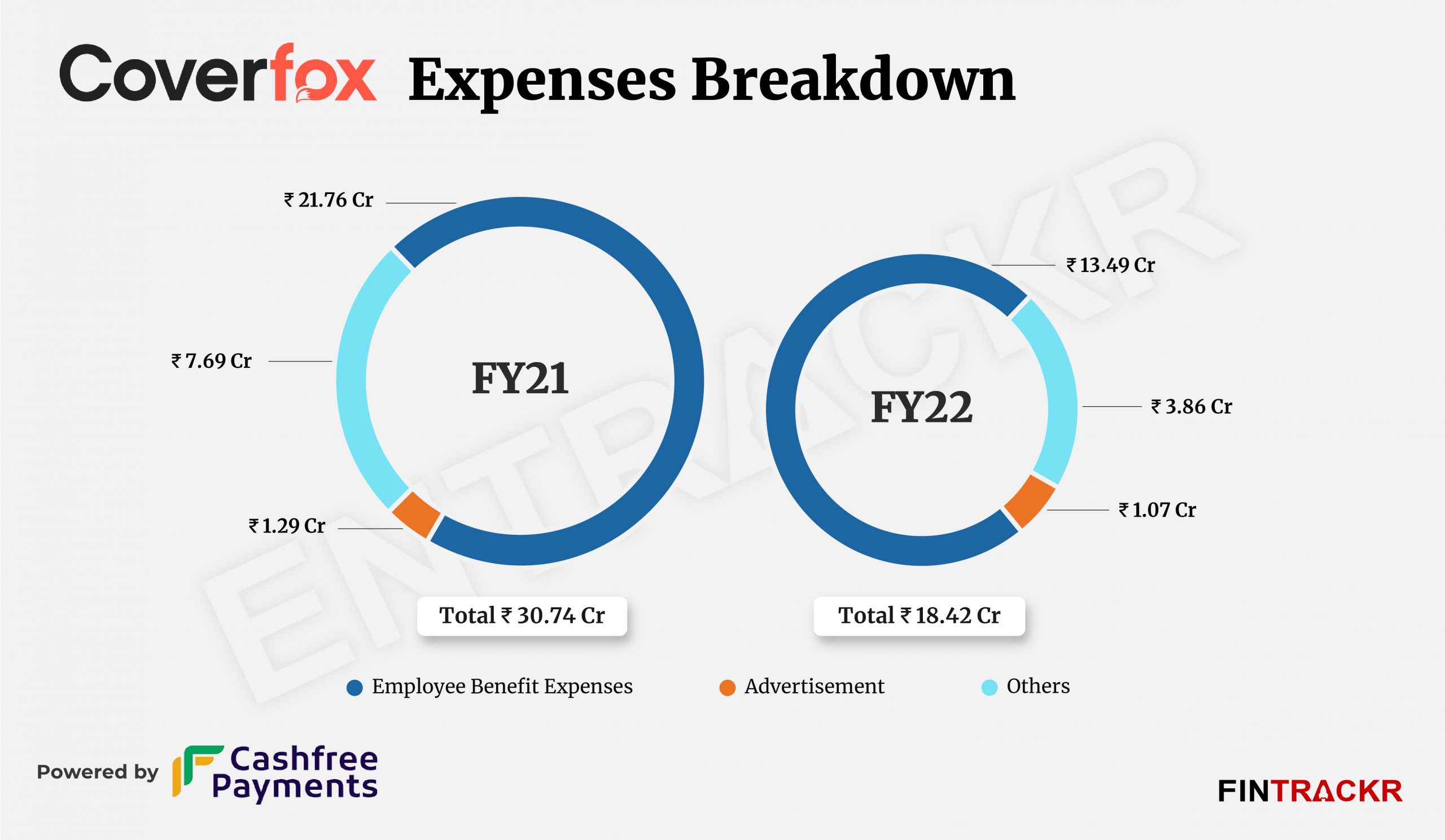

Austerity measures implemented by the firm are evident from its expenses which shrank 40% to Rs 18.42 crore in FY22 from Rs 30.74 crore in FY21.

Employee benefit expenses were the largest cost center for coverfox which constituted 73.24% of the overall cost and fell off 38% to Rs 13.49 crore in FY22. Cost for advertisement and promotion also lessened by 17% to Rs 1.07 crore in FY22.

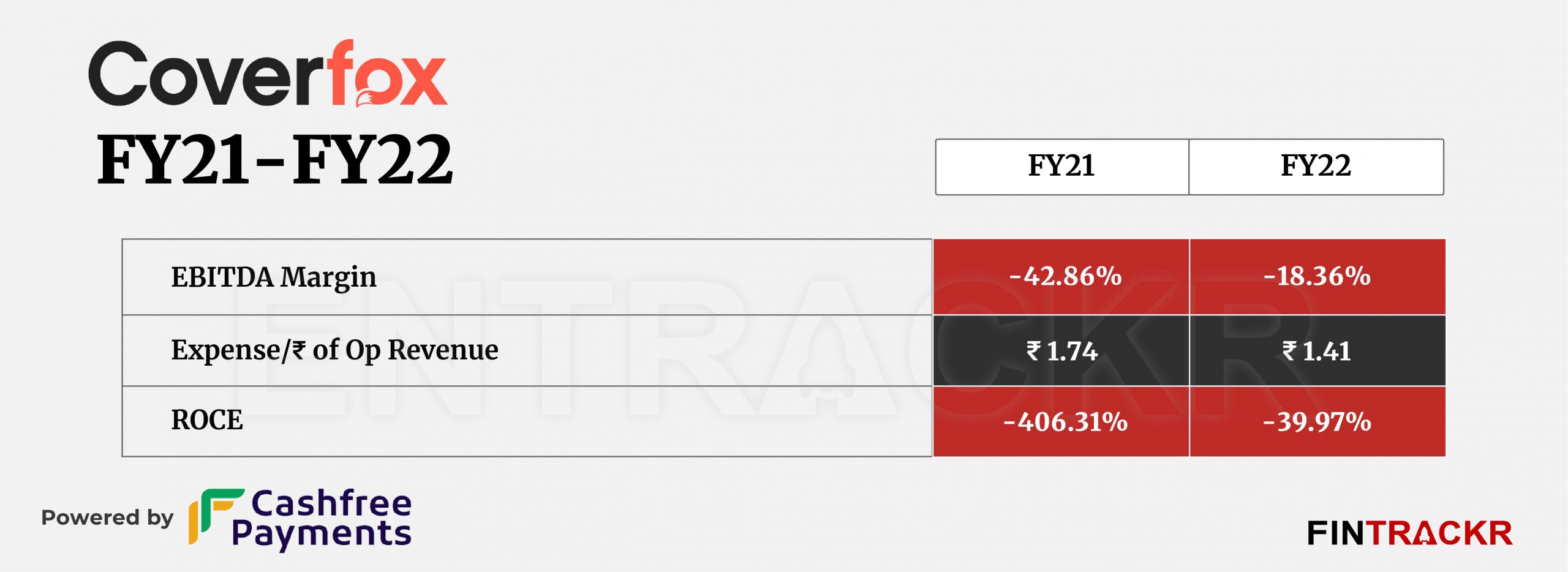

With tight control on expenses, the company managed to contract its losses by 61% to Rs 5 crore in FY22 from Rs 12.88 crore in FY21. On a unit level, Coverfox spent Rs 1.41 to earn a single unit of operating revenue in FY22.

Founded in 2013 by Devendra Rane and Varun Dua, Coverfox has raised over $55 million to date and was last valued at over $100 million. While Dua left the company in its early days to launch insurance company Acko, Rane abruptly moved from Coverfox in 2020 along with its chief executive officer Premanshu Singh.

The movement of Rane and the key leadership team was a jolt for Coverfox and its future seemed uncertain. However, Avaana capital’s co-founder Sanjib Kumar Jha took over as the CEO of the company in 2020. Coverfox was the maiden investment for Avaana Capital in late 2018.

Coverfox’s financial performance hasn’t been an impressive one in FY22 but the company is anticipating a turnaround. In February this year, the company’s chief executive officer Sanjib Jha projected that its consolidated revenue (Coverfox Insurance Broking and Glitterbug Technologies) crossed the Rs 40 crore mark in the fiscal year ending March 2022(FY22).

While Glitterbug Technologies is yet to file FY22’s results, the company has projected Rs 127 crore consolidated revenue by the end of the ongoing fiscal year (FY23). If Coverfox makes a turnaround in the coming year, then it would truly be one of the case studies in a startup ecosystem which has rarely seen any private-equity-led turnaround in the past few years.