The year 2019 was the beginning of Reliance’s full-fledged entry into the Indian startup ecosystem with over half a dozen acquisitions and investments. During the year, Reliance backed startups across segments including Fynd, Haptik, NowFloats, Reverie, EasyGov, Sankhya Sutra Labs and NewJ.

While all these companies are yet to disclose their financial numbers for the last fiscal year (FY22), AI-driven translation management platform Reverie has turned profitable in the fiscal year ending on March 31, 2022.

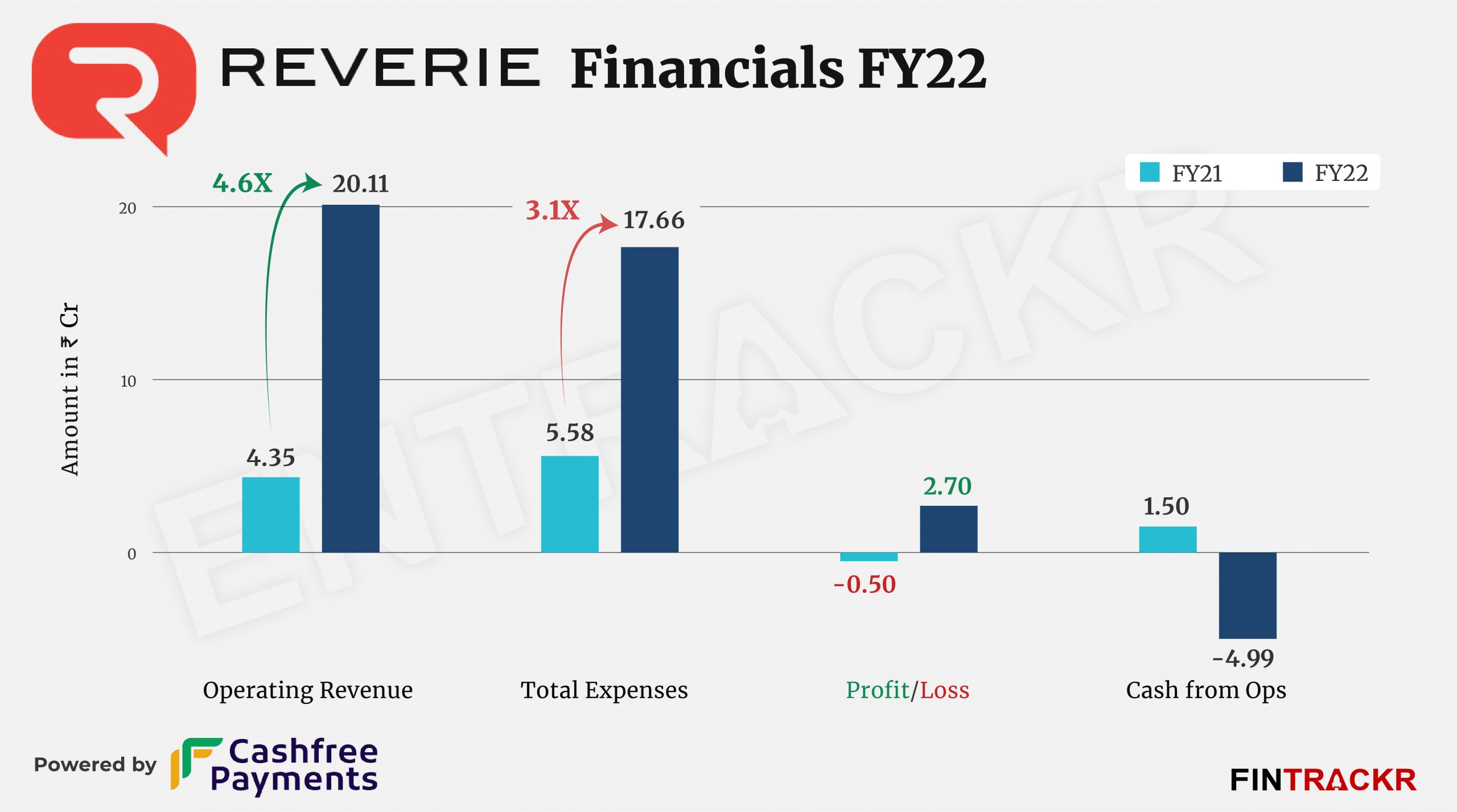

Reverie’s revenue from operations ballooned 4.6X to Rs 20.11 crore during FY22 from Rs 4.35 crore in FY21, according to its annual financial statements filed with RoC.

Reverie is a cloud-based language translation management platform that helps translate, speech-to-text or text-to-speech conversions, input and search on the web in several Indian languages.

The company was acquired by Reliance Industrial Investments & Holdings (RIIHL), a wholly-owned subsidiary of Reliance Industries, in April 2019. At the time of acquisition, Reverie disclosed that Reliance has acquired a majority stake in the company for Rs 190 crore and will further invest Rs 77 crore by March 2021.

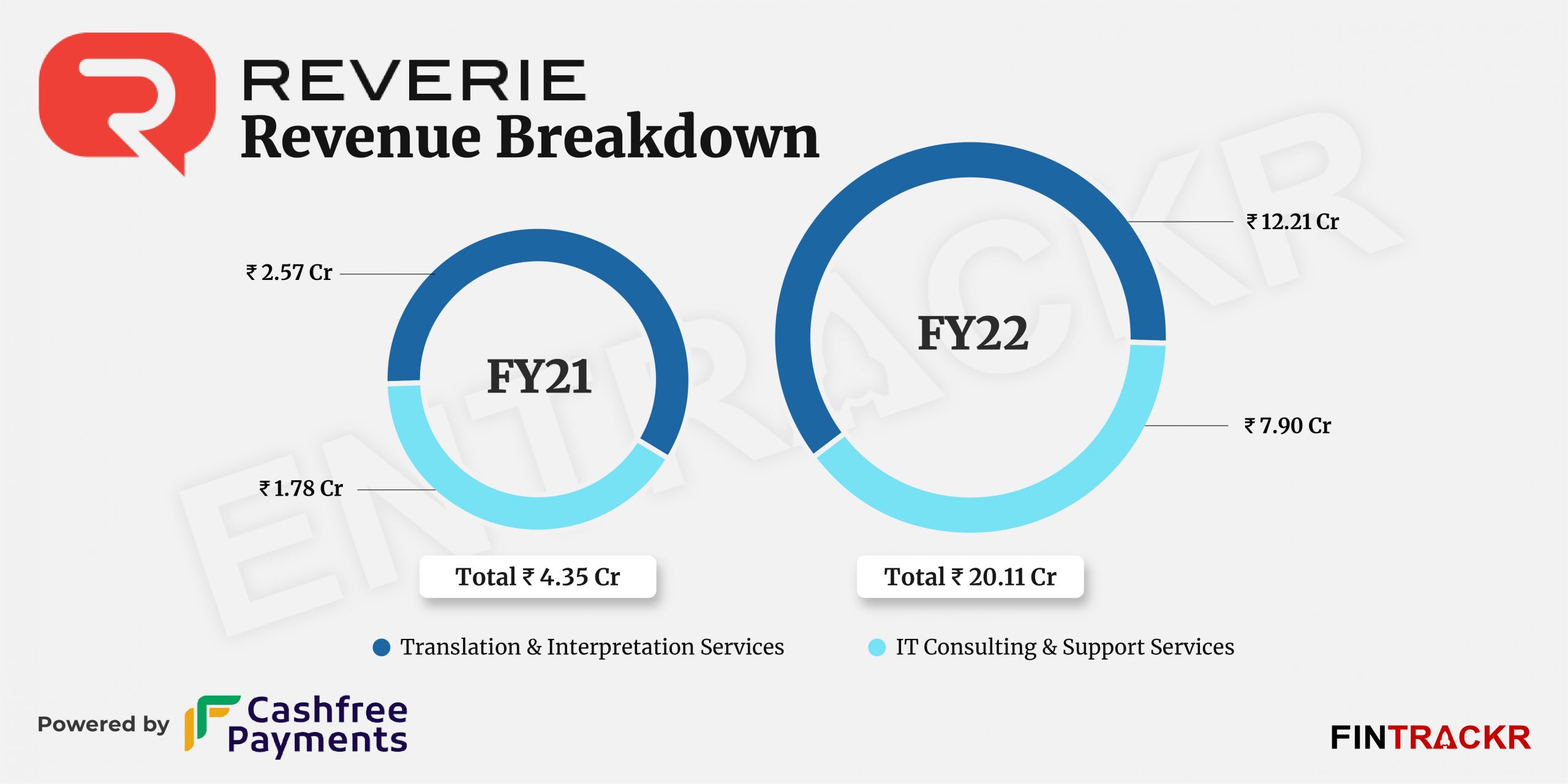

As per Fintrackr’s analysis, the firm generated 60.7% of its revenue from translation & interpretation services. This collection grew 4.8X to from Rs 2.57 crore in FY21.

The multilingual conversational AI chatbots and translation services are fed into many digital assets like mobile, tablets, IVRs, et al. The company also collected Rs 7.9 crore via IT consulting & support services in FY22 which jumped 4.4X from Rs 1.78 crore in FY21.

The Bengaluru-based company claims that it has empowered more than 30 million people with a reach of 200 million plus devices. Its mobile application, “Indic Keyboard Swalekh Flip,” supports around 22 Indian languages and it covers various industries, including BFSI, education, media & entertainment and e-commerce.

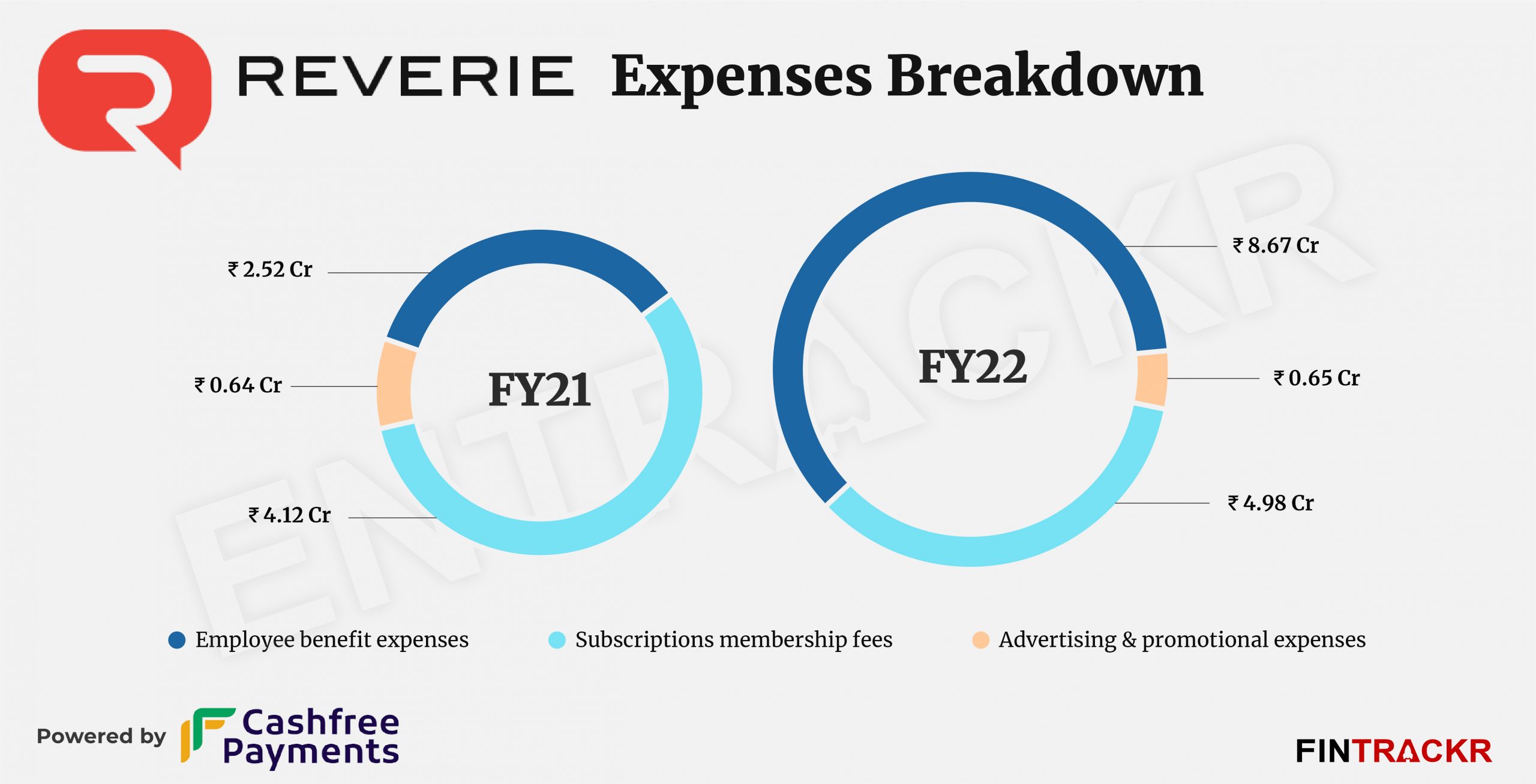

On the expense front, employee benefits expense was the largest cost centre for the company contributing 49% of the annual expenditure. This cost surged 3.4X to Rs 8.67 crore during FY22 from Rs 2.52 crore in FY21.

Subscriptions membership fees was found to be the second-largest cost which rose nearly 21% and formed 28.2% of the total expenses.

The firm also booked Rs 65 lakh as advertising & promotional expenses, close to the figures for FY21. In total, Reverie’s annual expenditure jumped over 3X to Rs 17.66 crore in FY22 from Rs 5.58 crore in FY21.

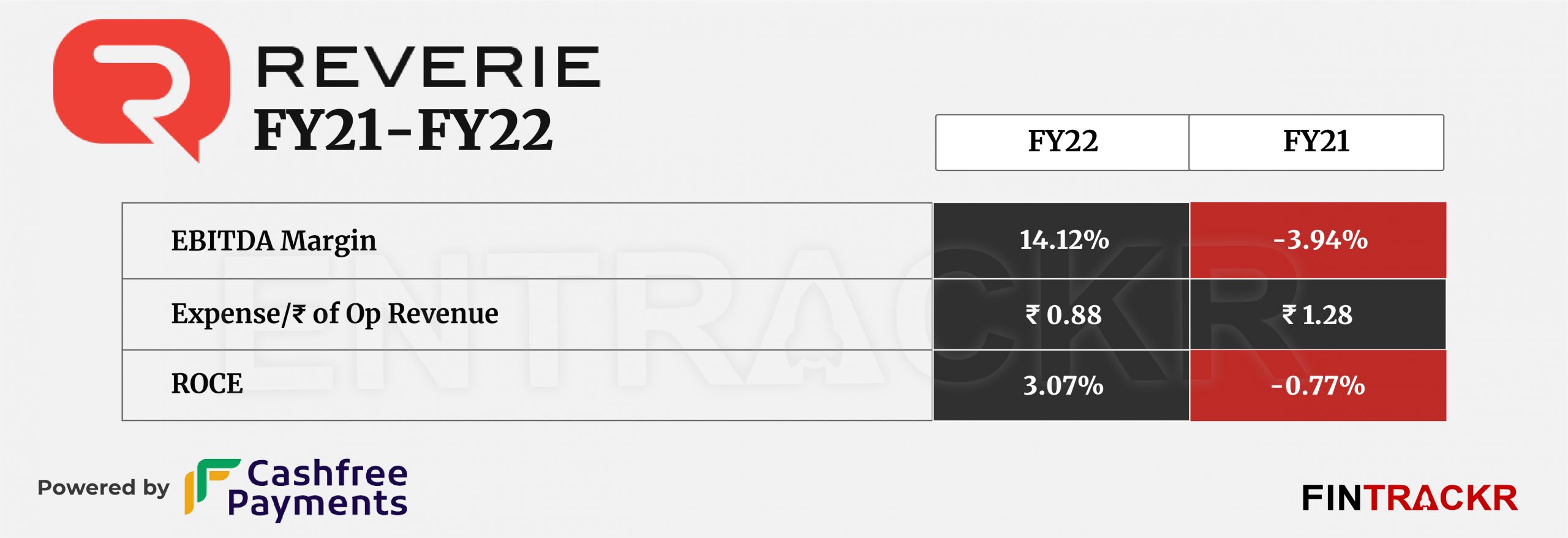

With an over four-fold jump in scale, the company also turned profitable and booked profits of Rs 2.7 crore in FY22 against the losses of Rs 50 lakh in the preceding fiscal year (FY21). On a unit level, Reverie spent Rs 0.88 to earn a rupee of operating revenue.

Reverie’s scale represents a noticeable growth in FY22, also evident from its improved ratios. EBITDA Margin and ROCE of the firm bettered from -3.94% and -0.77% in FY21 to 14.12% and 3.07% in FY22 respectively.

With its unique focus on Indic languages, Reverie benefits from the expected dominance of Indic language speakers in the new users joining the online space in India. That, in fact, will continue to be its opportunity, even as the amounts involved look small right now. With regional languages enjoying strong political support for use in more and more communications, seamless multi-lingual solutions from firms like Reverie will have a ready market going ahead too.