Mobile-first credit card startup OneCard is all set to become the 104th unicorn of India and 19th in the ongoing calendar year (2022). The credit card challenger is raising $100 million in a new financing round from new and existing backers, said three people aware of the deal’s details.

“Temasek and Singaporean sovereign fund GIC along with other existing investors are investing $100 million at a post-money valuation of $1.2 billion,” said one of the sources requesting anonymity.

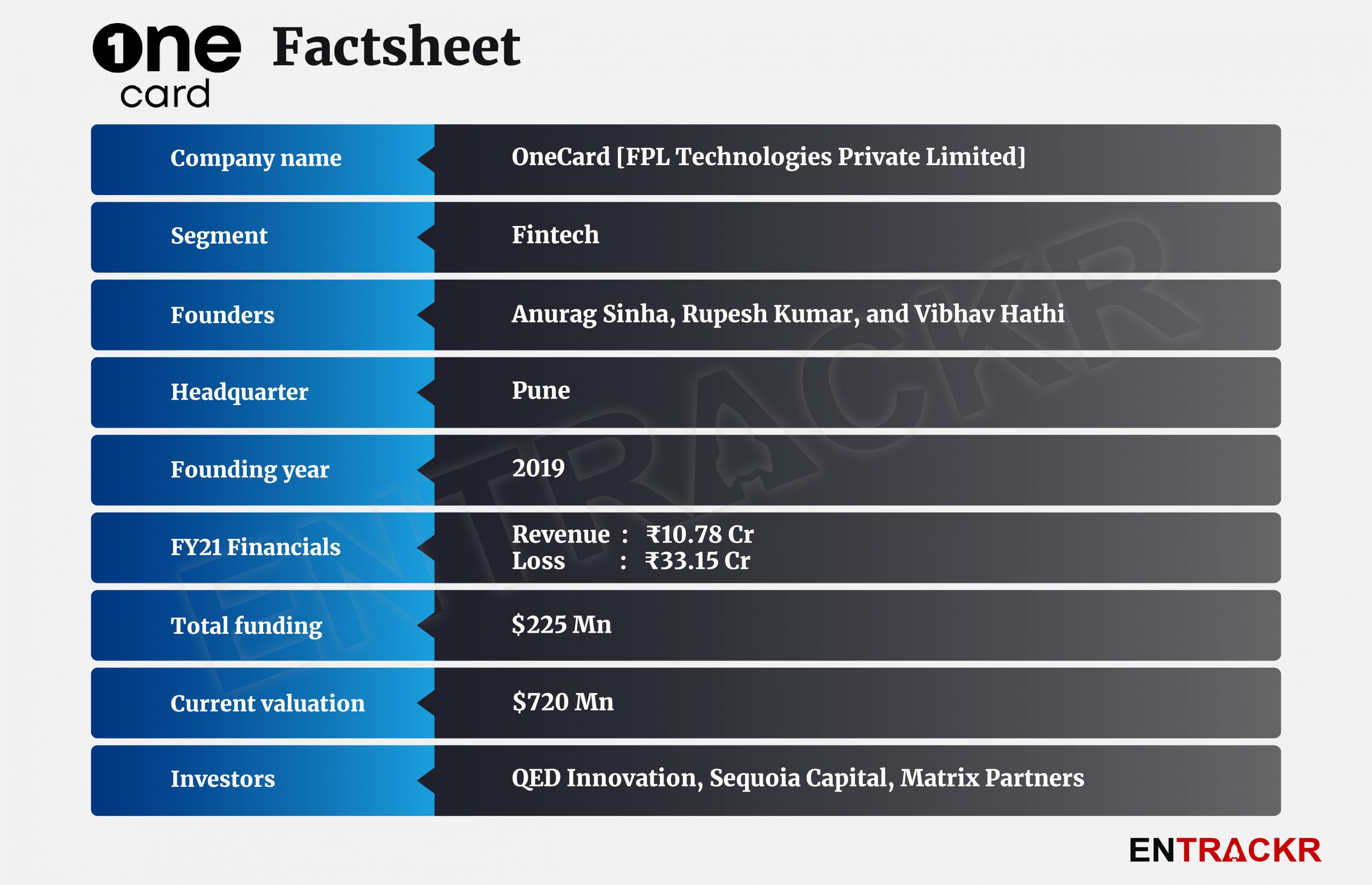

This would be the second funding round in the past six months. The company, run by FPL Technologies, raised a $76 million Series C round led by QED Fund and was valued at $722 million. Entrackr had exclusively reported this round last December.

“The discussions have been going on for the past several months but GIC and Temasek gave a term sheet last month only,” said the above-quoted source. According to sources, the deal will be announced in the coming weeks.

BusinessLine was the first to report about the discussions for the round in February.

OneCard’s Series D round is coming at a time when the future of the buy now pay later (BNPL) platforms is shaky in the wake of a Reserve Bank of India (RBI) diktat that bars prepaid payment instrument providers from offering non-bank credit lines. The company along with its competition Slice, Uni, Fi and others are busy figuring out their next moves.

For the uninitiated, OneCard offers first-time credit card users a virtual, cellphone-based card to build a credit score. It also enables an equated monthly instalment (EMI) facility for purchases of Rs 3,000 and above at an interest rate of 1.33% with a repayment tenure of 3-24 months.

OneCard offers credit cards in collaboration with banks, including IDFC First Bank, SBM Bank, South Indian Bank, Federal Bank and Bank of Baroda Financial. It currently has more than 600,000 users across the country.

Besides, OneCard, FPL also runs a credit score tracking and credit management app called OneScore. The company claims that the app has nearly 70 million users.

Queries sent to OneCard, Temasek and GIC did not elicit an immediate response. We will update the post when they respond.

For the first two fiscal years, OneCard’s parent FPL did not generate any revenue from operations. However, the company crossed Rs 10 crore in revenue during FY21. According to regulatory filings, the company earned Rs 10.78 crore in FY21 and saw a jump of 4.3X in its expenses to Rs 33.15 crore.

Update: The post has been updated to reflect that BusinessLine reported about the development first.