The pandemic had wiped out significant scale of most of the companies during FY21 but some such as Cashify and Perfios managed to sustain the blow with marginal fall in their collection. Another company to have followed a similar path is nutritional products maker cum omnichannel retail platform Healthkart.

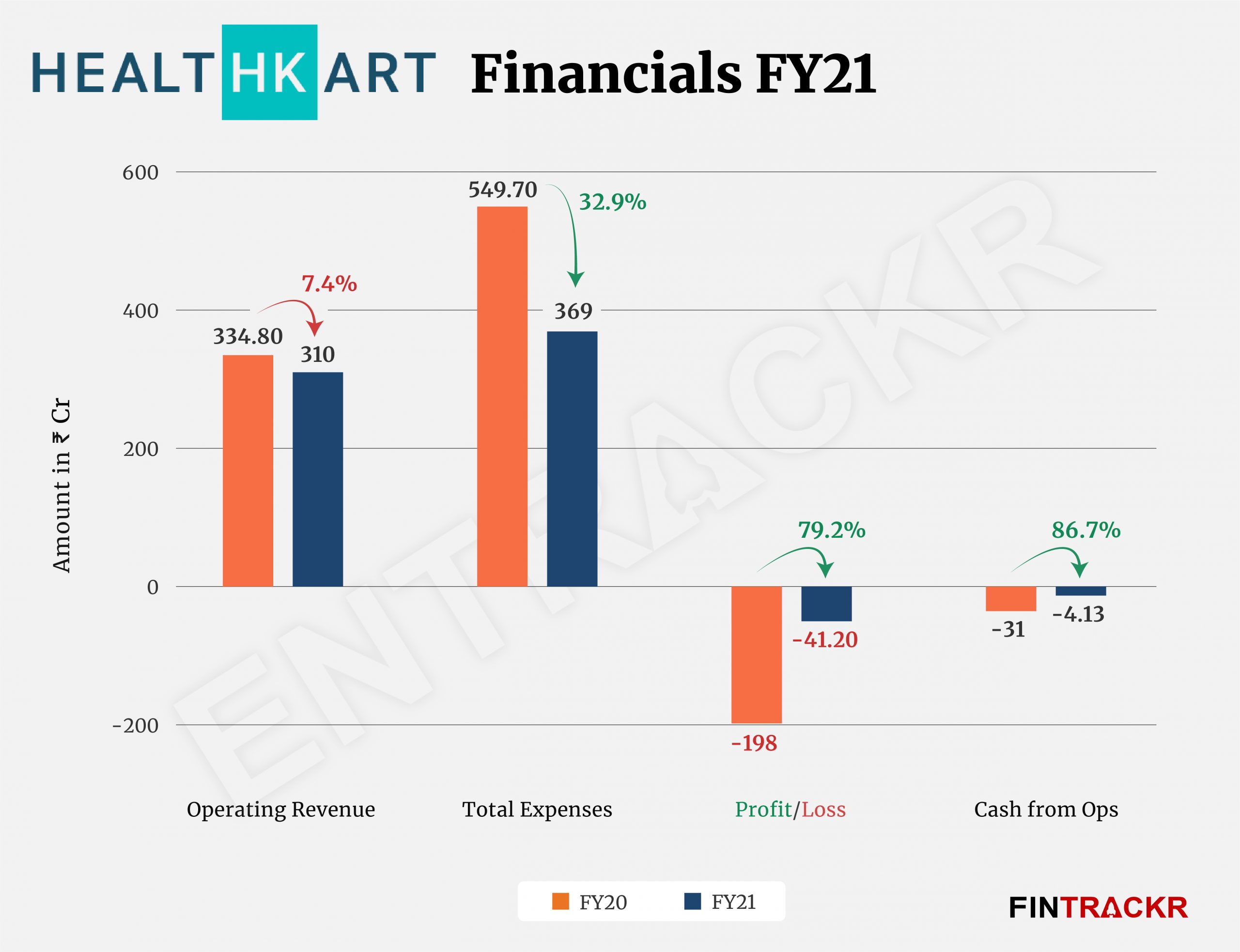

Healthkart’s (Bright Lifecare) operating revenue dropped by 7.4% to Rs 310 crore in FY21 from Rs 334.80 crore in FY20, according to the company’s annual financial statement with the Registrar of Companies (RoC).

Healthkart revenue mainly comes from sale of its in-house labels and facilitation fees from the sale of goods through its marketplace. Sales of own manufactured products contributed 96.5% of operating revenue which shrinks 8% to Rs 299.31 crore in FY21 from Rs 325.50 crore in FY20.

Healthkart owns and manufactures eight nutritional brands including popular supplement brands like MuscleBlaze, The Protein Zone, TrueBasics, HKVitals, bGreen, Nouriza and Gritzo. Currently, it has 110 offline stores spread across 40 cities.

Collection from marketplace services grew 14.6% in FY21 to Rs 10.74 crore. Apart from the online sales channel, the company has built a network of 135 stores across 54 cities. According to industry estimates, over 30% of its sales come from offline stores.

While the company’s scale dipped marginally in FY21, Healthkart has managed to bring down costs by 32.9% to Rs 369 crore in FY21 from Rs 549.7 crore in previous fiscal year (FY20).

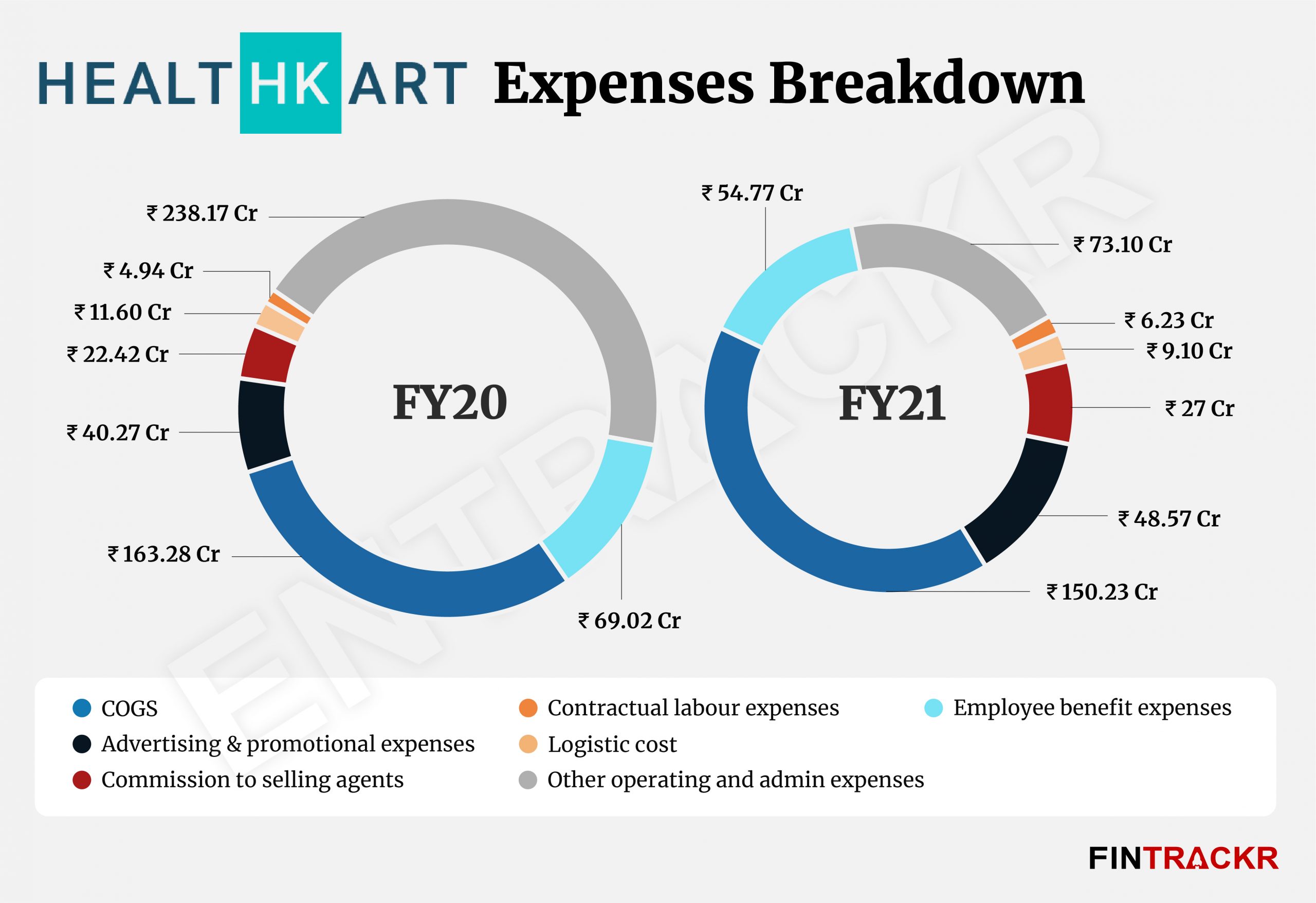

Since the selling of manufactured products is Healthkart’s core business, cost of materials remains the largest cost center for the company accounting for 40.7% of the total cost which shrank 8% to Rs 150.23 crore in FY21.

Employee benefits formed 14.8% of the overall cost which reduced 20.6% to Rs 54.77 crore in FY21 from Rs 69.02 crore in the previous fiscal year.

Healthkart spent 20.6% more on customer acquisition as their cost of advertisement and promotion increased to Rs 48.57 crore as compared to Rs 40.27 crore in the preceding financial year (FY20).

Contrary to consumer acquisition cost, expenditure on logistics contracted 21.6% to Rs 9.10 crore in FY21 whereas the expense on commission to selling agents shot up 20% to Rs 27 crore in FY21 pushing the overall cost to Rs 369 crore.

Importantly, Healthkart has booked Rs 166 crore as an expense against remeasurement of financial liability designated at fair value through profit or loss (FVTPL) in FY20, where this figure stood at Rs 19 crore in FY21. As a result, losses of the company dwindled 79% to Rs 41.2 crore in FY21 from Rs 198 crore in FY20.

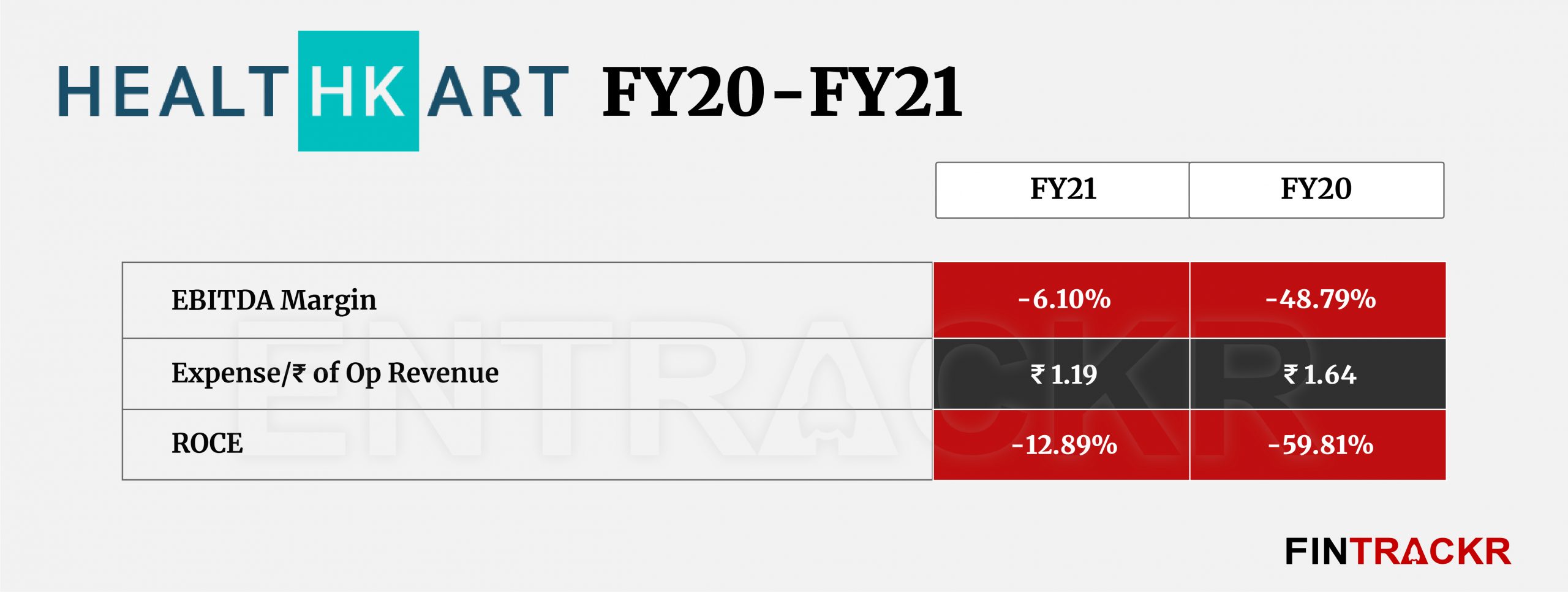

Cash outflows of the company also reduced 86.7% to Rs 4.13 crore in FY21. Along with EBITDA margin and ROCE, the company also improved its unit economics. It spent Rs 1.19 to earn a single unit of operating revenue.

To recall, Healthkart had separated its generic drug search business HealthkartPlus in 2015 and rebranded it to 1mg which now operates under Tata 1mg Technologies Private Limited. Last year, Tata Digital had acquired a majority stake in 1mg at an estimated valuation of more than $400 million.

Like Healthkart, 1mg also saw a marginal drop of 13.6% in its operating revenue to Rs 309.3 crore during FY21 as per the company’s annual financial statement filed with RoC. The company’s annual losses reduced to Rs 314.2 crore in FY21 from Rs 318 crore in the previous fiscal year (FY20).

So far, Healthkart has received $75 million from Sofina, Sequoia Capital, Kae Capital, IIFL and Omidyar Network. According to an ET report, Temasek and InvaAscent are looking to acquire stakes in Healthkart that may value the company at around $300 million.