Last week, India saw the birth of its 100th unicorn when Google-backed neobank Open raised funds. Interestingly, 60% of these startups entered this coveted club of unicorns—startups valued at $1 billion or more—only in the last 17 months.

Even as the rate at which India is producing unicorn startups is growing at a regular clip, the financial performance of such startups remains questionable. According to Entrackr’s data tracking platform Fintrackr, of the 100 unicorns in India, only 18 unicorns attained profitability in FY21 and 57 are deep in losses.

The remaining 25 from this list, mostly registered in the U.S. or Singapore, have not revealed their revenue, loss or profit figure.

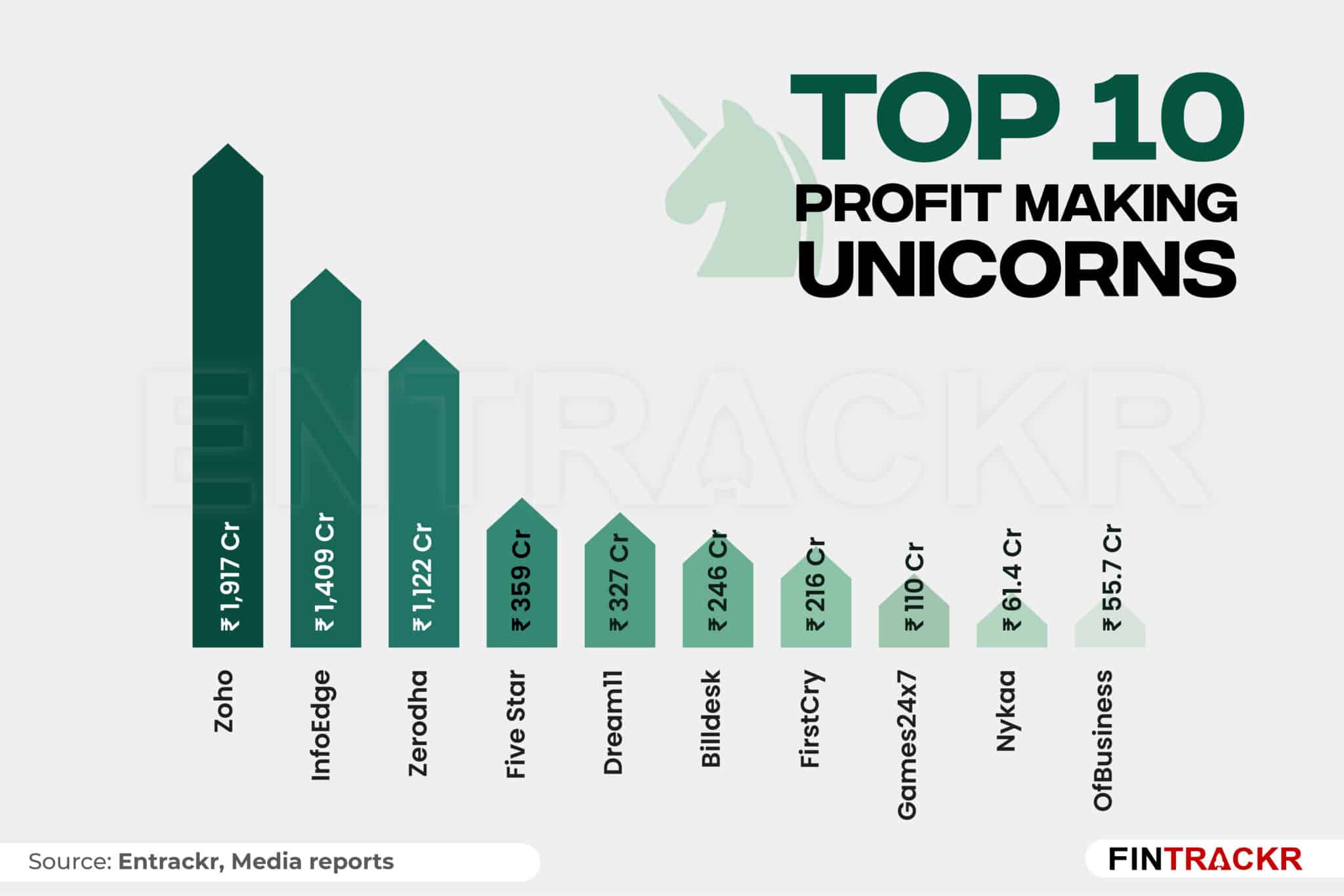

The top five profitable unicorns are Zoho, InfoEdge, Zerodha, Five Star and Dream11 with Rs 1,917 crore, Rs 1,409 crore, Rs 1,122 crore, Rs 359 crore and Rs 327 crore clocked as profit during FY21, respectively. While Zoho and Zerodha are bootstrapped, InFoEdge is a publicly listed company and Sequoia Capital-backed Five Star is an NBFC.

The full list can be found here.

If we take the top 10 list of profitable unicorns, only Games24X7 has managed to enter the list among the unicorns of 2022. The rest of the companies have either entered the coveted club in 2021 or before. The 16-year-old multi-gaming platform posted Rs 110 crore profit in the fiscal year 2021.

Fintrackr has also found a handful of startups that were profitable in FY20 but did not provide data for FY21 or slipped into losses in the fiscal. For context, professional networking platform Apna was profitable in FY20 while it posted loss in the next fiscal year (FY21). Cloud data protection and management company Druva, and SaaS companies Browserstack and Icertis were profitable in FY20 but they are yet to file FY21’s financial statements.

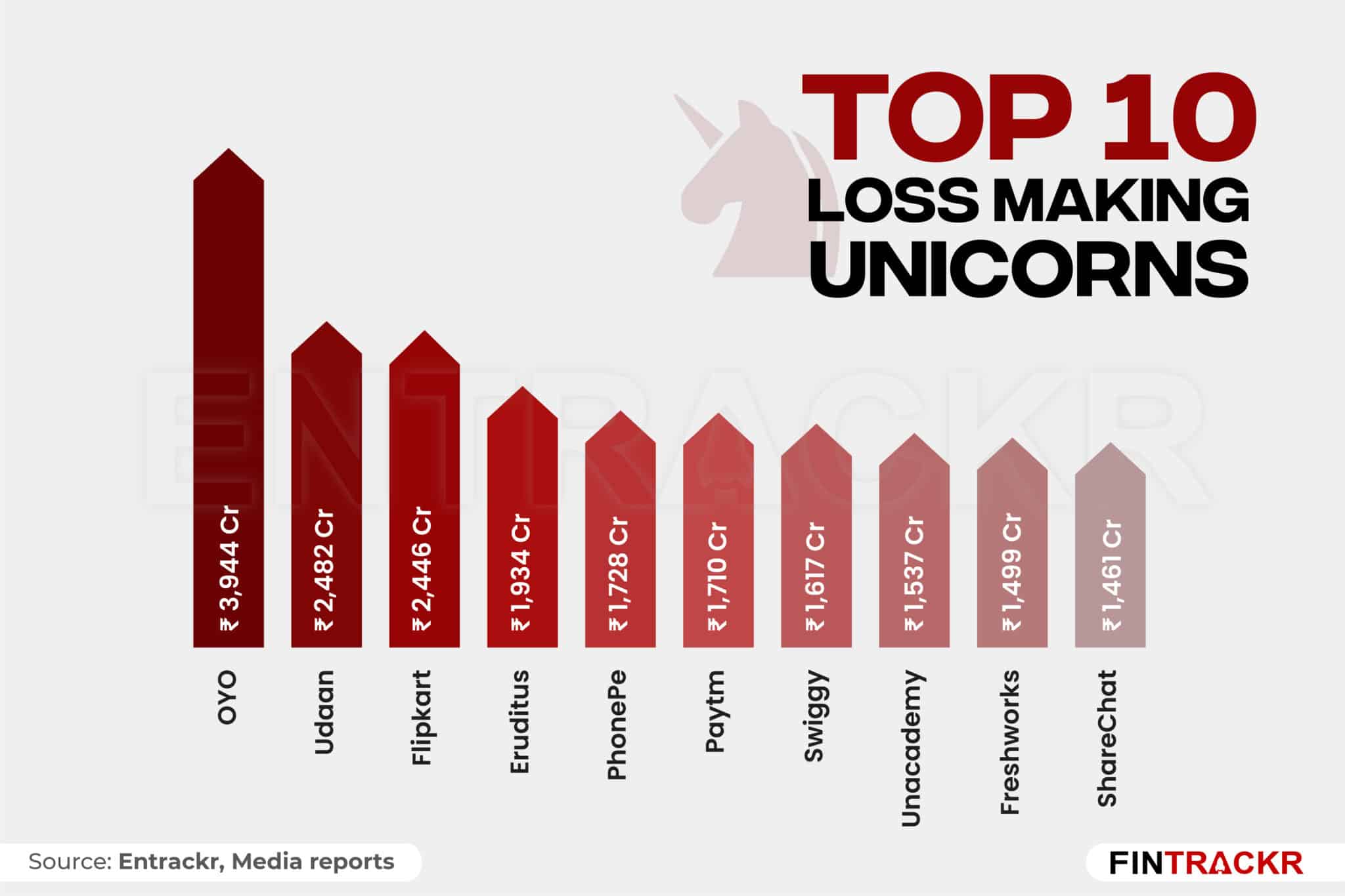

In terms of loss-making companies in this list, hospitality brand Oyo, B2B e-commerce platform Udaan and e-commerce marketplace Flipkart [acquired by Walmart] were the top three loss-making unicorns with more than Rs 2,000 crore loss each in FY21. Edtech startup Eruditus was the newest among the top 10 group to post losses close to the top three companies.

The huge losses incurred by tech companies in India can be analysed from the fact that the lowest among the top 10 loss-making companies – ShareChat – had posted Rs 1,461 crore loss in FY21.

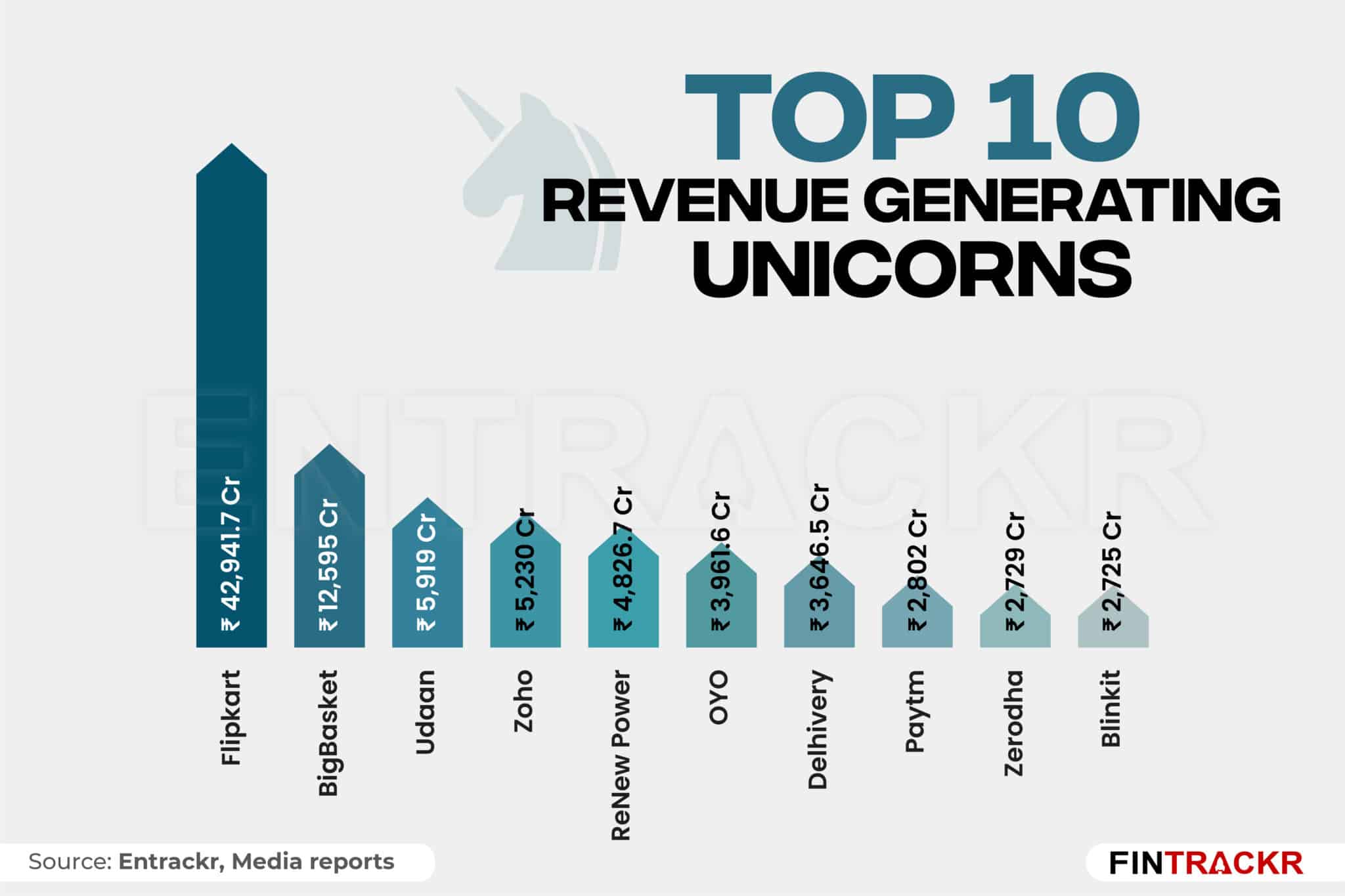

That said, the top three loss-making companies—Oyo, Udaan and Flipkart—were also on the list of top 10 revenue-generating companies in FY21. Where Flipkart recorded Rs 42,941.7 crore revenue in the fiscal, Tata Digital-controlled BigBasket and Udaan posted Rs 12,595 crore and Rs 5,919 crore revenue respectively. Oyo was in the sixth position with Rs 3,961.6 crore in revenue.

Top profitable companies Zoho and Zerodha registered Rs 5,230 crore and Rs 2,729 crore in revenue respectively.

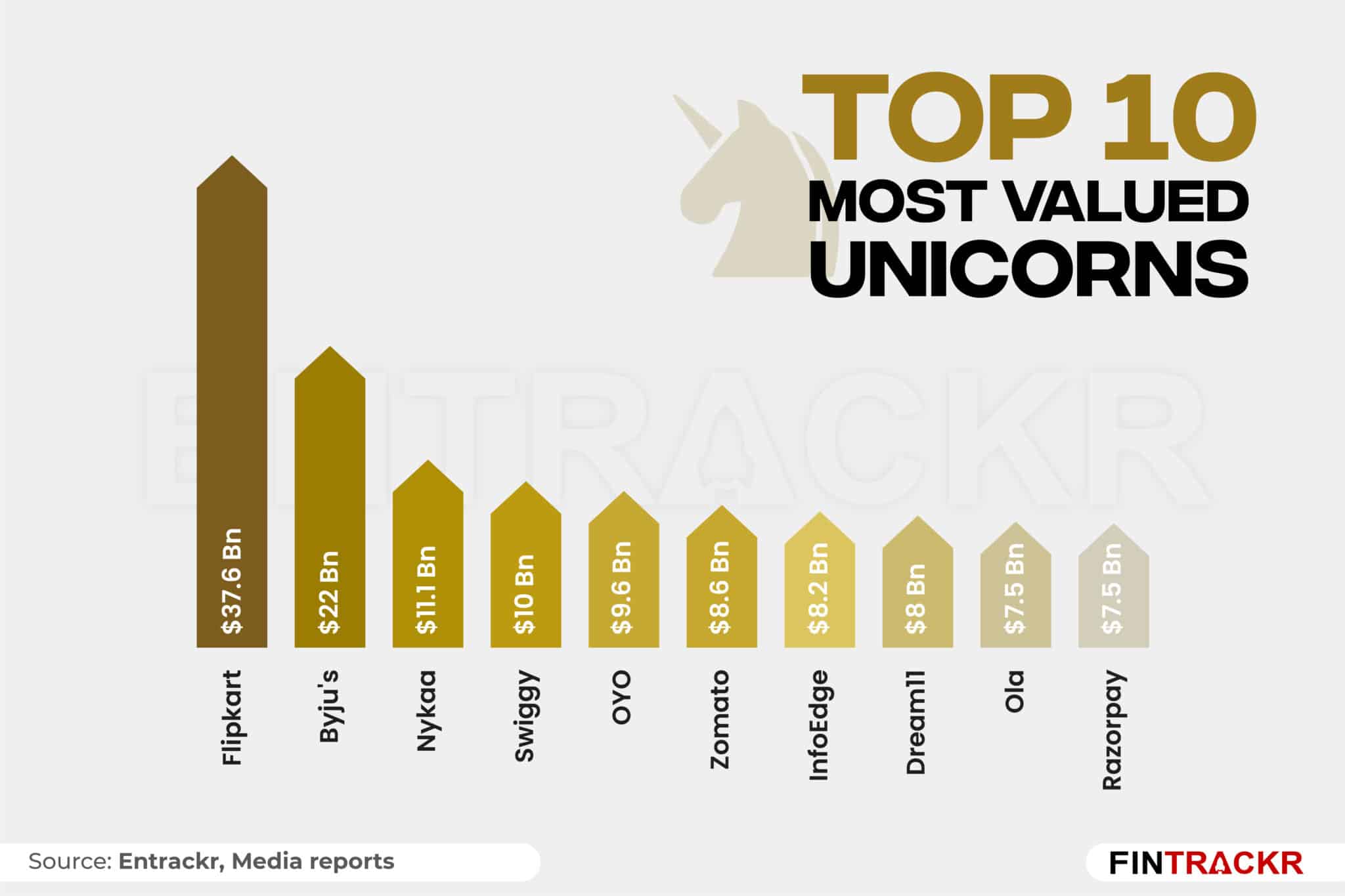

In terms of valuation, Flipkart was at the top position with a $37 billion valuation followed by edtech company Byju’s $22 billion. While Nykaa became a decacorn in 2021, Swiggy entered the club in 2022. Payments major Paytm, which was valued at $16 billion before going IPO, lost its decacorn status soon after the listing.

A couple of companies also gained unicorn status after going public such as EaseMyTrip and Gaming platform Nazara Technologies. However, the Rakesh Jhunjhunwala-backed gaming platform is now valued at under $1 billion.

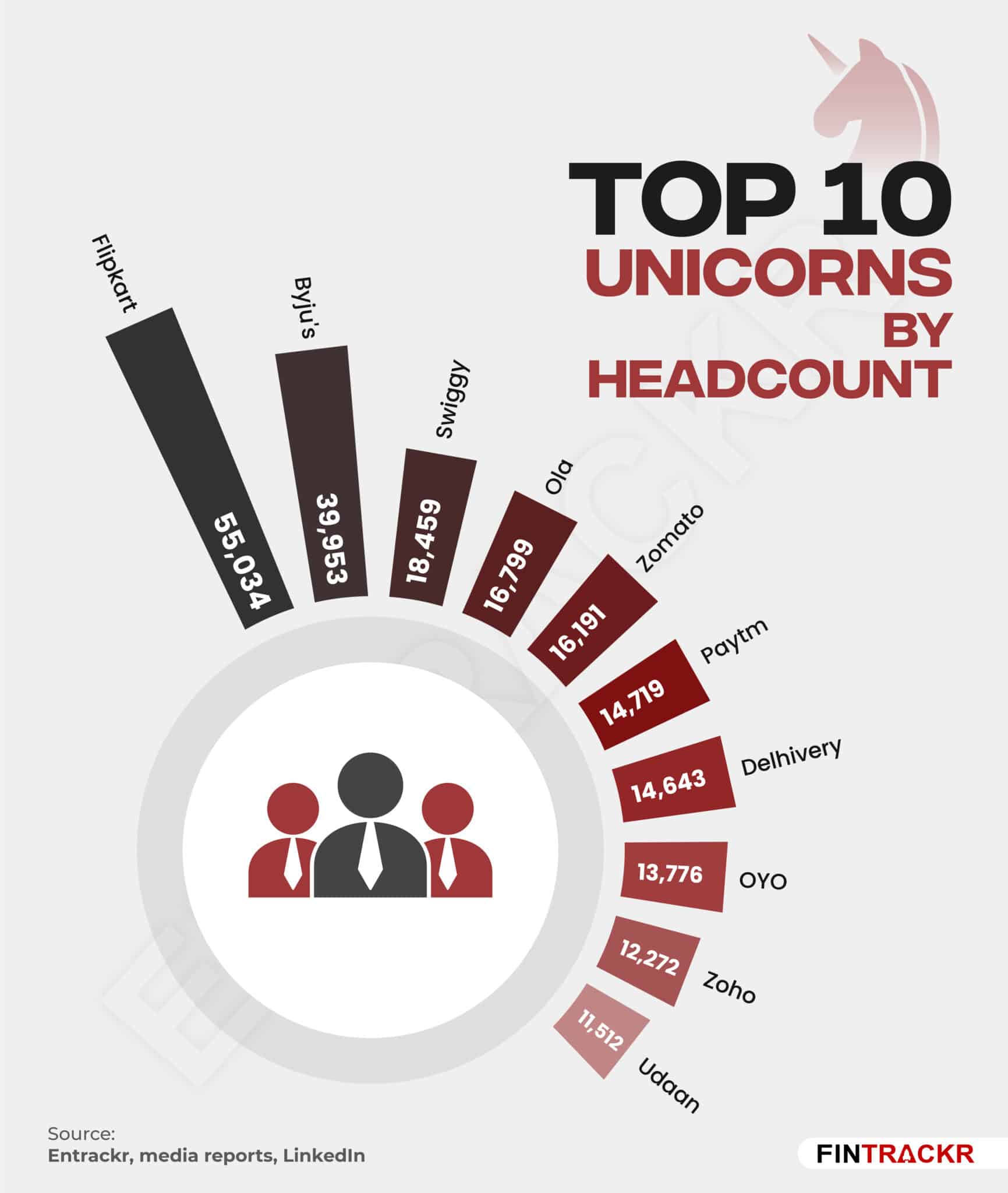

As per data tracked from LinkedIn, Flipkart had the most number of employees among the unicorns. The data reflects that Flipkart employs over 55,000 people, followed by Byju’s, Swiggy, Ola and Zomato with 39,953, 18,459, 16,799 and 16,191 headcounts respectively. The number of employees may vary at these companies if we include gig employees such as temporary or contractual workers.

Citywise, Bengaluru was the top unicorn maker as 38 out of the 100 unicorns are based out of the city. Delhi NCR isn’t far behind in the list as 30 startups from the region managed to make it to the list of 100 unicorns. Mumbai, Chennai, Pune and Hyderabad collectively produced 32 unicorns.