Business focused agritech firm Ninjacart has raised fresh money from Korea and Singapore-based venture capital firms. The new infusion in the company has come after six months of its mega $145 million round.

The board at Ninjacart has passed a special resolution to approve the allotment of 1,319 Series D preference Shares at an issue price of Rs 528,892 per share to raise Rs 69.8 crore or $9 million from STIC and Mainstreet Digital, regulatory filings show.

Both investors have invested Rs 37.5 crore each. According to Fintrackr’s estimates, the company has been valued at around $815 million. It’s worth noting that both the new investors have joined the ongoing Series D round and have poured money at the same valuation at which Ninjacart announced its round in December.

Ninjacart enables retailers, restaurants, and sellers in mandis et al to source fresh produce directly from farmers. It claims to have over 200 collection centres and 1,200 warehouses in India and moves over 1,400 tons of fresh produce across seven cities including Bengaluru, Chennai, Delhi (NCR) and Mumbai-Pune region.

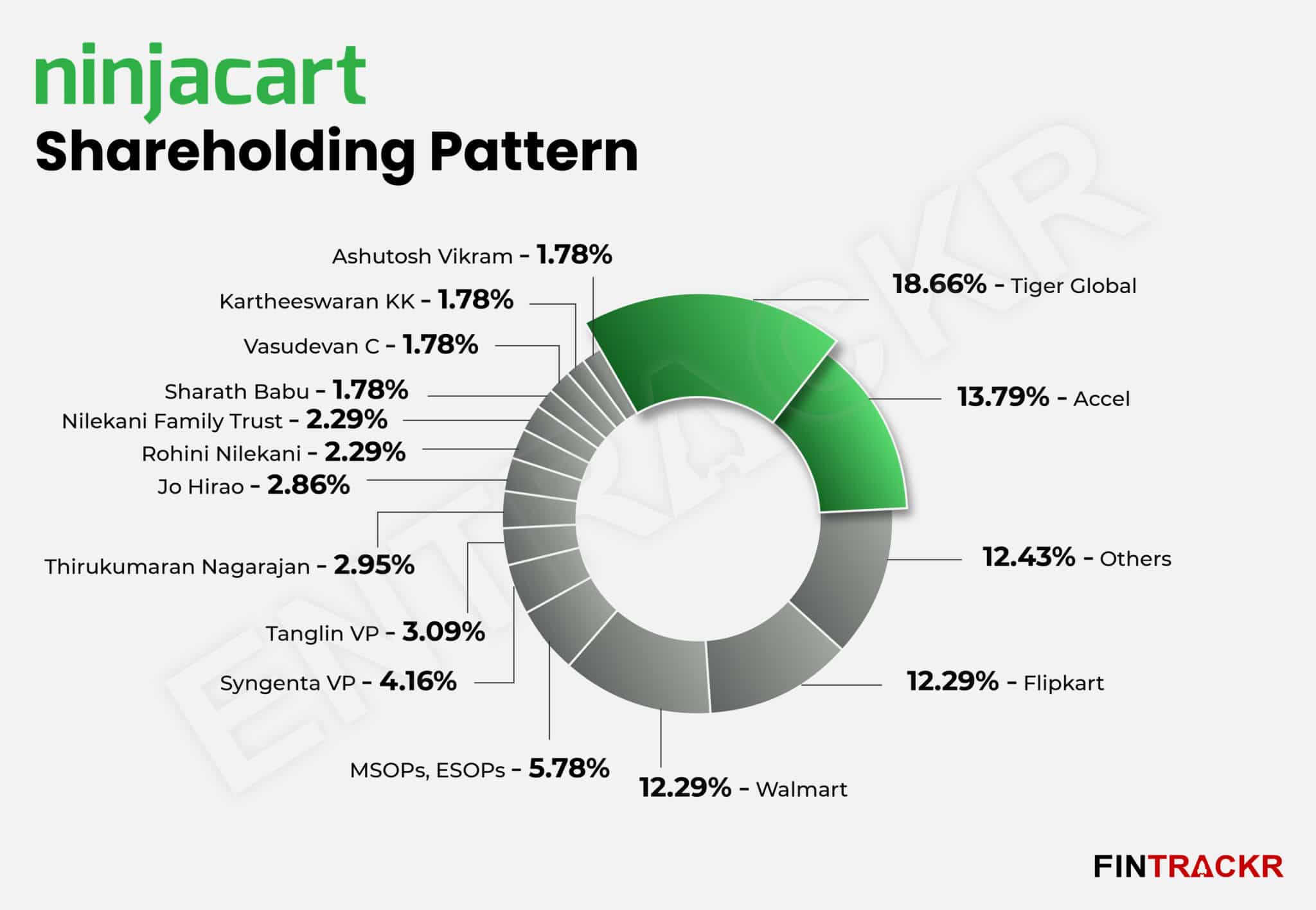

Following the new infusion, Tiger Global and Accel Partners remain the two largest stakeholders in Ninjacart with 18.66 and 13.79% respectively. Flipkart and Walmart hold 12.29% each.

In April, the Bengaluru-based company also expanded its ESOP pool which is now valued at Rs 170 crore. Entrackr had exclusively reported the addition of new options in the company’s employee stock option (ESOPs) pool.

Back in January, Ninjacart had announced ESOP buyback program worth Rs 100 crore or $13.3 million and it also launched a $25 million worth fund in March to back agritech startups.

As per data compiled by Fintrackr, agritech startups had raised $461 million across 36 deals in 2021. In the ongoing calendar year, Absolute was the top fundraiser in the space with a new round at $500 million valuation followed by Arya.ag which raised $60 million round at $300 million valuation.

In terms of the largest rounds in agritech space in India, Ninjacart is on top with $145 million followed by Waycool’s $117 million, DeHaat’s $115 million and Absolute’s $90 million and AgroStar’s $70 million round. AgroStar received its last tranche of Series D round at a valuation of $235 million. Entrackr had exclusively reported the development on May 13.

Ninjcarat is top valued at $815 million whereas DeHaat and Absolute both are valued at $500 million. As per Fintrackr’s estimates, Waycool was valued at $460 million during its last tranche.