Morgan Stanley-backed supply chain company Leading Enterprise in Advanced Pooling (LEAP) has adopted a new employee stock options (ESOPs) plan. The creation of the pool has come after five months of its Rs 104 crore worth debt round.

The board at LEAP has passed special resolution to adopt two stock option schemes namely Employee Stock Option Plan A and Employee Stock option Plan B to reward its employees.

The Plan A (2019) contitutes 4,132 stock options while the Plan B (2022) comprises of 16,093 options. Each option is convertible into one fully paid equity share, and shall be awarded to eligible employee in the coming months.

As per Fintrackr estimates, the total worth of the newly implemented plan is around Rs 36.2 crore.

LEAP provides supply chain solutions to fast-moving consumer goods (FMCG), consumer durables, retail, auto, beverages, e-commerce and auto-component manufacturing companies.

The company leases timber pallets, plastic utility boxes and crates to over 600 customers. The company claims to have 7,000 touch-points across the country with a network of 18 warehouses.

LEAP had raised Rs 180 crore from Morgan Stanley India Infrastructure in February 2021. Nine months later, it also raked in $34 million in a secondary round from Schroder Adveq and IIFL and offered partial exit to its early backers Mayfield Fund, IndiaNivesh and Six Sense Ventures.

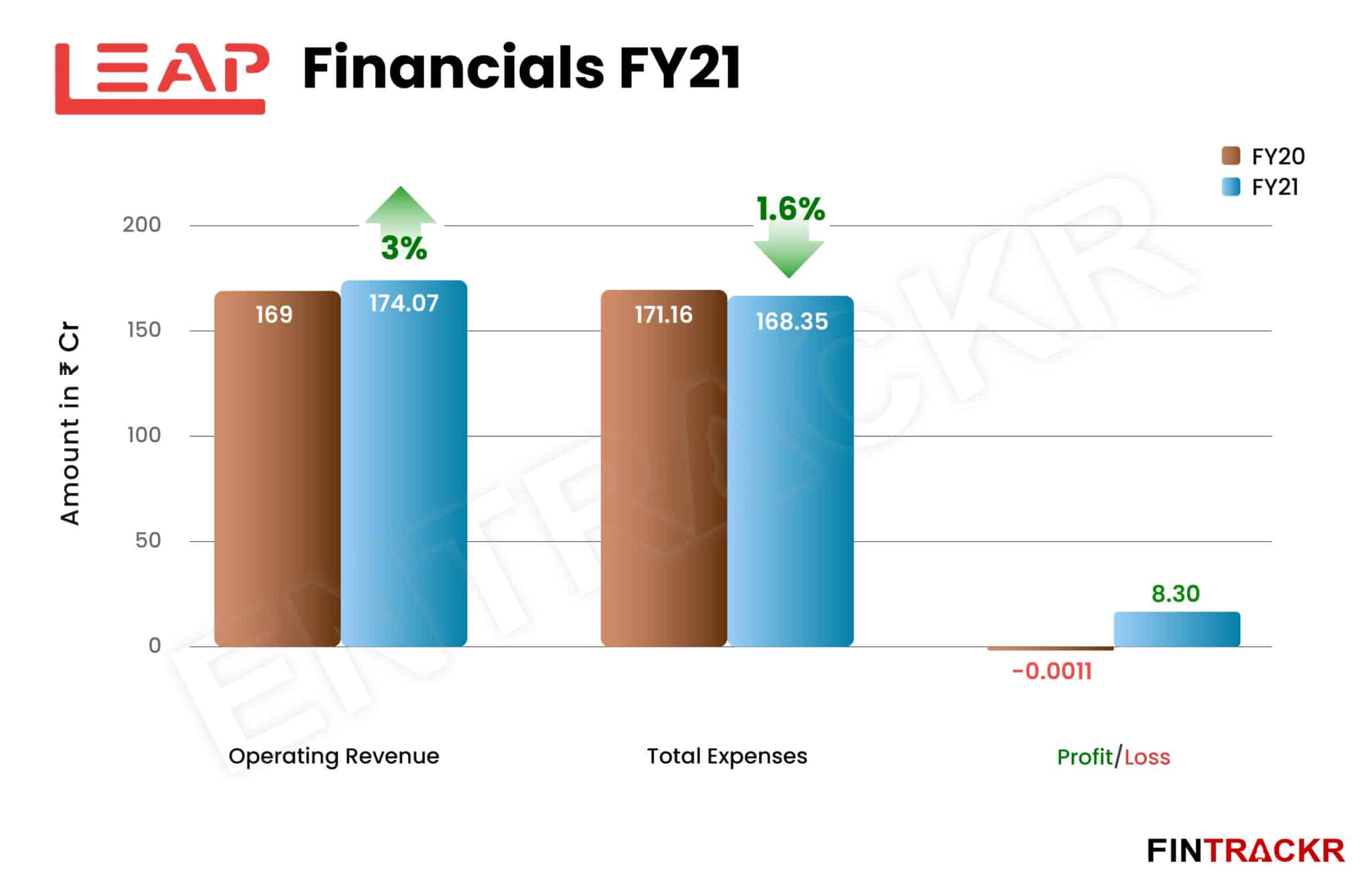

The eight year old company’s revenue from operations remained somewhat stable suring the previous fiscal, growing by only 3% to Rs 174 crore during FY21 from Rs 169 crore earned in FY20, as per regulatory filings. However, there was a significant improvement in margins and as a result the company posted profit after tax of Rs 8.3 crore as opposed to Rs 11 lakh it lost during FY20. Its EBITDA margins improved from 45.1% in FY20 to 49.15% during the fiscal ended in March 2021.