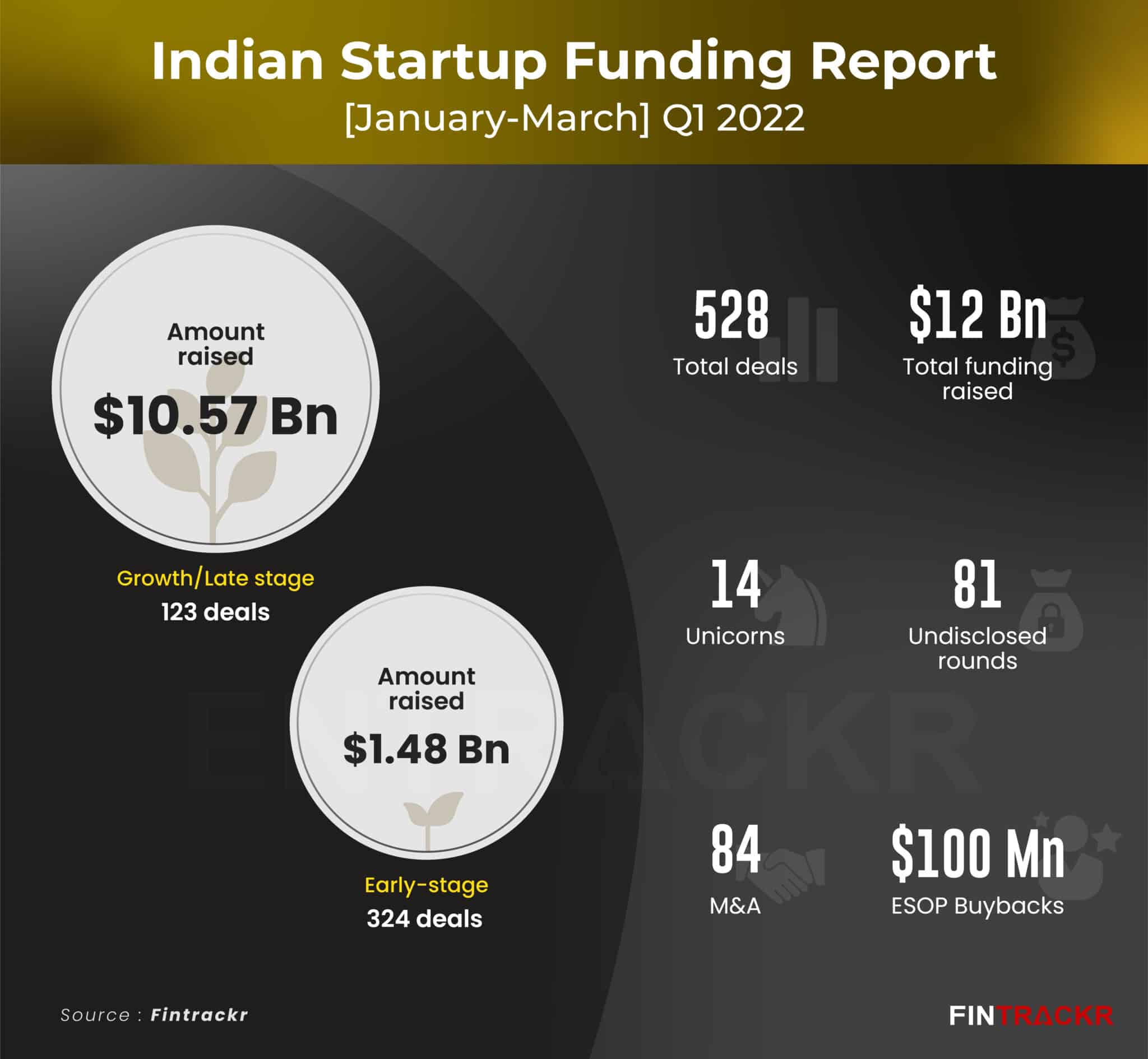

The Indian startup ecosystem is going through its golden age where emerging internet businesses have achieved new heights when it comes to funding, merger and acquisitions, minting unicorns and buying back employee stocks. Homegrown startups have raised more than $12 billion during the first three months of the ongoing calendar year or the first quarter of 2022 as compared to $4 billion during the same period in the previous year, according to our data tracking platform Fintrackr.

To put things in further perspective, Indian startups raised roughly the same amount ($12.1 billion) in six months in 2021 and during all of 2020 they raised $11.1 billion, per a report by Venture Intelligence.

Fintrackr has found that 528 startups including 324 in their early stage and 123 in their growth stage have announced their funding rounds worth $12.06 billion during the first quarter of this year. Among them, 81 startups did not divulge their transaction details. During the period, 14 startups achieved unicorn status.

In Entrackr’s quarterly funding report, here are details of the top 10 deals in both the growth stage and early-stage investments for the January to March period.

The details of all 528 deals can be found here.

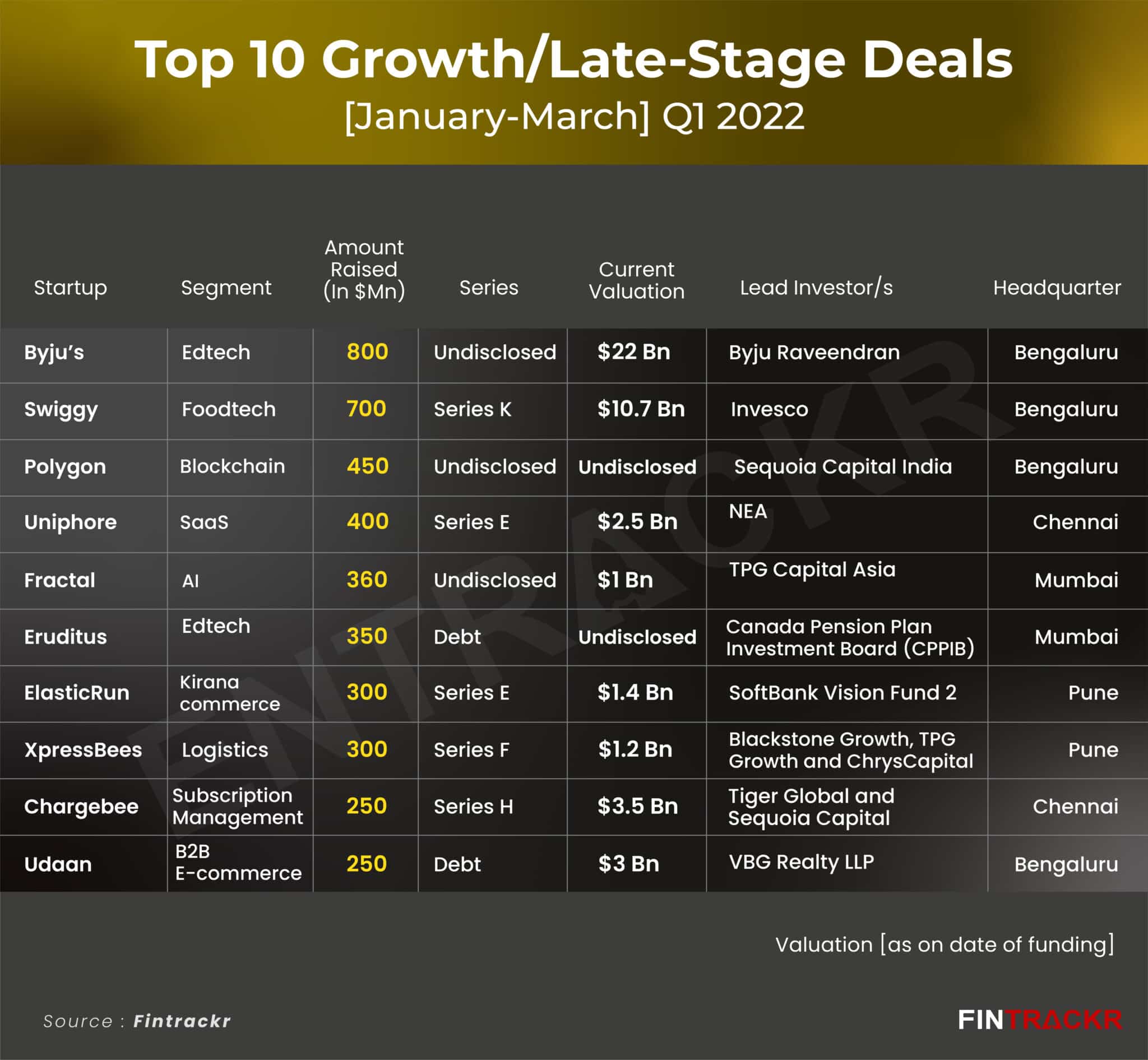

Top 10 growth-stage deals

A total of 123 growth and late-stage startups scooped up $10.57 billion in Q1 2022. Edtech company Byju’s was the top fundraiser with $800 million round, followed by foodtech major Swiggy’s $700 million decacorn round, Blockchain company Polygon’s $450 million round and speech recognition startup Uniphore’s $400 million unicorn round.

The top 10 list also includes Fractal, Eruditus, ElasticRun, XpressBees, ChargeBee and Udaan. The investments in Eruditus and Udaan were in debt as compared to equity in the rest of the startups.

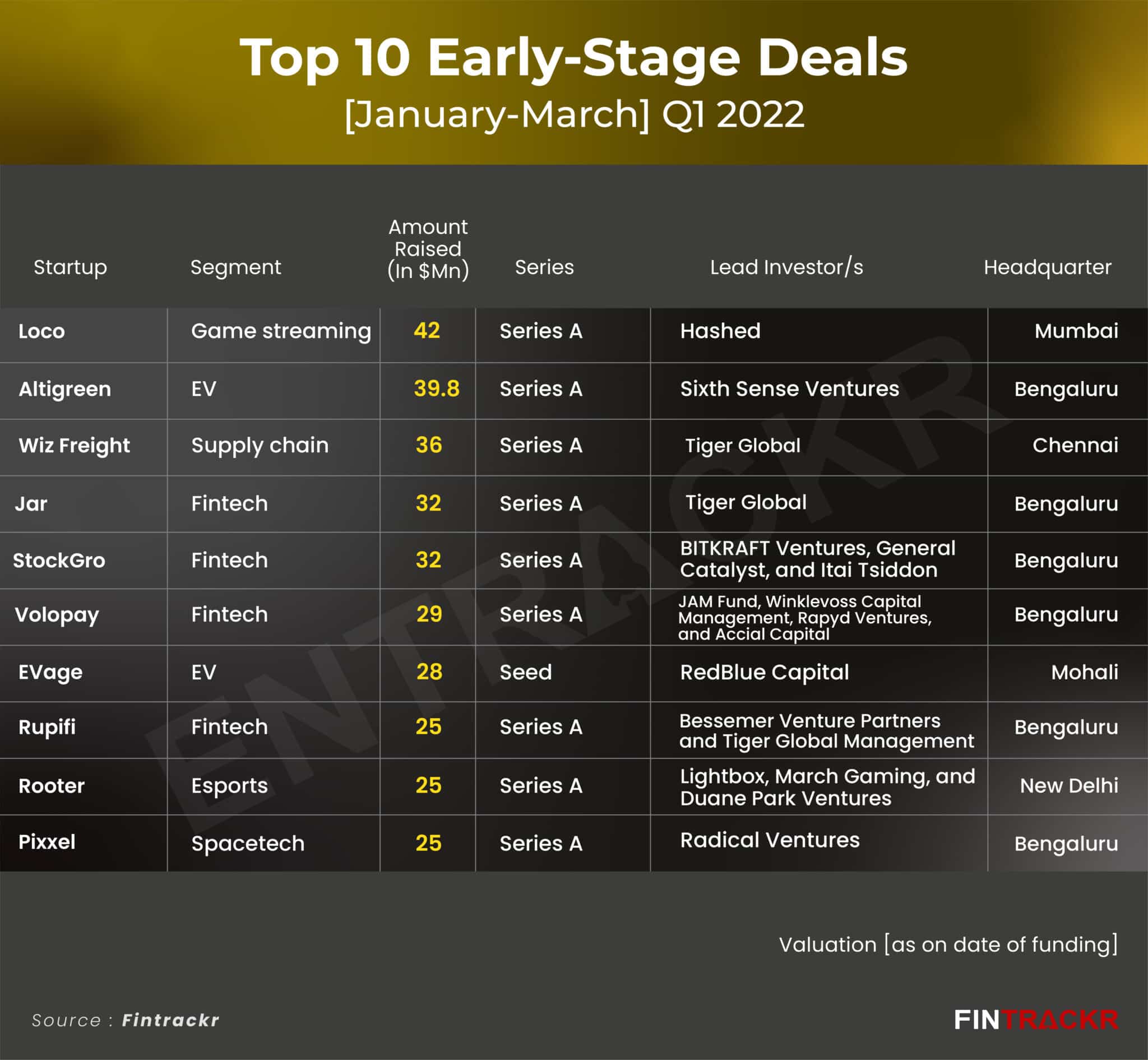

Top 10 early-stage deals

Around 324 early-stage startups raised funds worth $1.48 billion during Q1 2022 as compared to $503 million funding across 158 deals in Q1 2021. The top 10 early-stage investments include games streaming Loco, EV startup Altigreen, fintech startups Jar, supply chain startup Wiz Freight, fintech startups StockGro and Volopay, EV startup Evage among others.

During the period, 81 startups, mainly in their early stages, did not disclose the details of their financing round.

Unicorns of 2022

Like 2021, the ongoing year has also seen startups turning unicorns at the same pace. As of now, 14 startups including Games24x7, Oxyzo, CommerceIQ, Amagi, CredAvenue, Livspace, XpressBees, Uniphore, Hasura, LEAD, Mamaearth, Fractal, DealShare, Darwinbox have entered the unicorn club. In the previous year, 43 startups have achieved the feat.

Interestingly, Tiger Global, which was the lead investor in half of the unicorns of 2021, has backed only three startups namely DealShare, Oxyzo and Games24x7 that turned unicorns in 2022.

City wise deals

Bengaluru was on top in terms of the number of startup deals and the amount raised in the January-March quarter. The startups based out of the city scooped up over $6 billion across 214 deals or 50% of the total amount raised in the period. During the quarter, Delhi-NCR-based startups raised over $2 billion across 125 deals followed by Mumbai, Chennai and Hyderabad with 88, 31 and 30 deals respectively.

Segment-wise deals

Fintech was the top segment in terms of the number of fundraising in Q1 2022 with 71 deals followed by SaaS, D2C brands, health tech and edtech. The complete breakdown of deals across segments in the first quarter can be seen below.

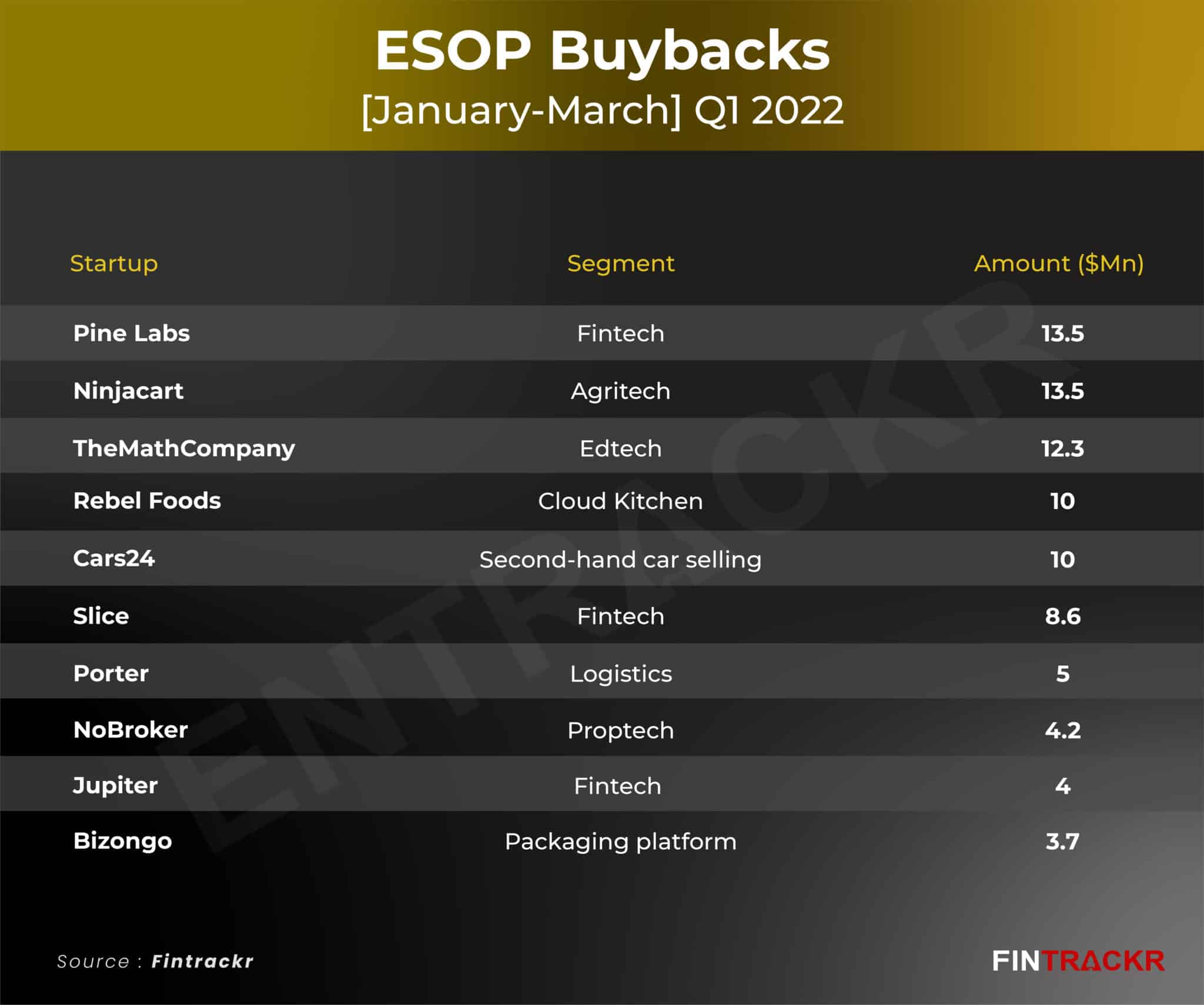

ESOP buybacks

Over the past couple of years, Indian startups have witnessed a sharp rise in ESOP buybacks or liquidity events. According to Fintrackr’s data, 18 startups across their early and growth stage have bought back ESOP worth $100 million held by their employees in the first quarter of 2022. When compared, the amount was $440 million in 2021.

Pine Labs was the latest entrant in this list with Rs 100 crore or $13.5 million worth ESOP buyback. The list also includes the likes of Rebel Foods, CoinSwitch Kuber, NoBroker, Cars24, LEAD, Slice, Bizongo, HomeLane, Ninjacart and Jupiter.

Acquisitions

Apart from fundraising and ESOP buyback exercise, homegrown startups have also recorded around 84 mergers and acquisitions deals. Fintrackr has featured top 10 acquisitions in Indian startups in terms of deal size which include the acquisition of majority stake in Addverb Technologies and Clovia by Reliance Retail worth $132 million and $125 million respectively.

The acquisitions of Knowlarity by GupShup and Unbxd and Netcore in a deal worth $100 million each were also in the headlines.