Months after its application, the Reserve Bank of India has yet to approve Mobikwik’s application to operate its Zaakpay payment gateway service, two banking industry sources told Entrackr. Consequently, banks have been told to stop dealing with Mobikwik’s payment gateway in 180 days’ time, the source added. That would indicate a very high probability of an eventual rejection.

This developing situation, if taken to its eventual conclusion, could force the company to suspend operations on Zaakpay for several months before it is allowed to apply again. Zaakpay’s services are deeply tied into Mobikwik’s overall services to merchants and customers, and reported a gross transaction value of Rs 11,358.97 crore in the fiscal year ending March 2021.

We have reached out to Mobikwik and the RBI for comment. We will update the story as and when they respond.

Zaakpay is apparently facing the sword of rejection because it had an inadequate net worth; RBI regulations require payment aggregators to have a minimum net worth of Rs 15 crore. According to data reviewed by Fintrackr, Zaakpay’s net worth stands at Rs 14.2 crore. One of Entrackr’s sources said that Mobikwik providing cryptocurrencies on its platform could also be a trigger for the denial of authorisation. (Mobikwik halted UPI payments for crypto purchases last week.)

“We depend on Zaakpay’s services for our consumer payments and BNPL [buy now pay later] segments and any disruption in its services may adversely affect the operations of [our] platform, which could have an adverse affect on our brand, reputation, business operations, financial condition and results of operations,” Mobikwik said in its Draft Red Herring Prospectus in 2021. The company confirmed that it has applied for a Payment Aggregator license in the DRHP.

“In Fiscals 2019, 2020 and 2021, our payment gateway costs to Zaakpay amounted to Rs 64.66 crore, Rs 142.8 crore and Rs 139.72 crore, respectively. Accordingly, any disruption in the functioning of Zaakpay, even if caused due to factors completely external to us, can adversely affect the operations of our MobiKwik Wallet and BNPL products,” Mobikwik said in the document, underlining the potential impact of the RBI’s refusal to grant Zaakpay an authorisation.

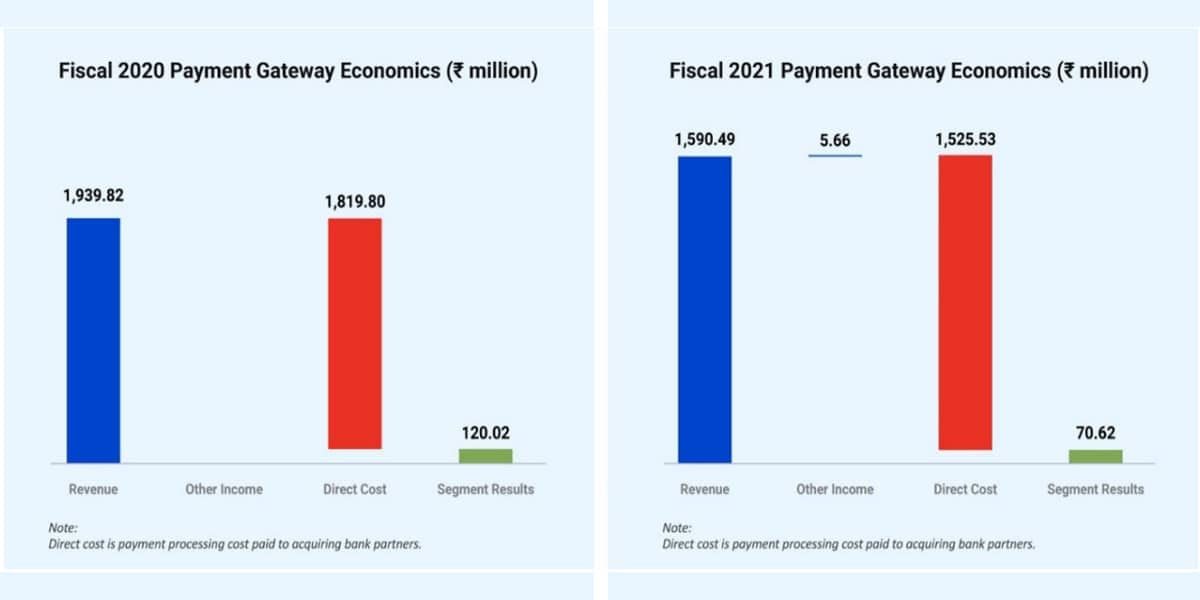

Zaakpay’s turnover has been immense, but its margins have been slim, as is usually the case with payment gateway providers, who only take a small cut of transaction fees:

“Our payment gateway segment [gross market value] decreased by 20.75% from ₹14,334.19 crore in Fiscal 2020 to ₹11,358.97 crore in Fiscal 2021,” the DRHP said.

Mobikwik was fined Rs 1 crore by the Reserve Bank of India in December 2021 for “deficiencies in regulatory compliance”. Earlier that year, the central bank ordered the company to investigate an alleged data leak.

The company’s IPO plans also appear to be in limbo after the slump suffered by the rush of web 2.0 IPO’s in India. That will surely impact its plans to ramp up and prepare for future disruptions, a reality that seems to be dawning faster than anyone expected.

Note: Amounts quoted from Mobikwik’s DRHP have been changed from millions to crores.