Kirana commerce platform ElasticRun became a unicorn at the start of last month after scoring a mammoth $300 million funding round from Softbank. While the rural India facing firm has stayed below the radar and avoided too much media attention, the company’s numbers tell their own story, with the firm crossing Rs 1,000 crore in operating revenue in the fiscal ending March 2021.

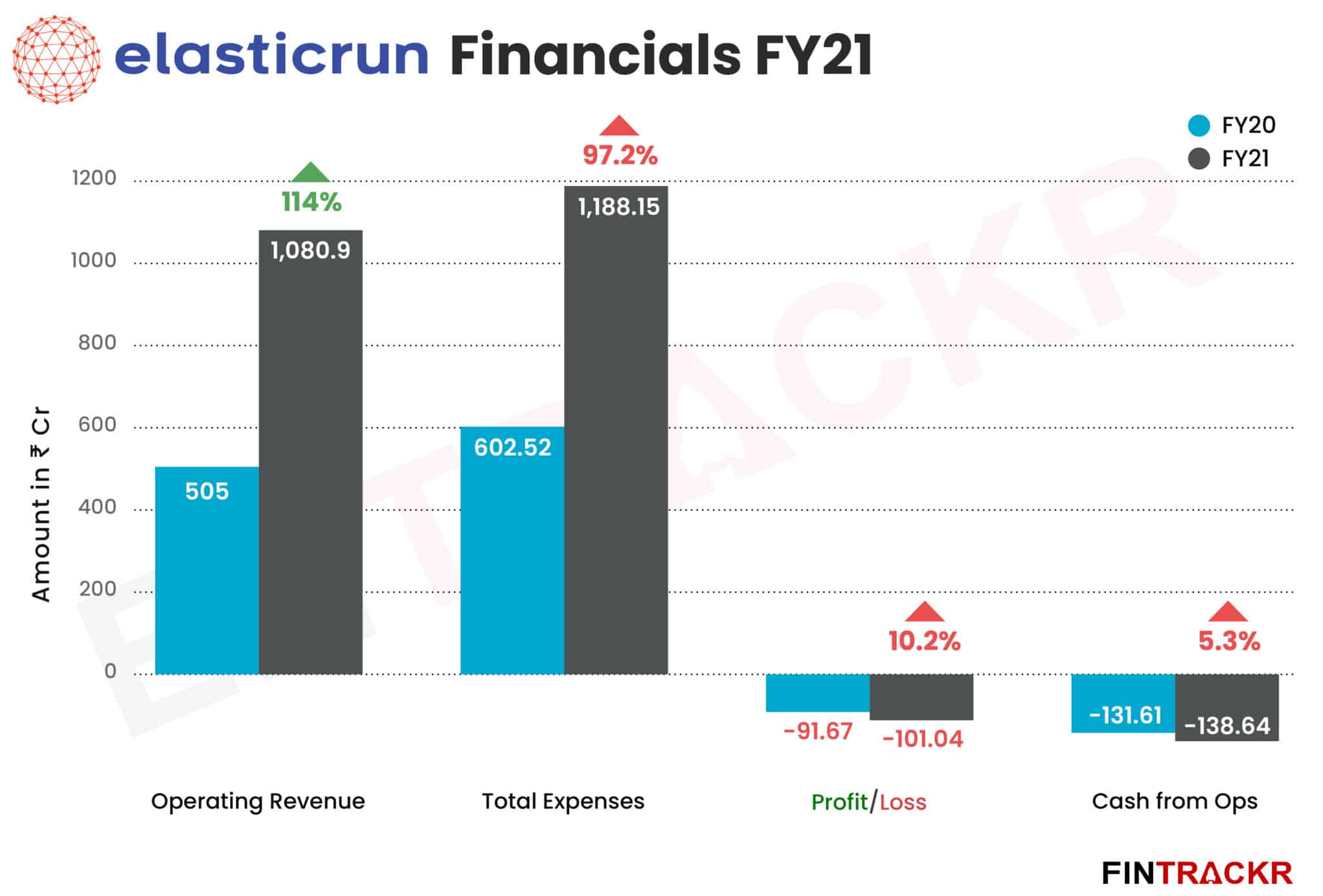

ElasticRun’s revenue from operations jumped 2.14X to Rs 1,081 crore in FY21 from Rs 505 crore during FY20. The B2B e-commerce platform aggregates supply from over 400 FMCG brands and provides logistics and warehousing services to rural stores in over eighty thousand villages across 26 states in India.

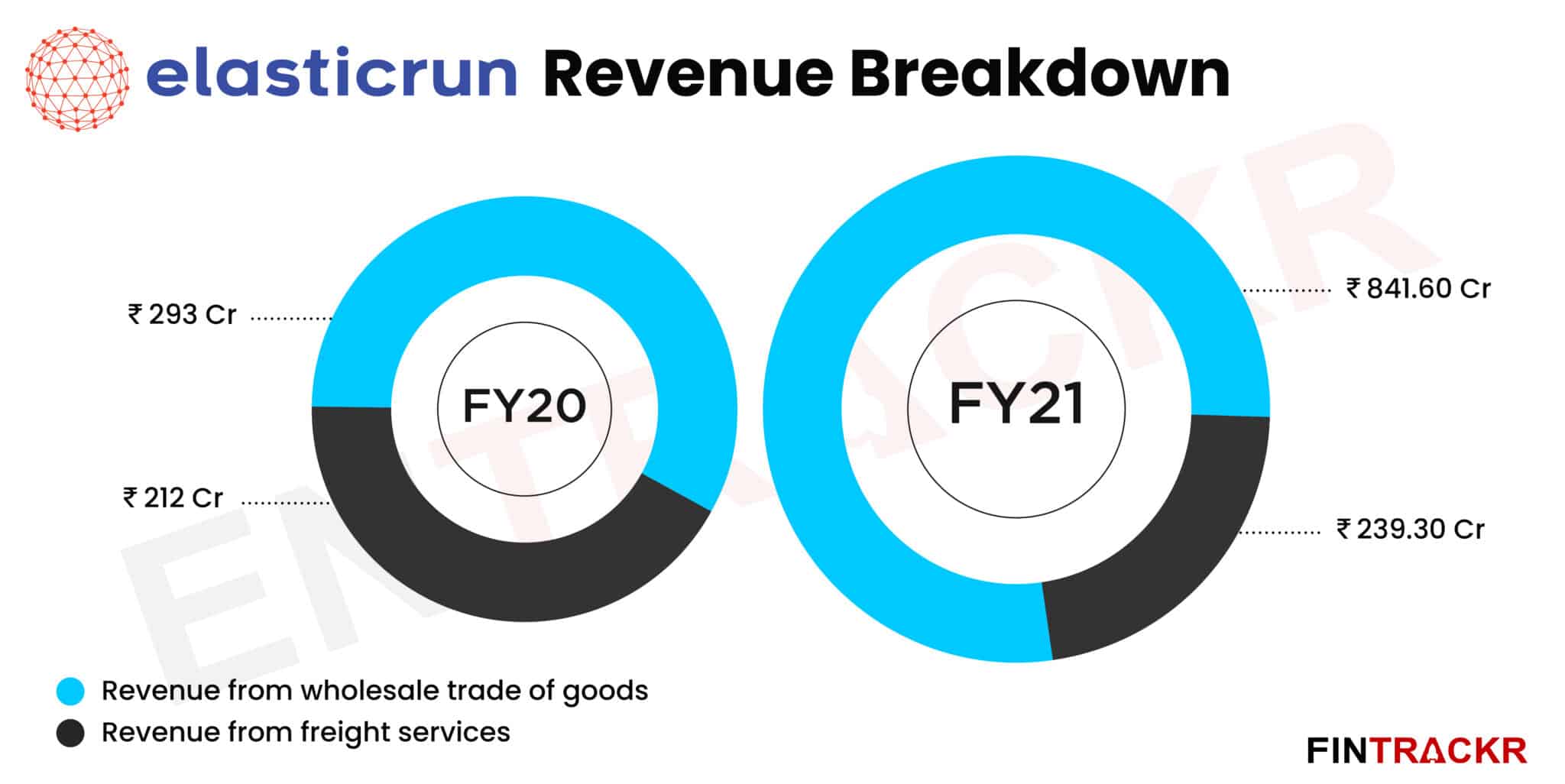

The wholesale trade of goods to rural stores accounts for 77.9% of the company’s operating revenue, growing nearly three times to Rs 841.6 crore during FY21 from Rs 293 crore in FY20.

Rural markets in India have been underserviced due to logistics problems and low ticket size and sourcing became even a bigger problem during the pandemic laden fiscal year (FY21).

ElasticRun’s own supply chain and the model of “no-capex”, “variable cost” network helped the company to reach out to more rural stores during the last fiscal.

The company also provides logistic and distribution services to its customer’s stores which accounts for 22.1% of its collections. Such revenue grew by 13% to Rs 239.3 crore during FY21 from Rs 212 crore in FY20.

The startup also generated a non-operating income of Rs 6.2 crore from its financial assets during FY21.

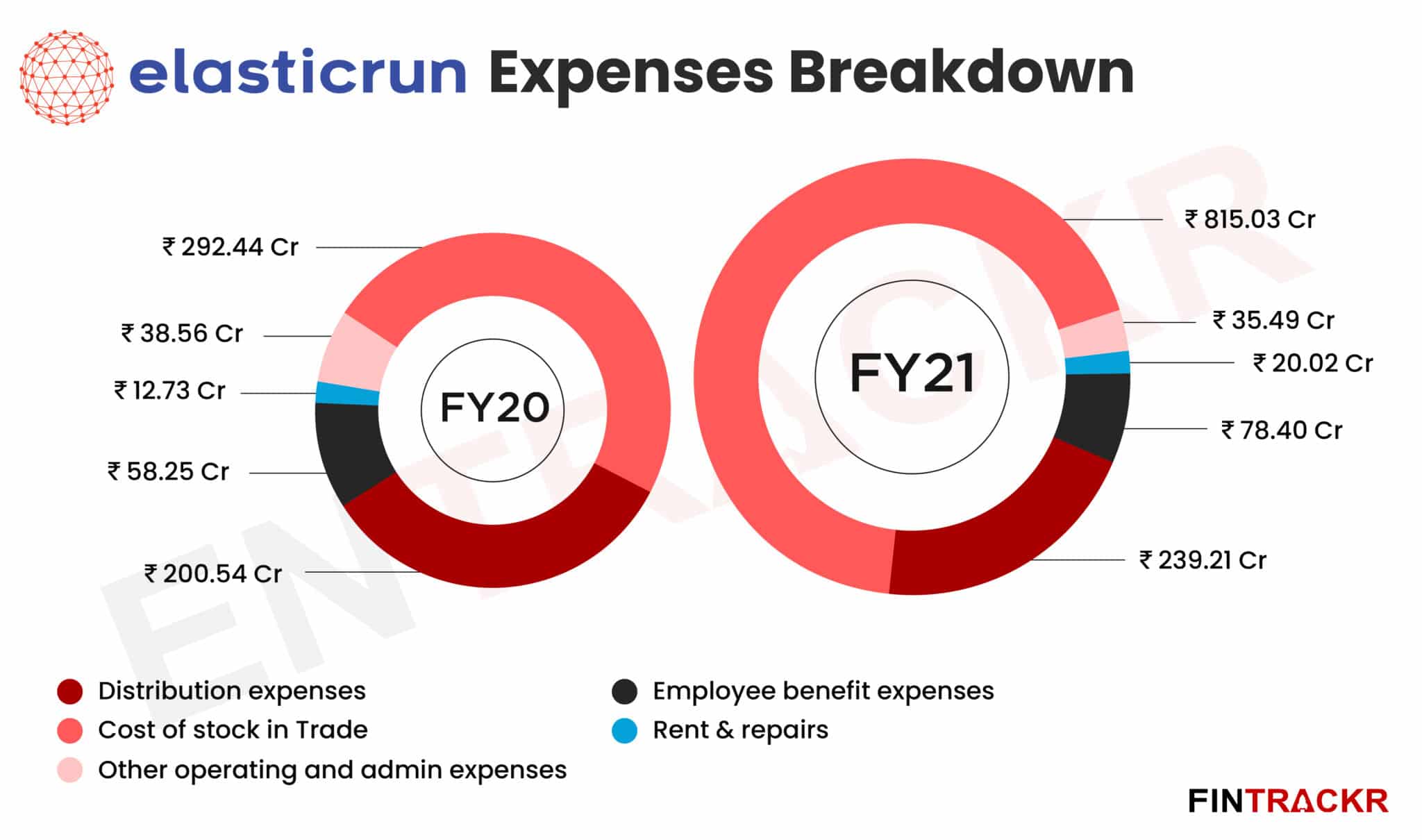

When it comes to expenses, procurement of FMCG goods turned out to be the largest cost centre for ElasticRun, accounting for 68.6% of its revenues. This expense grew in line with the overall operational scale which went up by 2.8X to Rs 815.03 crore in FY21 from Rs 292.4 crore spent during FY20.

Distribution and logistics came out as the second-largest cost for the B2B trade platform, making up 20.1% of annual expenses. Such expenses grew by 19.3% to Rs 239.2 crore in FY21 from Rs 200.54 crore spent during FY20. Importantly, the company seems to be providing its logistic services to its customers on at cost basis, not making or losing money on deliveries.

The Pune based company operates with a relatively smaller team which has been growing with its scale of operations and staff costs make up only 6.6% of annual costs. These payments grew by 34.6% to Rs 78.4 crore during FY21 from Rs 58.3 crore paid out in FY20.

Rental and repair expenses of warehouses and offices grew by 57% YoY to Rs 20.02 crore while safety security expenses amounted to Rs 3.9 crore during FY21.

Overall, the B2B startup’s annual expenditure surged 97.2% to Rs 1,188.2 crore during FY21 from Rs 602.5 crore spent in FY20.

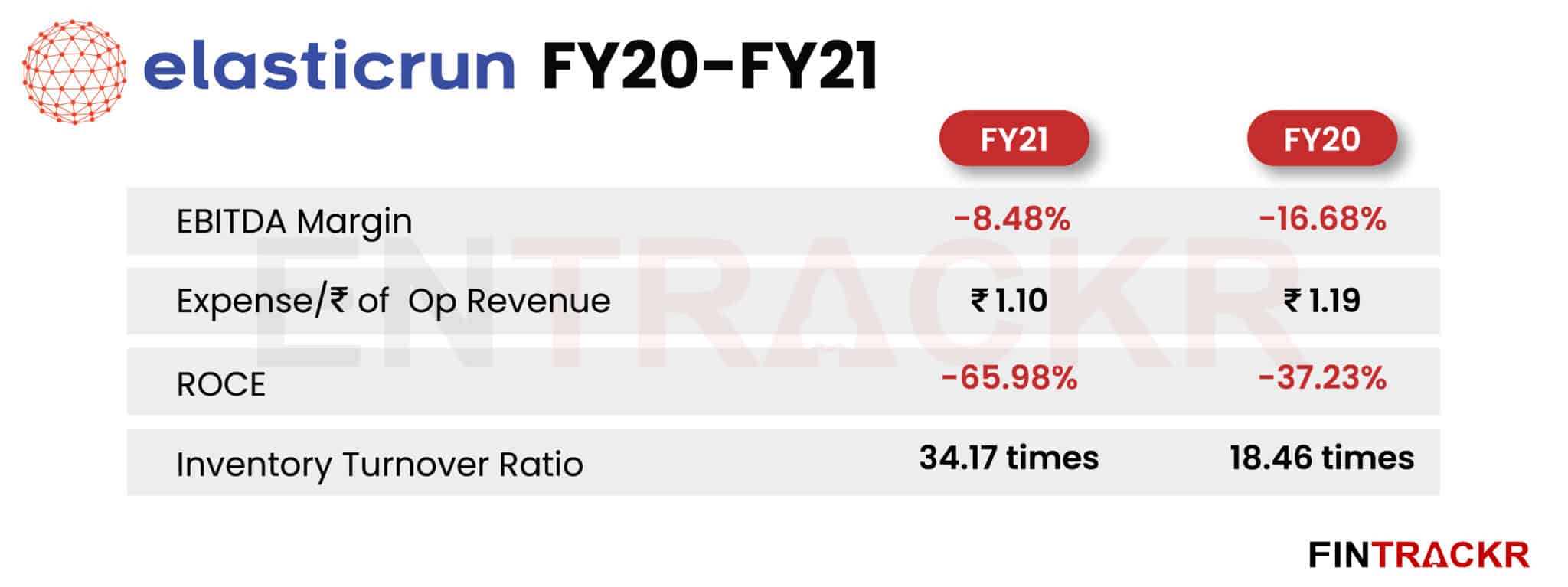

ElasticRun got pretty close to breakeven during FY2020-2021 as it has spent Rs 1.1 to earn a single rupee of operating revenue.

While ElasticRun’s annual losses grew by 10.2% YoY to Rs 101.04 crore, its EBITDA margin improved from -16.68% in FY20 to -8.48% in FY21. The company’s inventory turnover ratio improved to 34.17 times during FY21 from 18.46 times in FY20 even with the company moving 3X volume of goods.

ElasticRun’s tight control over costs would indicate that profitability is not too far away for this unicorn, although distribution and logistics costs will continue to challenge the firm in the near future too. Investors clearly believe the firm will deliver.