Pivots are challenging for startups and few make a turnaround after switching tracks. In the past five to six years, the Indian startup ecosystem probably hasn’t witnessed any convincing pivot story, except one: Amagi.

In 2018, Amagi pivoted from an advertising solution for local businesses on television channels, to a SaaS-based monetisation platform for TV networks and content owners across different platforms.

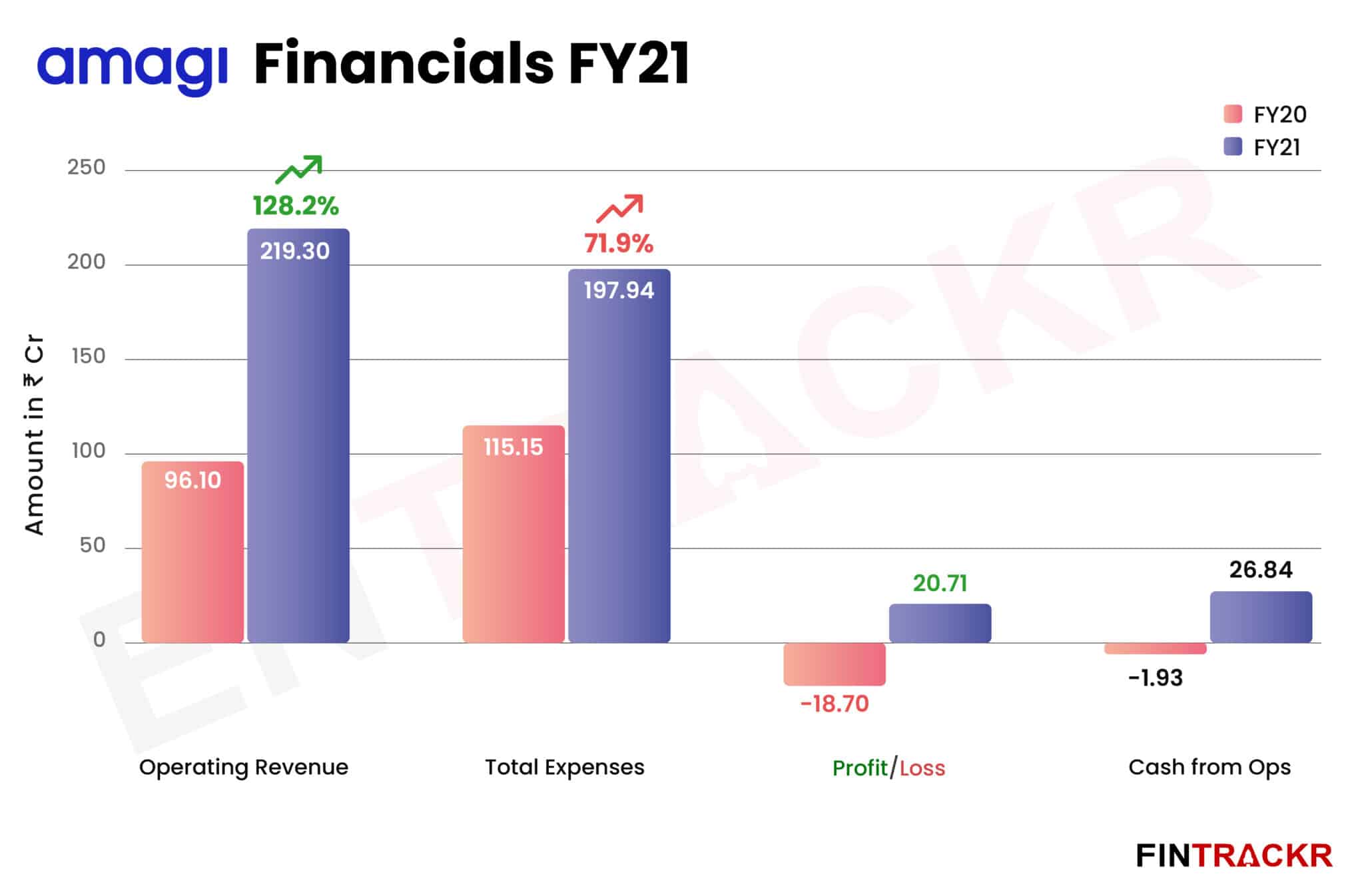

While the pivot was painful for Amagi as it had to let go over half of its workforce and start afresh, it managed to build over Rs 200 crore in revenue and churned significant profit in the fiscal ending March 2021. The 14-year-old company saw its revenue from operations grow around 2.3X to Rs 219.3 crore during FY21 from Rs 96.1 crore in FY20.

This Accel-backed company provides services such as linear/on-demand channel creation, content distribution over the cloud, management of broadcast services and geo-targeted ad insertion. Amagi claims to have an audience of over 2 billion people across the globe with numbers growing steadily each quarter.

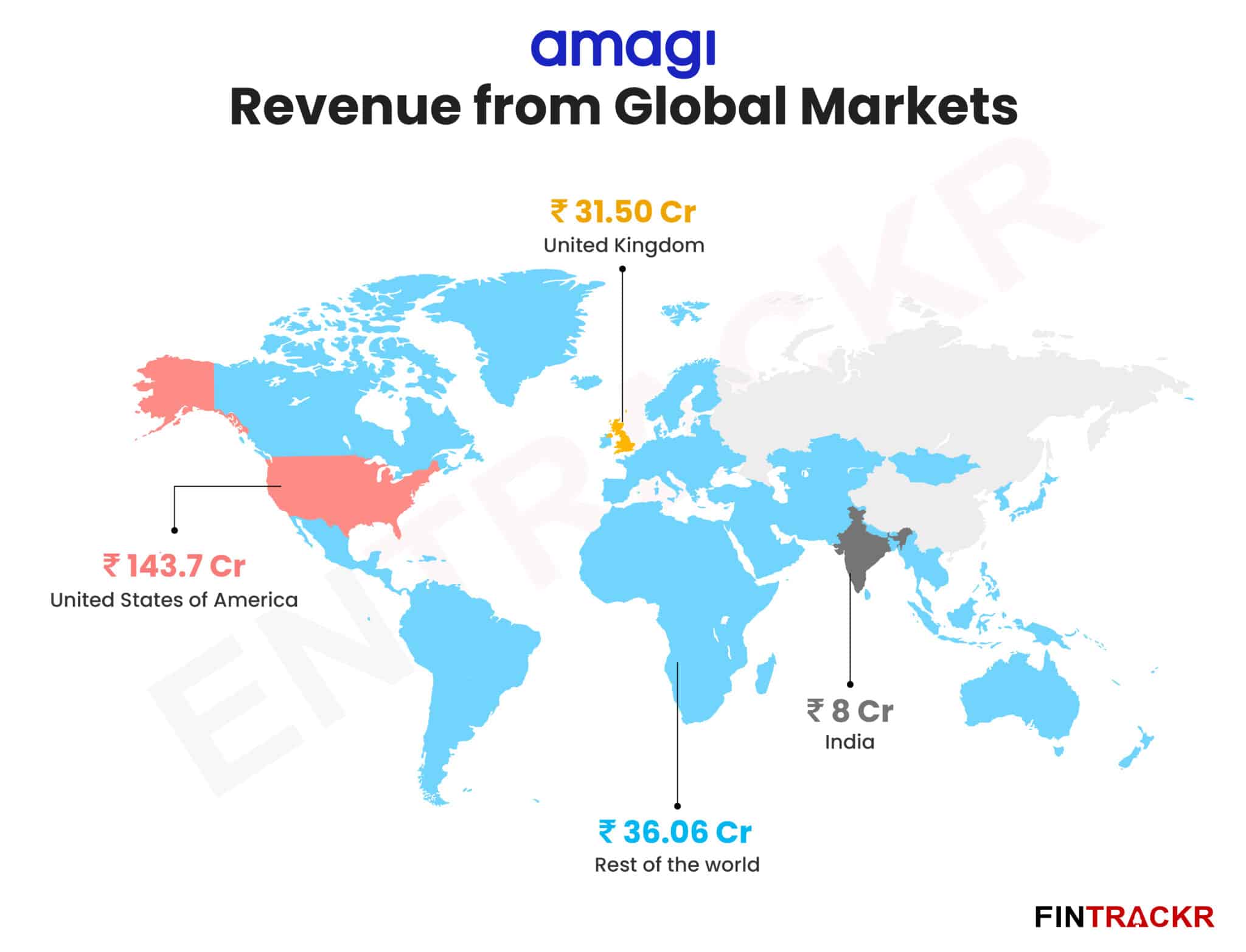

The United States is the largest market for the company which broadcast the Tokyo Olympics on its platform for American broadcasters such as NBCUniversal, USA Today and ABS-CBN. It generated around 65.5% of its revenue from the U.S. with collections ballooning 3.3X YoY to Rs 143.7 crore during FY21 in the country.

The United Kingdom is the second-largest market for the company accounting for 16.4% of its revenues with broadcasters such as A+E and VICE TV moving their broadcast operations to Amagi Cloud. UK collections swelled by 78.5% YoY to Rs 36.06 crore during FY21 as compared to the previous fiscal.

Operating revenue from the rest of the world also grew 99.4% to Rs 31.5 crore as several other broadcasters migrated onto Amagi’s cloud playout platform. India remains one of the smallest geographical markets in terms of revenue, accounting for only 3.6% of Amagi’s annual revenue. Indian collections actually contracted by nearly 50% to Rs 8 crore during FY21.

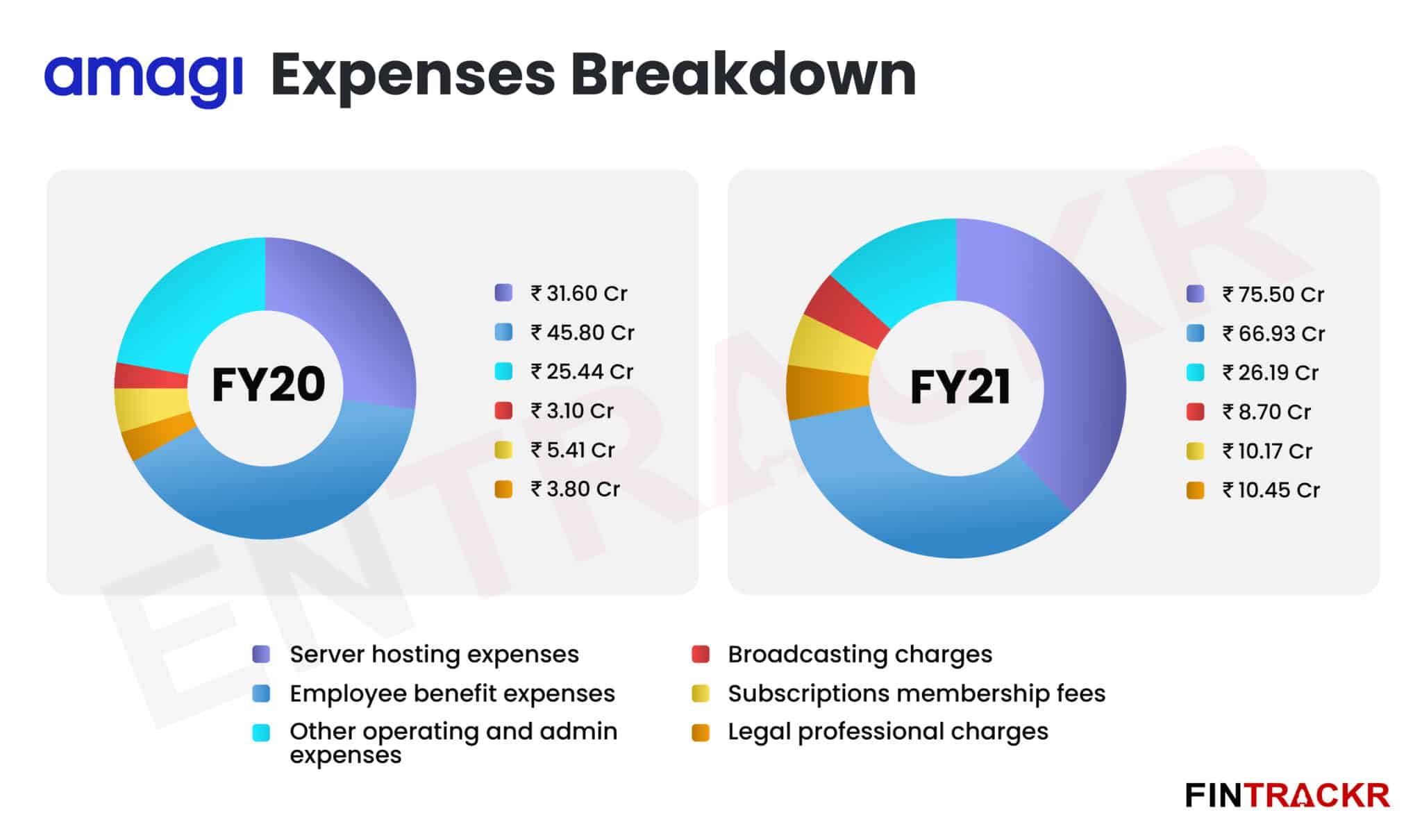

Cloud hosting and server related costs stood out as the single largest expense for the Bengaluru-based company, making up 38.1% of annual costs. These costs grew in line with operational scale, surging 2.4X YoY to Rs 75.5 crore during FY21 as compared to Rs 31.6 crore spent on the same in FY20.

On similar lines, broadcasting costs also grew 2.8X to Rs 8.7 crore during FY21 from Rs 3.1 crore spent in FY20.

Employee benefit expenses is the second largest cost centre for Amagi, accounting for 33.8% of its annual costs. These payments grew by 46.1% from Rs 45.8 crore to nearly Rs 67 crore during FY21 including SAR(Stock Appreciation Rights) payments of Rs 1.12 crore.

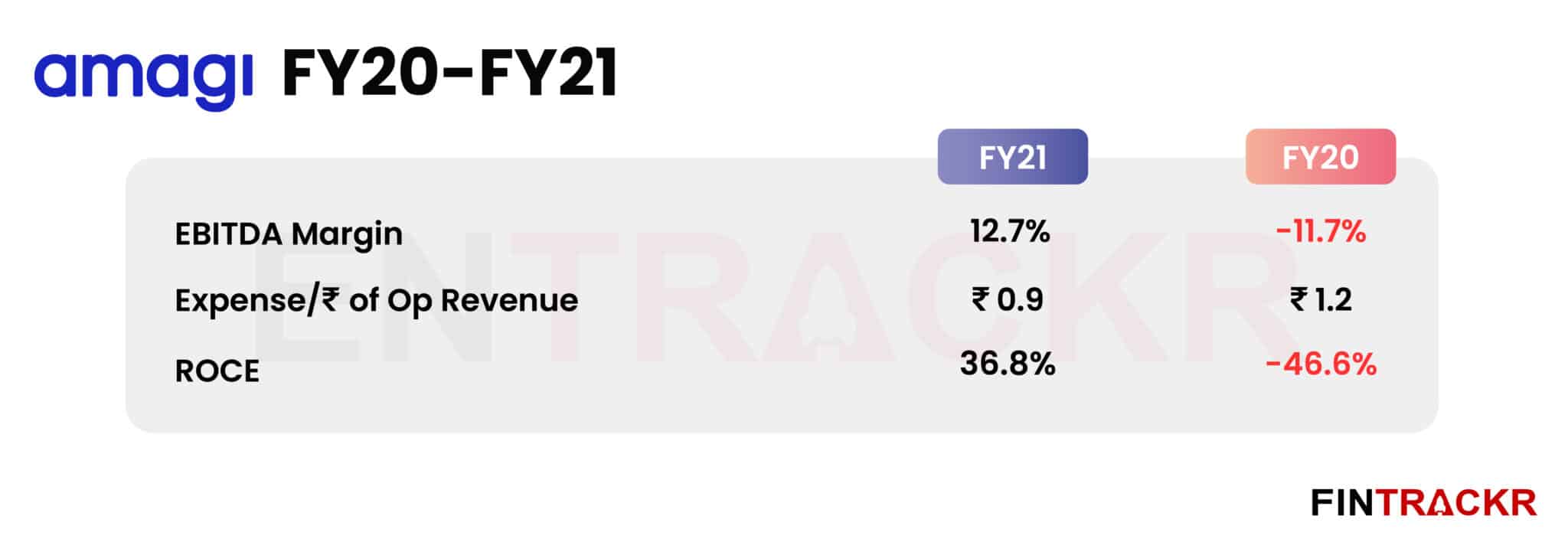

Further, legal professional expenses also surged 2.8x to Rs 10.5 crore pushing total expenses to nearly Rs 198 crore during FY21, 72% more as compared to Rs 115.2 crore spent in total in FY20. Amagi spent Rs 0.9 to earn a single rupee of revenue during FY21.

Even with the 2.4x growth in scale, the company has managed to improve its EBITDA margin to 12.7% in FY21 from -11.7% in FY20.

Coupled with positive margins and a surge in collections, Amagi posted a net profit of Rs 20.7 crore during FY21 as compared to the loss of Rs 18.7 crore booked in FY20.

Amagi’s success is a strong message to the many startups that have hoped to make their fortunes from firstly, advertising, and then, the domestic market. Both these ambitions take a disproportionate amount of effort/resilience, quality, and luck, as the advertising market becomes increasingly concentrated space favouring large players. Entry barriers have also come up due to the dominance of large media buying agencies. Amagi has lived to tell a good story thanks to its investors, a competent management, and of course, luck.