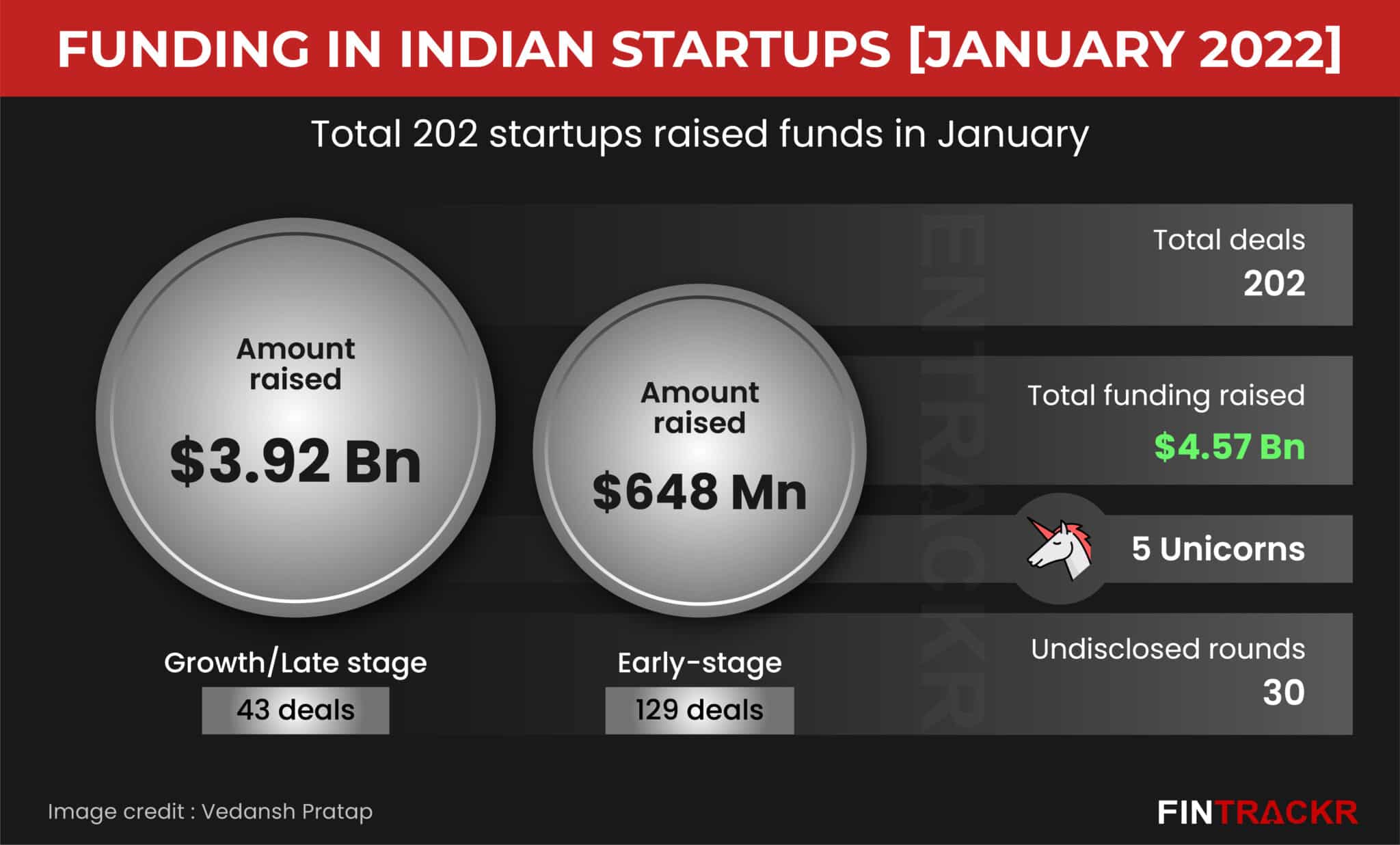

The Indian startup ecosystem had attained new heights in 2021 in terms of funding, acquisitions and ESOP buyback events. And the upward trend seems to have stretched into this year as well. Indian startups scooped up close to $4.6 billion in total fundraising in January according to our data tracking platform Fintrackr.

Overall, 202 startups announced their funding last month which includes 43 growth stage and late-stage startups, 129 early-stage firms, while 30 did not disclose their transaction details. This is more than a fivefold jump in the amount raised by Indian startups as compared to January last year which saw a fund inflow of $807 million across 85 startups including 14 undisclosed deals.

The month that went by also minted several unicorns. Five startups—baby and mother care brand MamaEarth, analytics service provider Fractal, edtech startup LEAD, HRtech platform Darwinbox and social commerce platform DealShare— attained unicorn status by raising investments at over $1 billion valuation.

In Entrackr’s monthly funding report, here are details of the top 10 deals in both the growth stage and early-stage investments for January:

Growth/late-stage deals

A total of 43 growth and late-stage startups raked in $3.92 billion in January. Foodtech major Swiggy was in the headlines as the Bengaluru-based foodtech major had raised $700 million at around $10.7 billion valuation, making its entry into the decacorn club. Fractal, Moglix, Dunzo and Ola Electric were also on the list with $360 million, $250 million, $240 million and $200 million funding respectively. B2B e-commerce platform Udaan also picked up $250 million via convertible note and debt.

Details of the 202 funding rounds can be found here.

The other deals that made it to the top 10 growth and late-stage funding list include DealShare’s $165 million round, Addverb’s $132 million investment from Reliance, Waycool’s $117 million equity and debt round and LEAD’s $100 million funding.

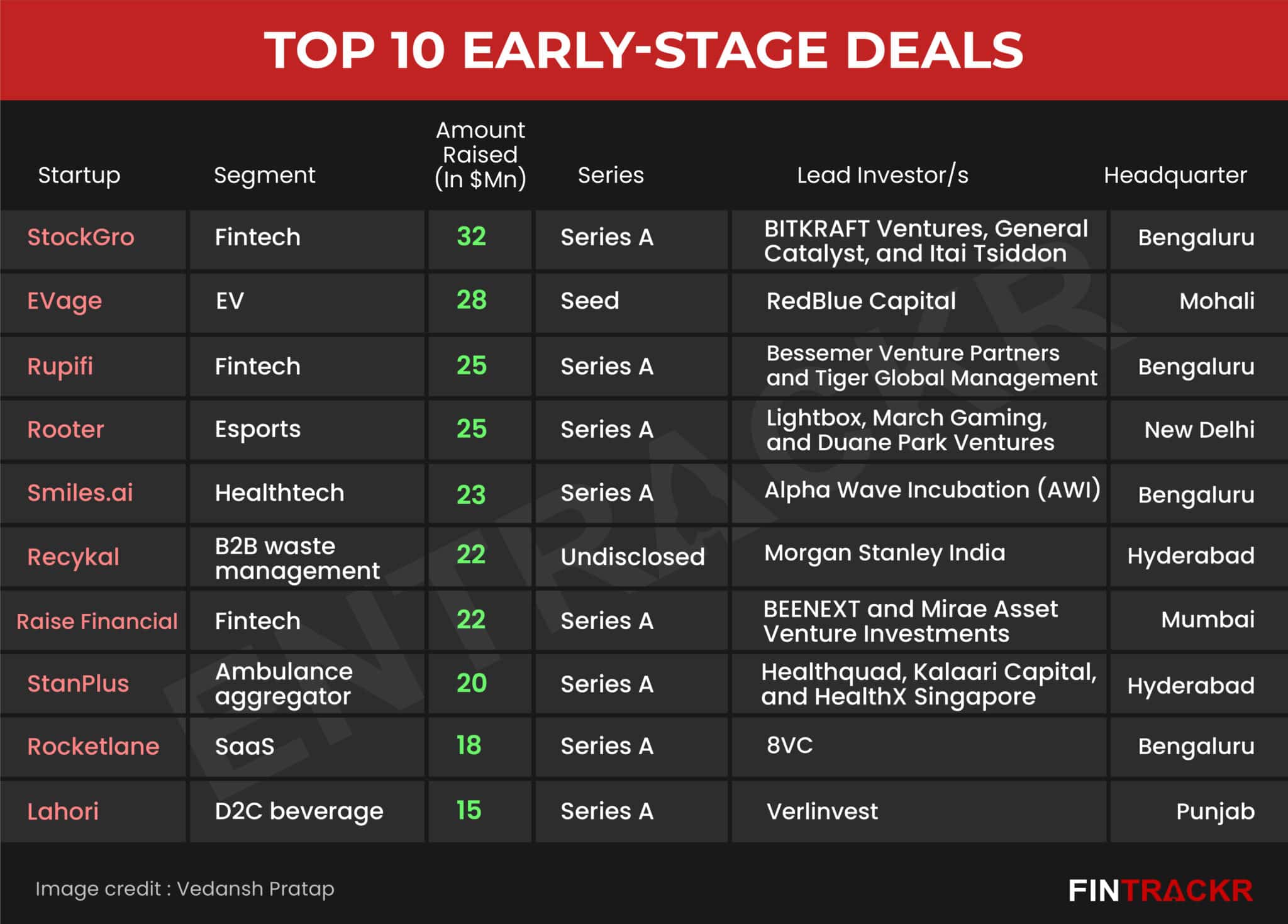

Early-stage deals

Around 129 early-stage startups had announced their deals worth $648 million in January. The list includes some of the largest early-stage investments such as fintech startup StockGro’s $32 million, EV startup Evage’s $28 million, fintech startup Rupifi’s $25 million, e-sports platform Rooter’s $25 million and healthtech platform Smiles.ai’s $23 million.

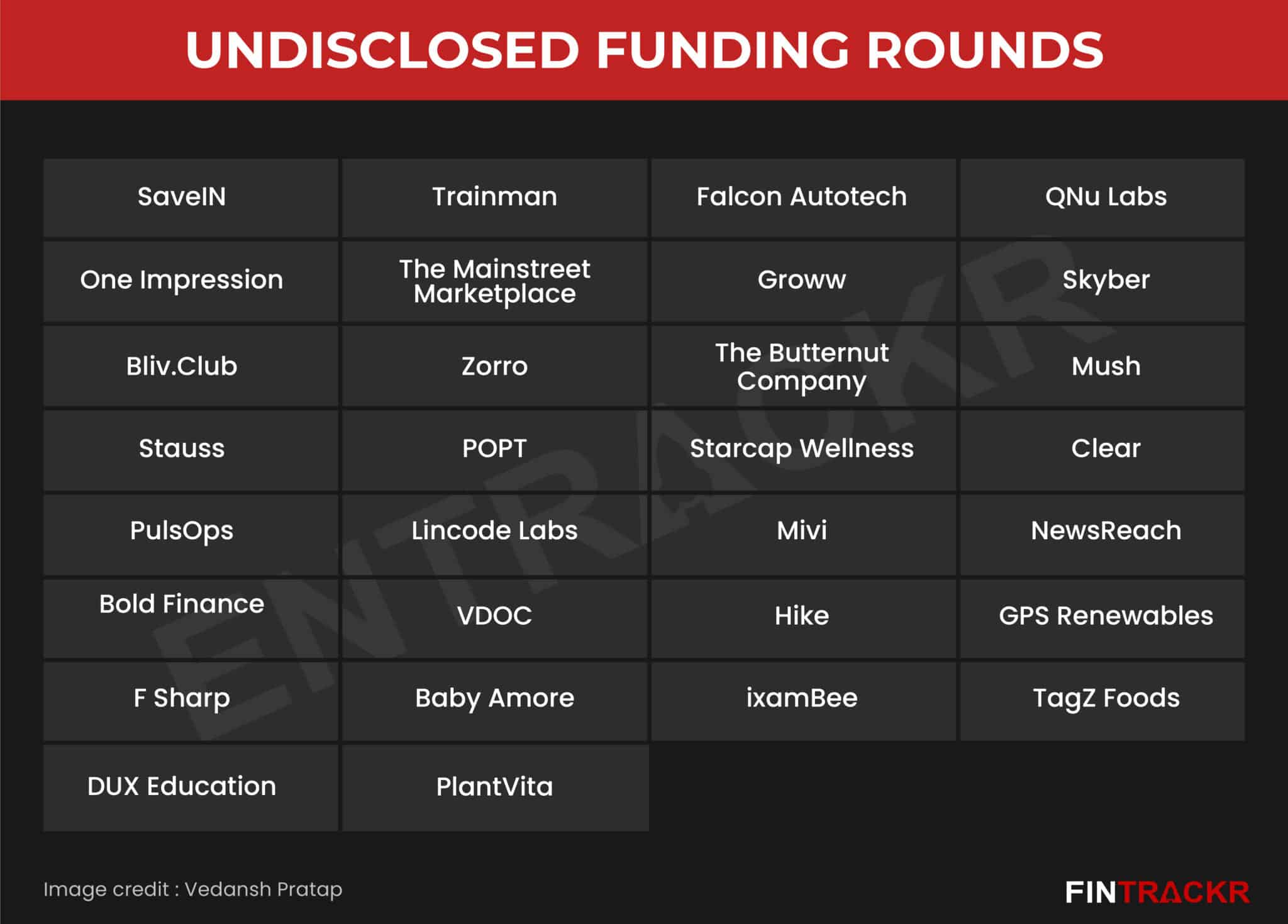

Undisclosed deals

In January, 30 startups did not reveal the details of their transaction. The list includes SaveIn, Trainman, Falcon Autotech, QNu Labs, The Mainstreet Marketplace, Skyber, Bliv.Club and Zorro. While almost all undisclosed fundings are in their early stages, fintech unicorn Groww also announced its undisclosed investment from Microsoft’s CEO Satya Nadella.

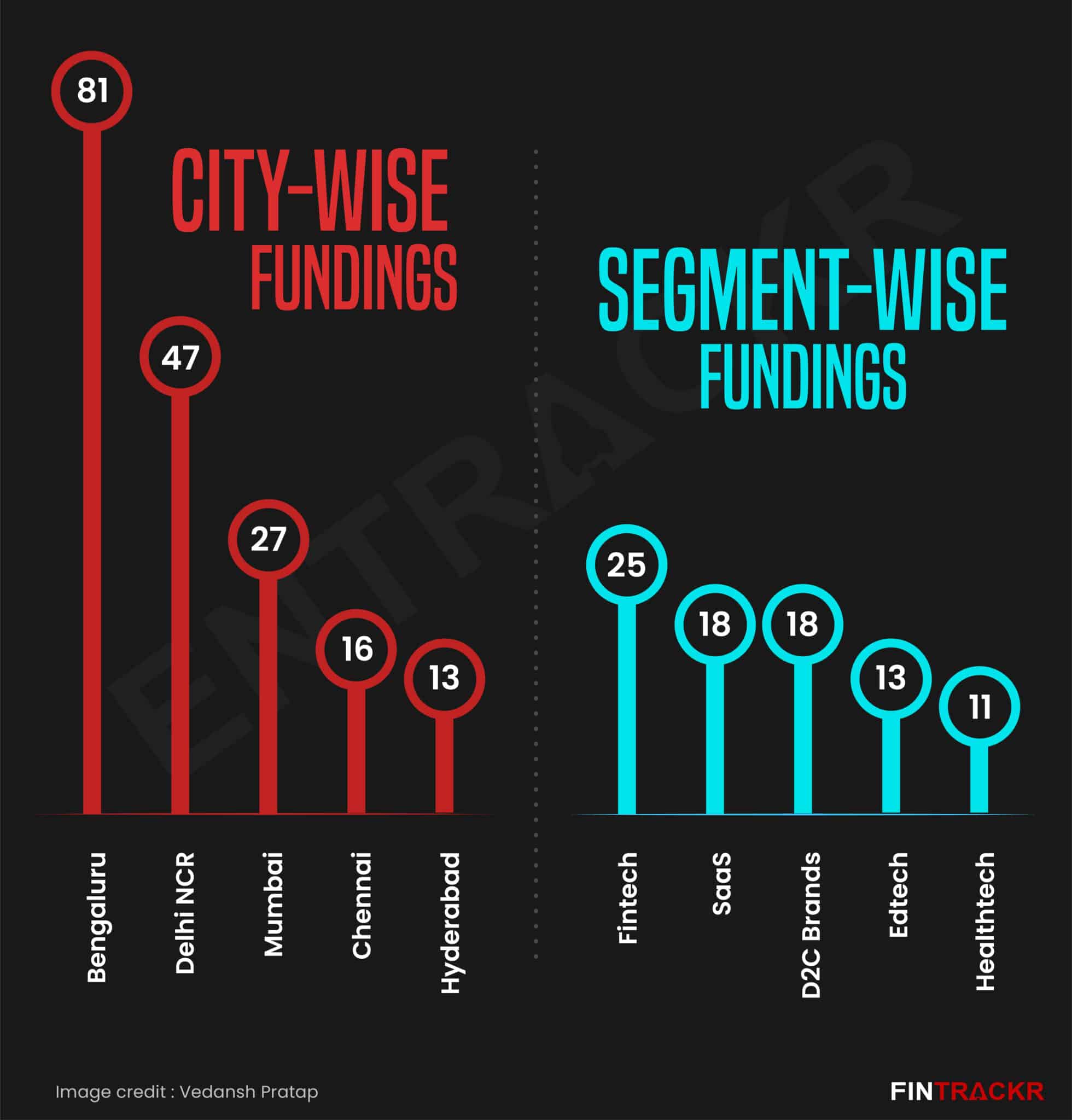

City wise deals

Once again, Bengaluru was the hotspot for investors as the startups based out of the Silicon Valley of India received close to $2.5 billion in total funding across 81 deals. During the last month, Delhi-NCR based startups raised $782 million across 47 deals followed by Mumbai, Chennai and Hyderabad.

Segment wise deals

Fintech was the top segment in terms of the number of fundraising in January with 25 deals followed by SaaS, D2C brands, edtech, healthtech and agritech with 18, 18, 13, 11 and 10 deals respectively. However, foodtech major Swiggy [$700 million] and startups in the B2B e-commerce and procurement space such as Udaan [$250 million ]and Moglix [$250 million] were the top fundraisers when it comes to the amount raised.

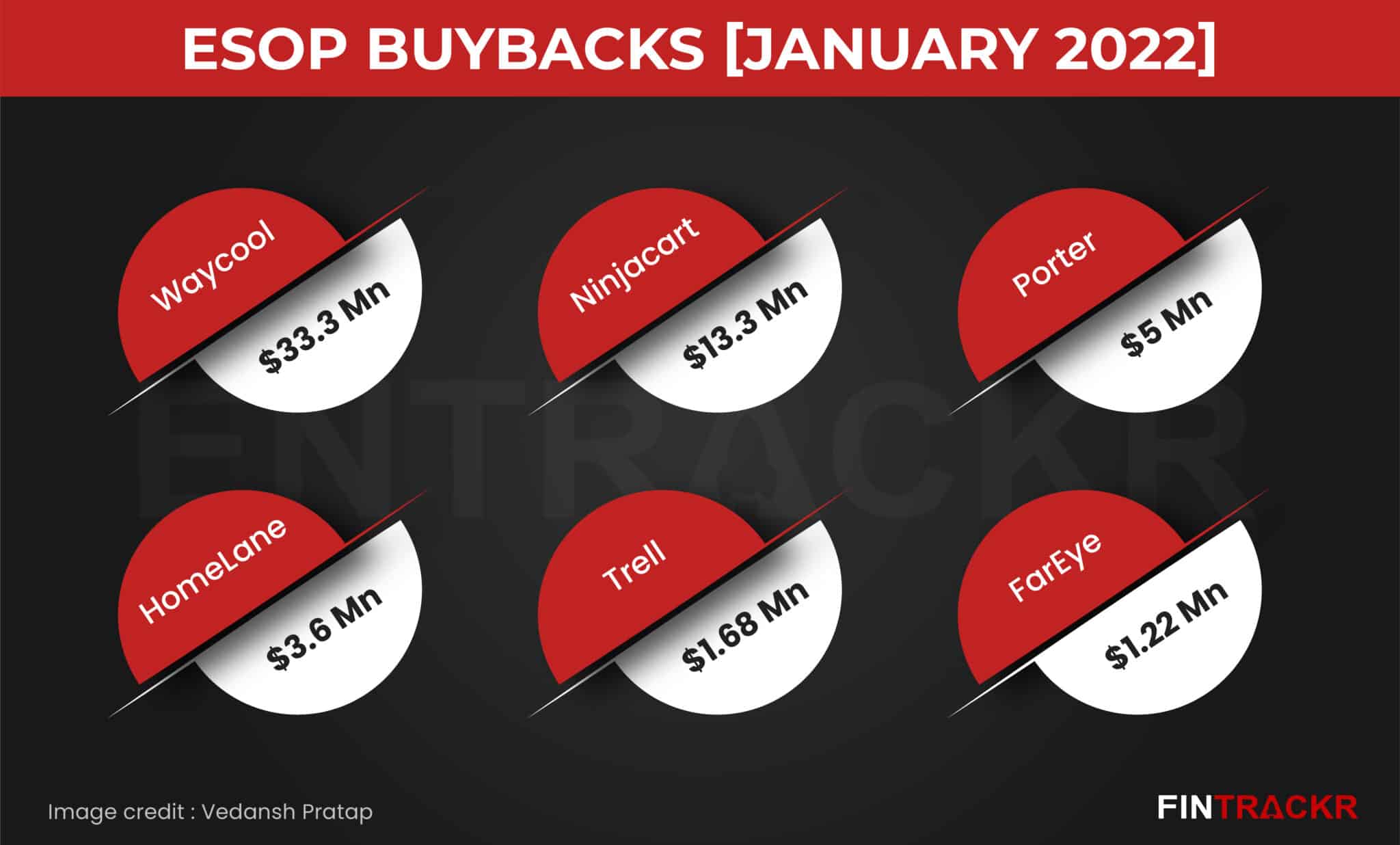

ESOP buybacks

Apart from the record fundraising, around half a dozen startups also announced their ESOP liquidity program in January to reward their employees. On Monday, SaaS startup FarEye had announced liquidation for ESOP holders worth $1.22 million via buyback.

The list includes lifestyle video and commerce platform Trell, logistics company Porter, online home interior design platform HomeLane and two agritech platforms Ninjacart and Waycool.

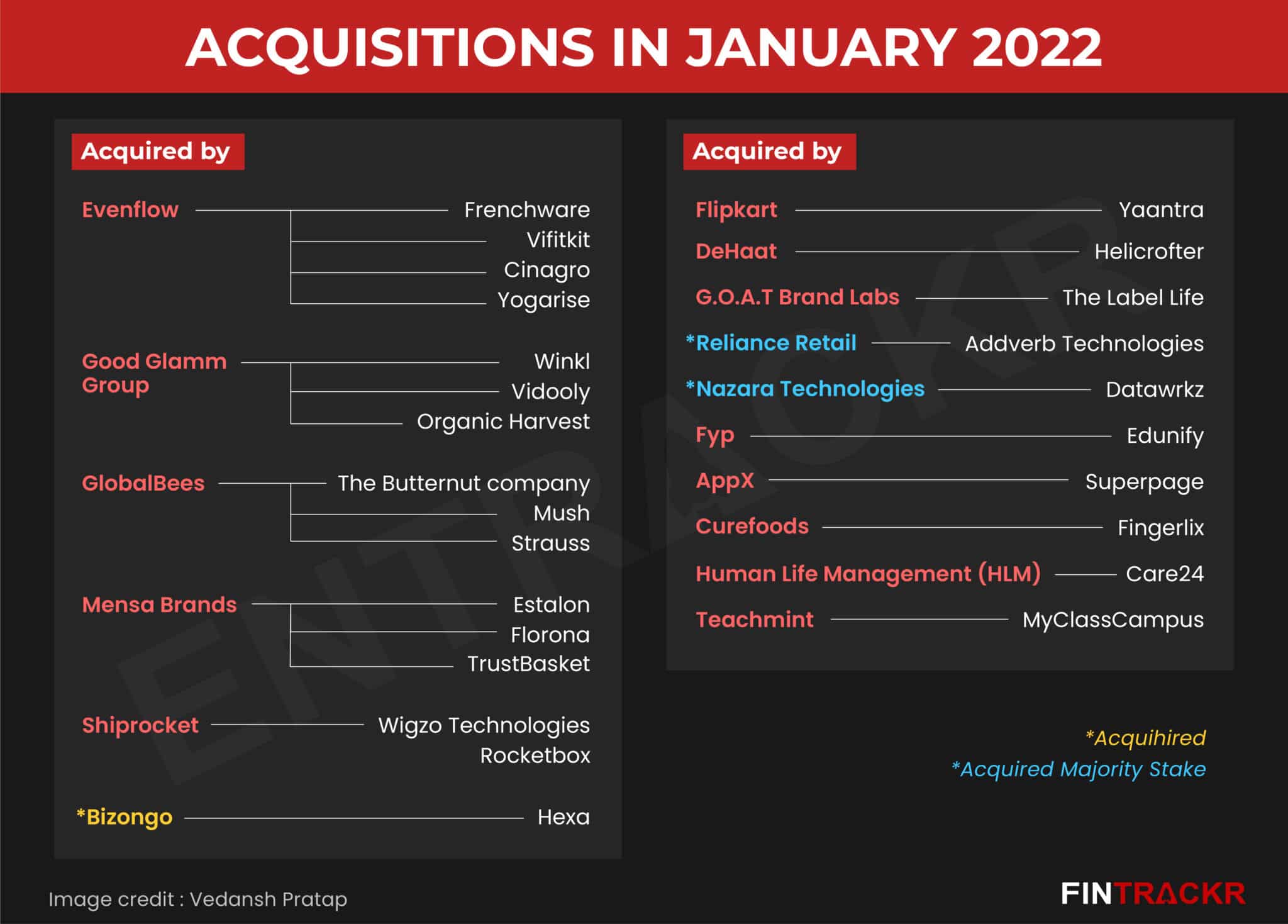

Acquisitions

Around 26 startups got acquired or consolidated with larger companies in January. E-commerce roll-up companies such as EvenFlow, Mensa Brands, GlobalBees and GOAT Brand Labs were the top acquirers in the month by adding 11 startups in their portfolio.

In terms of deal size, the acquisition of a majority stake in Addverb by Reliance Retail, Yaantra by Flipkart and Datawrkz by Nazaara Technologies are the top deals of the month.

On Monday, the Economic Survey 2021-22 released by the government said that India has become the third-largest startup ecosystem in the world after the US and China. According to the survey, more than 5,000 recognised startups were added in Delhi while 4,514 startups were added in Bengaluru between April 2019 and December 2021. With a total of 11,308, Maharashtra has more recognised startups than any other state.