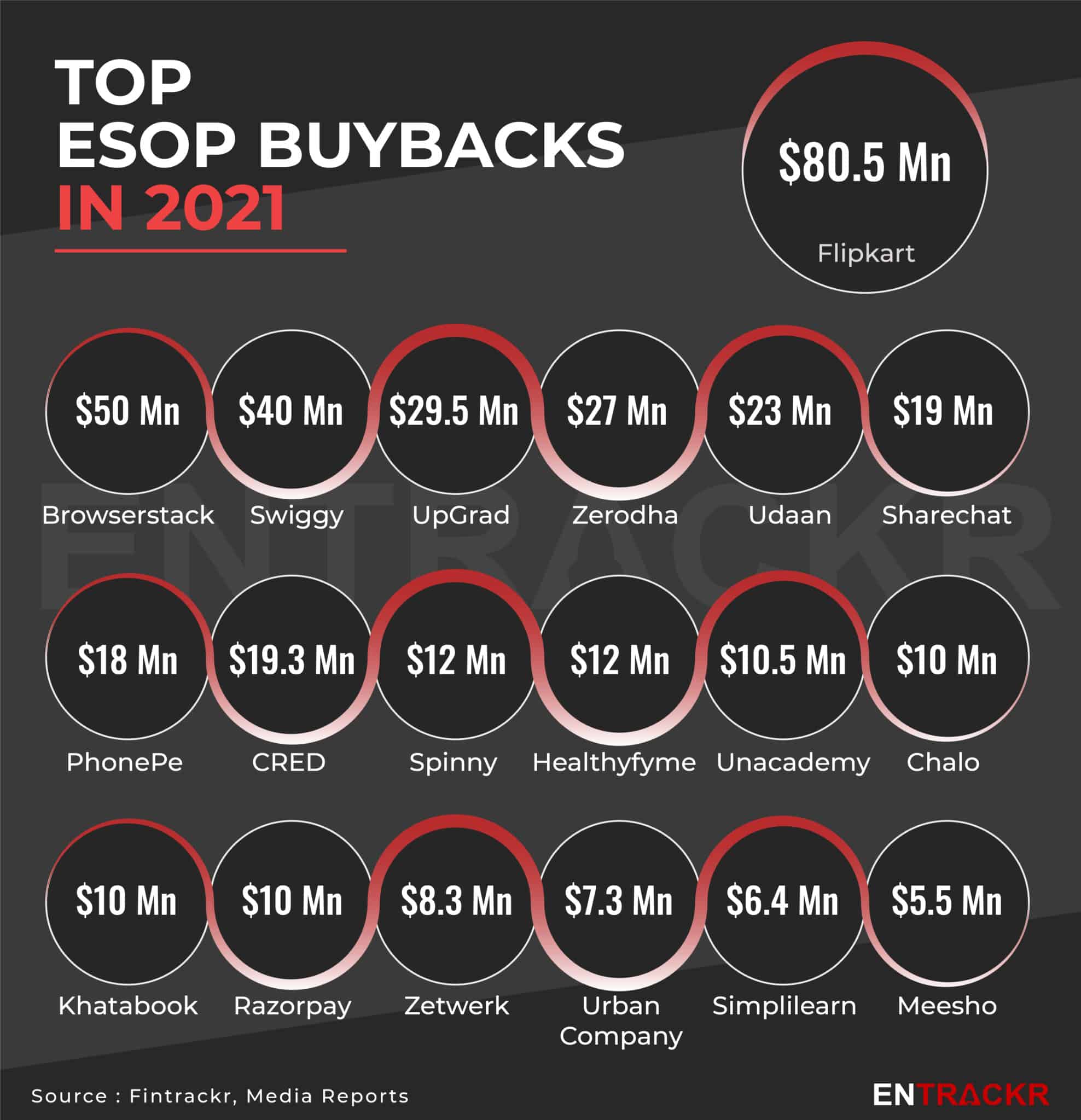

The year 2021 witnessed record numbers when it comes to employee stock ownership plan (ESOP) liquidity events by startups across stages. More than three dozen startups based out of India facilitated or announced ESOP buyback programs worth around $440 million through the year. This is more than an eight-fold jump in ESOP buyback as compared to the previous year.

Fintrackr’s research shows that companies such as Flipkart, Swiggy, PhonePe, Udaan, ShareChat, Razorpay, CRED, Browserstack, Meesho, Spinny, Zerodha, Unacademy, upGrad announced ESOP liquidity program worth more than $440 million. E-commerce major Flipkart, SaaS company Browserstack, digital payments platform PhonePe, edtech company upGrad, B2B e-commerce platform Udaan, social network platform ShareChat are the top buyers of ESOPs in the list.

Where Flipkart bought back ESOPs worth $80.5 million, BrowserStack announced a $50 million ESOP liquidity program. UpGrad, Udaan, CRED, ShareChat and PhonePe announced employees stock buyback programs worth $29.5 million, $23 million, $19.3 million, $19.1 million and $18 million, respectively.

Foodtech major Swiggy also announced that it will buy stock worth $35-40 million held by their employees in 2021 and 2022.

While a majority of these companies have already bought back stocks held by their employees, some of them are in the process. The list of the ones that are underway include Zerodha, MamaEarth and Locus.

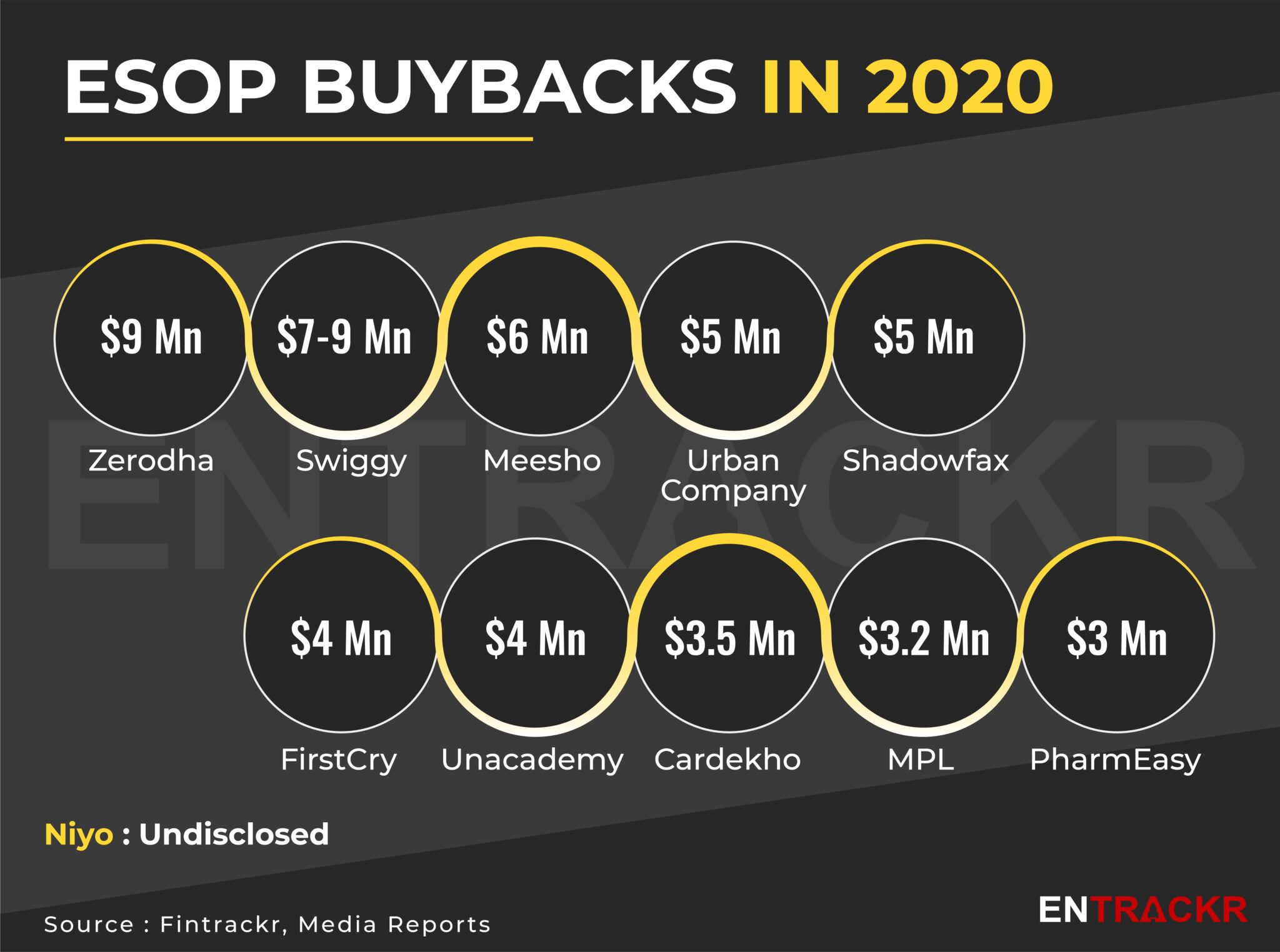

According to Fintrackr’s data, around a dozen companies including Zerodha, Swiggy, Unacademy, FirstCry, Urban Company and Meesho bought close to $50 million worth of ESOPs from their employees. Swiggy and Zerodha turned out to be the biggest fortune creators for their employees in the last year with $9 million worth of buyback each.

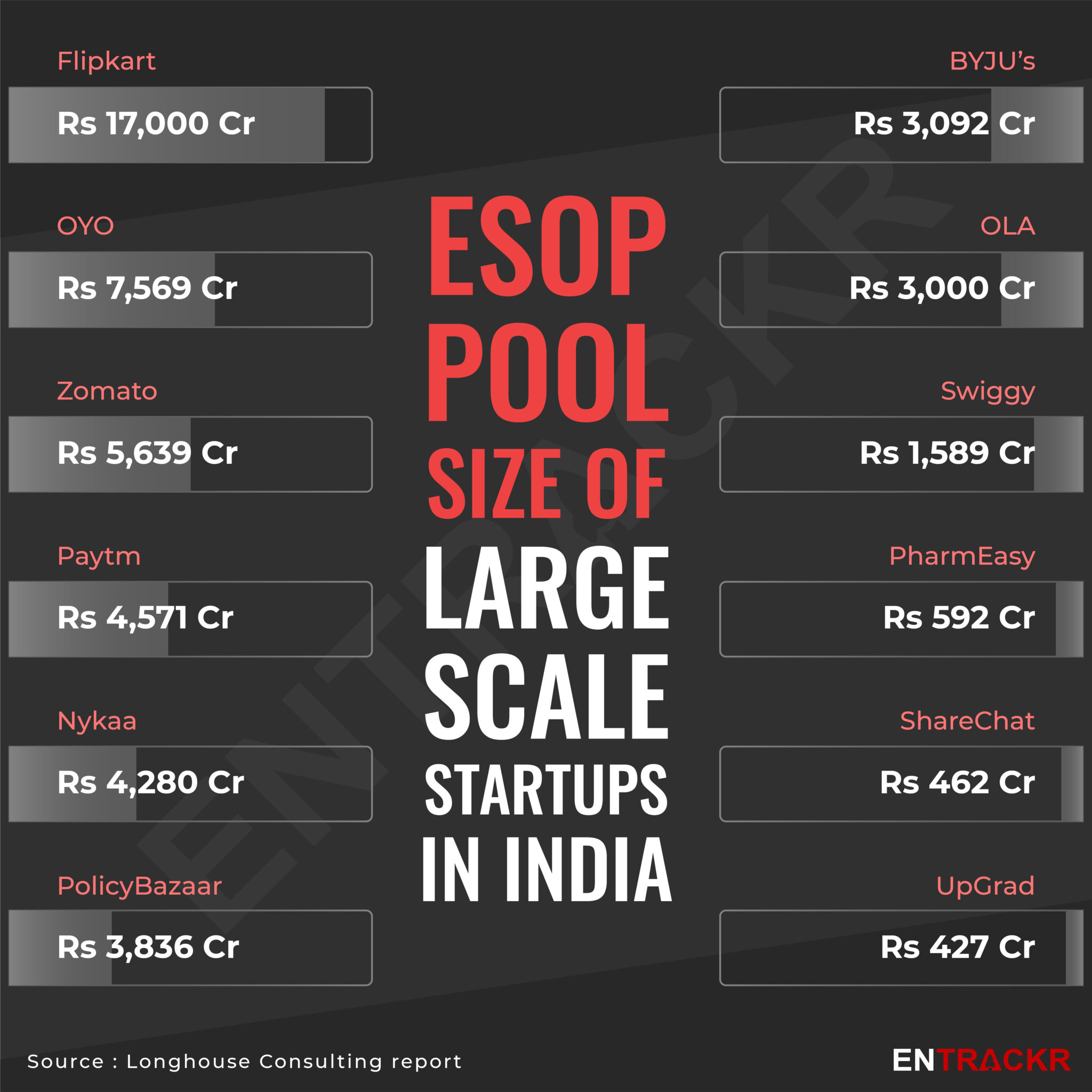

Apart from ESOP buyback, several growth-stage companies such as Flipkart, Paytm, Zomato, Nykaa, Byju’s, Zerodha, Swiggy, PharmEasy, OfBusiness and Ola have also expanded or created new ESOP pools for their employees.

According to a report by Longhouse Consulting, Flipkart has created a Rs 17,000 crore[$2.26 billion] ESOP pool whereas Oyo has created a pool of Rs 7,569 crore [$1 billion]. Zomato, Paytm and Nykaa have an ESOP pool of Rs 5,639 crore [$750 millon], Rs 4,571 crore [$610 million] and Rs 4,280 crore [$570 million], respectively. India’s most valued startup Byju’s has an ESOP pool of Rs 3,092 crore [$412 million].

In October, stockbroking platform Zerodha had allocated 7,00,000 options worth Rs 100 crore [$13.3 million] under its fresh ESOPs Plan 2021. Earlier, OfBusiness had expanded its ESOP pool size to Rs 282 crore or $38.5 million. Entrackr had exclusively reported both developments.

According to ShareChat, its ESOP pool is currently valued at Rs 1,280 crore or $170 million.

Over the past couple of years, ESOP allocation, expansion and buyback in Indian startups have picked up which is a sign of the ecosystem having come of age. The year also has been great for startups in terms of fundraising and adding more and more unicorns to its list. Out of 43 startups that turned unicorns in 2021, 15 startups including Spinny, CRED, Urban Company, BharatPe, Meesho, Moglix, UpGrad and ShareChat have provided ESOP liquidity programs this year.

Update: According to CRED, its total ESOP buyback in 2021 was worth around Rs 145 crore or $19.3 million. We have updated the story, headline and infographic to reflect the same.