In the manic action that Indian edtech space saw during fiscal 2020-2021 that was racked by Covid-19 disruptions, if Byju’s was everywhere, Unacademy stood out as one of the largest companies amongst its peers, raising Rs 1,965 crore and acquiring eight companies including CodeChef, Graphy, Coursavy during the fiscal year ending March 2021.

The Bengaluru-based unicorn has recently filed its financial results for FY21 and we scanned through the numbers to understand how the company fared while scaling up and adding new product verticals.

Prima facie, Unacademy’s inorganic acquisitions seem to have aided its growth, as the company’s operating revenues surged 6.1X YoY to Rs 398 crore during FY21 from Rs 65 crore in FY20.

Collections from paid subscriptions were the largest source of income for the company, with 95.7% of the operating revenue coming in from these repeat customers. Subscription revenue expanded over six-fold to Rs 380.8 crore during FY21 from only Rs 61.5 crore collected in FY20

.Unacademy collected another Rs 7.92 crore from the sale of education material and Rs 9.01 crore from advertising and other related operations during FY21. Further, the company also earned Rs 66.8 crore from its financial assets during the same period.

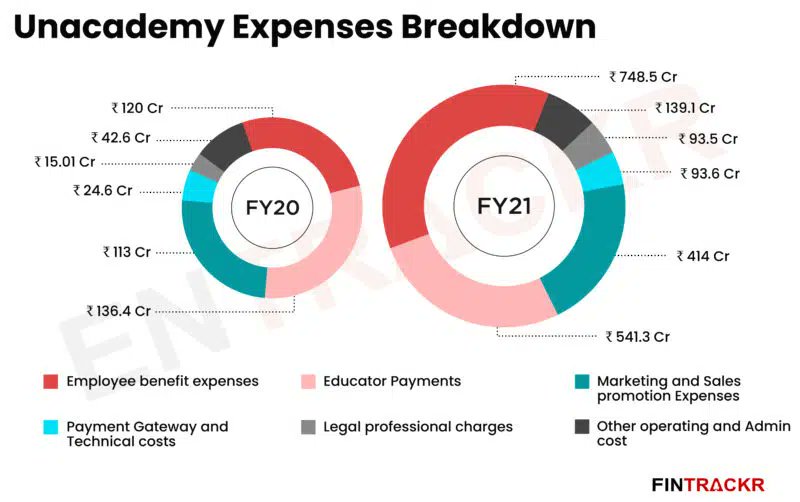

On the expense sheet, payment of employee benefits was the single largest expense for the edtech major, accounting for 37% of its annual expenses. During FY21, these costs blew up 6.2X year-on-year to Rs 748.5 crore, out of which Rs 474.4 crore were share-based payments. Importantly, around 83% i.e. Rs 392 crore of these share-based payments will be settled in cash in the coming years.

Co-founders Gaurav Munjal, Hemesh Singh and Roman Saini were awarded managerial remuneration and phantom stocks worth Rs 203.1 crore, Rs 152.01 crore and Rs 40.3 crore respectively.

Unacademy offers courses for classes 6-12 and for competitive exams including NEET UG, IIT JEE, GATE and UPSC CSE, claiming to have over 1,000 educators on its digital learning platform. If Unacademy’s association with the web series Kota Factory and Aspirants didn’t convince you about the star power and quality of their educators, then their spending on them might.

Educator payments have ballooned 4X YoY to Rs 541.3 crore and is the second-largest cost centre for the company.

The Softbank-backed startup was also an official sponsor of the Indian Premier League last year and spent handsomely on advertisement and sales promotion overall during the last fiscal. During FY21, these costs surged 3.7X to Rs 414 crore from Rs 113.4 crore spent in FY20.

The edtech firm also spent Rs 93.5 crore each on legal professional fees and technical charges (including payment gateway fees) during FY21.

While the increased scale is evident across the verticals, Unacademy burnt through a huge pile of cash to achieve the growth. Its total annual expenses ballooned 4.5X to Rs 2,030 crore in FY21 from Rs 452 crore spent in FY20. On a unit level, Unacademy spent Rs 5.1 to earn a single rupee of revenue during FY21.

As a result, the EBITDA margin for the growth stage company stood at -320.3% while annual losses have ballooned nearly 6X to Rs 1,537.5 crore during FY21. These are the kind of numbers and margins that have become the new normal in edtech, as they seek to grab share in the largest open market in the world, ever since China cracked down on its own edtech unicorns this year.

Even as the risks of such a crackdown from the government are scant in India, as educational institutes open up after prolonged lockdowns finally, it will be very interesting to see how ‘legacy’ institutes mount a comeback against the wave of edtech offerings that seek to supplant them.