Merchant commerce platform Pine Labs has registered yet another secondary transaction this year as the company’s co-founder Lokvir Kapoor has offloaded shares worth nearly $4.5 million to 12 new investors of the Singapore-incorporated company.

Kapoor has sold shares worth nearly $4.5 million to 12 investors which include Dream11 founder Harsh Jain & Family, Freshworks founder Girish Mathrubootham, Indifi founder Alok Mittal, Swiggy founder Sriharsha Majety and Relation Capital, regulatory filings of Pine Labs in Singapore show.

Following the secondary transaction, Jain & Family have acquired shares worth $950K in Pine Labs from Kapoor, followed by Mathrubootham and Relation Capital who bought shares worth $615K each. Mittal, Majety and seven other investors have bought the remaining shares.

These transactions were done across three phases.

While the size of the secondary round may not be worth a massive amount, it is a significant one for Pine Labs because the Amrish Rau-led company is gearing up for an initial public offering (IPO) in the US at a $6 billion valuation. To facilitate the IPO process, the company had recently converted its Singapore-based holding entity into a public company.

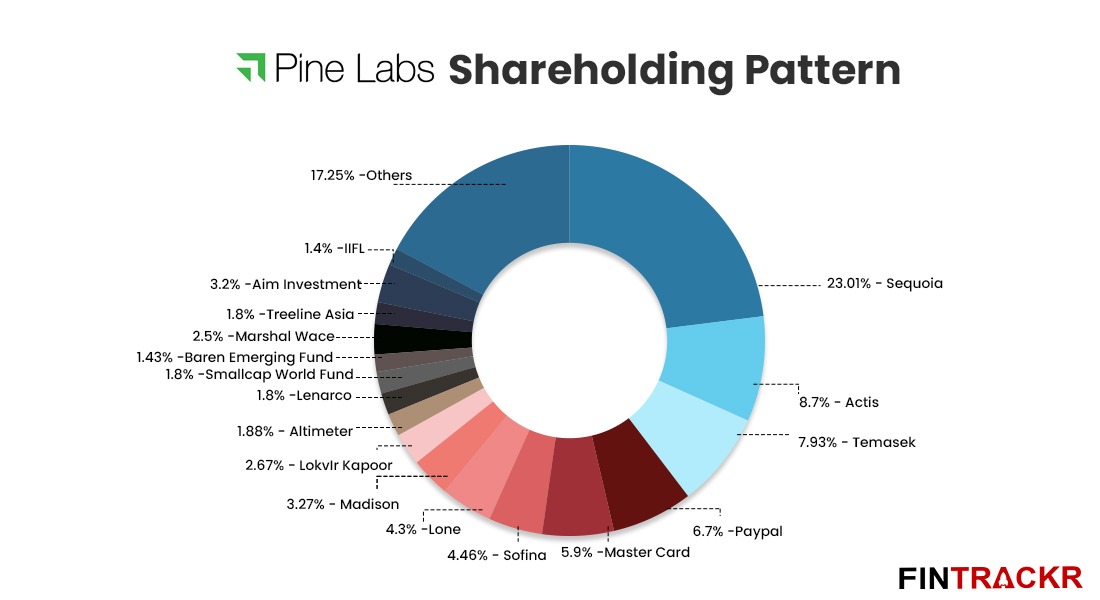

After this secondary transaction, Kapoor’s shareholding has been diluted to 2.67% post the secondary sale of shares while Sequoia remains the largest shareholder in the company, controlling a little over 23% stake.

Complete shareholding can be seen below:

Separately, Pine Labs has also allotted shares worth $4.1 million under the ESOP Scheme to 14 employees. Kanwarpal Singh Bindra was the biggest beneficiary of the latest ESOP allotment who received $2.6 million worth of ESOPs. More than a dozen employees have received the remaining share.

Earlier this year Pine Labs had also witnessed two partial exit rounds where existing backers of the company offloaded shares worth $290 million across two rounds in May and July. According to Fintrackr estimates, Sequoia had offloaded shares worth $225-230 million in Pine Labs to seven investors in a secondary transaction in July.

The US-based VC firm along with Madison India had sold shares worth $60 million in May this year.

Pine Labs is one of the largest funded fintech companies in 2021. The company has scooped up $700 million across three tranches this year and also forayed into new verticals. In April, it had acquired Malaysia-based payments platform Fave to enter into e-commerce enablement and the consumer payments space. Only last month, the company launched a new platform called Plural to foray into the payment gateway business.