Tiger Global is known for making large bets, but this year it has also shown interest in making smaller bets between $15-35 million. Small and medium enterprises (SMEs) focused insurance platform Plum and multi-brand car workshop and spare parts firm GoMechanic raised early-stage funds from the chief unicorn maker in India in the recent past.

GoMechanic had raised $42 million in a new round led by Tiger in June and the New York-based investor has just picked up 34 employee stock options (ESOPs) from the employees along with other backers including Sequoia, Chiratae and Orios Fund, according to the company’s regulatory filings with RoC.

Importantly, the company has facilitated the liquidation of these employee stock options at its latest valuation ($325 million) without any discount, keeping in line with its progressive stance regarding wealth creation amongst its employees.

The Gurugram-based company’s total stock option pool for employees makes up 5.79% stake in the company and is currently valued at $19 million.

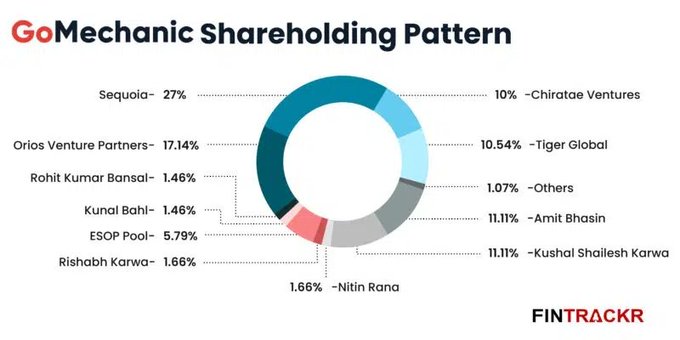

Sequoia Capital remains the largest stakeholder in GoMechanic, controlling 27% stake in the company. Its co-founders Kushal Shailesh Karwa and Amit Bhasin own 11.11% each whereas Rishabh Karwa and Nitin Rana own 1.66% each.

Collectively, the four co-founders own 25.54% of the company which is currently valued at $83 million. Its early backers Orios and Chiratae command 17.14% and 10% respectively. Tiger owns 10.54% while Kunal Bahl and Rohit Bansal own 1.46% each.

Complete shareholding can be seen below:

Founded in 2016, GoMechanic claims to have 250K users and has a network of over 650 workshops under its brand name. Last year, it also started selling spares parts under GoMechanic Spares. So far, the company has raised $61 million in total capital.

GoMechanic counts Blume Ventures-backed Pitstop, myTVS, and Crossroads among its major competitors. While the company is yet to file an annual financial statement for FY21, its operating revenue jumped to Rs 24.04 crore in FY20 from Rs 17.33 crore in the previous fiscal (FY19).

According to Fintrackr, its expenses blew 6.9X to Rs 82.03 crore in FY20 which were Rs 22.64 crore in FY19. Its losses stood at Rs. 58.44 crore in FY20.