Hospitality giant Oyo has filed its draft red herring prospectus or DRHP with SEBI along with details of its much-awaited Initial Public Offering (IPO). The SoftBank-backed company has also filed financials for the fiscal FY20-21 as part of the draft prospectus. We rounded up the numbers that matter to understand the inner workings of India’s largest hospitality startup before and during the tumultuous times of COVID 19 pandemic.

The Ritesh Agarwal-led company has multiple income streams and its operating revenue consists of the sale of accommodation services, commission from bookings of vacation homes and listings, cancellation income, sale of tours, packages and events. It also earns rental income from lease of office space, sale of food and beverages and subscription income from customers on its platform.

The pre-Covid bull run

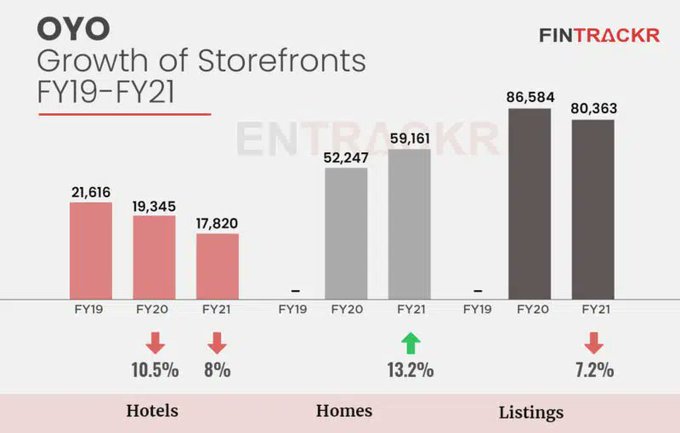

The fiscal ended in March 2020 was the biggest year for Oyo in terms of collections as the company went all in with its expansion plan in markets such as India, China, Southeast Asia, the Middle East and Europe and its entry into the United States. The number of storefronts or hotels on the Oyo platform ballooned 7.3X from 21,616 as at March 31, 2019 to 158,176 as at March 31, 2020.

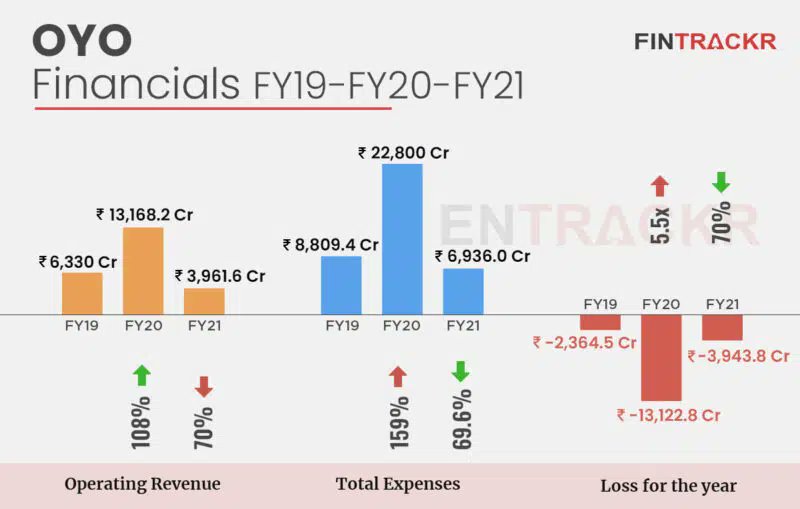

Oyo’s revenue from operations grew by 108% to Rs 13,168.2 crore in FY20 from Rs 6,330 crore earned during FY19. Sale of accommodation services accounted for 88% of the revenue, growing by 91.4% to Rs 11,591 crore in FY20

Commission income grew exponentially as the company ventured into vacation homes business and the listings business during the first quarter of FY20. Such income surged 2,312.3% to Rs 713.3 crore in FY20. Rental income grew by 1,024.2% to Rs 139 crore due to its co-living business and the launch of its coworking vertical after Innov8’s acquisition.

Oyo’s operating expenses were the biggest cost center for the firm accounting for 61% of the annual cashburn, increasing by 81.2% to Rs 9,738 crore in FY20. This was partly due to the company’s expansion plans to coworking , coliving spaces but it was the minimum payment guarantees to hotels which was hurting Oyo the most.

To chase scale, Oyo spent heavily on marketing and sales promotions to run online advertising on search engines and social media apart from the increased brokerage payments to OTAs across different global markets. As a result, marketing and promotion expenses surged 4.2X to Rs 1,880 crore during FY21.

While the growth of scale was evident, Oyo was burning through a huge pile of cash to acquire the growth. Annual expenses surged by 159% to around Rs 22,800 crore in FY20 from Rs 8,809.4 during FY19. Annual losses ballooned 5.5X from Rs 2,364.5 crore in FY19 to around Rs 13,122.8 crore in FY20 at an EBITDA margin of -46.5%.

Marketing and promotion spends dropped by 83% to Rs 542.7 crore in FY21 from Rs 1,880 crore spent on the same in FY20, as the company worked on increasing the share of bookings from its own D2C channels instead of third party OTAs.

Employee benefit expenses dropped by 63.4% to Rs 1742 crore in FY21 as a result of mass furlough of employees and pay cuts across all positions in the company. Further, payments of legal and professional fees also diminished by 48% to Rs 323 crore while outsourced manpower costs were cut short by 99% to only Rs 2 crore during FY21.

Due to the restructuring of business model and absence of demand during large parts of FY21, Oyo’s annual expenses were reduced by 69.6% to Rs 6,936 crore. Cost reduction measures were evident across the expenses sheet of the company and its annual losses dropped in line with revenues, reducing by 70% to Rs 3943.8 crore during FY21.

While EBITDA margins improved from -46.5% in FY20 to -29.3% in FY21, Oyo’s balance sheet sported outstanding losses of nearly Rs 16,792 crore at the end of March 2021.

Looking at Oyo’s FY21’s numbers, it appears that the company is optimistics about its new model: revenue sharing. This model has been working well for Oyo and this could be observed from reduction in its losses. The company believes that its performance in FY22 will improve significantly on the back of momentum in domestic as well as global travel.

In FY20, Oyo had posted an operating revenue of 13,168 crore, which is the highest among consumer internet companies in India. In fact, none of the B2C unicorns in India have been able to cross Rs 10,000 crore in revenue so far. If Oyo manages to get close to its pre-COVID revenue peak in the ongoing fiscal (FY22), its performance in the public market could fare up well.