Omnichannel home interior and renovation platform Livspace is likely to join the coveted club of unicorns soon as the company is in talks to mop up new funding.

The Bengaluru-based firm with operations in Singapore is in late-stage talks to raise a large round that may go beyond $200 million, said two people aware of the details of the deal. The new proceeds are coming at a time when Livspace is betting on global expansion. Besides 13 Indian cities, it has been operating in Singapore since 2019.

Livspace had announced a joint entity with Alsulaiman Group (ASG) to enable operations in Saudi with plans to cover other countries in the MENA region.

“Livspace is in advanced talks to raise a fresh round at a valuation of $1.5 to 1.8 billion,” said one of the sources requesting anonymity as talks are private. “The terms of the deal are in the final stage of negotiation and it may conclude in a few weeks from now.”

The making of a fresh round is also evident from the flow of new money in its Singapore-based-holding entity. Livspace Pte has already received close to $60 million worth tranche led by Saint Gobain. The French multinational corporation and ASG co-spearheaded the tranche with an infusion of $15 million each, according to Livspace’s regulatory filings in Singapore.

Saudi Arabia’s retail major ASG is the operating partner of Swedish furniture company Ikea in the Middle East, which is an existing investor in Livspace.

Trifecta Capital has put in $10 million whereas Jungle Ventures, TPG and Quaeroq have invested $12.43 million, $5 million and $1.1 million respectively in the fresh capital infusion.

Importantly, this appears to be one of the first equity bets by the Trifecta late-stage equity fund announced in April 2021.

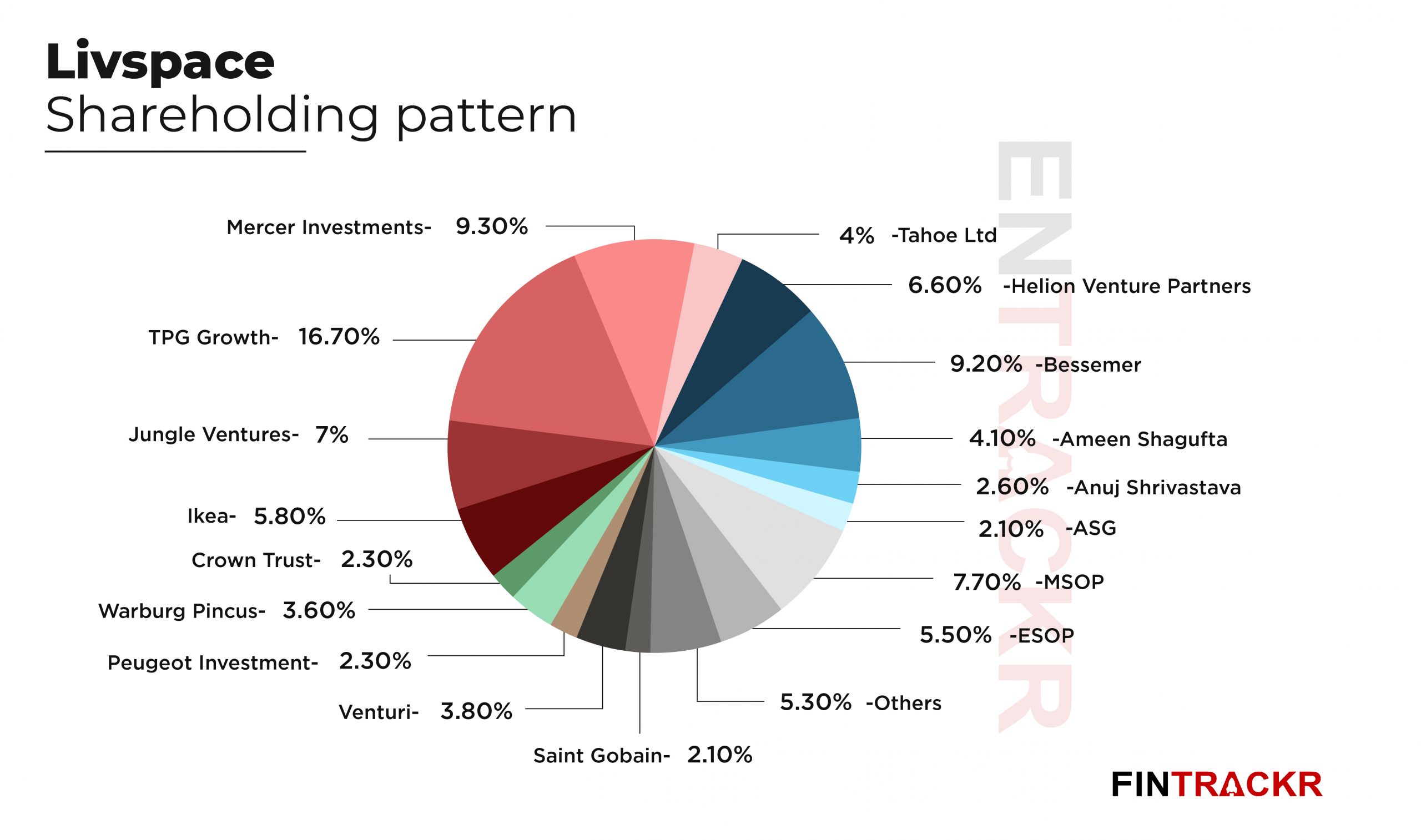

Fintrackr estimates that Livspace has been valued at around $750 million (post-money) in the fresh tranche. Following this, TPG Growth has emerged as the largest stakeholder with a 16.7% stake in the company.

Mercer Investments holds 9.3% whereas Bessemer and Jungle command 9.2% and 7% stakes respectively. Its co-founders Shagufta Ameen and Anuj Shrivastava hold 4.1% and 2.6% respectively while third co-founder Ramakant Sharma owns stakes mostly through MSOPs which make up around 7.7% stake in the company.

The infographic below gives Livspace’s current and complete shareholding pattern.

Right before this fresh infusion, Livspace had increased its stock option pool for employees to 79,392 shares and management stock option pool to 110,705. The newly minted ESOP pool is now worth around $40 million while the MSOP is worth around $55 million.

Queries sent to Ramakant Sharma did not elicit an immediate response. We’ll update the post in case we hear from him.

If the potential talks of the larger ($200 million) round gets through, Livspace’s valuation would jump 2X as compared to its current valuation. The seven-year-old company was valued at $500 million when it raised $90 million in December 2019.

Livspace could potentially join 33 companies that have surpassed the $1 billion valuation mark in 2021. Only this month, five startups: D2C meat brand Licious, MobiKwik (via secondary market), CoinSwitch Kuber, CarDekho and full-stack food-tech platform Rebel Foods attained a unicorn status.