Neobanking startup Fi (formerly epiFi) has raised around $50 million in what appears to be a Series B round led by B Capital. This is the second fundraise for the Bengaluru-based startup in 2021. In June, it had raised a $12 million Series A round.

Fi has approved the allotment of 1 equity and 3,90,531 Series B CCPS at a face value of Rs 10 and a premium of Rs 9,485.25 per share to raise Rs 370.81 crore or close to $50 million, regulatory filings with RoC show.

B Capital has spearheaded the round with Rs 148.33 crore followed by the Las Vegas-based Ocean view Capital which has put in Rs 111 crore. Alpha Wave and Qcm Holdings have invested Rs 74.16 crore and Rs 37.08 crore respectively.

Fi was reportedly in talks to raise a new round at a valuation of $250 million.

As per Fintrackr’s estimates, the company has been valued at around $325 million. The company was valued at $160-165 million during its Series A round in June.

Founded by former Google Pay executives Sujith Narayanan and Sumit Gwalani, the two-year-old startup provides millennial-focused digital banking solutions including saving accounts and debit card facilities.

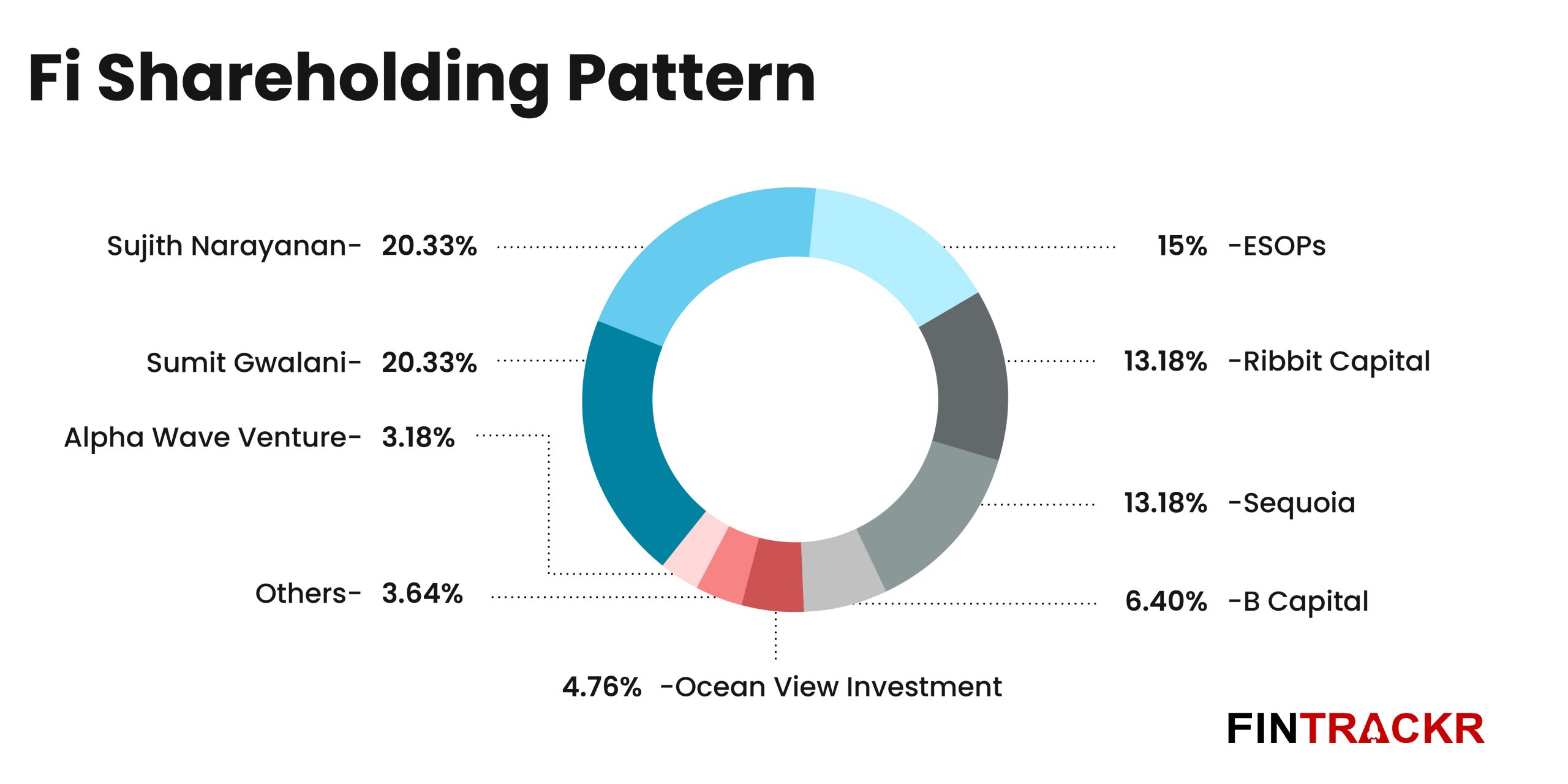

Following the allotment of fresh shares, the collective holding of Narayanan and Sumit Gwalani has been diluted to 40.66%. Lead investor B Capital has increased its holding to 6.40% in the company. Sequoia and Ribbit Capital remain the largest stakeholders among investors, controlling 13.18% stake each.

The complete shareholding pattern of Fi can be seen below.

According to Fintrackr’s estimates, Fi has recorded zero operating revenue in FY21 and this is not surprising as the company is in a pre-revenue stage and chasing growth [accounts] at all costs. Even in FY20, it posted zero operational revenue.

On the lines of its competition such as NiYO, Juno and recently launched Jupiter, the company seems not to have any immediate plans to monetise. Fi’s losses had surpassed Rs 50 crore in FY21 and this burn is likely to multiply in FY22 as well.