Online real estate rental startup NoBroker saw a windfall of funding from marquee investors Tiger Global and General Atlantic, amounting to nearly $129 million during the fiscal year ending in March 2020.

Flush with funds, the Bengaluru-based company, which saw 2.1X growth in scale during FY19, has scaled at a quick pace in FY20. However, the growth in the last fiscal has come at a significant cost.

Subscription leads op-revenue but ‘NoBroker Pay’ stands out

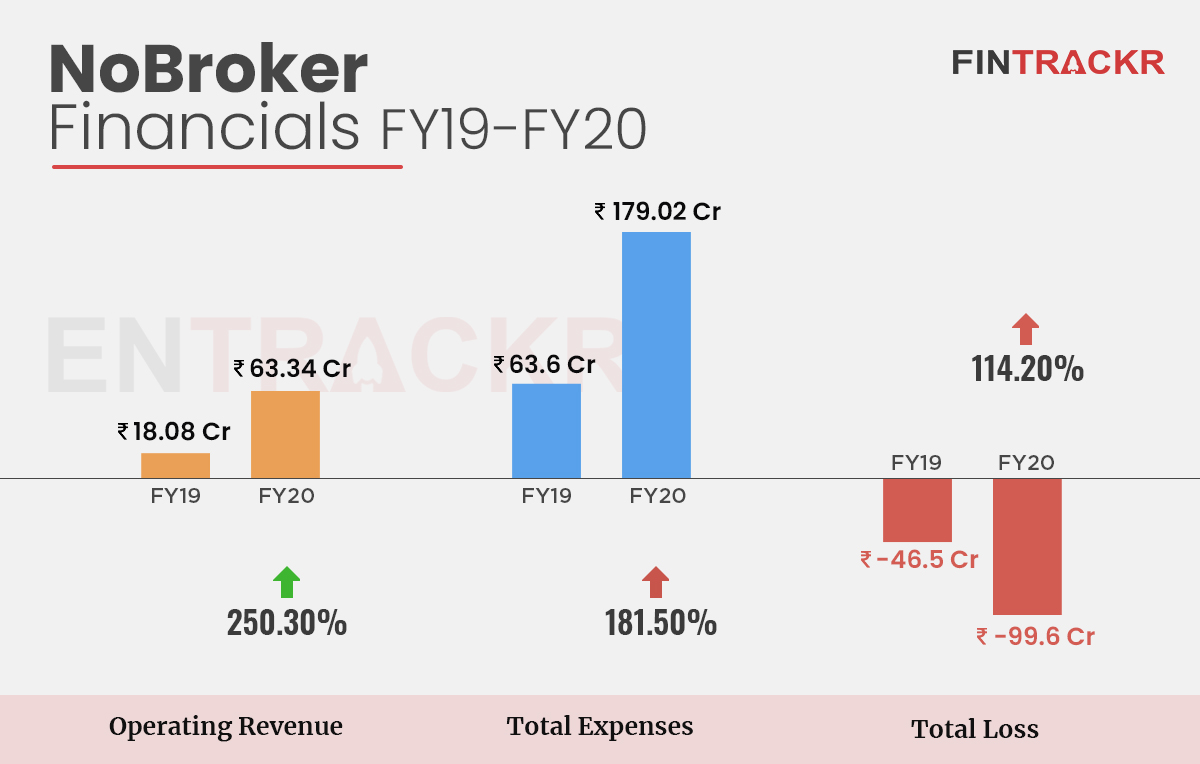

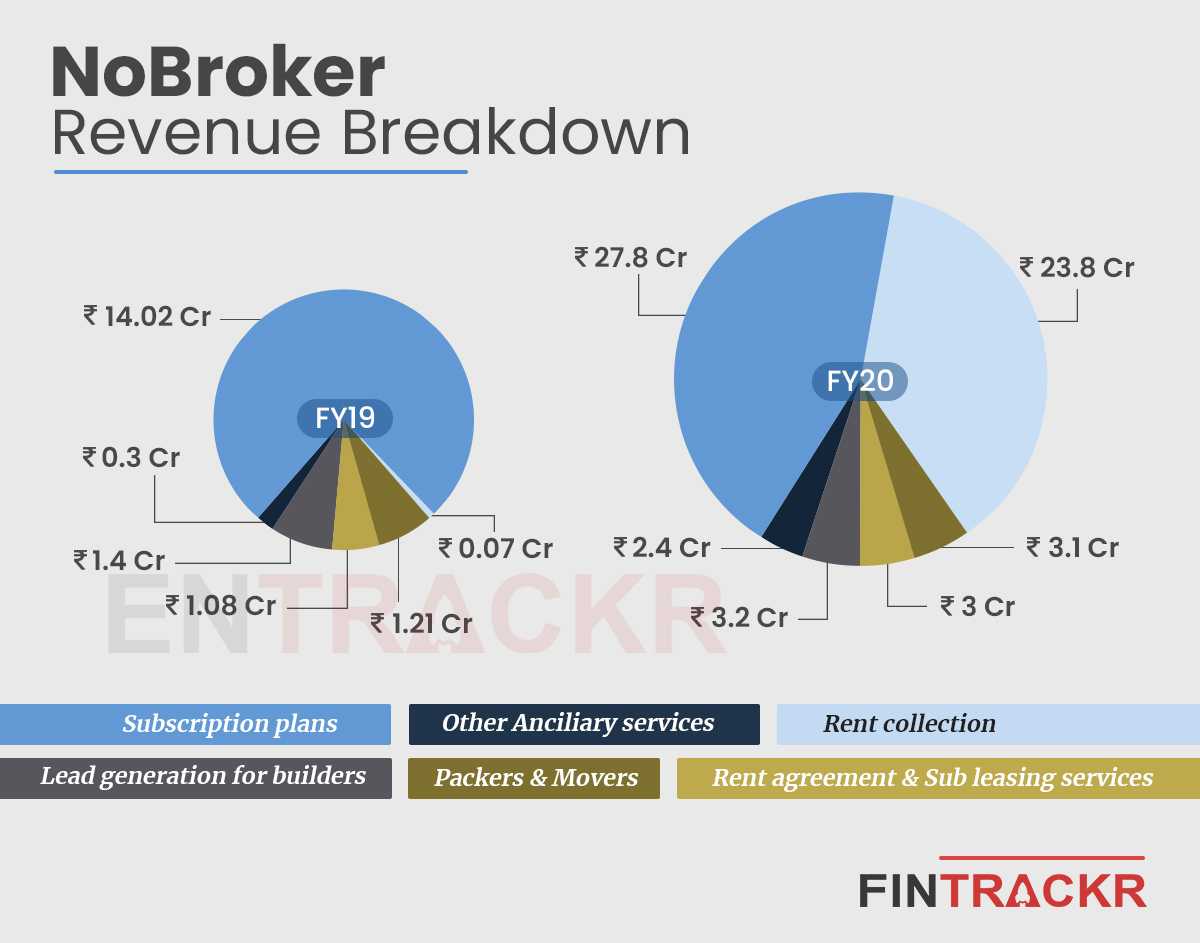

NoBroker saw its revenue from operations shoot up by 250.3% within 12 months, from Rs 18.08 crore in FY19 to Rs 63.34 crore in FY20. Digging deeper into the revenue streams for the company, Fintrackr found out that new product introductions have been the growth drivers for the company.

NoBroker had launched its rent payment feature ‘NoBroker Pay’ at the end of FY19 which allowed tenants to pay their monthly rental to landlords via UPI and credit cards. In its first year, this vertical generated revenues of Rs 23.8 crore for the company, which accounted for 37.6% of the annual revenue earned during FY20.

The sale of subscription plans remains the leading revenue vertical for NoBroker, making up 44% of the operating revenues. This collection grew by 98.3% to Rs 27.8 crore in FY20 from Rs 14.02 crore earned in FY19.

Income from rental agreement & subletting grew by 156.2% to Rs 3.1 crore while packers and movers services generated Rs 3 crore for NoBroker during FY20. The company also earns fees on lead generation services provided to real estate developers which grew by 128.6% to Rs 3.2 crore during FY20.

Understandably, Nobroker’s income from financial assets surged 4.5X from Rs 3.6 crore in FY19 to a little over Rs 16 crore during FY20.

Expenses jump 2.8X while losses touch Rs 100 Cr

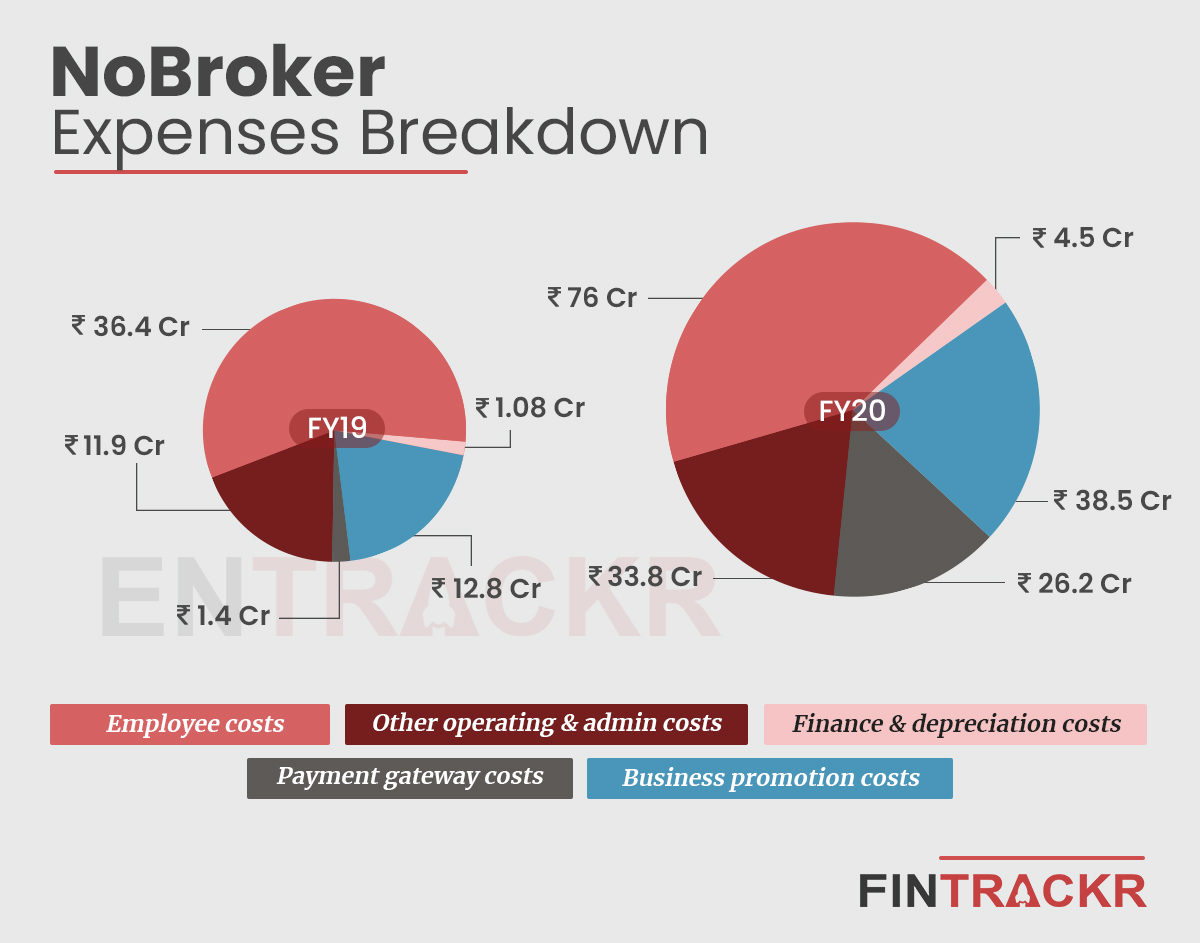

Moving over to the expenses, we see expenses incurred on employee benefits stood out as the largest cost centre for the company, accounting for 42.5% of the expenditure during FY20. Such costs grew by 53.6% from Rs 26.4 crore in FY19 to Rs 76 crore in FY20.

In step with revenues from ‘No BrokerPay’, payments made to payment aggregators, accounted for 14.6% of annual expenses. Such payments ballooned 18.7X to Rs 26.2 crore in FY20 from only Rs 1.4 crore during FY19.

The Tiger Global-backed firm splurged on promotions to push sales during the previous fiscal and saw its business promotion costs shoot up to 3X to Rs 38.5 crore in FY20 from Rs 12.8 crore in FY19. These expenses were the second-largest costs for NoBroker and accounted for 21.5% of the annual expenses. During the same period, communication costs also blew up 3.2x to Rs 15 crore in FY20.

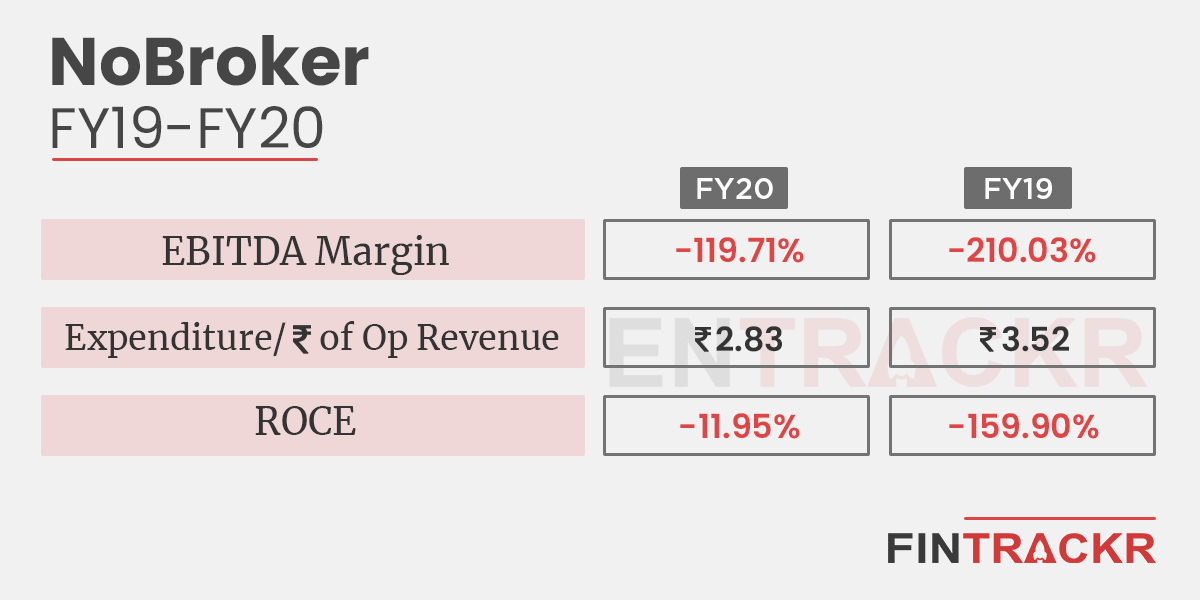

Chasing scale, the company saw its annual expenses spiked up by 181.5% from Rs 63.6 crore in FY19 to a little over Rs 179 crore during FY20. Thus, NoBroker spent Rs 2.83 to earn a single rupee of operating revenue in FY20.

NoBroker’s EBITDA margin improved from -210.03% in FY19 to -119.7% in FY20 while annual losses jumped by 114.2% to Rs 99.6 crore during the fiscal ended in March 2020.

Is NoBroker Pay just a top-line play?

While NoBroker’s financial health is far from being healthy in FY20, it looks like the company has definitely found a prominent revenue stream via NoBroker Pay which competes with CRED, Paymate and Paytm (indirectly: credit card to Paytm wallet to bank account transfer) among a few others.

NoBroker Pay has fetched about 38% of the company’s total revenue in FY20 and will continue to do so in the ongoing fiscal. However, it burns more than it earns. The company charges a flat processing fee of 1% to users whereas it pays over 1.5% as payment gateway charges (when users transfer money to the landlord’s bank account from his credit card).

On a bottom line, NoBrokers Pay subsidises such transactions and loses at 0.5% on the value of each transaction. This could also be observed from the company’s expenditure -Rs 26 crore – on payment gateway charges in FY20.

On similar lines, NoBroker Pay’s competition (aforementioned companies) also lose money on every transaction (it depends on what they are charging on the credit card to bank transfer).

Besides its core subscription revenue, which registered decent growth, the overall income funnels including rental agreement & subletting and packers and movers services have been faring up well. They have grown over 2x in FY20 as compared to the previous fiscal.