On Wednesday, buy-now-pay-later (BNPL) firm ZestMoney announced that it raised $50 million as part of a larger Series C fundraise. While the Goldman Sachs-backed company did not provide details of the funding round, Fintrackr has decoded the break up of the deal including its valuation and current shareholding structure.

According to ZestMoney’s regulatory filings in Singapore, the company has raised a total of $58 million in this round in which lead investor Zip Co Limited has pumped in $50 million. Collie Capital, Thorney Opportunities, Shaw Share Broking along with existing investors Flourish Ventures, Accion Quona Fund, ON Mauritius and Ribbit Capital have invested the remaining amount.

ZestMoney has raised the fresh fund at around $435 million valuation (post-money), according to Fintrackr’s estimates. Since the company is set to raise more money in the ongoing round, its valuation would change.

Founded by Lizzie Chapman, Priya Sharma and Ashish Anantharaman in 2015, ZestMoney allows customers to pay later for products in the range from Rs 50 to Rs 5 lakh. The company claims that its customers can transact at more than 10,000 online sites and 75,000 physical stores across the country.

The company operates in India via its subsidiary Camden Town Technologies, which saw its revenue from operations scale 2.7X YoY to Rs 72.4 crore in FY20. During the period, it spent Rs 256.5 crore in total while losses grew nearly 90% to Rs 181 crore in FY20.

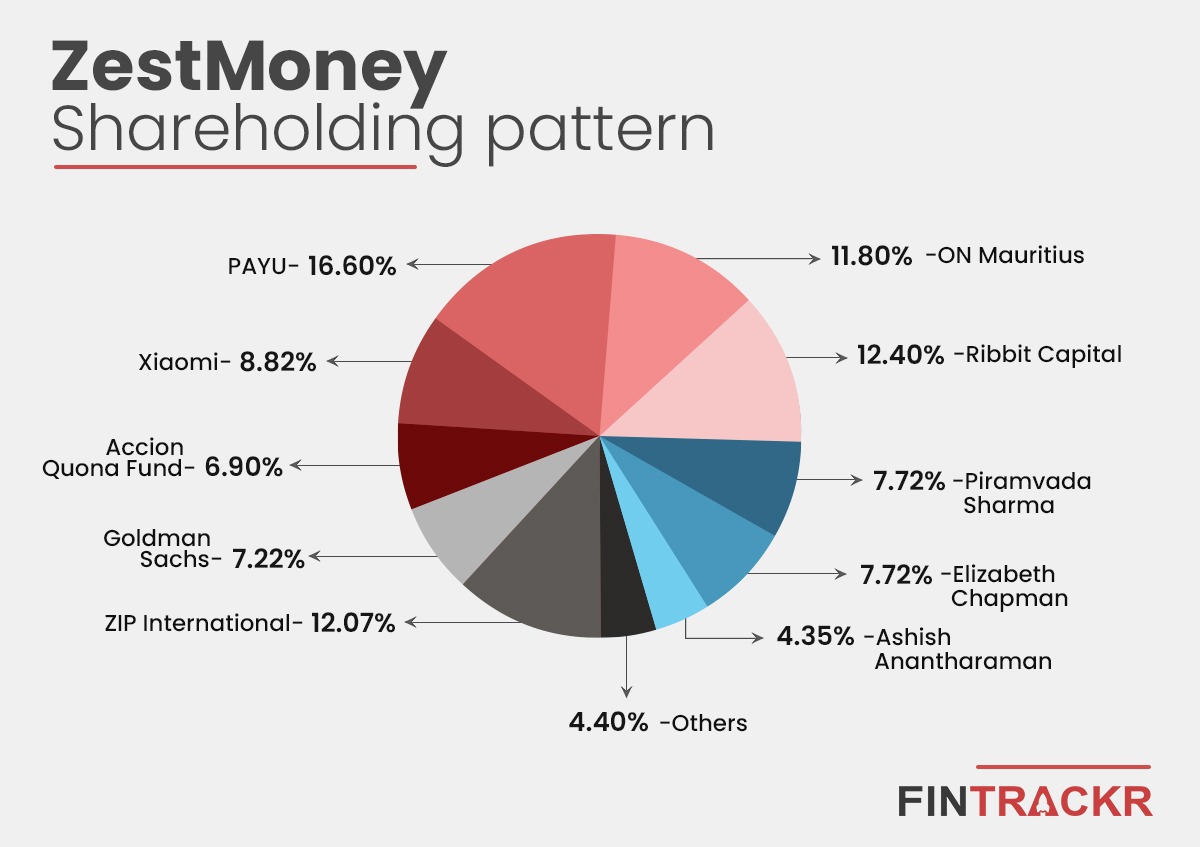

Following the allotment of fresh shares, the collective stakes of ZestMoney’s founders have been diluted to 19.79%. PayU, Ribbit and On Mauritius, the early backer of the company, have 16.60%, 12.40% and 11.80% stake respectively.

Zip Co Limited has acquired 12.07% stake in the company, the third-largest among investors.

Over the past couple of years, BNPL has emerged as one of the hottest categories among lending startups. While established players such as EarlySalary, LazyPay, Slice and KreditBee have emerged as the leaders in the segment, ZestMoney also competes with new-age startups like Bullet Money among others.

KreditBee had raised $145 million in two tranches from TPG-backed NewQuest Capital Partners and Motilal Oswal Private Equity in March.