The EV market in India has seen quite an uptick in the last two years after the central government announced its FAME II scheme and allocated Rs 10,000 crore to be rolled out as incentives to push EV demand.

Focus On Ather Energy

While only limited models are available in the EV four-wheeler market right now, it’s the two-wheeler EV market in India that has several players from legacy brands like Hero to new-age startups such as Ola electric and Ather Energy. The latter stood out as the fourth largest selling EV two-wheeler in India during the first half of 2021, selling 3677 units as per data released by AutocarPro.

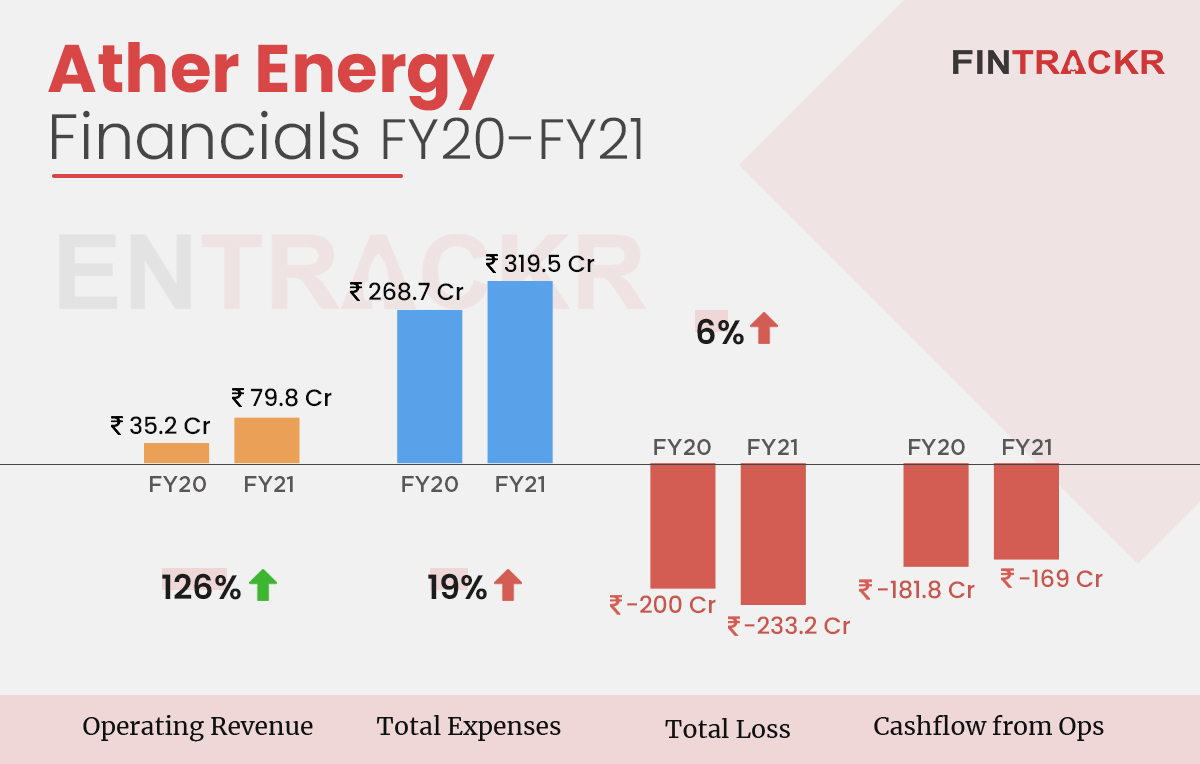

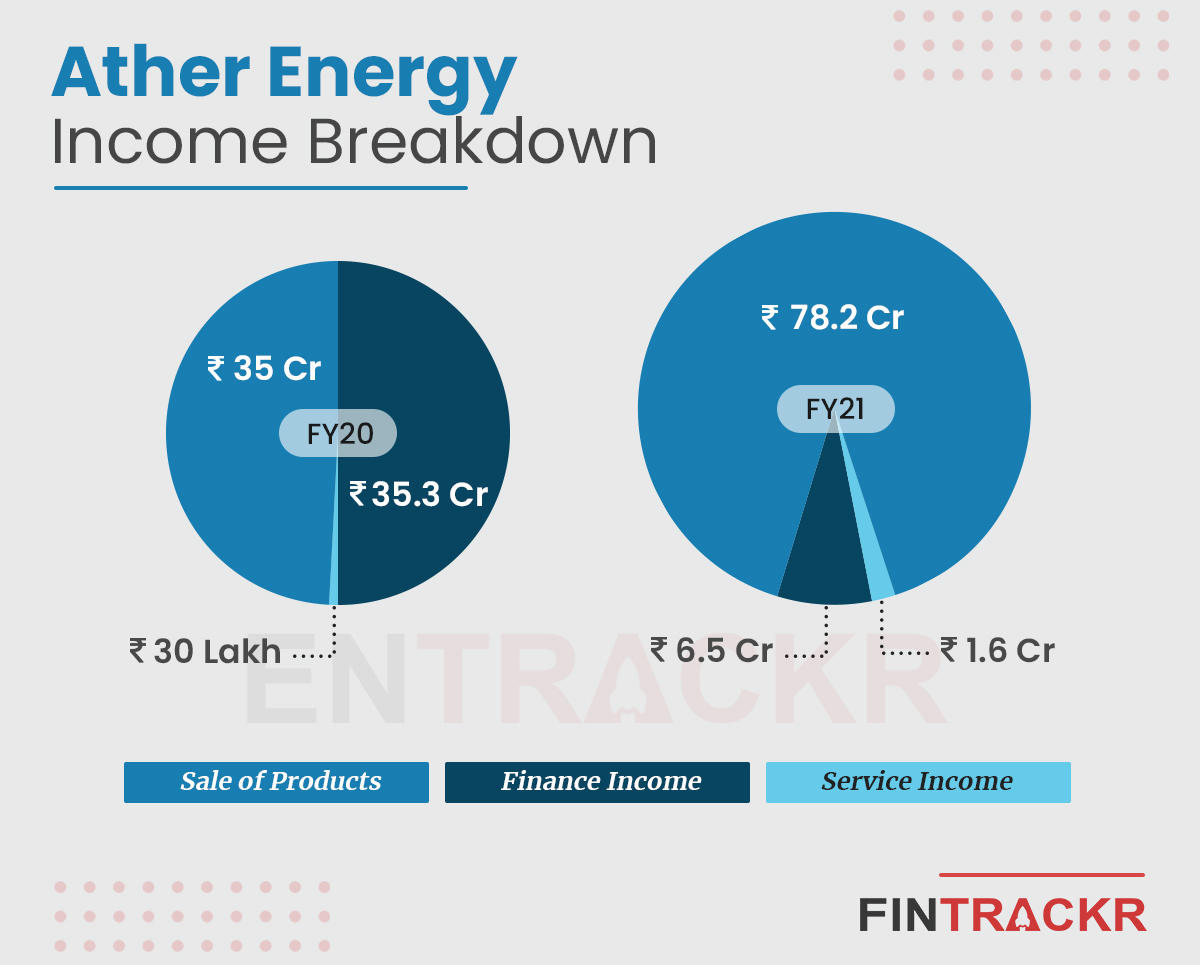

The Bengaluru-based startup has witnessed a steady growth in its scale of operations and saw its revenues grow by 126% from Rs 35.3 crore in FY20 to Rs 79.8 crore in FY21.

While the majority of this revenue is generated via the sale of EV scooters, collections from the after-sales service vertical have also grown 433.34% to Rs 1.6 crore during the last fiscal.

The Expenses Story

Moving over to the expense sheet, its annual expenditure grew by 19% to Rs 319.5 crore in FY21 from Rs 268.7 crore spent in total during FY20.

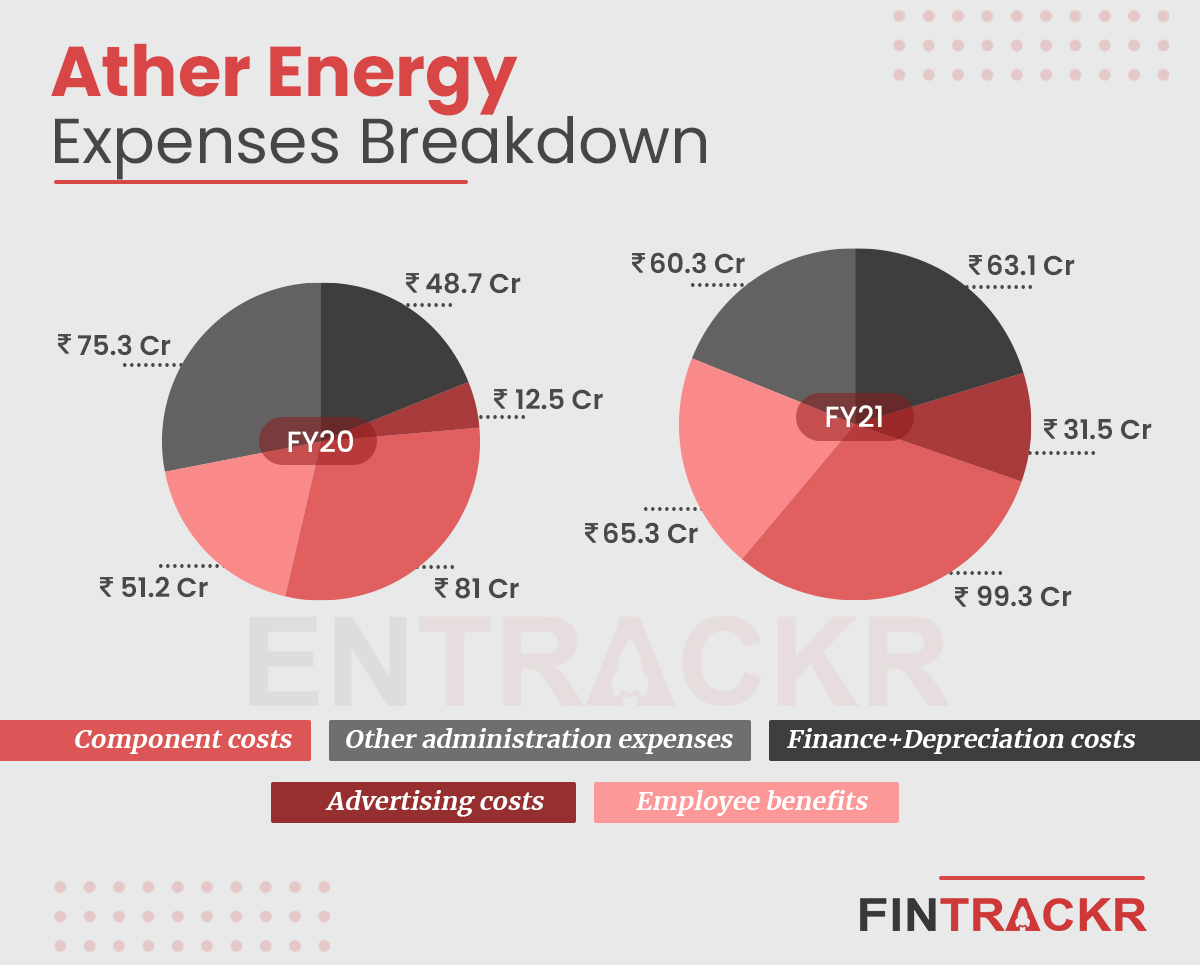

We see that the Bengaluru based EV manufacturer has spent around 31% of its annual expenditure on the procurement of raw materials and components for its scooters. These costs grew by 22.5% from Rs 81 crore in FY20 to Rs 99.3 crore in FY21 making it the largest cost centre for the Sachin Bansal-backed company.

Employee benefit expenses grew by 27.5% from Rs 51.2 crore in FY20 to Rs 65.3 crore paid out in FY21. These payments accounted for 20.4% of the annual aggregate costs and included share-based payments of Rs 14.3 crore.

To push sales, the company increased its burn on advertising and promotion towards the end of last year and accounted for nearly 10% of the annual costs. These costs shot up by 60.3% to Rs 31.5 crore in FY21 from Rs 12.5 crore spent in FY20. On the other hand finance costs dropped by 33.34% to Rs 28 crore and expenses on warranty claims were reduced by 47.5% to Rs 3.2 crore.

Ather Energy spent Rs 16 crore on legal fees and Rs 6.3 crore on research during FY21 while Rs 15.7 crore were written off due to loss on financial assets held by the company.

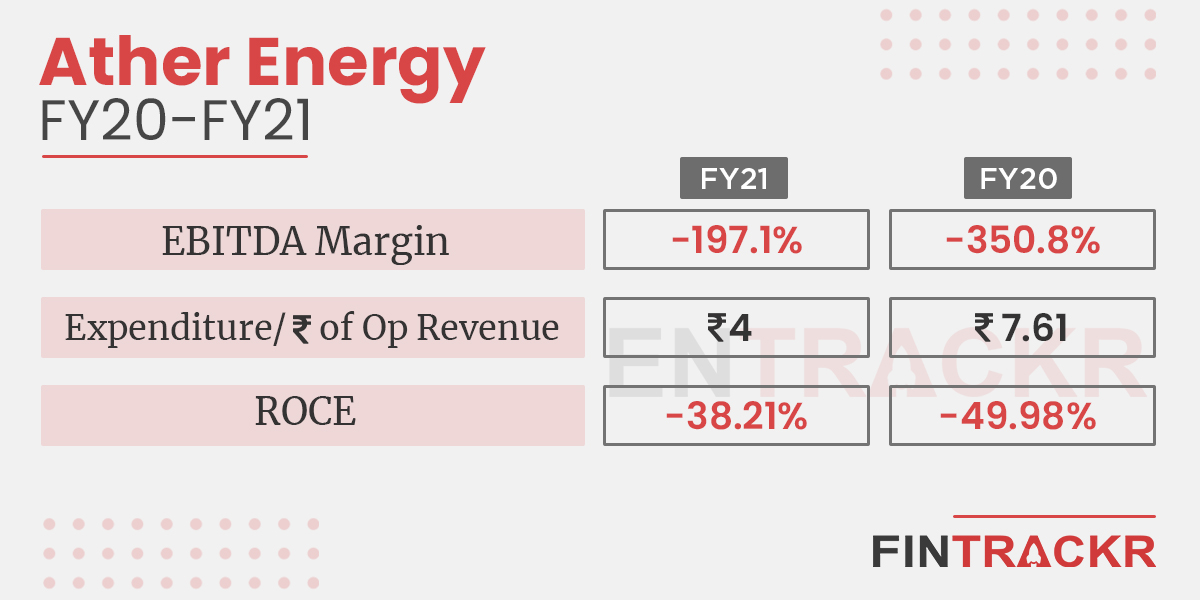

Thus, Ather Energy spent Rs 4 to earn a single rupee of operating revenue, improving by 47.4% from Rs 7.61 spent to earn the same during FY20. Even with a 126% increase in sales, its annual losses have increased by only 6% to Rs 233.3 crore in FY21 from Rs 220 crore lost in FY20.

While the company sports outstanding losses of Rs 619 crore on its balance sheet, it has managed to improve its EBITDA margins drastically from -350.8% in FY20 to -197.1% in FY21.

The picture should change by this time next year, as Ather Energy’s monthly sales are growing in lockstep with its expansion across multiple cities this year.