Multi-brand car workshop and spare parts platform GoMechanic has raised $35 million in its Series C round led by Tiger Global Management. The Gurugram-based company was in talks with a couple of blue-chip investors, including the New York-based hedge fund, to score a big round.

GoMechanic’s board has approved the allotment of 4,722 Series C preference shares at an issue price of Rs 541,061 to raise Rs 255.5 crore or $35 million, regulatory filings show.

Tiger Global spearheaded the financing with a $26.3 million investment. Existing investors Sequoia Capital, Orios Venture Partners and Chiratae Ventures have invested $4.3 million, $2.6 million and $1.7 million respectively.

The fresh round takes the total investment in GoMechanic to $55 million till date. Previously, it had raised $20 million across two institutional rounds from Sequoia, Chiratae, Orios and individuals including Pawan Munjal, Kunal Bahl, Rohit Bansal and Dhianu Das.

According to Fintrackr’s estimates, GoMechanic has been valued in the range of $315-320 million post the allotment of fresh shares.

Founded by Kushal Karwa, Amit Bhasin, Rishabh Karwa and Nitin Rana, the five-year-old company claims to have over 500 service partners on its platform and serviced over 2 million cars.

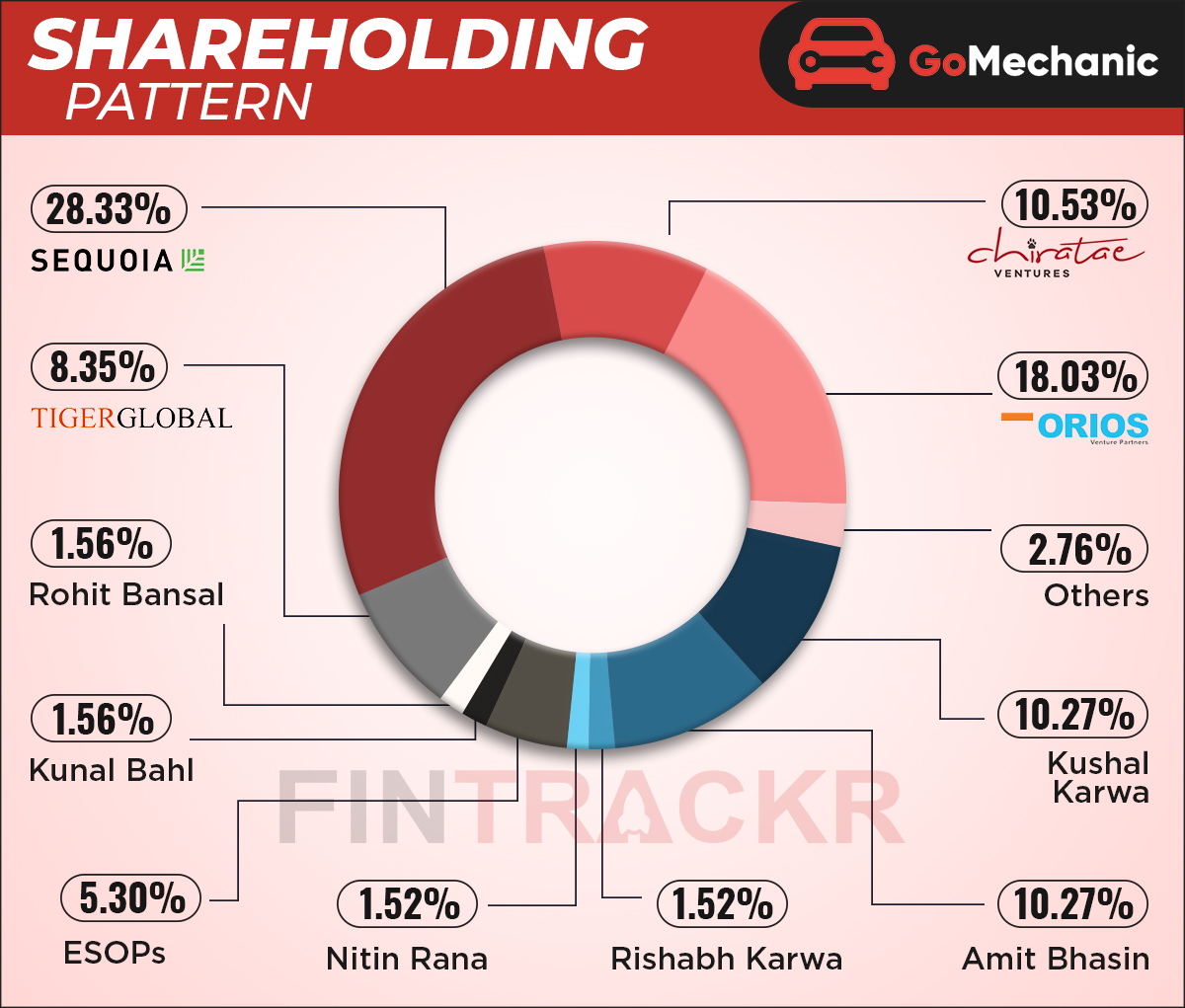

Fintrackr has also decoded GoMechanic’s current shareholding structure. Sequoia has emerged as the largest stakeholder among investors in GoMechanic with a 28.33% stake followed by Orios and Chiratae with 18.03% and 10.5% stake respectively. Tiger Global now holds 8.35% stake in the company

The collective holding of the co-founders have been diluted to 23.58% with Kushal Karwa and Amit Bhasin having 10.27% stake each while Rishabh Karwa and Nitin Rana holding 1.5% stake each. The full shareholding of GoMechanic can be seen below.

GoMechanic counts Blume Ventures-backed Pitstop, myTVS, and Crossroads among its major competitors. Two months ago, Gurugram-based Pitstop had scooped up $3.5 million as a part of its pre-Series B financing led by Ventureast.

Besides backing nine out of the 14 startups that have turned unicorn this year, Tiger Global has also led funding rounds in early as well as growth-stage startups including Plum, Koo and CoinSwitch Kuber. And, it is all set to lead new rounds in DealShare and BharatPe. Entrackr had exclusively reported the developments on April 13 and May 11 respectively.