Automobile classifieds portal CarTrade has filed its draft red herring prospectus or DRHP with SEBI to raise around Rs 2,000 crore via an offer-for-sale.

CarTrade’s offer comprises 26.96% of post-offer paid-up equity share capital with a face value of Rs 10 per share and the issue consists of a pure offer-for-sale or OFS of 12,354,811 equity shares.

The company’s largest shareholder Highdell Investments (Warnbug Pincus) is the biggest beneficiary of this OFS, offloading 5.3 million equity shares followed by MacRitchie Investments which will offload 3.5 million equity shares and CMDB II which will sell 1.6 Million Shares in this OFS.

Total 12 shareholders will offload part of their holdings including founder Vinay Sanghi who along with his family members will sell off 0.33 million equity shares. Therefore, it appears that this exercise is primarily a move to provide a partial exit to its existing investors.

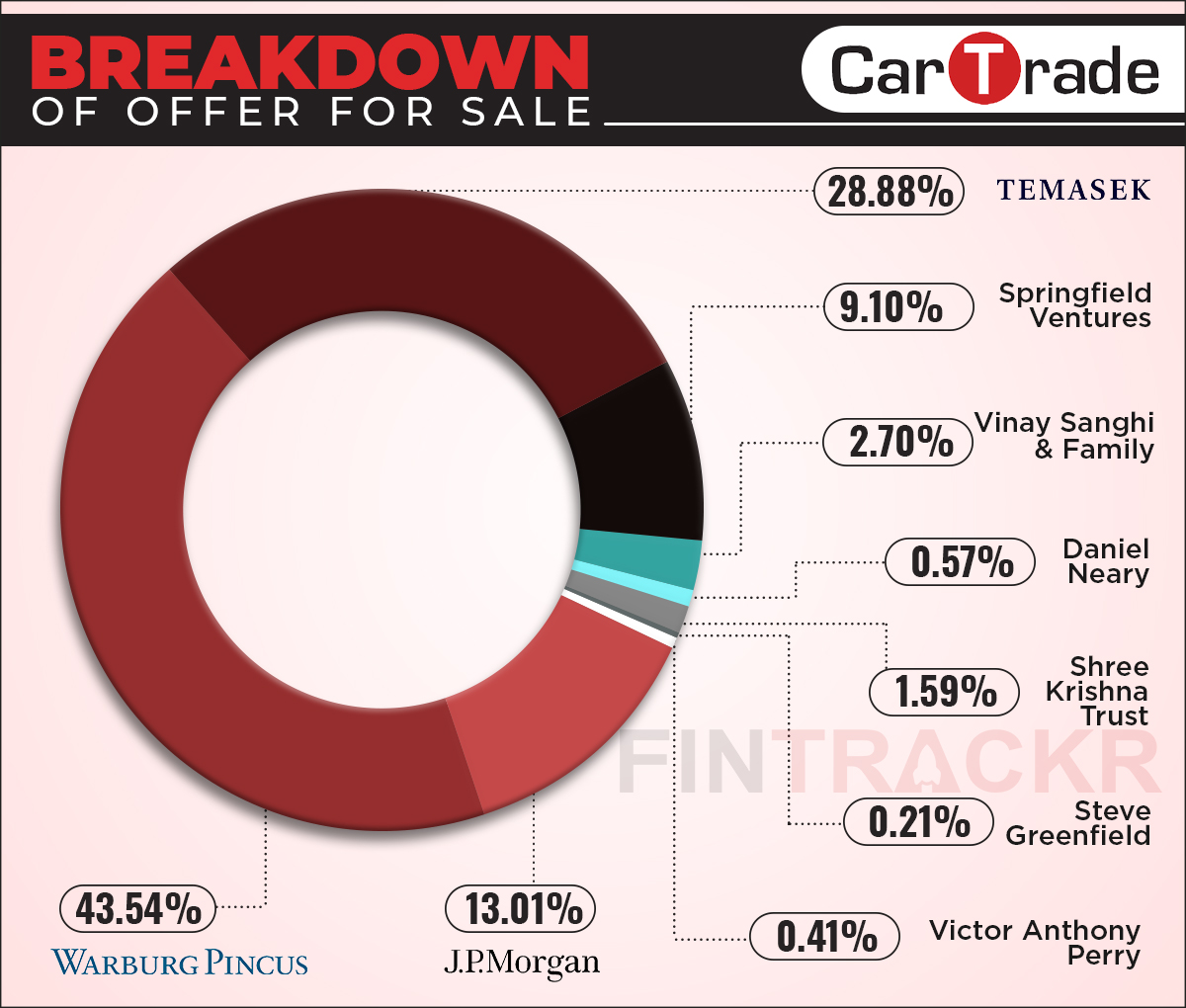

A complete breakdown of this OFS below.

CMDB, Highdell Investment, Macritchie Investments and Springfield Venture International are the investment vehicles of JP Morgan, Warburg Pincus, Temasek and March Capital Partners respectively.

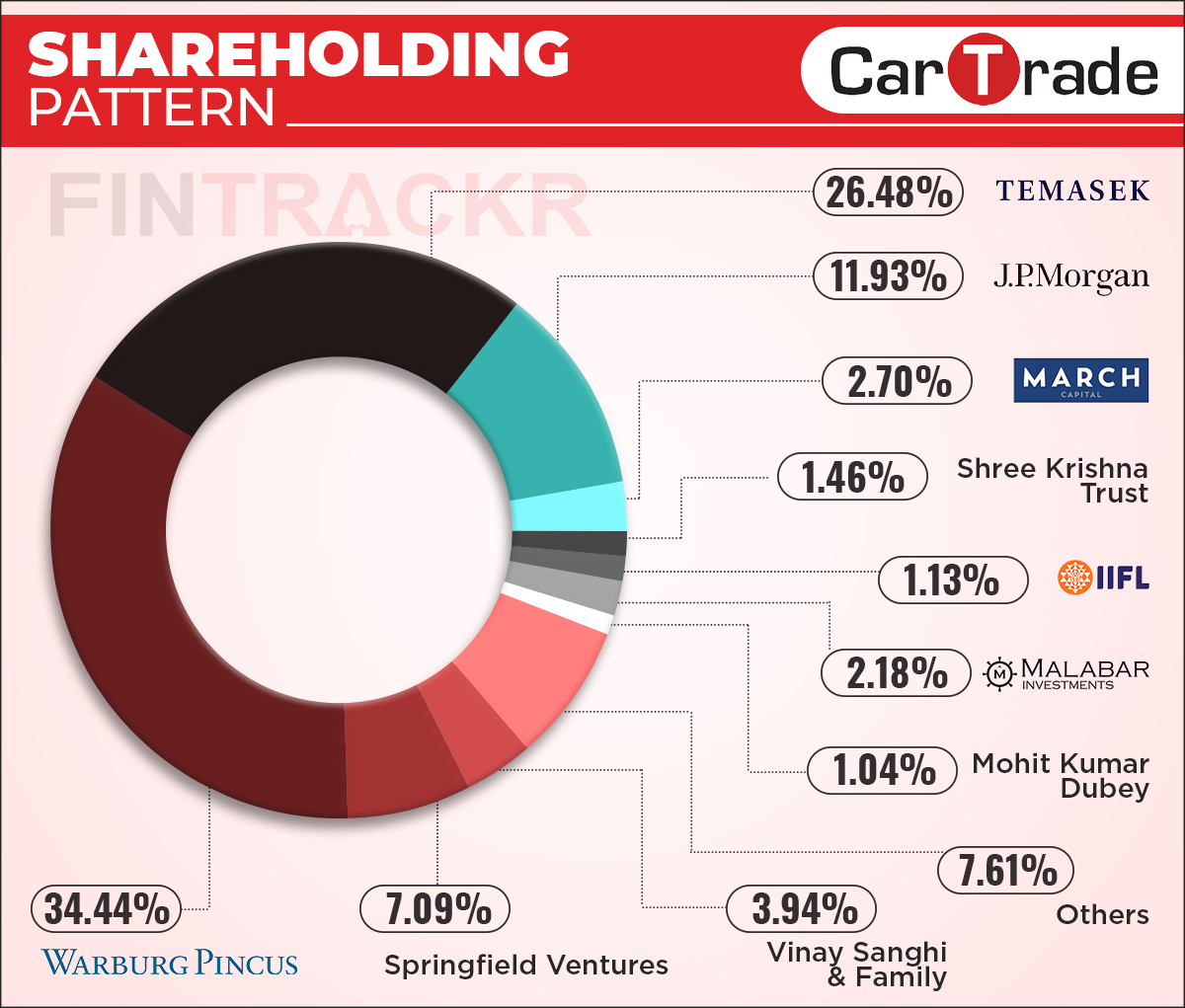

The complete shareholding pattern can be seen below.

Backed by the likes of Warburg Pincus, JP Morgan and Temasek, CarTrade’s DRHP said that it has reserved 75% of the offer for qualified institutional buyers. It further added that a maximum 15% of the offer will be available for non-institutional investors and the remaining 10% will be kept for retail bidders.

The development comes within a week after CarTrade converted its holding entity from a private limited company to a public limited company. The company also appointed its founder and CEO Vinay Vinod Sanghi as managing director for a period of five years effective from March 31, 2021. Sanghi also got approval from the company’s board to draw an annual salary of Rs 5.77 crore.

Founded in 2009, CarTrade has an auction model for old vehicles and an online portal for generating leads for new cars. The company had acquired CarWale in 2015 and took a majority stake in Shriram Automall in 2018. While it runs its offline auction business under Shriram Automall, the lead generation business is done through CarWale.