After Zomato’s back-to-back funding tranches, Swiggy has now scored $800 million from Falcon Edge, Amansa Capital, Think Investments, Carmignac and Goldman Sachs. Existing investors including Prosus and Accel also chipped in, an internal email sent to employees by the company’s co-founder and CEO Sriharsha Majety said.

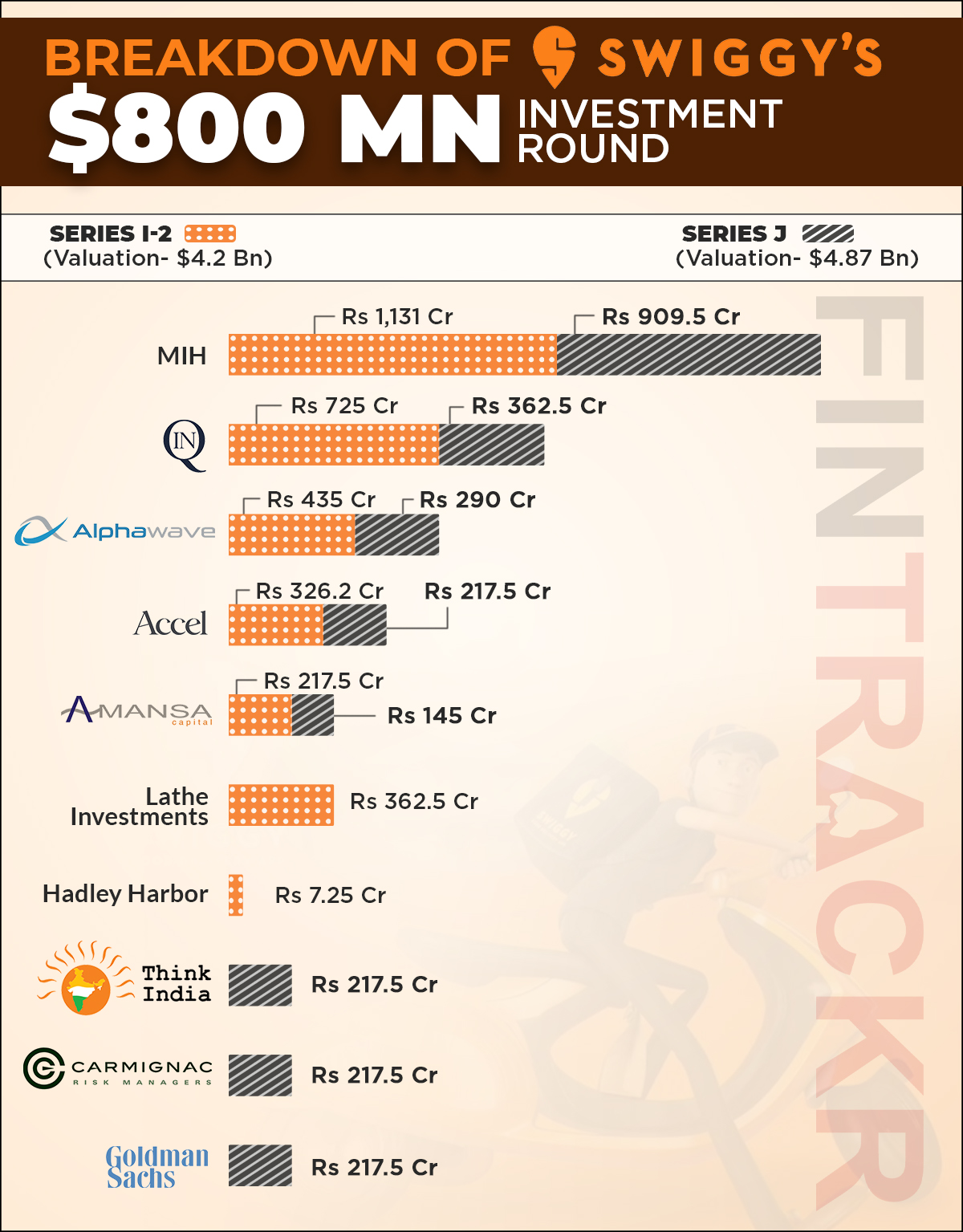

While the company has not disclosed any details of the transaction, Fintrackr has parsed the details from its regulatory filings and it shows that the Bengaluru-based foodtech major has mopped up around $792 million or Rs 5,780 crore across two funding rounds — $439 million or Rs 3,204.23 crore in a Series I-2 round and $353 million or Rs 2,577 crore in Series J round.

To raise Rs 3,204.23 crore, Swiggy allotted 1,33,357 Series I-2 preference shares at an issue price of Rs 240,275 per share. Prosus led the last tranche with Rs 1,131 crore whereas Alpha Wave and QIA poured in Rs 435 crore and Rs 725 crore respectively.

This was in continuation of Swiggy’s Series I round in which it had raised Rs 321 crore in May of 2020 at the same price per share.

Existing investors Lathe Investment and Accel invested Rs 362.5 crore and Rs 326.2 crore respectively whereas Hadley Harbor put in Rs 7.25 crore. Singapore-based asset management firm Amansa is a new investor that has infused Rs 217.5 crore in the Series I continuation tranche.

According to Fintrackr, Swiggy was valued at a $4.2 billion post allotment of the Series I-2 round.

Post this round, Swiggy kicked off its Series J round at a higher valuation. The company allotted 97,495 Series J preference shares at an issue price of Rs 2,64,303 per share to raise Rs 2,577 crore.

Prosus-owned MIH led this round as well with an infusion of Rs 909.5 crore along with other investors including Alpha Wave which invested Rs 290 crore and INQ Holdings’ Rs 362.5 crore.

Carmignac, Goldman Sachs, Think India and Accel have poured in Rs 217.5 crore each. Amansa invested Rs 145 crore.

Fintrackr’s estimates show that Swiggy has been valued at $4.9 billion in this new round. Following the infusion, Prosus remains the largest stakeholder in Swiggy with 35.3% whereas Alpha Wave and INQ Holdings have acquired 3.25% and 2.15% stake respectively.

The stake of the co-founders has been diluted to 8.12%. Chief Executive Officer Majety now owns 4.48% while Nandan Reddy has 2.02% and Rahul Jaimini, who left the firm last year, is left with 1.61%.

The two investment rounds have come at a time when Swiggy has been locked in an intense battle with Zomato to corner more market share. Over the past year, Info Edge-backed Zomato has mopped over $900 million and is gearing up for a public listing in the next few months.

The fresh capital would help Swiggy compete with its Gurugram-based arch-rival along with Amazon.

In FY20, Swiggy’s revenue from operations had surged 2.4X to Rs 2,696 crore from Rs 1,128.3 crore in FY19. The company had spent around Rs 6,864.1 crore in total during FY20 in which its annual losses stood at Rs 3,908 crore.

On Monday, Entrackr had exclusively reported on Swiggy rewarding its leadership team including its COO, CFO, CTO and HR head with ESOPs worth Rs 11.8 crore.