On April 6, credit card payment app CRED had announced its $215 million Series D round led by Falcon Edge Capital and existing investor Coatue Management. While the Bengaluru-based company didn’t disclose much details of the financing round, Fintrackr has decoded the numbers from its regulatory filings.

CRED passed a special resolution to allot 300,000 Series D preference shares at an issue price of $790 per share to raise $237 million in which the company has received $215 million, regulatory filings show.

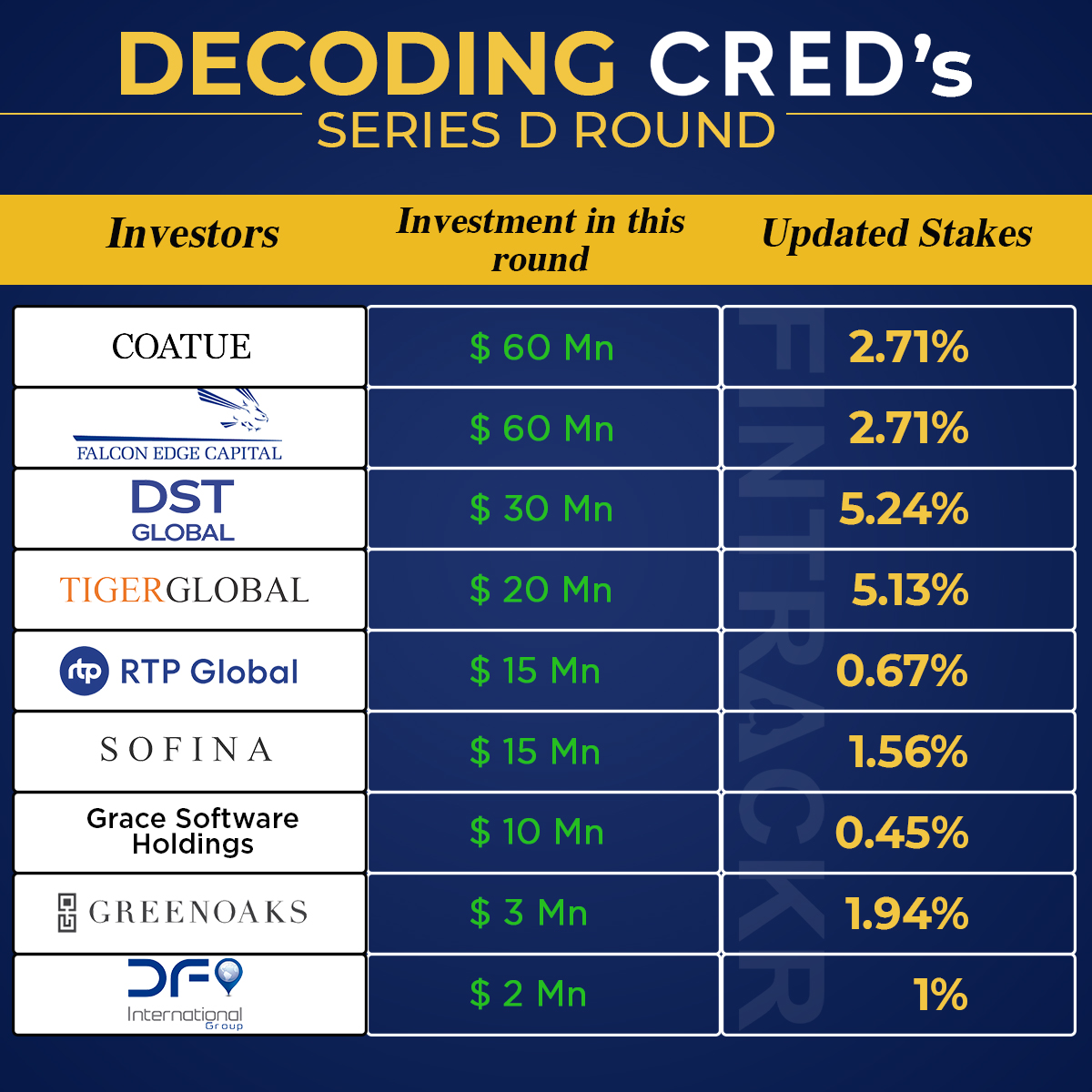

Falcon Edge’s Alpha Wave and Coatue Management have invested $60 million each. Existing investors DST Global, Sofina Ventures and RTP Global have put in $30 million, $15 million and $15 million respectively.

CRED’s another existing investor Tiger Global has pumped in $20 million whereas the rest of the amount in the round came from Grace Software Holdings, GreenOaks Capital and DF International.

As per Fintrackr’s estimates, CRED has reached a post-money valuation of $2.21 billion.

Following the allotment of fresh shares, DST Global has acquired 5.24% stake followed by Tiger Global which has 5.13% stake in the Kunal Shah-led company. Lead investors of the current round – Coatue Management and Falcon Edge – have acquired 2.71% stake each. The complete shareholding of all investors in the Series D round can be seen below.

CRED is a members-only credit card bill payment platform that rewards its members for clearing their credit card bills on time. With over 1,300 brands partners, CRED claims to have a customer base of 5.9 million and 20% share of all credit card bill payments in India.

Recently, CRED had projected a 208X growth in its operating revenues to Rs 108 crore during the fiscal year ending March 2021. According to Fintrackr, the two-and-a-half-year-old company’s operating expenses are estimated to surge by about 79% to Rs 677 crore in FY21 from Rs 378.4 crore in FY20.