Millennials-focused online furniture and appliance rental firm Rentomojo has raised Rs 10 crore from its two early backers: Accel and Chiratae Ventures. The fresh tranche of the Series C3 round has come at a time when the company is in the market to raise a fresh round. According to Entrackr sources, Rentomojo is in early-stage talks to mop up over Rs 200 crore from several investors.

Rentomojo has passed a special resolution to allot 1,074 Series C 3 preference shares at an issue price of Rs 101730.79 per share to raise the sum, regulatory filings show. Accel has put in Rs 7.28 crore whereas Chiratae (formerly IDG) has invested Rs 3.64 crore in the new tranche.

It’s worth noting that Rentomojo had kicked off its Series C round in mid-2019 and until now it raised over Rs 100 crore across multiple tranches. Besides Accel and Chiratae, Samsung’s investment arm Samsung Venture Investment and Bain Capital are its other institutional backers.

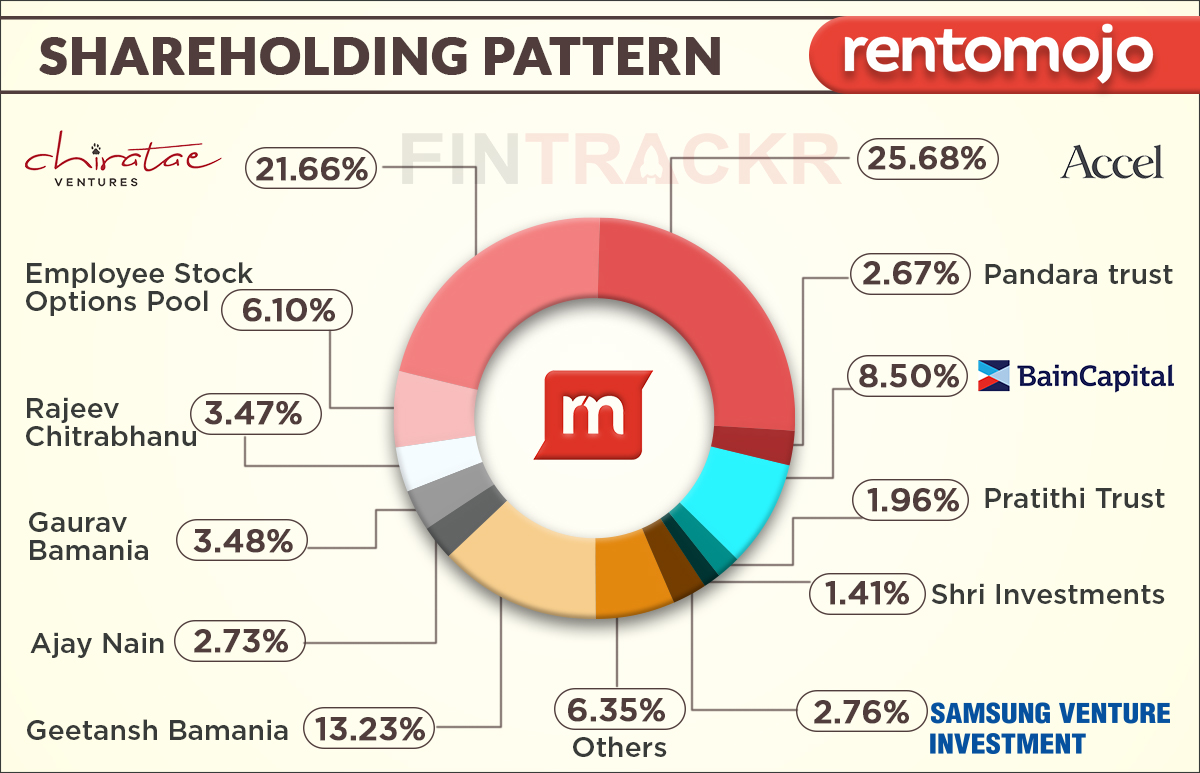

Following the fresh tranche, Accel emerges as the largest stakeholder in the company with a 25.68% stake while Chiratae owns 21.66%. At 13.23%, Rentomjo’s co-founder and chief executive officer Geetansh Bamania is the third-largest stakeholder in the company.

Bain Capital holds 8.5% and Samsung commands a 2.76% stake in the seven-year-old firm. At present, employee stock options (ESOPs) form a 6.10% stake.

Angel investor Gaurav Bamania and Rentomojo’s co-founder Ajay Nain own 3.48% and 2.73% respectively. Pandora Trust owns 2.67% while Pratithi Trust has ownership of 1.96%. Shri Investment commands 1.41% and many other investors collectively have 6.35% in the Bengaluru-based venture.

According to Fintrackr’s estimates, the company’s valuation has increased by 13.3% to Rs 850 crore in the fresh tranche. Rentomjo was valued at around Rs 750 crore or $100 million when it raised Rs 24.5 crore in May 2020.

Akin to other businesses, Rentomojo had also faced disruption in operations in the ongoing fiscal due to the pandemic. While the impact of the pandemic will be known when the company files FY21 financial results, it has recorded a 32.50% growth in its operating revenue in FY20.

According to separate regulatory filings, it has touched Rs 143 crore in operating income in FY20. Its losses has ballooned 56.70% to Rs 85.54 crore in FY20 from Rs 54.6 crore in FY19. Rentojo’s total expenditure stood at Rs 229.32 crore in the fiscal ending March 2020.