Digital payments platform Mobikwik has raised $7.2 million in what appears to be a funding round for the Gurugram-based company before going for an initial public offering.

Mobikwik has approved the allotment of 42,159 preference shares at an issue price of Rs 12,450 per share to raise Rs 52.5 crore or $7.2 million, regulatory filings show. The filings further reflect that this fundraise is IPO specific and it will be used for listing expenses and the company will raise more in this pre-IPO round.

As of now, more than 10 investors have participated in the round in which Elizabeth Matthew has put in Rs 15 crore or $2.02 million followed by Mauryan First and Orios Select Fund with Rs 9 crore or $1.23 million and Rs 7.5 crore or $1.02 million respectively. Vineet Sharma and Gaurav Dubey have invested Rs 7.31 crore or $1 million each in this round.

The development comes at a time when Mobikwik is reportedly targeting an IPO by September. According to a Bloomberg report, the company is planning to file its draft IPO prospectus by May and it intends to hold a pre-IPO round that will push the company’s valuation to $700 million.

As per Fintrackr’s estimates, Mobikwik has reached a post-money valuation of Rs 3,572 crore-Rs 3,610 crore ($493 million to $498 million) following the latest tranche. Mobikwik had raised its last funding in December 2020 in which the company raised Rs 52 crore led by Hindustan Media Ventures. During the round, the company’s pre-money valuation was estimated in the range of Rs 2,575-2,650 crore or $358-368 million.

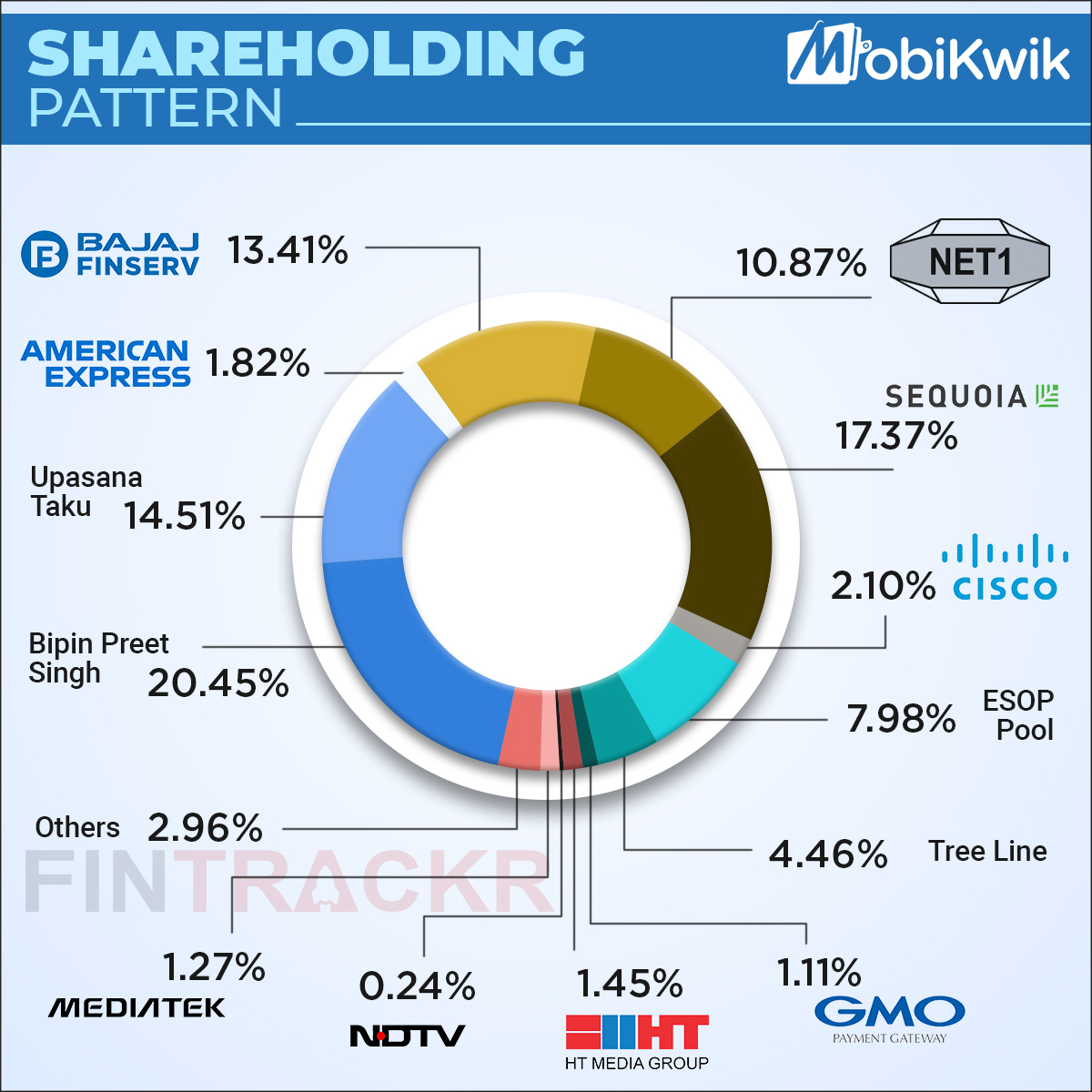

Fintrackr has also decoded Mobikwik’s current shareholding pattern. Co-founders Bipin Preet Singh and Upasana Taku hold 20.45% and 14.51% stake in the company respectively. Sequoia Capital is the largest stakeholder in Mobikwik among investors with a 17.37% holding followed by Bajaj Finance’s 13.41% stake.

Net1 Payments is another investor that holds a two-digit equity stake in Mobikwik at 10.87% whereas the rest of the investors control less than 5% stake in the company.

While Mobikwik eyes profitability in FY22, the company registered a 134% surge in net revenue to Rs 379 crore in FY20. According to Taku, the company registered a cash loss of Rs 9 crore in FY20 as compared to Rs 98 crore in FY19. The financials for FY21 is yet to come.