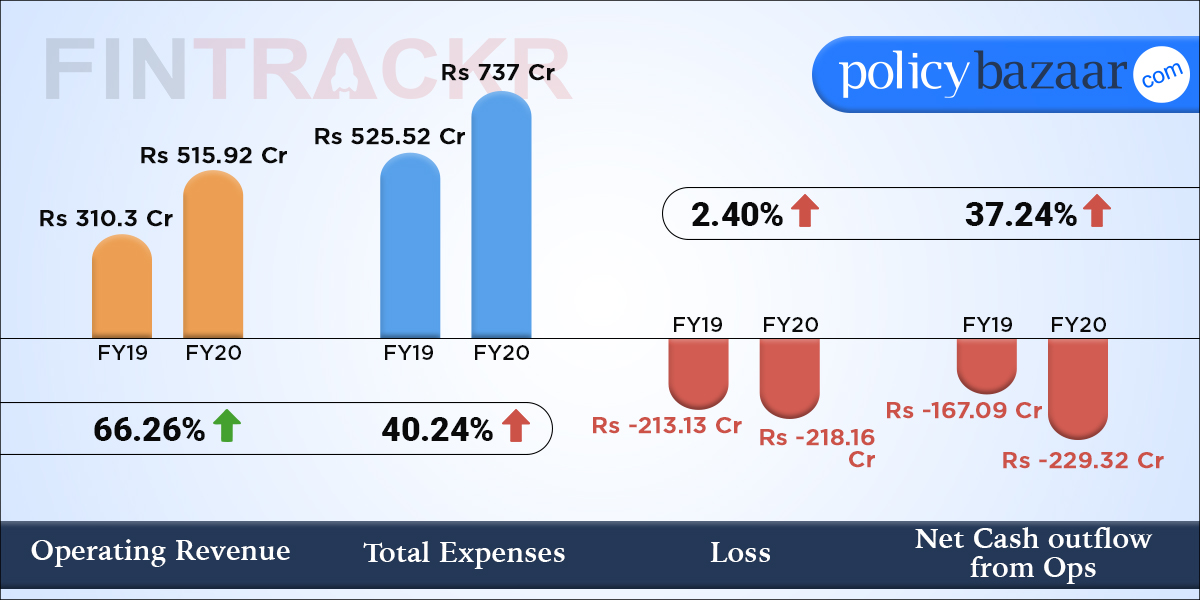

PolicyBazaar had a steady year of growth during the fiscal ended March 31, 2020, standing out as one of the largest online insurance broking companies with a topline of Rs 519 crore. Its operating revenue grew by 66.3% to nearly Rs 516 crore in FY20 from Rs 310.3 crore generated in FY19.

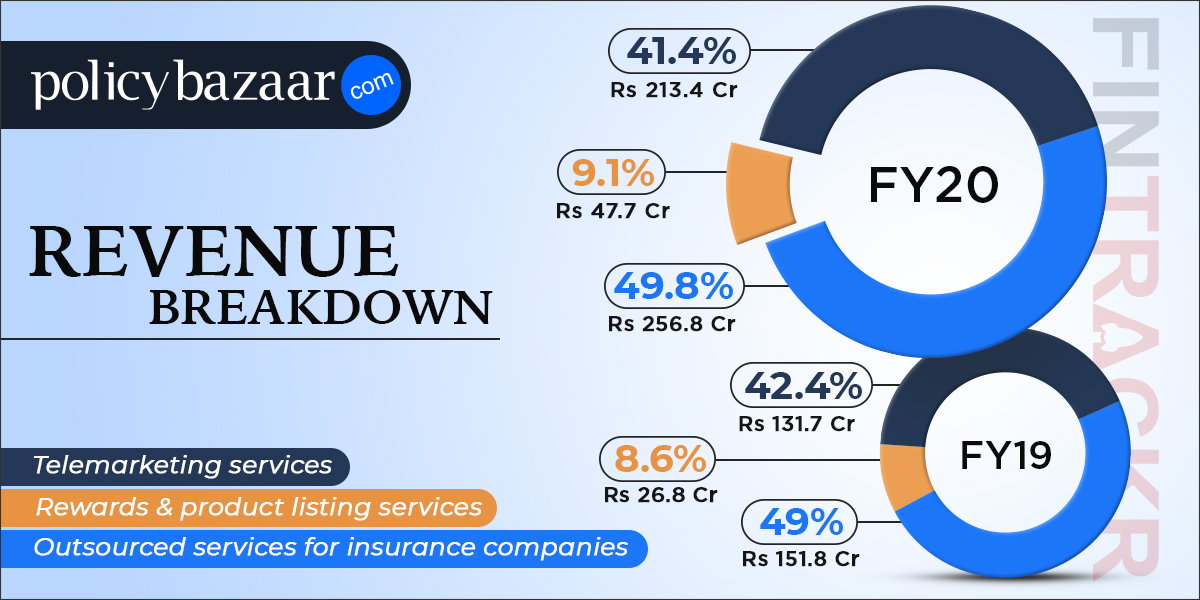

Looking over the revenue breakdown, we see how the company achieved this growth of scale. PolicyBazaar collects nearly 50% of its revenues from insurance companies for providing outsourced services such as customer processing. Such revenues grew by 69.2% to Rs 256.8 crore in FY20.

The second biggest revenue share is attributed to collections from the provision of telemarketing services provided to the insurance companies, making up 41.4% of the revenues. These collections surged by 62% to Rs 213.4 crore in FY20.

The segment which achieved the biggest surge in scale was the rewards management and product listing services, whose collections grew by 78% from Rs 26.8 crore in FY19 to Rs 47.7 crore in FY20.

PolicyBazaar tried to reign in its expenses during the last fiscal, and its total expenditure surged by 42% from Rs 525.5 crore in FY19 to nearly Rs 737 crore spent in FY20. It spent Rs 1.43 to earn a single rupee of revenue in FY20, improving 15.4% from Rs 1.69 spent to earn the same in FY19.

Expenses related to employee benefits remained the largest cost centre for the Gurugram-based company, accounting for 41.4% of the total expenditure during the last fiscal. These costs grew by nearly 37% from Rs 222.6 crore in FY19 to nearly Rs 305 crore during FY20.

Advertising and marketing costs grew 34% to around Rs 278 crore in FY20, after jumping 6.5X to Rs 207 crore in FY19. Communication and IT-related costs surged 52% to Rs 31.4 crore while legal fees also jumped by 66.3% to Rs 26.6 crore during FY20.

The company paid out Rs 25.8 crore for IP rights in FY20 and these payments grew by 66.3% during that period.

We have observed a trend with several Internet economy companies during the last fiscal, with a lot of them letting go of their leased properties and reducing their physical presence and rental costs significantly. PolicyBazaar also followed suit, reducing its rental costs by 67% to Rs 6.4 crore and amortising outstanding lease assets of nearly Rs 30 crore in FY20. Further, finance costs ballooned 8.5x to Rs 10.7 crore pushing net cash outflows to surge by 37.2% to Rs 229.3 crore in FY20.

Even with a 40% surge in cost of operations, PolicyBazaar actually controlled its losses. It lost Rs 218.2 crore in FY20, up only 2.4% from Rs 213.1 crore it lost in FY19. Actually, the company‘s EBITDA margins improved from -65.5% in FY19 to -34.1% in FY20. The improvement in unit economics is a good sign for the thirteen-year-old firm which is all set to go public this year. While it’s not clear whether it will eye public listing overseas or domestically, sources have been indicating that it’s likely to choose a foreign listing.