Daily grocery delivery platform Milkbasket has had a tough outing in the last two years facing operational problems and fierce competition from heavy funded companies such as Swiggy and BigBasket, but the Gurugram-based subscription commerce platform has persevered and managed to scale up its annual income 3.8X to Rs 322 crore in FY20.

The Unilever-backed startup is in late-stage talks with Reliance Industries for a potential acquisition, making a perfect addition to the latter’s JioMart platform. With MilkBasket inching closer to breakeven point while maintaining healthy growth in scale, the acquisition makes sense for Mukesh Ambani’s JioMart to compete with the likes of BigBaket’s BBDaily and Swiggy’s SuprDaily.

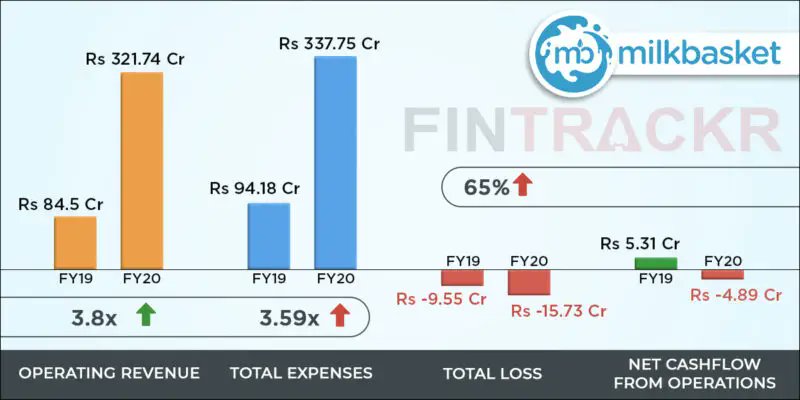

Looking over its financial numbers in FY20, Milkbasket saw its operating revenue shoot up 3.8X to Rs 321.74 crore in FY20 from Rs 84.5 crore in FY19. The company sold goods worth Rs 313.3 crore grocery along with milk and daily essentials, accounting for 97.3% of these collections whereas the rest 2.7% was earned through the provision of services such as delivery, advertising and platform fees.

With the surge in orders, the company scaled up its inventory to fulfil high-frequency products. As a result, its purchase of stock in trade ballooned 3.7X to Rs 306.4 crore in FY20 from the purchases of Rs 82.1 crore made in FY19. These purchases made up nearly 91% of the total expenditure incurred by MilkBasket in FY20.

The six-year-old startup spent heavily on its logistics and support operations during the last fiscal and cost related to IT, logistics and support services shot up 3.8X to Rs 10.4 crore in FY20, in line with the increase in sales.

Even with the scale-down of its operations in Bengaluru and the NCR region, the company increased its talent pool to deal with increased scale and hiring continued in the last fiscal. Costs related to employee benefits grew 2.2X to Rs 4.7 crore in FY20 from Rs2.11 crore in FY19 while still being nowhere close to the employee costs of its competitors.

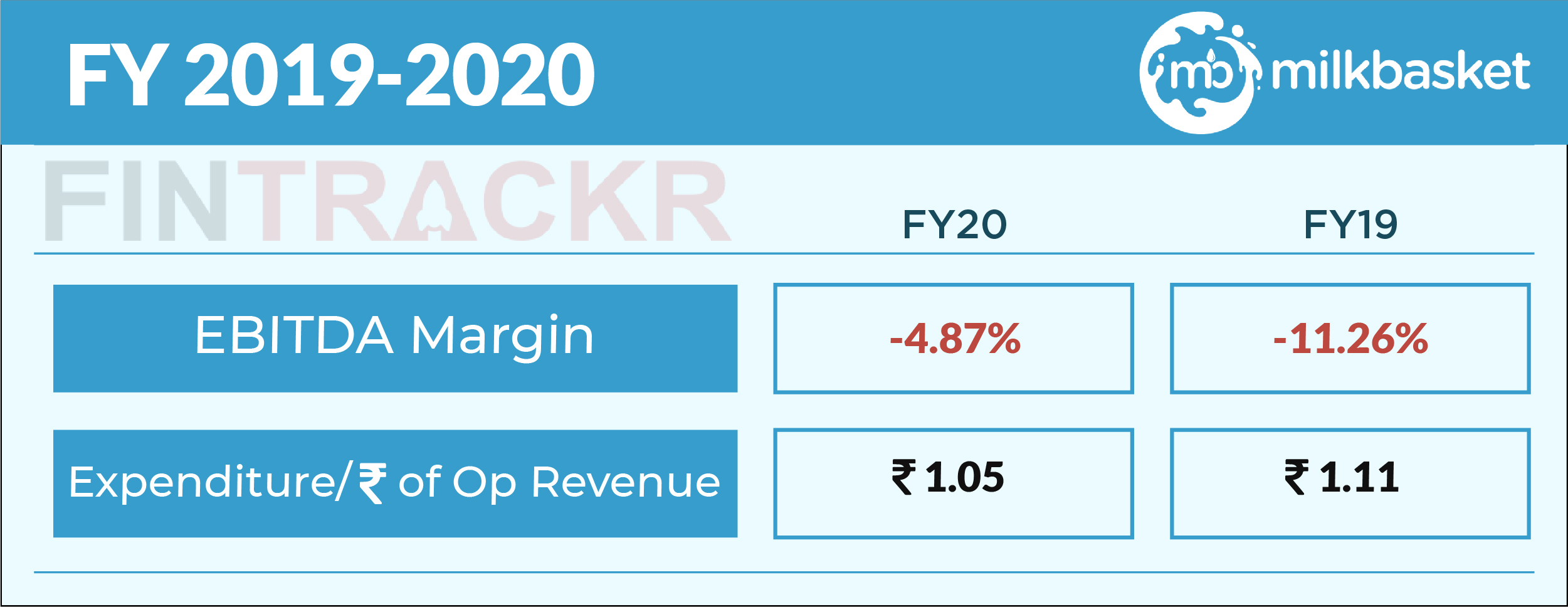

With increased sales, commission paid out to its sales partners also grew 4.5X to Rs 4.65 crore in FY20 from Rs 1.04 crore in FY19. Rental costs of Rs 1.2 crore pushed total expenses to Rs 337.8 crore in FY20, up 3.6X from Rs 94.2 crore total spending in FY19. Moving closer to breakeven, Milkbasket spent Rs 1.05 to earn a single rupee of operating revenue in FY20.

While Milkbasket has achieved a 280% surge in its collections, its losses grew by 65% to Rs 15.73 crore during the fiscal ended in March 2020 and EBITDA margin improved by 639 BPS to -4.87% in FY20. But even with great results, the company is in need of immediate capital infusion as its auditors have pointed out that outstanding losses of Rs 27.4 crore have caused complete erosion of shareholder’s equity.

MilkBasket is one of the rare companies in the grocery space that have been able to scale to several hundred crore rupees in operating revenue with sound unit economics. Experts believe that venture capital firms avoided investing in Milkbasket as heavyweights including SoftBank-Tiger Global (Grofers) and Naspers-DST Global (Swiggy), Alibaba (BigBasket) had already chosen their bets. With the potential fold-up of Milkbasket by Reliance, independent play in the grocery subscription space would come to an end.

Sequoia Capital-backed Dailyninja was acquired by BigBasket in 2019 while Y Combinator-backed SuprDaily became part of Swiggy in the same year. Several small-scale firms including RainCan and Morningcart and Doodhwala have also consolidated with large players.