Direct to consumer mattress and pillow brand WakeFit has been able to build a strong brand in the segment in the past three years. This could also be gauged after analysis of its financial performance in FY20. The Sequoia-backed company’s topline shot up by 150% during the fiscal ended in March 2020.

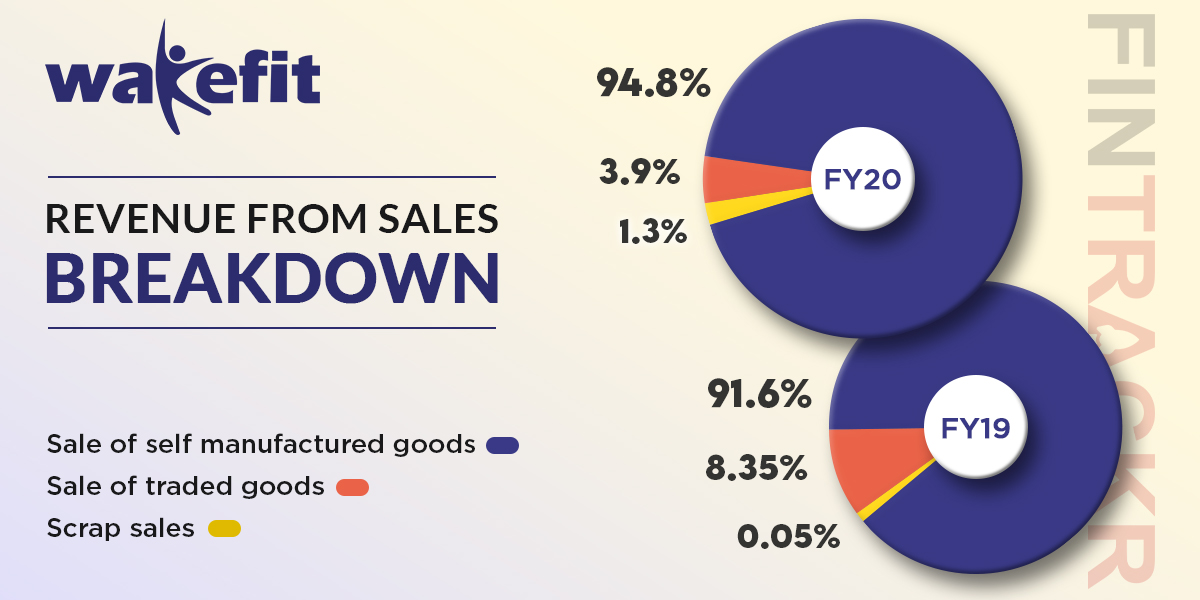

Around 95% of these revenues were generated through the sale of goods manufactured by WakeFit including mattresses and pillows. Such sales grew by 2.6X to Rs 187.2 crore in FY20 from Rs 72.95 crore in FY19.

Sale of goods such as bed sheets, pillowcases et al which were bought and rebranded by WakeFit amounted to Rs 7.7 crore, growing by 15.5% in FY20. Sale of scrap goods added another Rs 2.6 crore to revenue from operations which stood at Rs 197.45 crore during FY20. Revenue registered a 2.5X jump from Rs 79.63 crore earned in FY19

WakeFit moved inventory at a turnover ratio of 16.06X, on an average replacing stock within 23 days during FY20.

Moving over to the expense sheet, the cost of raw materials procured for production naturally stood out as the biggest cost centre for the mattress manufacturing company. Amounting for 54% of the total expenditure incurred, such expenses ballooned 2.12X from Rs 46.7 crore in FY19 to Rs 99.3 crore in FY20.

The four-year-old company also purchased stock in trade worth Rs 6.04 crore during the same period.

Employee benefit expenses jumped 3.13X from Rs 5.4 crore in FY19 to Rs 16.9 crore in FY20 and rental costs also grew by 3.4X as the company expanded its production. Wakefit also invested Rs 14.8 crore in new plant and machinery and paid outsourced contract workers Rs 5.6 crore during FY20.

Further, transportation costs tripled to Rs 15.5 crore during the fiscal ended in March 2020 from Rs 5.5 crore spent in FY19.

With the increasing scale of its operations, the online mattress brand’s expenditure on customer acquisition also swelled up. Advertising and promotion costs jumped 6.8X to Rs 26.5 crore while commission paid on sales also grew by 85% to Rs 10.4 crore in FY20.

Miscellaneous expenses of Rs 1.08 crore pushed the total expenditure to Rs 184.23 crore in FY20, which grew 2.6X from expenses of nearly Rs 70 crore spent in FY19. Wakefit spent Rs 0.93 to earn a single rupee of operating revenues during FY20.

Even while the company more than doubled its scale during FY20, it has managed to register a healthy jump in profits for three years in a row. Profits during the year rose by 56.6% to Rs 10.15 crore in FY20 from Rs 6.65 crore in FY19.

For a manufacturing company, Wakefit has achieved remarkable financial performance throughout the last three years, It has managed to keep its efficiency and profitability ratios up in green while multiplying its scale of operations each year.

With healthy operational cash inflows along with the recent Rs 185 crore series B round and minimal outside debt, the D2C brand looks to have a good runway in the current fiscal as more and more of durable shopping shifts online.