Edtech startup Pariksha has raised a new financing round led by Bharat Inclusive Technology Fund. The fresh proceeds appear to be Series A round for the Pune-based startup. The company has allotted 31,885 preference shares and 30 equity shares at an issue price of Rs 4,122.65 per share to raise around Rs 13.16 crore, regulatory filings show.

This is the second investment for Pariksha in 2020 after an undisclosed round led by INSEAD Angels in April. Besides Bharat Inclusive Technology Fund, Lets Venture, 9Unicorns, Innercircle One Consulting and Nikhil Vora are the new investors in this round.

While Bharat Inclusive and Lets Venture have collectively pumped in Rs 11.76 crore, the rest of investors put in the remaining amount. According to Fintrackr, Pariksha’s post-money valuation is estimated in the range of Rs 95-100 crore.

Launched by Karanvir Singh, Utkarsh Bagri, Vikram Shekhawat and Deepak Choudhary, Pariksha is an online vernacular test preparation platform which helps candidates to prepare for various preliminary and mains entrance tests in the public sector. The freemium app helps students to prepare in their choice of language through video-on-demand and live-streaming classes.

Pariksha operated in 11 states and six languages including Hindi, Marathi, Tamil, Bengali and English. Besides tier-II, III cities and rural regions, Pariksha also targets candidates from urban regions.

According to the company’s website, it has over 3 million users who have attempted more than 400 million questions. The app has completed more than 34 million number of tests.

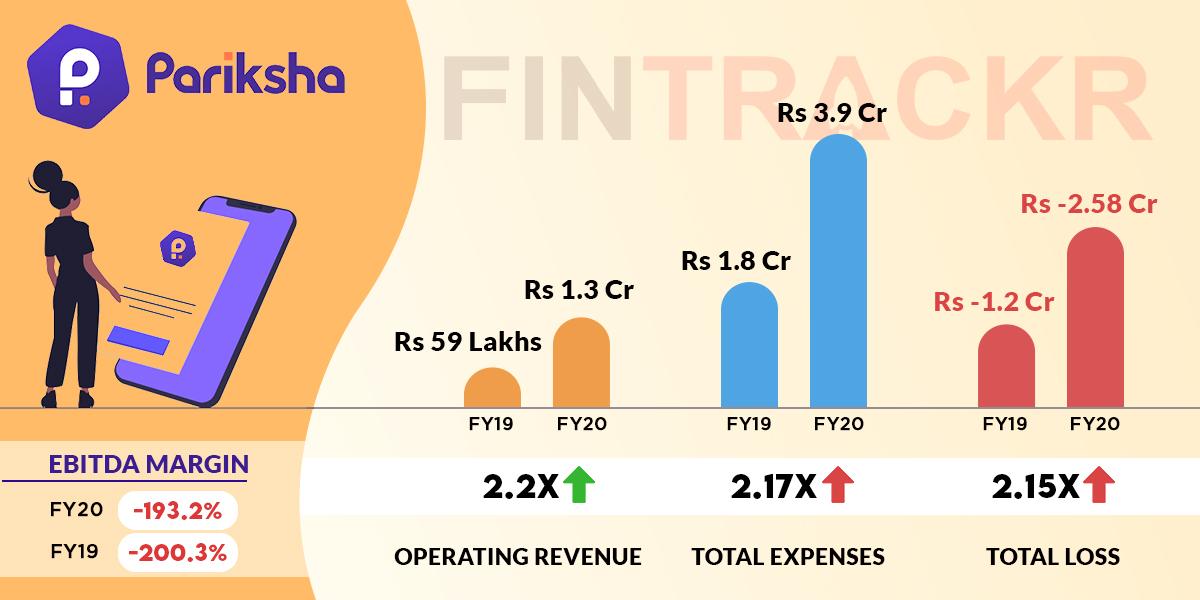

Pariksha has also filed its financials for FY20. The edtech startup has recorded a 2.2X jump in revenue which grew to Rs 1.3 crore during the fiscal ended in March 2020. While the collections have doubled, it recorded a similar jump in expenses and losses. The company spent an aggregate Rs 3.9 crore during FY20 and lost Rs 2.58 crore on the same at an EBITDA margin of -193.2%.