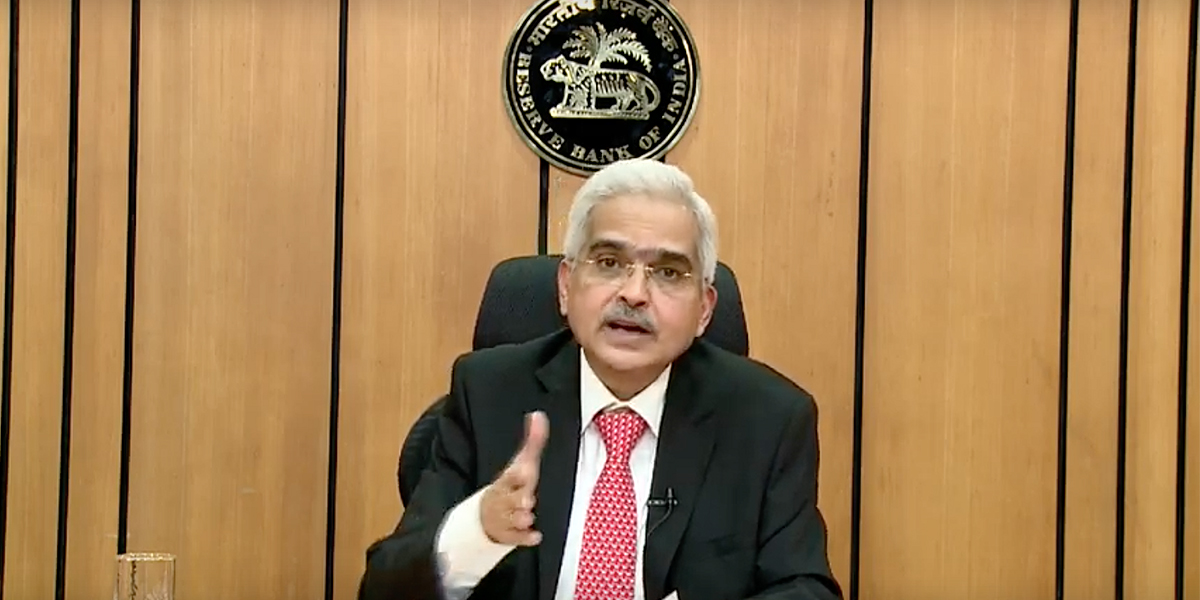

Reserve Bank of India Governor Shaktikanta Das on Friday announced a moratorium of another three months from June 1 to August 31 on repayment of term loans and interest on working capital.

“In view of the extension of the lockdown and continuing disruptions caused by COVID-19, the moratorium on repayment of loans and interest on working capital are being further extended from 1 June till August 31 taking the total period of applicability of the measures to 6 months,” said Governor Das in a press conference.

To meet the working capital requirements of the individuals, the lending institutions are being permitted to restore the margins for working capital to their original levels by March 31, 2020, he added.

This three-month extension comes two months after the RBI had initially permitted a pause on EMI repayments from March 1 and till May 31. In its earlier announcement, the central bank mentioned that the accumulated interest for the period will be paid after the expiry of the deferment period. This led to a lot of confusion that these repayments have to be made in one go.

In addition, the earlier announcement also implied that the moratoriums are no relief to one’s EMIs and credit card’s outstanding payments cycle. If one chose not to pay their loans or credit card bill, then they will be charged an applicable monthly interest rate.

Moratorium period refers to the period of time during which borrowers do not have to pay an equated monthly installment or EMI on the loan taken.

Providing clarity on the same, Das added that lending institutions are being permitted to convert the accumulated interest on working capital facilities over the total deferment period of 6 months into a funded interest term loan which shall be fully repaid during the course of the current financial year ending 31 March 2021.

Given the state of the economy and businesses during the COVID-19 pandemic, the announcement would provide relief to many individuals, especially self-employed, who are finding it difficult to pay their EMIs due to loss of income resulting from job losses or pay cuts.

Importantly, this was the first media briefing from the RBI governor since Finance Minister Nirmala Sitharaman concluded announcing the details of the fifth and last tranche of Rs 20 lakh crore financial stimulus package.

The governor also said that the biggest blow from COVID-19 has been to private consumption which accounts for around 60% of the domestic demand.

On the basis of an assessment of the current and evolving macroeconomic situation, other relaxations announced by RBI’s MPC or Monetary Policy Committee includes a further cut of 40 basis points in the repo rate bringing it down to 4%. Earlier in March, the MPC had cut repo by 75 basis points to 4.4%.

Significantly, Das also said that India’s gross domestic product or GDP growth is also expected to be in negative territory in 2020-21 with inflation outlook being ‘highly uncertain’.

“GDP growth in 2020-21 is estimated to remain in the negative territory with some pick up in growth impulses in the second half of 2020-21 onwards,” Das said.