India’s tech prowess was on display when it built and delivered its digital payments system Unified Payments Interface or UPI. Since its inception in 2016, UPI has achieved various milestones and has become the most preferred mode of payments among Indians.

Blown away by the framework of UPI, even Google had written to the US Federal Reserve Board about the successful example of NPCI-owned payment railroad to build faster digital payments service in the country.

UPI has just completed its fourth fiscal year. While the first fiscal year (FY17) was the testing period, it came into limelight and picked up pace post demonetization era.

Growing on the back of the government-promoted BHIM and third-party apps like PhonePe and Paytm, UPI cornered sizeable pie of overall P2P, recharge and bill payments market in FY18. In the latter half of FY18, Google Pay became the first overseas player to join the UPI ecosystem.

In that fiscal, UPI had processed 913.517 million transactions worth Rs 1,09,587.8 crore (or Rs 1.09 trillion). Industry experts tracking this space had lauded the growth trajectory of UPI, which was set for the next phase of growth.

And then came the big numbers.

During FY19, UPI clocked 5.39 billion (5391.52 million) transactions amounting to Rs 8,76,970.72 crore (or Rs 8.76 trillion). The big takeaway: 490% growth in volume and 700% growth in terms of value. The FY20 also started on a good note as UPI broke all previous records and crossed 1 billion transactions in a month for the first time in October 2019. Since then, it has been doing over a billion transactions for six months in a row now.

The FY20 also started on a good note as UPI broke all previous records and crossed 1 billion transactions in a month for the first time in October 2019. Since then, it has been doing over a billion transactions for six months in a row now.

For FY20, UPI has clocked 12.51 billion (12,519 million) transactions worth Rs 2 1,31,730 crore (Rs 21.31 trillion), a 132% jump in volume and 143% surge in value as compared to FY19.

This was the period too when India’s central bank and NPCI had collectively taken some positive steps such as waiver of MDR charges, onboarding more banks and enabling recurring payments to ramp up growth of UPI.

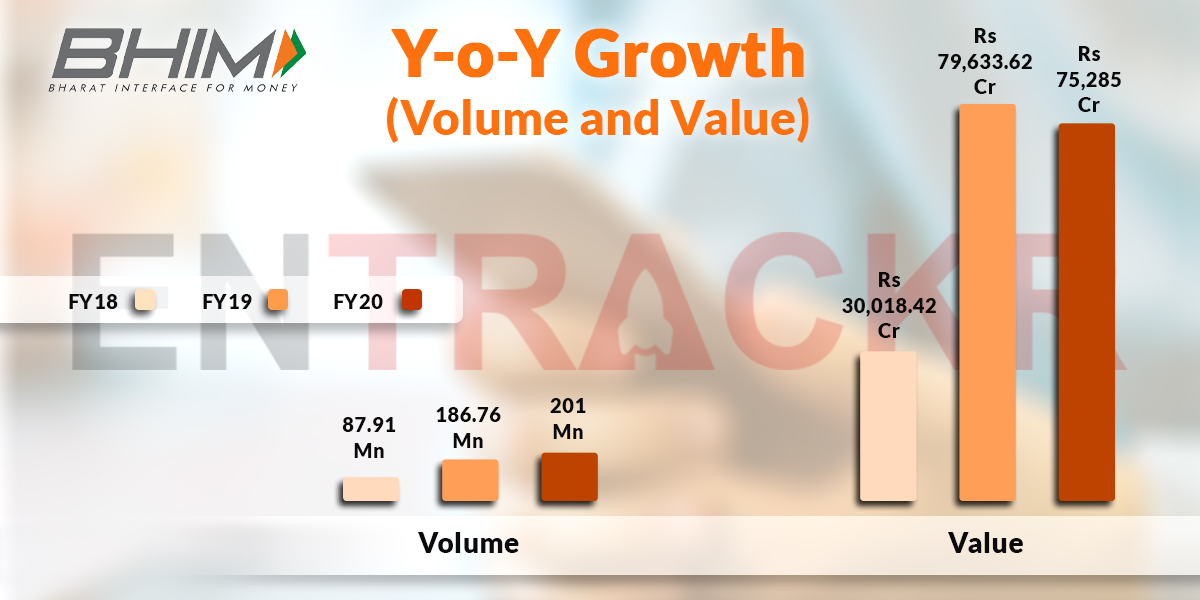

Significantly, the growth of UPI in FY19 and FY20 was mainly driven by three payment apps Google Pay, Paytm and PhonePe while BHIM’s growth remained flat and headed towards saturation. While the number of transactions processed by BHIM stood at 201 million in FY20 as compared to 186.7 million in FY19, the amount processed via the platform saw a dip in FY20 as compared to FY19.

While the number of transactions processed by BHIM stood at 201 million in FY20 as compared to 186.7 million in FY19, the amount processed via the platform saw a dip in FY20 as compared to FY19.

Notably, leading players Google Pay, PhonePe and Paytm haven’t revealed their monthly transactions figure through UPI since July 2019.

UPI’s contribution to Govt’s digital payments target

UPI had contributed about 18% (5.3 billion) of the target of 30 billion for digital payments in FY19 set by the government via the Ministry of Electronics and Information Technology (MeitY).

However, the total target was reportedly missed by about 4 billion.

For background, digital payments count payment methods such as card-based payments, immediate payment service (IMPS), digital wallets, UPI, national automated clearing house (NACH) and Aadhaar-enabled payment system (AePS).

For FY20, MeitY had reportedly increased the digital payments target to 45 billion from 40 billion. The executive agency of the government had also assigned fixed targets for the various players in the business such as SBI, Paytm, HDFC, ICICI and Axis Bank.

If we go by numbers, UPI has contributed 27.7% (12.5 billion) of the targeted 45 billion digital payments for FY20, we can say that it has done its job decently. All payments entities are likely to achieve the target collectively after missing it for two consecutive financial years.

Growth prediction of UPI for FY21

According to RBI, it sees payment systems like IMPS and UPI registering average annualised growth of over 100% and NEFT at 40% till 2021. Even with ongoing growth rate, UPI can maintain its leadership over IMPS, credit and debit cards.

In FY20, IMPS registered 2,579.08 million transactions worth Rs 2,337,390 crore as compared to UPI’s 12,522 million transactions worth Rs 2 1,31,730 crore.

Given that NPCI had announced to double the per transaction payment limit for UPI to Rs 2 lakh from April 1, the platform will cross IMPS in terms of the value of the transaction as well.

NPCI’s chief Dilip Asbe also predicted that UPI would expand fivefold to 500 million in the next three years. Meanwhile, NPCI along with RBI, is planning to set up a subsidiary to take the UPI model to other countries.

Moreover, the entry of WhatsApp is likely to change the dynamics of the UPI ecosystem. Experts believe that WhatsApp would take no time to reach what others have achieved in three or two years. Such a belief may turn true if we factor in its reach to 400 million users in India.