Scaling companies without external capital are rare in India. We have very few examples where entrepreneurs have broken the Rs 1,000 crore revenue barrier without venture capital money. Sreedhar Vembu is one such founder whose firm Zoho kept growing year after year and without any external investment.

The Chennai-based SaaS (software-as-a-service) firm has recorded a 37.1% growth in operating revenue to Rs 3,308 crore in FY19 from Rs 2,412 crore in FY18. For the very first time, Zoho has made a revenue of Rs 121.07 crore from India while export of services stood at Rs 3,187 crore during FY19.

In the end, the company’s profit surged by 26.3% to Rs 516 crore in FY19 from Rs 408.4 crore in FY18.

To achieve greater scale and profit, Zoho invested Rs 888.35 crore in the property while adding computers and IT equipment worth Rs 430.2 crore during the last fiscal to fuel the growth of scale.

At the end of FY19, its total assets increased by 31.6% to Rs 4,178.4 crore from Rs 3,174.5 crore in FY18 and Zoho’s asset turnover ratio stood at .93 indicating that these assets were utilised efficiently.

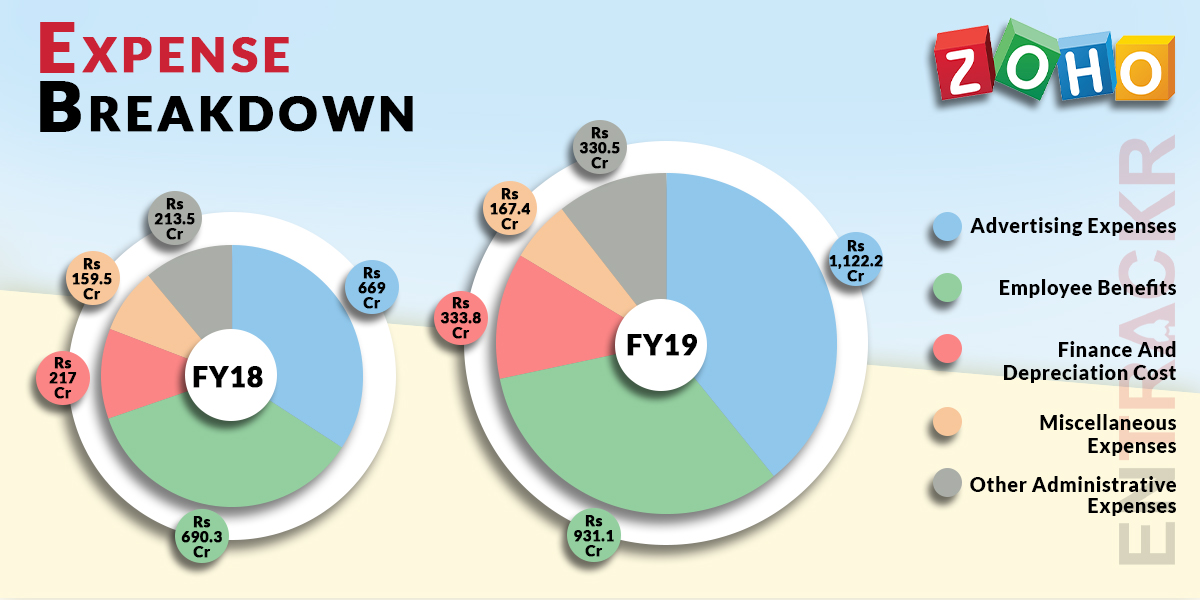

With a growing scale, the company’s total expenditure also grew by 48%, reaching Rs 2,885 crore in FY19 from Rs 1,949.3 crore in FY18. Zoho spent Rs 931 crore on employee benefits, up by 35% from Rs 690.3 crore in FY18. With a huge pool of assets, depreciation and amortisation accounted for Rs 330 crore on the expense sheet alongside Rs 4.25 crore in finance cost.

Advertising expenses stood out as the single biggest cost element for the Vembu-led company, growing by almost 68% to reach Rs 1,122.2 crore in FY19 from Rs 669 crore in FY18.

Even with the increase in the expenditure, the net cash inflow for FY19 rose by 63.2% to Rs 1,113.2 crore from Rs 681.9 crore indicating that the SaaS company is generating healthy cash flows even if profits have increased only by 26.3%.

Profit margins are reduced marginally as reflected in the increase in unit expenditure from Rs .81 to Rs .87 but the company stood in a healthy position due to increase in scale.

Financial performance of Zoho in FY19 is undoubtedly a stellar case study for the majority of startups who have been bleeding profusely and largely dependent on venture capital money.

The journey of Zoho is also a testament to the fact that entrepreneurship is a long-term game. The company was founded in 1996 and recently completed its 24th anniversary. Vembu and team have set an impeccable lesson for the Indian startup ecosystem.