We often see growth-stage startups venture into new segments in search of scale. Paytm tried instant messaging and Lifafa whereas ShareChat is foraying into social commerce and Cure.Fit has started offering groceries.

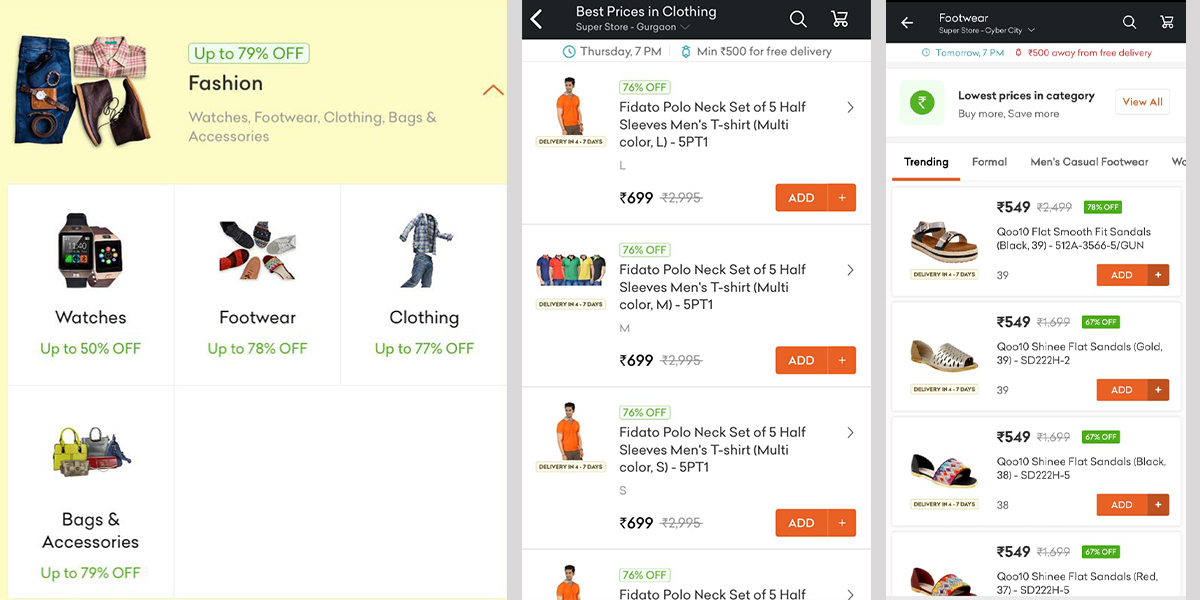

While there are many consumer-facing internet companies that have forayed into ancillary verticals, Grofers is attempting at something that no online grocery player has tried before. The Gurugram-based company has started selling fashion products, footwear and accessories such as watches over the last couple of weeks.

Entrackr has found the newly-added vertical on both its website and mobile application. At present, the majority of its offerings in these categories is under Rs 1,000. Unlike grocery where Grofers largely follows a private label strategy, the company is currently relying on third-party sellers in fashion.

According to its website, the Albinder Dhindsa-led company delivers its fashion offerings across India within four to seven days. And already Grofers is clocking about 300-400 daily transactions in these non-core categories, according to two Entrackr sources.

Queries sent to Dhindsa did not elicit a response until the publication of this post.

Curiously, Qoo10 has listed its footwear brand on Grofers. Last year, the Singapore-based e-commerce marketplace had acquired India e-commerce unicorn ShopClues.

Backed by SoftBank and Tiger Global, the Grofers has been focusing on the mass-market segment through its in-house brands. About 60% of its offerings in grocery, FMCG and house-hold items are formed by its private labels.

In a bid to bring in more revenue, the company has recently started adding its in-house grocery products to local kirana stores as well. As reported by Entrackr, it has been converting local neighborhood stores into Grofers-branded stores and placing its products on their shelves across the NCR region and adjacent cities.

Grofers foraying into fashion is one of their ways to diversify and add more use cases to a platform which is already being used frequently. However, several industry experts view this strategy as a distraction.

“With Amazon, Walmart and Jio expected to go aggressive on grocery in the coming months, this seems like a major distraction for Grofers,” said one of the entrepreneurs in the fashion e-tailing space, requesting anonymity.

“Unlike grocery, these categories work very differently. They should focus on growing their share of groceries.”

Founded by Dhindsa and Saurabh Kumar, Grofers had raised $220 million last year in a round led by the SoftBank Vision Group at a valuation of $644 million.

According to its regulatory filings in Singapore, the firm had a revenue of Rs 1,282.3 crore in FY19. It also incurred a two-fold rise in expenses to Rs 1,993.5 crore in the last fiscal as compared to Rs 909.65 crore in FY18. Grofers had a net loss of Rs 702 crore.