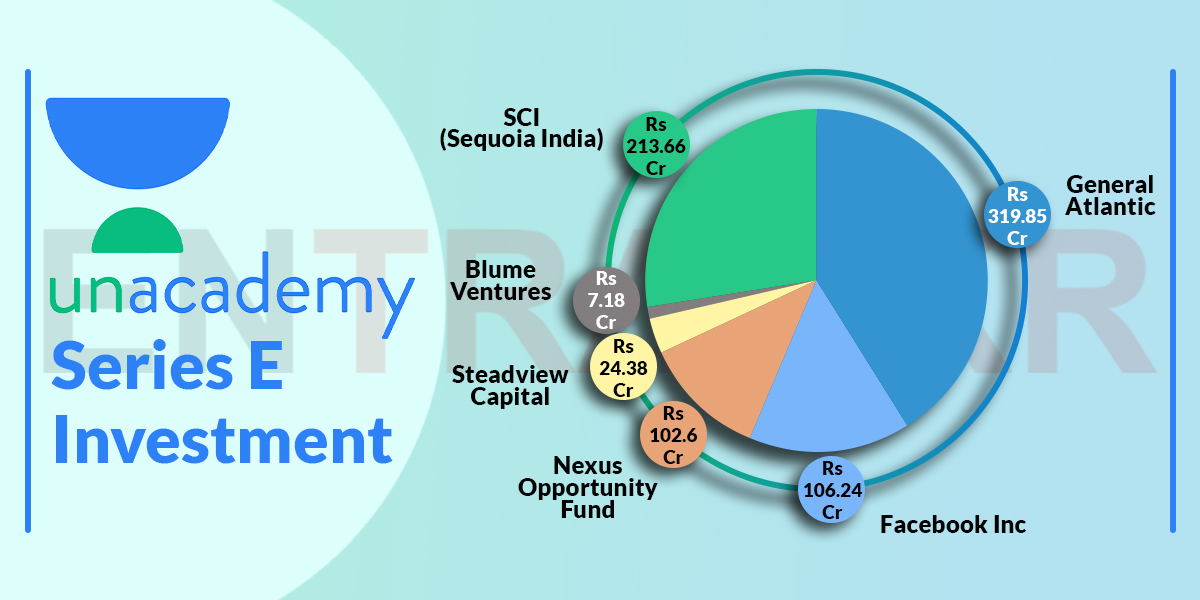

Unacademy had announced a $110 million Series E round led by General Atlantic last month but the company didn’t disclose the break-up of the round. We have outlined the details of the said investment round, enumerating the investment amounts from the six investors as reflected in documents filed by the company with the Ministry of Corporate Affairs.

Unacademy has allotted 200 equity shares and 13,175 Series E preference shares in this round according to regulatory filings. Equity shares are allotted at a price of Rs 58,893.6 each while the convertible preference shares carry a conversion ratio of 1:10 and priced at Rs 5,88,935.93 per share. In total, Unacademy raised Rs 774 crore from six investors.

Leading the pack, Singapore based General Atlantic has invested Rs 319.85 crore and picked up 5,431 preference shares. Existing investor Sequoia India injected Rs 213.66 crore for 3,628 shares while Facebook Inc poured in Rs 106.24 crore and picked up 1,804 shares.

Nexus Venture Fund has purchased 1,742 shares for Rs 102.6 crore whereas Steadview Capital acquired 448 shares by pouring in Rs 24.4 crore for the same. Blume Ventures followed with an investment of Rs 71.8 crore for 122 Series E shares.

In addition to the above, both General Atlantic and Facebook Inc have picked up 100 equity shares each for a total investment of Rs 1.17 crore.

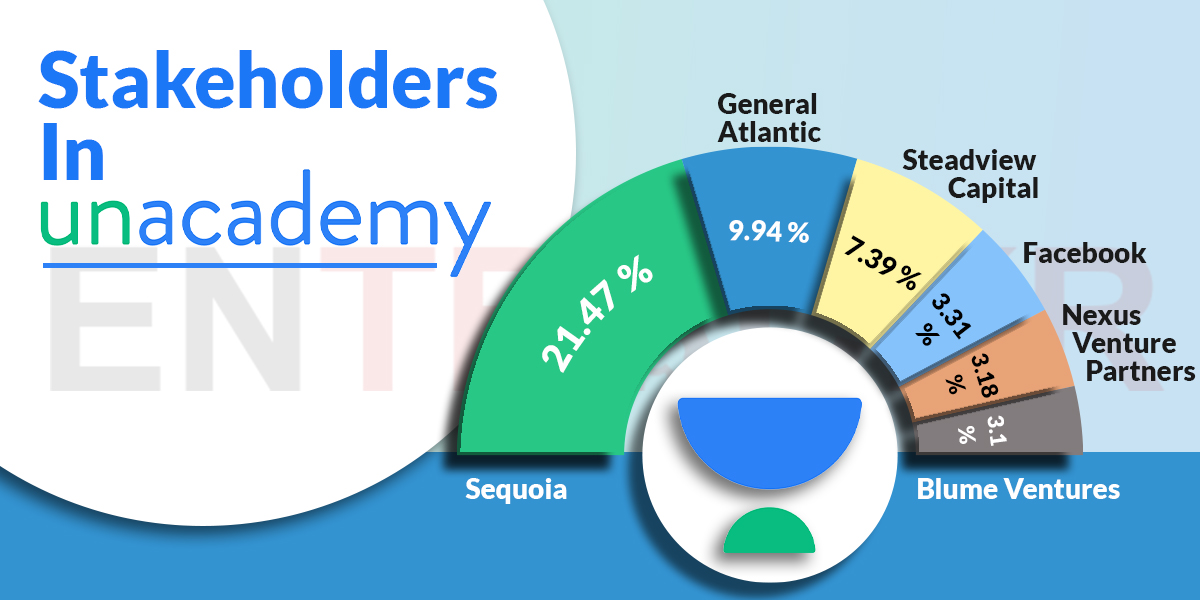

Following this investment round, Sequoia holds 21.47% stake in the Bengaluru based firm while General Atlantic has 9.94% ownership in Unacademy. Steadview, Nexus and Blume own 7.39%, 3.18% and 3.1% respectively.

Social media giant Facebook holds 3.31% stake in Unacademy.

Unacademy has been valued at $510 million (post-money) in the Series E financing round. For the unaware, Unacademy offers free and behind the paywall online video lessons to crack various competitive examinations.

Unacademy claims to cross 1,00,000 Plus subscribers this week and is going to be India’s biggest education tech company in the next 12 months.

According to a recent report, it has 30 categories at the moment and likely to have operating revenue of Rs 120 crore in FY20. It will be a 10X jump from its FY19’s revenue. During the last fiscal, the company had recorded Rs 11.66 crore in revenue from operations and had a loss of Rs 90.27 crore.