Grofers’ Singapore based parent has filed its financial results for the year ending March 2019 and Entrackr’s analysis is starkly different from what has been widely reported by media outlets.

Citing Indian regulatory filings of a single entity, several publications had reported that the firm generated revenues of Rs 70 crore against loss of Rs 448 crore during the last fiscal. But the numbers didn’t add up for the second biggest player in its segment, having claimed to reach annual GMV of Rs 2,500 crore during FY19.

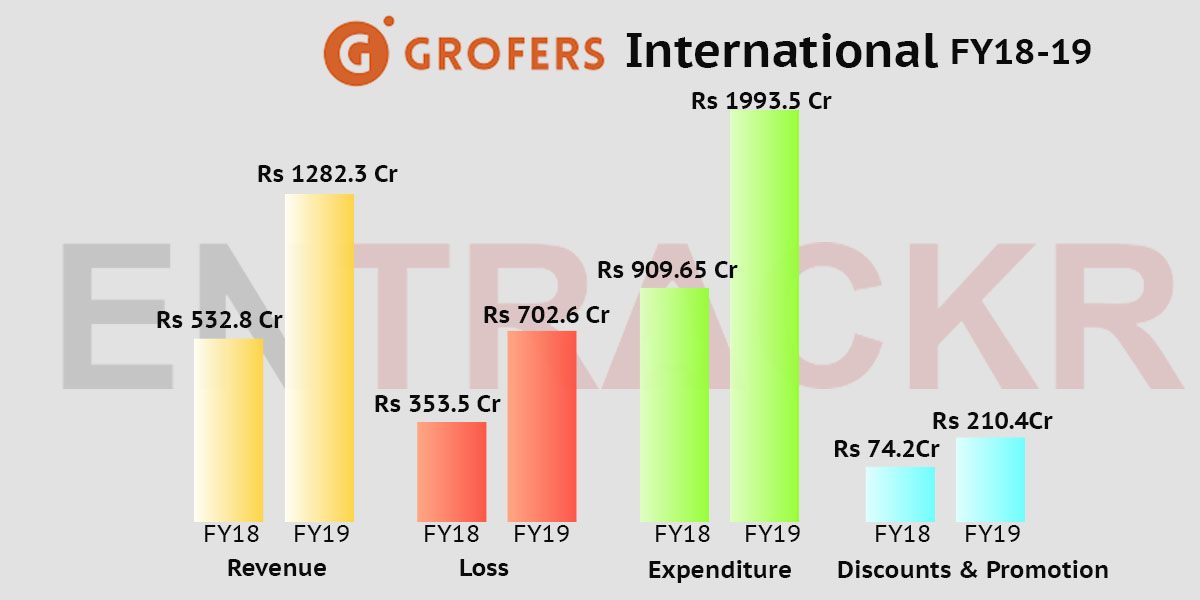

Hence, we started digging and mined fresh data from regulatory filings in Singapore. Grofers’ Singapore based parent has posted a revenue of Rs 1,282.3 crore in FY19 registering a 2.4X growth as compared to Rs 532.8 crore it earned in FY18.

As Entrackr had reported earlier, Grofers actually operates through two separate B2B entities to manage its local operations: Hands On trade for distribution of goods and Grofers India for business support and brand management a fact that has been missed by the rest of the publications.

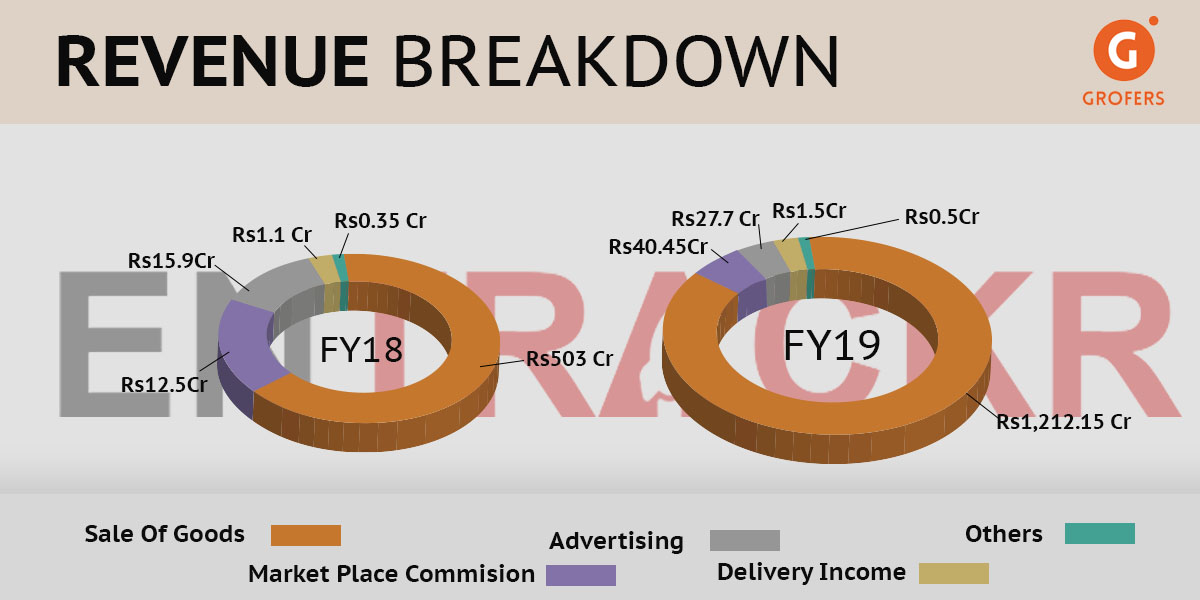

While the company has opened up multiple channels to drive revenue such as commission from the marketplace, advertising, and delivery income but it was the sale of goods which made the bulk of revenue, constituting 94.5% of the revenues generated by firm in FY19.

Earning through marketplace commission was the second biggest contributor at Rs 40.45 crore, growing 3.2 X from Rs 12.5 crore it generated from the same in FY18. The company also uses its platform to advertise certain products from its partner brands and generated Rs 27.7 crore in advertisement income, growing 70% in the year ended March 2019.

Delivery and other ancillary services added Rs 2 crore to the operating revenues while the company earned another Rs 8.6 crore through rent and investment in mutual funds.

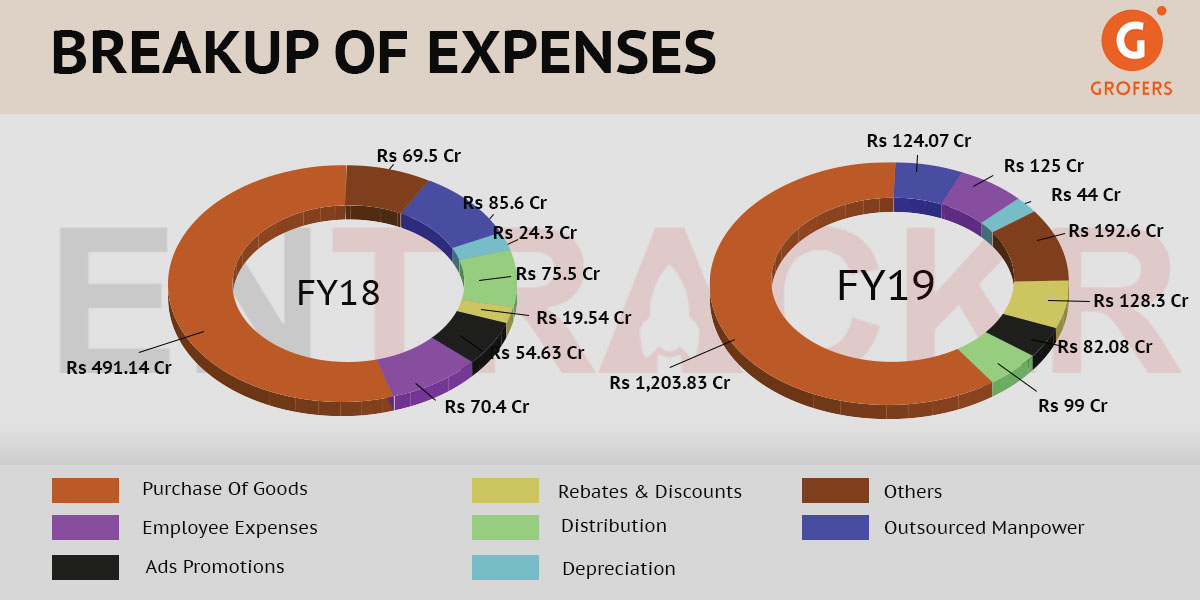

Grofers’ growth in the last fiscal was fueled by the volume of goods the company processed through its brands and sub-brands (read private labels). Its biggest expense in FY19 was the purchase of goods which amounted to Rs 1,204 crore, as compared to Rs 491.14 crore it spent during FY18 growing in a similar fashion to its revenues.

Interestingly, while the volume of goods rose by 150%, distribution expenses grew only by 31% to Rs 99 crore from Rs 75.5 crore in FY18 indicating that the company is now likely utilising its distribution channels more efficiently.

Grofers also spent significantly more on its workforce as employee benefit expenses grew by 80% to Rs 125 crore in FY19 from Rs 70.6 crore in FY18. Similarly, expenditure on outsourced manpower also grew by 45% from Rs 85.6 crore in FY18 to Rs 124.07 crore.

The biggest outliers in the company’s expenses sheet were the burn on business promotion and the discounts offered by the company during the last fiscal as it had access to more capital to drive sales on its platform.

Further analysis of Grofers’ Income Statement by Entrackr reveals that the expenditure on Rebates and Discounts grew 6.6X to Rs 128.3 crore in FY19 as compared to only Rs 19.54 crore during FY18. Expenditure on advertisement and promotions also grew by 50.3% to reach Rs 82.08 crore.

Depreciation and expenses on other operational functions such as legal charges, rent, commission and brokerage amounted to another Rs 236.6 crore and pushed total expenditure during FY19 to Rs 1,993.5 crore, growing more than two folds from Rs 909.65 crore in FY18.

Grofers had raised Rs 672.74 crore through the issue of shares during the last fiscal to fuel these expenses whilst its assets also grew by roughly 42% during the same period.

Akin to other growth-stage startups, Grofers burnt cash for achieving greater scale and market penetration. The net cash outflow from operations grew by 44.2% to reach Rs 564 crore during FY19 and losses for the year almost doubled to reach Rs 702.6 crore as compared to the corresponding figure of Rs 353.5 crore in FY18. Grofers’ balance sheet also sported accumulated losses of Rs 2,103 crore at the end of the last fiscal year.

If we look at the revenue and burn ratio for Grofers, both grew at a similar pace. The financial statement also reveals that the company is on its way to becoming a pure-play private label brand. Unlike BigBasket, Grofers targets the mass market with a sharp focus on monthly stock-up.

Besides selling online, it has also been eyeing offline retail for its host of private label brands like Happy Day, Mother’s Choice and Family Farm.

While it’s early to say how well the strategy of pushing private labels in offline space would work for Grofers, it appears to be a meaningful move because private labels offer sound margins when compared to the marketplace model.